Exam 10: Financial Statement Analysis

Exam 1: Introduction to Accounting48 Questions

Exam 2: Types of Organisations and the Financial Reporting Framework102 Questions

Exam 3: Ethics and Corporate Governance33 Questions

Exam 4: Wealth and the Measurement of Profit43 Questions

Exam 5: Presentation of Financial Position and the Worksheet77 Questions

Exam 6: Presentation of Financial Performance and the Worksheet74 Questions

Exam 7: Presentation of Cash Flows59 Questions

Exam 8: Accounting for Selected Assets126 Questions

Exam 9: Liabilities and Sources of Financing82 Questions

Exam 10: Financial Statement Analysis86 Questions

Exam 11: Worksheet to Debits and Credits27 Questions

Exam 12: An Introduction to Management Accounting: a Strategic Perspective54 Questions

Exam 13: Performance Measurement and the Balanced Scorecard49 Questions

Exam 14: Costs and Cost Behaviour63 Questions

Exam 15: Budgets55 Questions

Exam 16: Cost-Volume-Profit Analysis43 Questions

Exam 17: Accounting for Decision Making: With and Without Resource Constraints56 Questions

Exam 18: Capital Investment Decisions62 Questions

Select questions type

Trend analysis is a financial analysis technique for comparing the relationship between different items over a period of time.

Free

(True/False)

4.8/5  (29)

(29)

Correct Answer:

False

Trend analysis is a technique commonly used in financial statement analysis to assess a business' growth prospects.

Free

(True/False)

4.9/5  (34)

(34)

Correct Answer:

True

If profit has increased over a period of time relative to sales, and owners' investments have not increased at the same rate, then it would be reasonable to conclude that management has been efficient in increasing returns to shareholders.

Free

(True/False)

4.7/5  (40)

(40)

Correct Answer:

True

A high average days outstanding for accounts receivable could indicate that:

(Multiple Choice)

4.8/5  (40)

(40)

Comparing the performance of an entity with the industry norms is complicated by:

(Multiple Choice)

4.7/5  (36)

(36)

If financial statement analysis is to be effective, it requires that the information needs of the person or group for whom the analysis is being done are clearly identified.

(True/False)

4.8/5  (37)

(37)

The ratio that shows the percentage of a company's assets financed by equity is the:

(Multiple Choice)

4.8/5  (35)

(35)

Asset turnover, return on assets, and debt to total assets are all examples of long-term solvency ratios.

(True/False)

4.7/5  (42)

(42)

After analysing a company's financial statements over a five-year period, the current year being Year 5, it was determined that the current ratio was as follows: 1.6:1 (Year 5); 1.5:1 (Year 4); 1.1:1 (Year 3); 0.95:1 (Year 3); 0.90:1 (Year 1). From this information we can conclude that the company has been increasing the amount of cash at bank.

(True/False)

4.8/5  (33)

(33)

A low accounts receivable turnover ratio could indicate that:

(Multiple Choice)

4.8/5  (29)

(29)

As a user group, lenders can be classified as short, medium, or long-term lenders, and all three have an interest in the net realisable value of assets. However, it is generally only certain long-term lenders who have a particular interest in the net realisable value of specific assets.

(True/False)

4.9/5  (28)

(28)

Trend analysis involves choosing a base year and plotting the trend in key outcome indicators, such as sales and profits, in subsequent years.

(True/False)

4.8/5  (44)

(44)

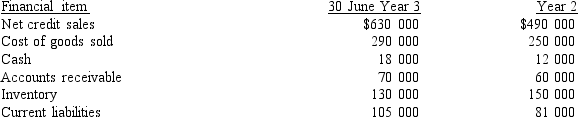

The following financial data relate to Bandara Pty Ltd for the years ended 30 June Year 3 and 30 June Year 2.

Additional information

The debtors figure at 30 June Year 1 was $78 000 (net). The inventory figure at 30 June Year 1 was $130 000. The company provides its credit customers 30 days to pay. The average inventory turnover for the industry in which the company operates is 101 days.

Additional information

The debtors figure at 30 June Year 1 was $78 000 (net). The inventory figure at 30 June Year 1 was $130 000. The company provides its credit customers 30 days to pay. The average inventory turnover for the industry in which the company operates is 101 days.

(Essay)

4.9/5  (39)

(39)

Index number trends are calculated relative to a base year at 100, and all other numbers are set according to that index.

(True/False)

4.8/5  (32)

(32)

Which of the following is not typically part of the annual report published by a company for investors and other decision makers?

(Multiple Choice)

4.8/5  (30)

(30)

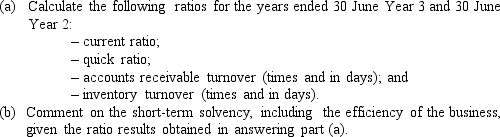

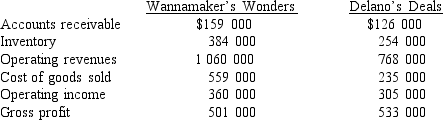

Use the following information to answer questions 25 and 26.

-Rounded up to two decimal places, what are the inventory turnovers for Wannamaker's and Delano's?

-Rounded up to two decimal places, what are the inventory turnovers for Wannamaker's and Delano's?

(Multiple Choice)

5.0/5  (19)

(19)

Showing 1 - 20 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)