Deck 15: No Arbitrage and the Pricing of Interest Rate Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/17

Play

Full screen (f)

Deck 15: No Arbitrage and the Pricing of Interest Rate Securities

1

How strong is the correlation among rates with different maturities in the term structure obtained from the CIR model?

As with the Vasicek model, the interest rates on the term structure are perfectly correlated.

2

How can we obtain ? in order to calibrate the Vasicek model?

? can be estimated directly from the time series of interest rates rt.

3

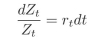

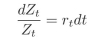

For a deterministic interest rate model, what would be the rate of return on securities? Explain.

Given no arbitrage:

4

What are the three steps for derivative pricing and hedging?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

5

What is a Partial Differential Equation (PDE)?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

6

For the Vasicek model can we say that always m∗(r, t)=m(r, t)? Explain.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

7

What is a solution to a PDE?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

8

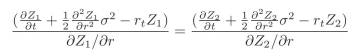

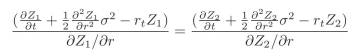

What's the intuition behind the following relationship:

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

9

Why is it that in a deterministic interest rate world we have that:

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

10

How can we obtain ¯r and ? in order to calibrate the Vasicek model?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

11

Does the following equality hold in the real world?  Why or why not?

Why or why not?

Why or why not?

Why or why not?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

12

How strong is the correlation among rates in the term structure obtained from the Vasicek model? Is this realistic?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

13

What relation should hold across all securities, given the no arbitrage condition?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

14

What do we need to build in order to be able to price any security through no arbitrage?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

15

IntheVasicekmodeldewehavelevel,slopeandcurvatureintheterm structure?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

16

Does the Vasicek model match the term structure?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

17

What problem does the Cox-Ingersol-Ross (CIR) model solve when com- pared to the Vasicek and Ho-Lee models?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck