Deck 10: Financial Statement Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 10: Financial Statement Analysis

1

Solvency and profitability are important aspects of financial statement analysis, as an entity can be in the position of not being able to repay debt, which could result in liquidation, even though the entity is making profits.

True

2

If financial statement analysis is to be effective, it requires that the information needs of the person or group for whom the analysis is being done are clearly identified.

True

3

External sources can provide relevant information when industry trends and business risk are being analysed.

True

4

Of all the user groups identified for financial statement analysis, it is the equity investor who is most interested in information on management efficiency.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

Trend analysis is a financial analysis technique for comparing the relationship between different items over a period of time.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

Measuring profits against sales over a period of time provides information on the increasing/decreasing profitability of the entity, and can determine whether the entity is increasing/decreasing its efficiency in each sale made.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

7

The owners of a small entity, such as a sole trader, have greater access to the entity's accounting information than the equity participants of a large entity such as a public company. However, for the purposes of financial statement analysis, the accounting information needs of equity participants are the same.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

Effective financial analysis relies on internal sources of information such as the financial statements and notes to the accounts, as well as external sources such as the financial press and trade journals.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

Ratio analysis is a technique used for analysing financial statements, but it is only useful if it is based on items from the same financial statement; that is, if the items being compared are either exclusively all from the statement of comprehensive income or all from the balance sheet.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

As a user group, lenders can be classified as short, medium, or long-term lenders, and all three have an interest in the net realisable value of assets. However, it is generally only certain long-term lenders who have a particular interest in the net realisable value of specific assets.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

The owners of an entity are regarded as equity investors whether they are sole traders, partnerships or shareholders in a multinational corporation, whereas preference shareholders may be classified as equity or debt investors depending on the characteristics of the shares.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

Consistency implies that the measurement and display of transactions and events need to be carried out in a consistent manner throughout an entity, and over time for that entity, but does not imply there is consistency between entities.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

Trend analysis is a technique commonly used in financial statement analysis to assess a business' growth prospects.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

Index number trends are calculated relative to a base year at 100, and all other numbers are set according to that index.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

Although the financial statements are important sources of information for financial analysis, it is true to say that they lose some relevance in assessing the entity's current position, due to the historical nature of the information involved.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

The most common information needs of users of financial statement analysis relate to profitability, liquidity and risk.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

If profit has increased over a period of time relative to sales, and owners' investments have not increased at the same rate, then it would be reasonable to conclude that management has been efficient in increasing returns to shareholders.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

An entity has debt finance that exceeds its equity finance by 20%. Under the traditional 'best-practice' approach used by Australian banks and financial institutions, it would be considered that the debt finance is too high.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

The social environment in which an entity operates includes factors such as concern for the natural environment and ensuring full employment, and is directly relevant to an analysis of business performance.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

Financial analysis is only useful if it is measured relative to something else, such as past periods and similar entities in the same industry.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

When measuring short-term solvency, the current ratio compares current assets to current liabilities, but inventory is normally excluded when calculating the quick ratio.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

Comparing the performance of an entity with the industry norms is complicated by:

A) not all businesses in the industry being the same.

B) different businesses using different accounting methods.

C) business being diversified.

D) all of the above.

A) not all businesses in the industry being the same.

B) different businesses using different accounting methods.

C) business being diversified.

D) all of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

The 'true and fair view' of the auditor with respect to the financial statements of an entity, asserts that the financial assertions contained in the report are accurate in detail.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is a technique for analysing financial statement data?

A) Trend analysis

B) Financial ratio analysis

C) Vertical analysis

D) All of the above

A) Trend analysis

B) Financial ratio analysis

C) Vertical analysis

D) All of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

Trend analysis involves choosing a base year and plotting the trend in key outcome indicators, such as sales and profits, in subsequent years.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

What are some of the factors that are directly relevant to an analysis of business performance?

A) Size and riskiness of the business

B) Economic, social and political environment

C) Industry trends and effects of changes in technology

D) All of the above

A) Size and riskiness of the business

B) Economic, social and political environment

C) Industry trends and effects of changes in technology

D) All of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

Unlike ordinary shareholders, preference shareholders are more likely to be interested in the extent to which profit is safe, rather than in profit growth, due to the fact that the return on their investment is typically fixed.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

28

An implication of the efficient markets hypothesis (EMH) is that managers will choose accounting policies in order to influence reported net profit.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

Financial statement analysis must be:

A) viewed in the wider context of the industry and the political and social environments.

B) targeted to the needs of the users of the analysis.

C) as good as the base information on which the analysis is made.

D) All of the above are correct.

A) viewed in the wider context of the industry and the political and social environments.

B) targeted to the needs of the users of the analysis.

C) as good as the base information on which the analysis is made.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

The statement of cash flow is considered a source of internal information for the financial analysis of an entity's solvency and its capacity to continue as a going concern.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

A company has no prepayments and has a current ratio of 0.98:1 and a quick ratio of 0.95:1. This indicates that the company cannot pay its debts if called upon to do so.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

Under the efficient markets hypothesis (EMH), it is possible that individual shares may be under- or over-priced.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

After analysing a company's financial statements over a five-year period, the current year being Year 5, it was determined that the current ratio was as follows: 1.6:1 (Year 5); 1.5:1 (Year 4); 1.1:1 (Year 3); 0.95:1 (Year 3); 0.90:1 (Year 1). From this information we can conclude that the company has been increasing the amount of cash at bank.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

Comparability, as a qualitative characteristic of useful information, calls for consistency in the application of accounting policy choice.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

If a company has a debt to equity ratio of 1:48, it means that for every $1 of equity, the company has $1.48 in liabilities.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

The accounts receivable and inventory turnover ratios are important in evaluating the short-term efficiency of an entity.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

A secured lender is exposed to a higher level of financial risk than an unsecured lender.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

General purpose reporting by corporations contributes to the efficiency of the share market and, ultimately, the allocation of scarce resources.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

Lenders can be classified as short, medium or long-term lenders. In regard to financial statement analysis for lenders, which of the following statements is incorrect?

A) All lender groups are interested in the profitability of the entity.

B) Short-term lenders are particularly interested in the net realisable value of specific assets.

C) All lender groups are interested in the capacity of the entity to repay its debt.

D) Long-term lenders are particularly interested in how well their interest is covered by the profits being made.

A) All lender groups are interested in the profitability of the entity.

B) Short-term lenders are particularly interested in the net realisable value of specific assets.

C) All lender groups are interested in the capacity of the entity to repay its debt.

D) Long-term lenders are particularly interested in how well their interest is covered by the profits being made.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

Asset turnover, return on assets, and debt to total assets are all examples of long-term solvency ratios.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

41

Inventory turnover:

A) is the ratio of inventory to sales.

B) measures the success of a company in converting its investment in inventory into sales.

C) is the ratio of sales to inventory.

D) measures the success of the company's purchasing department.

A) is the ratio of inventory to sales.

B) measures the success of a company in converting its investment in inventory into sales.

C) is the ratio of sales to inventory.

D) measures the success of the company's purchasing department.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

Given a high value, which of the following ratios best indicates that a retailing company is controlling the cost of the products it sells?

A) Gross profit margin

B) Operating profit margin

C) Return on assets

D) Return on equity

A) Gross profit margin

B) Operating profit margin

C) Return on assets

D) Return on equity

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not typically part of the annual report published by a company for investors and other decision makers?

A) Financial statements

B) Notes to the financial statements

C) Budgets prepared by management

D) The audit report

A) Financial statements

B) Notes to the financial statements

C) Budgets prepared by management

D) The audit report

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

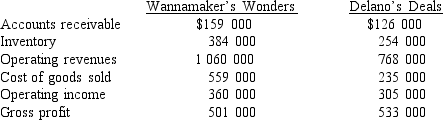

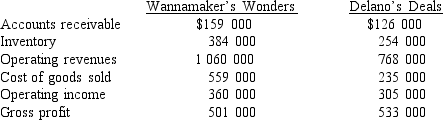

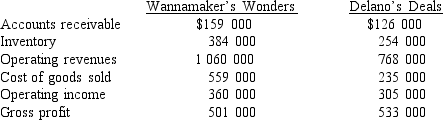

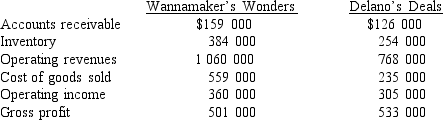

Use the following information to answer questions 25 and 26.

Rounded up to two decimal places, what are the inventory turnovers for Wannamaker's and Delano's?

A) 2.76 and 3.02

B) 0.93 and 1.20

C) 1.46 and 0.93

D) 1.30 and 2.18

Rounded up to two decimal places, what are the inventory turnovers for Wannamaker's and Delano's?

A) 2.76 and 3.02

B) 0.93 and 1.20

C) 1.46 and 0.93

D) 1.30 and 2.18

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

The analysis technique that shows each item on the financial statements as a percentage of one item on that statement is known as:

A) trend analysis.

B) comparative financial statements.

C) common size financial statements.

D) working capital schedule.

A) trend analysis.

B) comparative financial statements.

C) common size financial statements.

D) working capital schedule.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

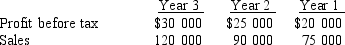

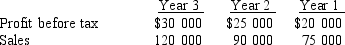

The statements of comprehensive income of LMA Ltd for the years ending 31 December reveal the following information:  Based on this information, which of the following statements is incorrect?

Based on this information, which of the following statements is incorrect?

A) Profit has increased in Year 3 by 20% over Year 2, 66.7% from Year 1 to Year 2, and 50% from Year 1 to Year 3.

B) Profit in Year 3 has decreased from Year 2 and Year 1 for each sale made.

C) The information shows that in Year 2 management was more efficient in creating profits from the sale of goods compared to the other years.

D) Sales have increased in Year 3 by 33.4% over Year 2, 20% from Year 1 to Year 2, and 60% from Year 1 to Year 3.

Based on this information, which of the following statements is incorrect?

Based on this information, which of the following statements is incorrect?A) Profit has increased in Year 3 by 20% over Year 2, 66.7% from Year 1 to Year 2, and 50% from Year 1 to Year 3.

B) Profit in Year 3 has decreased from Year 2 and Year 1 for each sale made.

C) The information shows that in Year 2 management was more efficient in creating profits from the sale of goods compared to the other years.

D) Sales have increased in Year 3 by 33.4% over Year 2, 20% from Year 1 to Year 2, and 60% from Year 1 to Year 3.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following assets would be used in calculating the current ratio but not normally in determining the quick ratio?

A) Accounts receivable

B) Cash

C) Short-term investments

D) Inventory

A) Accounts receivable

B) Cash

C) Short-term investments

D) Inventory

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

When evaluating the return on a shareholder's investment, it is necessary to consider the return relative to:

A) the shareholders' funds.

B) the industry average.

C) the rate of inflation.

D) earnings per share.

A) the shareholders' funds.

B) the industry average.

C) the rate of inflation.

D) earnings per share.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

The current ratio indicates the:

A) funds employed by the shareholders of the company.

B) amount of readily liquid current assets for each dollar of urgent liabilities.

C) amount of current assets to meet each dollar of current liabilities.

D) profitability of the business.

A) funds employed by the shareholders of the company.

B) amount of readily liquid current assets for each dollar of urgent liabilities.

C) amount of current assets to meet each dollar of current liabilities.

D) profitability of the business.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

Profit is not relevant when calculating:

A) return on equity.

B) price/earnings ratio.

C) earnings per share.

D) accounts receivable turnover.

A) return on equity.

B) price/earnings ratio.

C) earnings per share.

D) accounts receivable turnover.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

The use of debt to increase a company's return on equity is:

A) financial leverage.

B) financial lift.

C) measured by the debt to equity ratio.

D) liquidity.

A) financial leverage.

B) financial lift.

C) measured by the debt to equity ratio.

D) liquidity.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

The conclusion that a company was able to generate 79.5c of net profit for every dollar of sales reflects which of the following?

A) Operating leverage

B) Return on assets

C) Net profit margin

D) Asset turnover

A) Operating leverage

B) Return on assets

C) Net profit margin

D) Asset turnover

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

For financial information to be useful for analysis, it must be both relevant and reliable. Other required qualitative characteristics are:

A) predictability and conservatism.

B) timeliness and cost.

C) understandability and comparability.

D) consistency and creativity.

A) predictability and conservatism.

B) timeliness and cost.

C) understandability and comparability.

D) consistency and creativity.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following analysis techniques selects a base year, sets it at 100 and then calculates the change in subsequent years as a percentage of the base year?

A) Common-size statements

B) Percentage changes

C) Index number trends

D) Trend analysis

A) Common-size statements

B) Percentage changes

C) Index number trends

D) Trend analysis

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

The ratio of cost of goods sold to inventory is known as:

A) inventory turnover.

B) asset turnover.

C) accounts receivable turnover.

D) return on sales.

A) inventory turnover.

B) asset turnover.

C) accounts receivable turnover.

D) return on sales.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

Inventory turnover in days indicates:

A) the average number of days to purchase inventory.

B) the average number of days to convert inventory into cash.

C) the average number of days taken to sell the inventory.

D) the overall earning power of the inventory.

A) the average number of days to purchase inventory.

B) the average number of days to convert inventory into cash.

C) the average number of days taken to sell the inventory.

D) the overall earning power of the inventory.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

As the proportion of debt increases in a firm's capital structure, what can we say with certainty about the firm's risk and financial leverage?

A) Both remain the same

B) Both decrease

C) Both increase

D) Leverage increases and risk may increase

A) Both remain the same

B) Both decrease

C) Both increase

D) Leverage increases and risk may increase

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

Gross profit margin measures the:

A) efficiency of management in turning over the company's goods at a profit.

B) efficiency of the use of assets in generating assets.

C) effectiveness of investments in inventories.

D) effectiveness of the collection of accounts receivables.

A) efficiency of management in turning over the company's goods at a profit.

B) efficiency of the use of assets in generating assets.

C) effectiveness of investments in inventories.

D) effectiveness of the collection of accounts receivables.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements concerning the comparison of financial information between firms is not true?

A) The selection of industry norms based on averages is problematic.

B) The financial and business risks of firms differ.

C) Firms use similar accounting policies.

D) The size of the business influences the operating results.

A) The selection of industry norms based on averages is problematic.

B) The financial and business risks of firms differ.

C) Firms use similar accounting policies.

D) The size of the business influences the operating results.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

Profit from ordinary operations divided by sales is:

A) working capital.

B) income from operations.

C) net profit margin.

D) return on assets.

A) working capital.

B) income from operations.

C) net profit margin.

D) return on assets.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

Use the following information to answer questions 25 and 26.

Assuming that all sales have been made on credit and rounding up to two decimal places, what are the accounts receivables turnovers for Wannamaker's and Delano's?

A) 6.67 and 6.10

B) 3.51 and 1.86

C) 1.63 and 2.42

D) 3.15 and 4.23

Assuming that all sales have been made on credit and rounding up to two decimal places, what are the accounts receivables turnovers for Wannamaker's and Delano's?

A) 6.67 and 6.10

B) 3.51 and 1.86

C) 1.63 and 2.42

D) 3.15 and 4.23

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

The financial structure of an entity can be assessed using the:

A) current ratio.

B) quick asset ratio.

C) times interest earned.

D) debt to equity ratio.

A) current ratio.

B) quick asset ratio.

C) times interest earned.

D) debt to equity ratio.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

63

A lower than normal price/earnings ratio could mean:

A) the company's shares are undervalued.

B) the market is expecting future EPS to be higher.

C) the company's shares are overvalued.

D) shareholders are receiving a high return.

A) the company's shares are undervalued.

B) the market is expecting future EPS to be higher.

C) the company's shares are overvalued.

D) shareholders are receiving a high return.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following information to answer questions 28 and 29.

Kestal Ltd reported sales of $500 000 for the year ending 31 December. The net profit before interest and tax was $120 000, and the net profit after tax was $90 000. The average of total assets was

$1 000 000. The average shareholders' equity was $700 000.

What is the asset turnover for the year ending 31 December?

A) 2

B) 0.5

C) 0.7

D) 11.11

Kestal Ltd reported sales of $500 000 for the year ending 31 December. The net profit before interest and tax was $120 000, and the net profit after tax was $90 000. The average of total assets was

$1 000 000. The average shareholders' equity was $700 000.

What is the asset turnover for the year ending 31 December?

A) 2

B) 0.5

C) 0.7

D) 11.11

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

If an investor (shareholder) discovers by analysing financial statements that she 'lost 5 cents for each dollar invested in the company', which ratio did she examine?

A) Debt to equity

B) Debt to assets

C) Return on equity

D) Financial leverage

A) Debt to equity

B) Debt to assets

C) Return on equity

D) Financial leverage

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

Return on equity for Delta company is 7%. This means that:

A) Delta will pay a dividend of $0.07 on each ordinary share.

B) The market value of Delta's ordinary shares will increase.

C) Delta earned $0.07 for each dollar of equity.

D) The book value of Delta's ordinary shares will increase by 7%.

A) Delta will pay a dividend of $0.07 on each ordinary share.

B) The market value of Delta's ordinary shares will increase.

C) Delta earned $0.07 for each dollar of equity.

D) The book value of Delta's ordinary shares will increase by 7%.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

The ratio that shows the percentage of a company's assets financed by equity is the:

A) rate of return on ordinary shareholders' equity.

B) return on assets ratio.

C) asset turnover ratio.

D) equity ratio.

A) rate of return on ordinary shareholders' equity.

B) return on assets ratio.

C) asset turnover ratio.

D) equity ratio.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

A price earnings ratio shows:

A) the earnings yield based on market values.

B) the amount the market is willing to pay for $1 of profits

C) the comparison between earnings of different companies.

D) the profitability of ordinary shares

A) the earnings yield based on market values.

B) the amount the market is willing to pay for $1 of profits

C) the comparison between earnings of different companies.

D) the profitability of ordinary shares

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

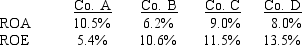

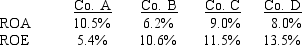

Which of the following companies, whose ROE and ROA are given, is probably the most valued by shareholders?

A) Co. A

B) Co. B

C) Co. C

D) Co. D

A) Co. A

B) Co. B

C) Co. C

D) Co. D

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

The conclusion that a company 'earned 12.5c of profit for every dollar invested in assets' by the company reflects which of the following?

A) Operating leverage

B) Return on assets

C) Profit margin

D) Asset turnover

A) Operating leverage

B) Return on assets

C) Profit margin

D) Asset turnover

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

A low accounts receivable turnover ratio could indicate that:

A) few customers are defaulting on their debts.

B) the company is making collections from its customers very quickly..

C) the company is making collections from its customers very slowly.

D) a small proportion of the company's sales are credit sales.

A) few customers are defaulting on their debts.

B) the company is making collections from its customers very quickly..

C) the company is making collections from its customers very slowly.

D) a small proportion of the company's sales are credit sales.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

Use the following information to answer questions 28 and 29.

Kestal Ltd reported sales of $500 000 for the year ending 31 December. The net profit before interest and tax was $120 000, and the net profit after tax was $90 000. The average of total assets was

$1 000 000. The average shareholders' equity was $700 000.

What is the return on equity for the year ending 31 December?

A) 9%

B) 12%

C) 12.9%

D) 17.1%

Kestal Ltd reported sales of $500 000 for the year ending 31 December. The net profit before interest and tax was $120 000, and the net profit after tax was $90 000. The average of total assets was

$1 000 000. The average shareholders' equity was $700 000.

What is the return on equity for the year ending 31 December?

A) 9%

B) 12%

C) 12.9%

D) 17.1%

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

A high average days outstanding for accounts receivable could indicate that:

A) few customers are defaulting on their debts.

B) the company is making collections from its customers very quickly.

C) the company is making collections from its customers very slowly.

D) a small proportion of the company's sales are credit sales.

A) few customers are defaulting on their debts.

B) the company is making collections from its customers very quickly.

C) the company is making collections from its customers very slowly.

D) a small proportion of the company's sales are credit sales.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

A clear distinction between return on assets and return on equity is that return on assets:

A) must always be a smaller percentage than is return on equity.

B) is a measure of management's investment decisions that excludes any consideration of how the investments were financed.

C) is of greater interest to investors than is return on equity.

D) measures operating leverage while return on equity measures financial leverage.

A) must always be a smaller percentage than is return on equity.

B) is a measure of management's investment decisions that excludes any consideration of how the investments were financed.

C) is of greater interest to investors than is return on equity.

D) measures operating leverage while return on equity measures financial leverage.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

Return on equity is a measure of:

A) financial leverage.

B) firm value.

C) company performance.

D) liquidity.

A) financial leverage.

B) firm value.

C) company performance.

D) liquidity.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

A higher than normal price/earnings ratio could mean:

A) the company's shares are undervalued.

B) the market is expecting future EPS to be higher.

C) the market is expecting future EPS to be lower.

D) shareholders are receiving a high return.

A) the company's shares are undervalued.

B) the market is expecting future EPS to be higher.

C) the market is expecting future EPS to be lower.

D) shareholders are receiving a high return.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is a measure of short-term solvency?

A) Debt to assets ratio

B) Assets to equity ratio

C) Current ratio

D) Dividend payout ratio

A) Debt to assets ratio

B) Assets to equity ratio

C) Current ratio

D) Dividend payout ratio

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

Thorpedo Ltd reported a return on assets of 15% for the year ending 31 December. It also acquired a licence for cash by paying $1m at the end of the year ending 31 December. This licence is expected to generate net profits of $0.1m per year and the asset is not amortised. Assuming the results for the next financial year mirror the year ending 31 December and the licence did increase net profit by $0.1m. What is the effect on Thorpedo Ltd's return on assets for this subsequent financial year?

A) A decrease

B) An increase

C) No change

D) Cannot be determined

A) A decrease

B) An increase

C) No change

D) Cannot be determined

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

A company has the following accounts: I Paid up capital

II Reserves

III Retained profits

IV Dividends payable

Return on equity is net profit divided by:

A) I only

B) I and II Only

C) I, II and III

D) 1, II, III and IV

II Reserves

III Retained profits

IV Dividends payable

Return on equity is net profit divided by:

A) I only

B) I and II Only

C) I, II and III

D) 1, II, III and IV

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following would be an appropriate interpretation of a current ratio of 1.76?

A) The company earned $1.76 for every dollar of assets.

B) The company has $1.76 of current assets for every dollar of current liabilities.

C) The company's debt is 176% of its capital structure.

D) The company has $1.76 of current assets for every dollar of total assets.

A) The company earned $1.76 for every dollar of assets.

B) The company has $1.76 of current assets for every dollar of current liabilities.

C) The company's debt is 176% of its capital structure.

D) The company has $1.76 of current assets for every dollar of total assets.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck