Essay

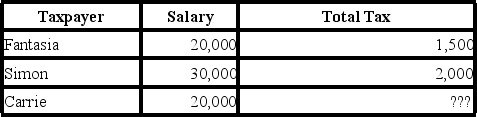

Given the following tax structure, what amount of tax would need to be assessed on Carrie to make the tax horizontally equitable? What is the minimum tax that Simon should pay to make the tax structure vertically equitable based on Fantasia's tax rate? This would result in what type of tax rate structure?

Correct Answer:

Verified

Horizontal equity means that two taxpaye...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Which of the following is a tax?

Q13: Margaret was issued a $150 speeding ticket.

Q18: Common examples of sin taxes include the

Q18: The city of Granby,Colorado recently enacted a

Q21: Congress would like to increase tax revenues

Q23: Consider the following tax rate structures. Is

Q52: Marc,a single taxpayer,earns $60,000 in taxable income

Q70: The tax base for the federal income

Q108: While sales taxes are quite common, currently

Q128: Relative to explicit taxes, implicit taxes are