Deck 4: Accrual Accounting Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/312

Play

Full screen (f)

Deck 4: Accrual Accounting Concepts

1

Expense recognition is tied to revenue recognition.

True

2

The revenue recognition principle dictates that revenue be recognized in the accounting period in which the performance obligation is satisfied.

True

3

The periodicity assumption is often referred to as the expense recognition principle.

False

4

The cash basis of accounting is not in accordance with generally accepted accounting principles.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

5

Revenue received before it is recognized and expenses used or consumed before being paid are both initially recorded as liabilities.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

6

The expense recognition principle is frequently referred to as the matching principle.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

7

The revenue recognition principle and the expense recognition principle are helpful guides used in determining net income or net loss for a period.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

8

Income will always be greater under the cash basis of accounting than under the accrual basis of accounting.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

9

Accrued revenues are revenues that have been received but not yet recognized.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

10

Adjusting entries are often made because some business events are not recorded as they occur.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

11

An adjusting entry to a prepaid expense is required to recognize expired expenses.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

12

An adjusting entry always involves two balance sheet accounts.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

13

Revenue received before it is recognized and expenses paid before being used or consumed are both initially recorded as liabilities.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

14

Adjusting entries are not necessary if the trial balance debit and credit columns balances are equal.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

15

The periodicity assumption states that the economic life of a business entity can be divided into artificial time periods.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

16

Adjusting entries are recorded in the general journal but are not posted to the accounts in the general ledger.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

17

The expense recognition principle requires that efforts be related to accomplishments.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

18

An adjusting entry would be made to the revenue account only when cash is received.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

19

An adjusting entry always involves a balance sheet account and an income statement account.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

20

Recognizing when an expense contributes to the production of revenue is critical.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

21

Accrued revenues are revenues that have been recognized but not yet recorded.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

22

Accumulated Depreciation is a liability account and has a credit normal account balance.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

23

Closing entries deal primarily with the balances of permanent accounts.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

24

The book value of a depreciable asset is always equal to its market value because depreciation is a valuation technique.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

25

Financial statements can be prepared from the information provided by an adjusted trial balance.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

26

A liability-revenue account relationship exists with an unearned rent revenue adjusting entry.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

27

The accrued interest for a three month note payable of $10,000 dated December 1, 2013 at an interest rate of 6% is $150 on December 31, 2013.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

28

The difference between unearned revenue and accrued revenue is that accrued revenue has been recorded and needs adjusting and unearned revenue has never been recorded.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

29

The only accounts that are closed are temporary accounts.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

30

Asset prepayments become expenses when they expire.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

31

The cost of a depreciable asset less accumulated depreciation reflects the book value of the asset.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

32

The adjusting entry for unearned revenue results in an increase (a debit) to an asset account and an increase (a credit) to a revenue account.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

33

The adjusting entry for accrued salaries requires a debit to Salaries and Wages Payable.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

34

The balances of the Depreciation Expense and the Accumulated Depreciation accounts should always be the same.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

35

An adjusted trial balance must be prepared before the adjusting entries can be recorded.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

36

Unearned revenue is a prepayment that requires an adjusting entry when services are performed.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

37

A contra asset account is subtracted from a related account in the balance sheet.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

38

If prepaid costs are initially recorded as an asset, no adjusting entries will be required in the future.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

39

Accrued revenues are revenues that have been recognized but cash has not been received before financial statements have been prepared.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

40

Without an adjusting entry for accrued interest expense, liabilities and interest expense are understated, and net income and stockholders' equity are overstated.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

41

The post-closing trial balance will contain only permanent-balance sheet-accounts.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

42

When closing entries are prepared, each income statement account is closed directly to retained earnings.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

43

Cash is a temporary account.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

44

The Dividends account is closed to the Income Summary account at the end of each year.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

45

A revenue account is closed with a credit to the revenue account and a debit to Income Summary.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

46

Financial statements must be prepared before the closing entries are made.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

47

An expense account is closed with a credit to the expense account and a debit to the Income Summary account.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

48

Closing entries result in the transfer of net income or net loss into the Retained Earnings account.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

49

Expenses are recognized when:

A) they contribute to the production of revenue.

B) they are paid.

C) they are billed by the supplier.

D) the invoice is received.

A) they contribute to the production of revenue.

B) they are paid.

C) they are billed by the supplier.

D) the invoice is received.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is not generally an accounting time period?

A) A week.

B) A month.

C) A quarter.

D) A year.

A) A week.

B) A month.

C) A quarter.

D) A year.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

51

In the accounting cycle, closing entries are prepared before adjusting entries.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

52

Management usually wants ________ financial statements and the IRS requires all businesses to file _________ tax returns.

A) annual, annual

B) monthly, annual

C) quarterly, monthly

D) monthly, monthly

A) annual, annual

B) monthly, annual

C) quarterly, monthly

D) monthly, monthly

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

53

Adjustments would not be necessary if financial statements were prepared to reflect net income from:

A) monthly operations.

B) fiscal year operations.

C) interim operations.

D) lifetime operations.

A) monthly operations.

B) fiscal year operations.

C) interim operations.

D) lifetime operations.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

54

An accounting time period that is one year in length is called:

A) a fiscal year.

B) an interim period.

C) the time period assumption.

D) a reporting period.

A) a fiscal year.

B) an interim period.

C) the time period assumption.

D) a reporting period.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

55

A 10-column worksheet is a permanent accounting record.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

56

Accounts receivable is a permanent account.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

57

The post closing trial balance will have fewer accounts than the adjusted trial balance.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

58

One of the accounting concepts upon which adjustments for prepayments and accruals are based is:

A) expense recognition.

B) cost.

C) monetary unit.

D) economic entity.

A) expense recognition.

B) cost.

C) monetary unit.

D) economic entity.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

59

The periodicity assumption states that:

A) a transaction can only affect one period of time.

B) estimates should not be made if a transaction affects more than one time period.

C) adjustments to the enterprise's accounts can only be made in the time period when the business terminates its operations.

D) the economic life of a business can be divided into artificial time periods.

A) a transaction can only affect one period of time.

B) estimates should not be made if a transaction affects more than one time period.

C) adjustments to the enterprise's accounts can only be made in the time period when the business terminates its operations.

D) the economic life of a business can be divided into artificial time periods.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

60

The accounting cycle begins with the journalizing of the transactions.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

61

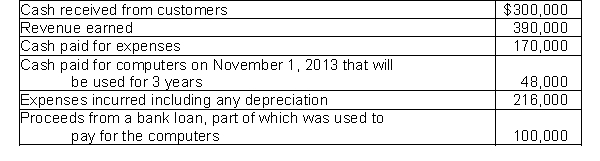

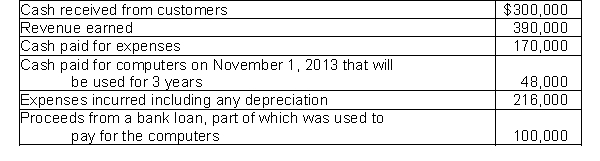

The following is selected information from L Corporation for the fiscal year ending October 31, 2014.  Based on the accrual basis of accounting, what is L Corporation's net income for the year ending October 31, 2014?

Based on the accrual basis of accounting, what is L Corporation's net income for the year ending October 31, 2014?

A) $204,000

B) $174,000

C) $158,000

D) $220,000

Based on the accrual basis of accounting, what is L Corporation's net income for the year ending October 31, 2014?

Based on the accrual basis of accounting, what is L Corporation's net income for the year ending October 31, 2014?A) $204,000

B) $174,000

C) $158,000

D) $220,000

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

62

Using accrual accounting, expenses are recorded and reported only:

A) when they are incurred whether or not cash is paid.

B) when they are incurred and paid at the same time.

C) if they are paid before they are incurred.

D) if they are paid after they are incurred.

A) when they are incurred whether or not cash is paid.

B) when they are incurred and paid at the same time.

C) if they are paid before they are incurred.

D) if they are paid after they are incurred.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

63

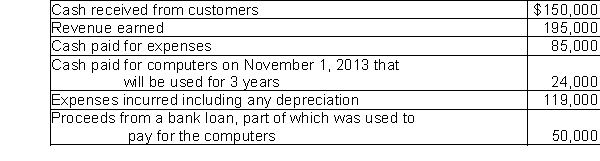

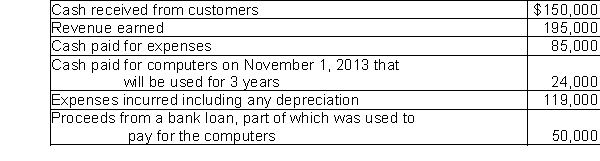

The following is selected information from C Corporation for the fiscal year ending October 31, 2014.  Based on the accrual basis of accounting, what is C Corporation's net income for the year ending October 31, 2014?

Based on the accrual basis of accounting, what is C Corporation's net income for the year ending October 31, 2014?

A) $102,000

B) $86,000

C) $76,000

D) $110,000

Based on the accrual basis of accounting, what is C Corporation's net income for the year ending October 31, 2014?

Based on the accrual basis of accounting, what is C Corporation's net income for the year ending October 31, 2014?A) $102,000

B) $86,000

C) $76,000

D) $110,000

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

64

Which principle dictates that efforts (expenses) be recorded with accomplishments (revenues)?

A) Cost principle.

B) Periodicity principle.

C) Revenue recognition principle.

D) Expense recognition principle.

A) Cost principle.

B) Periodicity principle.

C) Revenue recognition principle.

D) Expense recognition principle.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

65

Which is not an application of revenue recognition?

A) Recording revenue as an adjusting entry on the last day of the accounting period.

B) Accepting cash from an established customer for services to be performed over the next three months.

C) Billing customers on June 30 for services completed during June.

D) Receiving cash for services performed.

A) Recording revenue as an adjusting entry on the last day of the accounting period.

B) Accepting cash from an established customer for services to be performed over the next three months.

C) Billing customers on June 30 for services completed during June.

D) Receiving cash for services performed.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

66

Why do generally accepted accounting principles require the application of the revenue recognition principle?

A) Failure to apply the revenue recognition principle could lead to a misstatement of revenue.

B) It is easy to apply the revenue recognition principle because revenue issues are always easy to identify and resolve.

C) Recording revenue when cash is received is an objective application of the revenue recognition principle.

D) Accounting software has made the revenue recognition easy to apply.

A) Failure to apply the revenue recognition principle could lead to a misstatement of revenue.

B) It is easy to apply the revenue recognition principle because revenue issues are always easy to identify and resolve.

C) Recording revenue when cash is received is an objective application of the revenue recognition principle.

D) Accounting software has made the revenue recognition easy to apply.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

67

Otto's Tune-Up Shop follows the revenue recognition principle. Otto services a car on August 31. The customer picks up the vehicle on September 1 and mails the payment to Otto on September 5. Otto receives the check in the mail on September 6. When should Otto show that the revenue was recognized?

A) August 31

B) August 1

C) September 5

D) September 6

A) August 31

B) August 1

C) September 5

D) September 6

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

68

On April 1, 2013, nPropel Corporation paid $48,000 cash for equipment that will be used in business operations. The equipment will be used for four years. nPropel records depreciation expense of $48,000 for the calendar year ending December 31, 2013. Which accounting principle has been violated?

A) Depreciation principle.

B) No principle has been violated.

C) Cash principle.

D) Expense recognition principle.

A) Depreciation principle.

B) No principle has been violated.

C) Cash principle.

D) Expense recognition principle.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

69

Which statement is correct?

A) As long as a company consistently uses the cash basis of accounting, generally accepted accounting principles allow its use.

B) The use of the cash basis of accounting violates both the revenue recognition and expense recognition principles.

C) The cash basis of accounting is objective because no one can be certain of the amount of revenue until the cash is received.

D) As long as management is ethical, there are no problems with using the cash basis of accounting.

A) As long as a company consistently uses the cash basis of accounting, generally accepted accounting principles allow its use.

B) The use of the cash basis of accounting violates both the revenue recognition and expense recognition principles.

C) The cash basis of accounting is objective because no one can be certain of the amount of revenue until the cash is received.

D) As long as management is ethical, there are no problems with using the cash basis of accounting.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

70

A furniture factory's employees work overtime to finish an order that is sold on January 31. The office sends a statement to the customer in early February and payment is received by mid-February. The overtime wages should be expensed in:

A) January.

B) February.

C) the period when the workers receive their checks.

D) either January or February depending on when the pay period ends.

A) January.

B) February.

C) the period when the workers receive their checks.

D) either January or February depending on when the pay period ends.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

71

La More Company had the following transactions during 2013:

-Sales of $4,500 on account

-Collected $2,000 for services to be performed in 2014

-Paid $1,875 cash in salaries for 2013

-Purchased airline tickets for $250 in December for a trip to take place in 2014

What is La More's 2013 net income using accrual accounting?

A) $2,875

B) $4,875

C) $4,625

D) $2,625

-Sales of $4,500 on account

-Collected $2,000 for services to be performed in 2014

-Paid $1,875 cash in salaries for 2013

-Purchased airline tickets for $250 in December for a trip to take place in 2014

What is La More's 2013 net income using accrual accounting?

A) $2,875

B) $4,875

C) $4,625

D) $2,625

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

72

In a service-type business, revenue is recognized:

A) at the end of the month.

B) at the end of the year.

C) when the service is performed.

D) when cash is received.

A) at the end of the month.

B) at the end of the year.

C) when the service is performed.

D) when cash is received.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

73

A small company may be able to justify using a cash basis of accounting if they have:

A) sales under $1,000,000.

B) no accountants on staff.

C) few receivables and payables.

D) all sales and purchases on account.

A) sales under $1,000,000.

B) no accountants on staff.

C) few receivables and payables.

D) all sales and purchases on account.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

74

Under the accrual basis of accounting:

A) cash must be received before revenue is recognized.

B) net income is calculated by matching cash outflows against cash inflows.

C) events that change a company's financial statements are recognized in the period they occur rather than in the period in which cash is paid or received.

D) the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared under generally accepted accounting principles.

A) cash must be received before revenue is recognized.

B) net income is calculated by matching cash outflows against cash inflows.

C) events that change a company's financial statements are recognized in the period they occur rather than in the period in which cash is paid or received.

D) the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared under generally accepted accounting principles.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

75

The revenue recognition principle dictates that revenue should be recognized in the accounting records:

A) when cash is received.

B) when the performance obligation is satisfied.

C) at the end of the month.

D) in the period that income taxes are paid.

A) when cash is received.

B) when the performance obligation is satisfied.

C) at the end of the month.

D) in the period that income taxes are paid.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

76

A flower shop makes a large sale for $1,000 on November 30. The customer is sent a statement on December 5 and a check is received on December 10. The flower shop follows GAAP and applies the revenue recognition principle. When is the $1,000 considered to be recognized?

A) December 5

B) December 10

C) November 30

D) December 1

A) December 5

B) December 10

C) November 30

D) December 1

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

77

The expense recognition principle states that expenses should be matched with revenues. Another way of stating the principle is to say that:

A) assets should be matched with liabilities.

B) efforts should be matched with accomplishments.

C) dividends should be matched with stockholder investments.

D) cash payments should be matched with cash receipts.

A) assets should be matched with liabilities.

B) efforts should be matched with accomplishments.

C) dividends should be matched with stockholder investments.

D) cash payments should be matched with cash receipts.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

78

Under the cash basis of accounting:

A) revenue is recognized when services are performed.

B) expenses are matched with the revenue that is produced.

C) cash must be received before revenue is recognized.

D) a promise to pay is sufficient to recognize revenue.

A) revenue is recognized when services are performed.

B) expenses are matched with the revenue that is produced.

C) cash must be received before revenue is recognized.

D) a promise to pay is sufficient to recognize revenue.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

79

A company spends $20 million dollars for an office building. Over what period should the cost be written off?

A) When the $20 million is expended in cash.

B) All in the first year.

C) After $20 million in revenue is earned.

D) None of these answer choices are correct.

A) When the $20 million is expended in cash.

B) All in the first year.

C) After $20 million in revenue is earned.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck

80

The expense recognition principle matches:

A) customers with businesses.

B) expenses with revenues.

C) assets with liabilities.

D) creditors with businesses.

A) customers with businesses.

B) expenses with revenues.

C) assets with liabilities.

D) creditors with businesses.

Unlock Deck

Unlock for access to all 312 flashcards in this deck.

Unlock Deck

k this deck