Exam 4: Accrual Accounting Concepts

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

The worksheet starts with two columns for the:

Free

(Multiple Choice)

5.0/5  (37)

(37)

Correct Answer:

C

The final step in the accounting cycle is to prepare:

Free

(Multiple Choice)

4.9/5  (48)

(48)

Correct Answer:

C

Better Publications, sold annual subscriptions to their magazine for $42,000 in December, 2013. The magazine is published monthly. The new subscribers received their first magazine in January, 2014.

1. What adjusting entry should be made in January if the subscriptions were originally recorded as a liability?

2. What amount will be reported on the January 2014 balance sheet for Unearned Subscription Revenue?

Free

(Essay)

4.8/5  (33)

(33)

Correct Answer:

1. Unearned Sales Revenue 3,500

Sales Revenue 3,500

2. Unearned Sales Revenue at January 31:

Adjustments would not be necessary if financial statements were prepared to reflect net income from:

(Multiple Choice)

4.8/5  (42)

(42)

On February 1, the Acts Tax Service received a $3,600 cash retainer for tax preparation services to be provided rateably over the next 4 months. The full amount was credited to the liability account Unearned Service Revenue. Assuming that the revenue is recognized rateably over the 4 month period, what balance would be reported on the February 28 balance sheet for Unearned Service Revenue?

(Essay)

4.8/5  (40)

(40)

Prepare adjusting entries for the following transactions. Omit explanations.

1. Depreciation on equipment is $800 for the accounting period.

2. There was no beginning balance of supplies and purchased $600 of office supplies during the period. At the end of the period $120 of supplies were on hand.

3. Prepaid rent had a $1,000 normal balance prior to adjustment. By year end $300 was unexpired.

(Essay)

4.7/5  (36)

(36)

Match the statements below with the appropriate terms by entering the appropriate letter code in the spaces provided.

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (35)

(35)

Closing entries deal primarily with the balances of permanent accounts.

(True/False)

4.8/5  (31)

(31)

One of the accounting concepts upon which adjustments for prepayments and accruals are based is:

(Multiple Choice)

4.8/5  (35)

(35)

Accrued revenues are revenues that have been received but not yet recognized.

(True/False)

4.9/5  (27)

(27)

Match the statements below with the appropriate terms by entering the appropriate letter code in the spaces provided.

TERMS:

TERMS:

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (34)

(34)

Accrued revenues are revenues that have been recognized but cash has not been received before financial statements have been prepared.

(True/False)

4.8/5  (41)

(41)

A contra asset account is subtracted from a related account in the balance sheet.

(True/False)

4.8/5  (40)

(40)

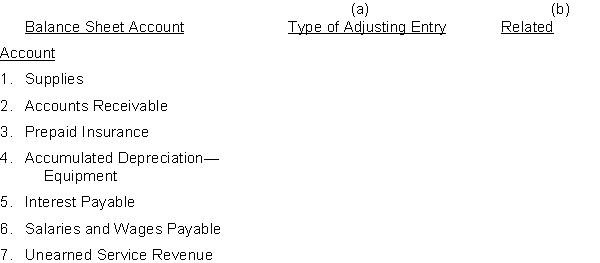

The adjusted trial balance of Masters Company includes the following balance sheet accounts that frequently require adjustment. For each account, indicate (a) the type of adjusting entry (prepaid expenses, unearned revenues, accrued revenues, or accrued expenses) and (b) the related account in the adjusting entry.

(Essay)

4.8/5  (42)

(42)

A revenue account is closed with a credit to the revenue account and a debit to Income Summary.

(True/False)

4.8/5  (34)

(34)

Closing entries result in the transfer of net income or net loss into the Retained Earnings account.

(True/False)

4.7/5  (38)

(38)

An adjusting entry made to record accrued interest on a note receivable due next year consists of a:

(Multiple Choice)

4.8/5  (40)

(40)

Wang Company had the following transactions during 2013:

-Sales of $10,800 on account

-Collected $4,800 for services to be performed in 2014

-Paid $3,100 cash in salaries

-Purchased airline tickets for $600 in December for a trip to take place in 2014

What is Wang's 2013 net income using cash basis accounting?

(Multiple Choice)

4.9/5  (37)

(37)

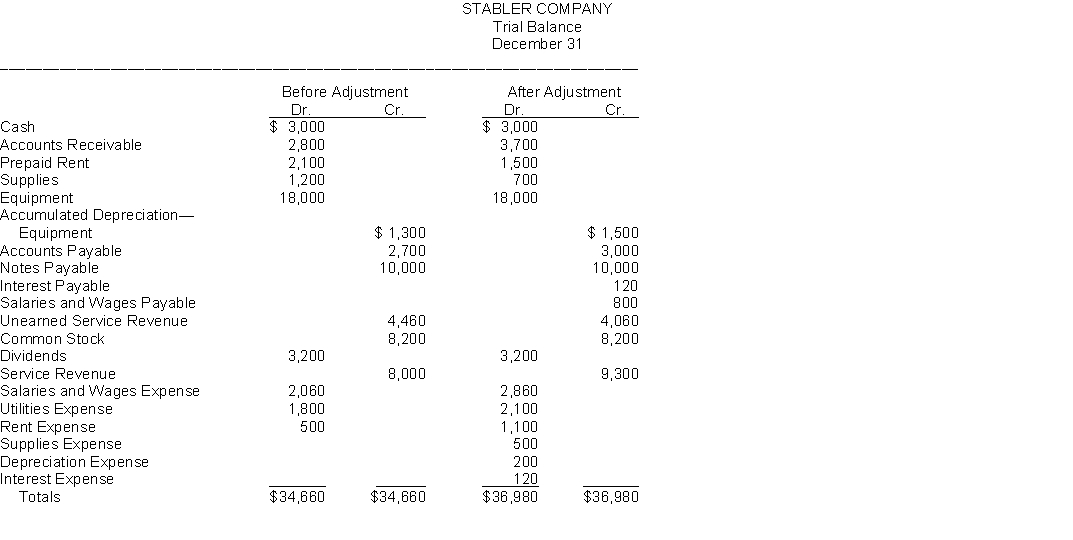

Presented below is the Trial Balance and Adjusted Trial Balance for Stabler Company on December 31.  Instructions:

Prepare in journal form, with explanations, the adjusting entries that explain the changes in the

balances from the trial balance to the adjusted trial balance.

Instructions:

Prepare in journal form, with explanations, the adjusting entries that explain the changes in the

balances from the trial balance to the adjusted trial balance.

(Essay)

4.8/5  (41)

(41)

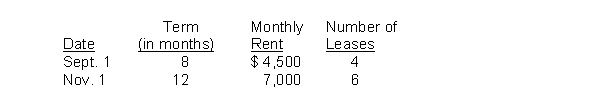

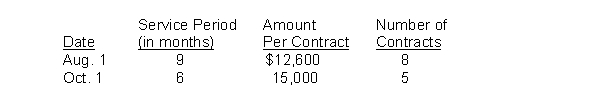

A review of the ledger of Weakly Service Co. at December 31, 2014, produces the following data pertaining to the preparation of annual adjusting entries:

(a) Notes Payable $80,000: This is a 9-month note, dated September 1, 2014, with a 9% interest rate.

(b) Prepaid Rent $648,000. The company rents offices throughout the Midwest. During 2014 it signed 10 leases as shown below:  (c) Unearned Service Revenue $171,000. During 2014 the company entered into 13 monthly service contracts with clients. The clients prepaid for the services to be provided over the contract period in an even manner.

(c) Unearned Service Revenue $171,000. During 2014 the company entered into 13 monthly service contracts with clients. The clients prepaid for the services to be provided over the contract period in an even manner.  Instructions:

Prepare the adjusting entries at December 31, 2014. Show all computations.

Instructions:

Prepare the adjusting entries at December 31, 2014. Show all computations.

(Essay)

4.7/5  (41)

(41)

Showing 1 - 20 of 312

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)