Deck 10: Foreign Currency Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/75

Play

Full screen (f)

Deck 10: Foreign Currency Transactions

1

A U.S.company that has purchased inventory from a German vendor would be exposed to a net exchange gain on the unpaid balance if the

A)amount to be paid was denominated in dollars.

B)dollar weakened relative to the Euro and the Euro was the denominated currency.

C)dollar strengthened relative to the Euro and the Euro was the denominated currency.

D)U.S.company purchased a forward contract to buy Euros.

A)amount to be paid was denominated in dollars.

B)dollar weakened relative to the Euro and the Euro was the denominated currency.

C)dollar strengthened relative to the Euro and the Euro was the denominated currency.

D)U.S.company purchased a forward contract to buy Euros.

C

2

When an economic transaction is denominated in a currency other than the entity's domestic currency, the entity must establish a

A)domestic rate.

B)hedge rate.

C)rate of currency change.

D)rate of exchange.

A)domestic rate.

B)hedge rate.

C)rate of currency change.

D)rate of exchange.

D

3

In a credit transaction resulting in an exposed asset or liability, gains and losses on foreign currency transactions should be recognized:

A)only upon settlement or payment.

B)when the sale or purchase takes place.

C)at settlement or payment and at the end of any reporting period.

D)only if material.

A)only upon settlement or payment.

B)when the sale or purchase takes place.

C)at settlement or payment and at the end of any reporting period.

D)only if material.

C

4

A U.S.company that has sold its product to a German firm would be exposed to a net exchange gain on the unpaid receivable if the

A)amount to be paid was denominated in dollars.

B)dollar weakened relative to the Euro and the Euro was the denominated currency.

C)dollar strengthened relative to the Euro and the Euro was the denominated currency.

D)U.S.company purchased a forward contract to buy Euros.

A)amount to be paid was denominated in dollars.

B)dollar weakened relative to the Euro and the Euro was the denominated currency.

C)dollar strengthened relative to the Euro and the Euro was the denominated currency.

D)U.S.company purchased a forward contract to buy Euros.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

5

A forward exchange contract is being transacted at a premium if the current forward rate is

A)less than the expected spot rate.

B)greater than the expected spot rate.

C)less than the current spot rate.

D)greater than the current spot rate.

A)less than the expected spot rate.

B)greater than the expected spot rate.

C)less than the current spot rate.

D)greater than the current spot rate.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

6

A U.S.firm has purchased, for 50,000 FC, an electric generator from a foreign firm.The exchange rates were 1 FC = $0.80 on the delivery date and 1 FC = $0.76 when the payable was paid.What is the final recorded value of the equipment if the two-transaction method is used?

A)$40,000

B)$38,000

C)$42,000

D)$50,000

A)$40,000

B)$38,000

C)$42,000

D)$50,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

7

Given the following information for a 90 day contract: ?

What will be the forward rate?

A)1FC = .75 US Dollars

B)1FC = .57 US Dollars

C)1FC = .745 US Dollars

D)1FC = .70 US Dollars

What will be the forward rate?

A)1FC = .75 US Dollars

B)1FC = .57 US Dollars

C)1FC = .745 US Dollars

D)1FC = .70 US Dollars

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

8

The best definition for direct quotes would be "direct quotes measure

A)how much foreign currency must be exchanged to receive 1 domestic currency."

B)current or spot rates."

C)how much domestic currency must be exchanged to receive 1 foreign currency."

D)exchange rates at a future point in time."

A)how much foreign currency must be exchanged to receive 1 domestic currency."

B)current or spot rates."

C)how much domestic currency must be exchanged to receive 1 foreign currency."

D)exchange rates at a future point in time."

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

9

A transaction involving foreign currency will most likely result in gains and losses to the reporting entity if the

A)forward exchange contract is selling at a premium.

B)transaction is denominated and measured in the reporting entity's currency.

C)transaction takes place in a country with a tiered monetary system.

D)transaction is denominated in a foreign currency and measured in the reporting entity's currency.

A)forward exchange contract is selling at a premium.

B)transaction is denominated and measured in the reporting entity's currency.

C)transaction takes place in a country with a tiered monetary system.

D)transaction is denominated in a foreign currency and measured in the reporting entity's currency.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following factors influences the spread between forward and spot rates?

A)which currency is denominated as the domestic currency

B)the interest rate differential over time

C)the current cross rate between the two currencies

D)all are factors that may influence the spread

A)which currency is denominated as the domestic currency

B)the interest rate differential over time

C)the current cross rate between the two currencies

D)all are factors that may influence the spread

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following does not represent an exchange risk on an exposed position to a company transacting business with a foreign vendor?

A)transaction is denominated in foreign currency, settled at a future date

B)firm commitment to purchase inventory to be paid for in foreign currency

C)Forecasted foreign currency transaction with a high probability of occurrence

D)firm commitment to purchase inventory denominated in U.S.dollars

A)transaction is denominated in foreign currency, settled at a future date

B)firm commitment to purchase inventory to be paid for in foreign currency

C)Forecasted foreign currency transaction with a high probability of occurrence

D)firm commitment to purchase inventory denominated in U.S.dollars

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is not true about exchange rates?

A)A strengthening currency is evidenced by an increase in the directly quoted exchange rate.

B)Importers benefit from a strong dollar.

C)If one can buy 1 FC for $.50, $1.00 will buy 2 FC.

D)The points in an exchange rate, or broker's commission, are influenced by several factors, including supply and demand for currency.

A)A strengthening currency is evidenced by an increase in the directly quoted exchange rate.

B)Importers benefit from a strong dollar.

C)If one can buy 1 FC for $.50, $1.00 will buy 2 FC.

D)The points in an exchange rate, or broker's commission, are influenced by several factors, including supply and demand for currency.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

13

A U.S.manufacturer has sold goods to a foreign firm for a sale price of 80,000 FC on 12/15/16.The invoice is due 1/15/17.The U.S.Firm fiscal year is 12/31/16.Given the following exchange rates, what gain or loss would the U.S.firm record on 12/31? ?

A)loss of $4,000

B)loss of $1,600

C)gain of $2,400

D)gain of $4,000

A)loss of $4,000

B)loss of $1,600

C)gain of $2,400

D)gain of $4,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

14

Foreign currency transactions not involving a hedge should be accounted for using

A)the one-transaction method.

B)the two-transaction method.

C)a hybrid of the one- and two-transaction methods.

D)either the one- or the two-transaction method (allowed by the FASB).

A)the one-transaction method.

B)the two-transaction method.

C)a hybrid of the one- and two-transaction methods.

D)either the one- or the two-transaction method (allowed by the FASB).

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

15

Wild, Inc.sold merchandise for 500,000 FC to a foreign vendor on November 30, 2020.Payment in foreign currency is due January 31, 2021.Exchange rates to purchase 1 foreign currency unit are as follows: ?

In the year in which the sale was made, 2020, what amount should Wild report as foreign exchange gain/loss from this transaction?

A)$25,000 loss

B)$20,000 loss

C)$5,000 loss

D)$20,000 gain

In the year in which the sale was made, 2020, what amount should Wild report as foreign exchange gain/loss from this transaction?

A)$25,000 loss

B)$20,000 loss

C)$5,000 loss

D)$20,000 gain

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

16

Hugh, Inc.purchased merchandise for 300,000 FC from a British vendor on November 30, 2018.Payment in British pounds is due January 31, 2019.Exchange rates to purchase 1 FC is as follows: ?

In the December 31, 2018 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

A)$3,000 loss

B)$9,000 gain

C)$9,000 loss

D)$3,000 gain

In the December 31, 2018 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

A)$3,000 loss

B)$9,000 gain

C)$9,000 loss

D)$3,000 gain

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

17

A bank dealing in foreign currency tells you that the foreign currency will buy you $.80 US dollars.The bank has given you

A)a direct quote.

B)an indirect quote.

C)the official (fixed) rate.

D)a forward rate.

A)a direct quote.

B)an indirect quote.

C)the official (fixed) rate.

D)a forward rate.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

18

The forward rate in a forward contract

A)is the spot rate at the expiration date of the contract.

B)changes as the spot rate changes.

C)is said to be at a discount if it exceeds the spot rate at the inception of the contract.

D)None of the above are true.

A)is the spot rate at the expiration date of the contract.

B)changes as the spot rate changes.

C)is said to be at a discount if it exceeds the spot rate at the inception of the contract.

D)None of the above are true.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

19

A U.S.manufacturer has sold computer services to a foreign firm, billed the firm and later received 200,000 foreign currency units (FC).The exchange rates were 1 FC = $.75 on the date of the sale and 1 FC = $.80 when the receivable was settled.On the transaction date, the settlement exchange rate is estimated to be 1 FC = $.72.By the settlement date, what is the total exchange gain or loss recorded for the transaction if the two-transaction method is used?

A)$10,000 exchange gain

B)$6,000 exchange loss

C)$10,000 exchange loss

D)no gain or loss

A)$10,000 exchange gain

B)$6,000 exchange loss

C)$10,000 exchange loss

D)no gain or loss

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

20

A United States based company that has not hedged an exposed asset position would experience an exchange gain if

A)forward rates increased.

B)forward rates decreased.

C)spot rates increased.

D)spot rates decreased.

A)forward rates increased.

B)forward rates decreased.

C)spot rates increased.

D)spot rates decreased.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

21

Exchange gains and losses on a forward exchange contract that covers the same time period as the transaction which it provides a fair value hedge for should be recognized as

A)an extraordinary item.

B)part of the original sales transaction.

C)income from continuing operations.

D)other comprehensive income.

A)an extraordinary item.

B)part of the original sales transaction.

C)income from continuing operations.

D)other comprehensive income.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

22

On 6/1/17, an American firm sold inventory costing 100,000 Euro from a Dutch firm with payment to be received on 8/1/17.Also on 6/1/17, the American firm acquired an option for $1,500 to sell 100,000 Euro on 8/1/17.The strike price for the option was $1.21.The exchange rates were as follows: ?

The American firm's fiscal year end is June 30, 2017.What is the net gain or loss recognized in the financial statements for the year ended June 30, 2017?

A)$700 loss

B)$1,000 loss

C)$6,000 loss

D)$4,300 loss

The American firm's fiscal year end is June 30, 2017.What is the net gain or loss recognized in the financial statements for the year ended June 30, 2017?

A)$700 loss

B)$1,000 loss

C)$6,000 loss

D)$4,300 loss

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

23

On August 1, 2016, an American firm purchased a machine costing 200,000,000 yen from a Japanese firm to be paid for on October 1, 2016.Also on August 1, 2016, the American firm entered into a contract to purchase 200,000,000 yen to be delivered on October 1, 2016, at a forward rate of 1 Yen = $0.00783.The exchange rates were as follows: ?

Which of the following statements is incorrect concerning the accounting treatment of these transactions?

A)The machine's final recorded value was $1,558,000.

B)The beginning balance in the accounts payable was $1,562,000.

C)An exchange loss on the accounts payable of $4,000 was recognized on October 1, 2016.

D)The value of the accounts payable just before payment, on October 1, 2016, was $1,558,000.

Which of the following statements is incorrect concerning the accounting treatment of these transactions?

A)The machine's final recorded value was $1,558,000.

B)The beginning balance in the accounts payable was $1,562,000.

C)An exchange loss on the accounts payable of $4,000 was recognized on October 1, 2016.

D)The value of the accounts payable just before payment, on October 1, 2016, was $1,558,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

24

Larson, Inc.sold merchandise for 600,000 FC to a foreign vendor on November 30, 2020.Payment in foreign currency is due January 31, 2021.On the same day, Larson signed an agreement with a foreign exchange broker to sell 600,000 FC on January 31, 2021.Exchange rates to purchase 1 FC are as follows: ?

What will be the recorded amount of the Forward Contract on November 30, 2020?

A)$894,000

B)$888,000

C)$882,000

D)$0

What will be the recorded amount of the Forward Contract on November 30, 2020?

A)$894,000

B)$888,000

C)$882,000

D)$0

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

25

On 6/1/17, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/17.Also on 6/1/17, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/17.The exchange rates were as follows: ?

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.What is the value of the Forward Contract on 6/30/17?

A)$75,000

B)$1,000

C)$993

D)$74,000

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.What is the value of the Forward Contract on 6/30/17?

A)$75,000

B)$1,000

C)$993

D)$74,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

26

The two distinguishing characteristics of a derivative are

A)one or more options and one or more exchange rates.

B)one or more underlying and one or more notional amounts.

C)cash flows and economic exchange.

D)a per share price and a quantity.

A)one or more options and one or more exchange rates.

B)one or more underlying and one or more notional amounts.

C)cash flows and economic exchange.

D)a per share price and a quantity.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

27

A derivative:

A)requires little or no initial investment.

B)derives its value from changes in its underlying rate.

C)can be settled for cash without having to buy or sell the related asset or liability.

D)All of the above.

A)requires little or no initial investment.

B)derives its value from changes in its underlying rate.

C)can be settled for cash without having to buy or sell the related asset or liability.

D)All of the above.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

28

Gains and losses resulting from a derivative instrument used for a cash flow hedge are recognized in current earnings:

A)for the portion is deemed ineffective.

B)as incurred.

C)in the same period the hedged item affects earnings.

D)Both a and c are correct.

A)for the portion is deemed ineffective.

B)as incurred.

C)in the same period the hedged item affects earnings.

D)Both a and c are correct.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

29

Pile, Inc.purchased merchandise for 500,000 FC from a foreign vendor on November 30, 2020.Payment in foreign currency is due January 31, 2021.On the same day, Pile signed an agreement with a foreign exchange broker to buy 500,000 FC on January 31, 2021.Exchange rates to purchase 1 FC are as follows: ?

What will be the adjustment to the account payable included in the journal entry record on December 31, 2020?

A)$20,000 debit

B)$20,000 credit

C)$30,000 debit

D)$0

What will be the adjustment to the account payable included in the journal entry record on December 31, 2020?

A)$20,000 debit

B)$20,000 credit

C)$30,000 debit

D)$0

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

30

Larson, Inc.sold merchandise for 600,000 FC to a foreign vendor on November 30, 2020.Payment in foreign currency is due January 31, 2021.On the same day, Larson signed an agreement with a foreign exchange broker to sell 600,000 FC on January 31, 2021.The discount rate is 8% and exchange rates to purchase 1 FC are as follows: ?

What is the net amount of the gains or losses recognized in the financial statements for the year ended December 31, 2020?

A)$5,840 gain

B)$6,000 loss

C)$18,000 loss

D)$12,000 gain

What is the net amount of the gains or losses recognized in the financial statements for the year ended December 31, 2020?

A)$5,840 gain

B)$6,000 loss

C)$18,000 loss

D)$12,000 gain

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is not true regarding forward contracts that cover periods of time different from the settlement period (transaction date to the settlement date)?

A)If the forward contract expires before the settlement date, the gain or loss will partially offset the gain or loss on the foreign currency transaction.

B)If the forward contract expires after the settlement date, post-settlement date gains and losses are not recognized as components of current operating income.

C)Premium and discount are amortized over the life of the contract.

D)All of these statements are true.

A)If the forward contract expires before the settlement date, the gain or loss will partially offset the gain or loss on the foreign currency transaction.

B)If the forward contract expires after the settlement date, post-settlement date gains and losses are not recognized as components of current operating income.

C)Premium and discount are amortized over the life of the contract.

D)All of these statements are true.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

32

Happ, Inc.agreed to purchase merchandise from a British vendor on November 30, 2018.The goods will arrive on January 31, 2019 and payment of 100,000 British pounds is due at that time.On November 30, 2018, Happ signed an agreement with a foreign exchange broker to buy 100,000 British pounds on January 31, 2019.Exchange rates to purchase 1 British pound are as follows: ?

Because of this commitment hedge, Happ, Inc.will record the merchandise at what value when it arrives in January?

A)$165,000

B)$164,000

C)$163,000

D)$159,000

Because of this commitment hedge, Happ, Inc.will record the merchandise at what value when it arrives in January?

A)$165,000

B)$164,000

C)$163,000

D)$159,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

33

On 6/1/17, an American firm purchased inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/17.Also on 6/1/17, the American firm acquired an option for $1,500 to purchase 100,000 Canadian dollars for delivery on 8/1/17.The strike price for the option was $0.685.The exchange rates were as follows: ?

The entry to settle the option will include:

A)a credit to Investment in Option of $1,500

B)a debit to Foreign Currency of $73,000

C)a credit to cash of $73,000

D)a credit to Investment in Option of $2,000

The entry to settle the option will include:

A)a credit to Investment in Option of $1,500

B)a debit to Foreign Currency of $73,000

C)a credit to cash of $73,000

D)a credit to Investment in Option of $2,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

34

The purpose of a hedge on an identifiable commitment where the U.S.company is selling goods is to:

A)fix the basis of sales revenue to the date of the commitment

B)eliminate all exchange gains/losses from the date of commitment to the date of settlement

C)fix the basis of cost of goods sold to the date of commitment

D)eliminate any exchange gains/losses from the transaction date to the settlement date

A)fix the basis of sales revenue to the date of the commitment

B)eliminate all exchange gains/losses from the date of commitment to the date of settlement

C)fix the basis of cost of goods sold to the date of commitment

D)eliminate any exchange gains/losses from the transaction date to the settlement date

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

35

To qualify for fair value hedge accounting, a company must document all but:

A)its hedging objectives and strategy.

B)how hedge effectiveness will be assessed.

C)the nature of the risk being hedged.

D)the amount of the gain or loss in other comprehensive income.

A)its hedging objectives and strategy.

B)how hedge effectiveness will be assessed.

C)the nature of the risk being hedged.

D)the amount of the gain or loss in other comprehensive income.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

36

The time value of an option is the difference between the

A)premium paid and its current rate.

B)premium paid and its intrinsic value.

C)exercise price and its current rate.

D)call option price and the put option price.

A)premium paid and its current rate.

B)premium paid and its intrinsic value.

C)exercise price and its current rate.

D)call option price and the put option price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

37

On 6/1/17, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/17.Also on 6/1/17, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/17.The exchange rates were as follows: ?

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.What is the recorded value of the Forward Contract on 6/1/17?

A)$73,000

B)$74,000

C)$68,000

D)$0

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.What is the recorded value of the Forward Contract on 6/1/17?

A)$73,000

B)$74,000

C)$68,000

D)$0

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

38

A fair value hedge may include hedges against the change in the fair value of all but:

A)an accounts receivable.

B)a purchase order.

C)a long-term loan.

D)a forecasted sale.

A)an accounts receivable.

B)a purchase order.

C)a long-term loan.

D)a forecasted sale.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

39

Which is true of foreign currency forward contracts and foreign currency options?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

40

On 6/1/17, an American firm purchased inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/17.Also on 6/1/17, the American firm acquired an option for $1,500 to purchase 100,000 Canadian dollars for delivery on 8/1/17.The strike price for the option was $0.685.The exchange rates were as follows: ?

The American firm's fiscal year end is June 30, 2017.What is the net gain or loss recognized in the financial statements for the year ended June 30, 2017?

A)$2,000 loss

B)$1,000 loss

C)$0

D)$1,000 gain

The American firm's fiscal year end is June 30, 2017.What is the net gain or loss recognized in the financial statements for the year ended June 30, 2017?

A)$2,000 loss

B)$1,000 loss

C)$0

D)$1,000 gain

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

41

Zerlie's Imports purchased automotive parts from a German firm on July 1, 2016.The parts cost 150,000 Euros to be paid for on August 15.To pay for the parts, Zerlie's Imports borrowed 150,000 euros from a German bank on July 16.The loan bears an 11% interest rate to be repaid on August 15 in euros.

?

Another option would have been for Zerlie's to have hedged the purchase with a forward exchange contract on July 1 to buy 150,000 euros at a forward rate of $0.67.Exchange rates were as follows:

?

?

Required:

?

a.Compute the effect on net income assuming the following:

?

?

?

?

?

?

(1)

Zerlie did not borrow to pay for the transaction or hedge the transaction on July 1.?

?

(2)

Zerlie borrowed from the German bank on July 16.?

?

(3)

Zerlie hedged the full purchase on July 1.?

?

** ignore present values and discount rates

?

?

?

b.Determine which of these three alternatives would have been the best for Zerlie under the situation described.?

?

Another option would have been for Zerlie's to have hedged the purchase with a forward exchange contract on July 1 to buy 150,000 euros at a forward rate of $0.67.Exchange rates were as follows:

?

?

Required:

?

a.Compute the effect on net income assuming the following:

?

?

?

?

?

?

(1)

Zerlie did not borrow to pay for the transaction or hedge the transaction on July 1.?

?

(2)

Zerlie borrowed from the German bank on July 16.?

?

(3)

Zerlie hedged the full purchase on July 1.?

?

** ignore present values and discount rates

?

?

?

b.Determine which of these three alternatives would have been the best for Zerlie under the situation described.?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

42

On January 1, 2016, a U.S.firm bought a truck from a foreign firm for 10,000 FC, to be paid on March 1 in FC.The spot rate was 1 FC = $1.25 on January 1 and 1 FC = $1.265 on March 1.To protect themselves from exchange rate changes, the U.S.firm entered into a forward exchange contract on January 1 to buy FC on March 1 for $1.28.

Required:

Make all the necessary journal entries to record the transactions for the U.S.firm on January 1 and March 1.Ignore the split between spot gain/loss and time value.

Required:

Make all the necessary journal entries to record the transactions for the U.S.firm on January 1 and March 1.Ignore the split between spot gain/loss and time value.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

43

Wolters Corporation is a U.S.corporation that purchased 50,000 chocolate bars from a foreign manufacturer on March 1, 2024 for 80,000 foreign currency units, to be paid on April 30, 2024.On March 1, 2024 Wolters also entered into a forward contract to purchase 80,000 foreign currency units on April 30, 2024.Wolters has a March 31 year end.

?

Exchange rates are as follows:

?

?

Required:

?

Prepare the journal entries to record the transactions through April 30, 2024.March 31 is the fiscal period end.Ignore the split between spot gain/loss and time value.

?

Exchange rates are as follows:

?

?

Required:

?

Prepare the journal entries to record the transactions through April 30, 2024.March 31 is the fiscal period end.Ignore the split between spot gain/loss and time value.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

44

On 6/1/17, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 9/1/17.Also on 6/1/17, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 9/1/17.The exchange rates were as follows: ?

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.The transaction qualifies as for accounting as a cash flow hedge.What is the amount that will be recognized in earnings in the year ended 6/30/17?

A)$1,000

B)$667

C)$333

D)$0

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.The transaction qualifies as for accounting as a cash flow hedge.What is the amount that will be recognized in earnings in the year ended 6/30/17?

A)$1,000

B)$667

C)$333

D)$0

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

45

In a hedge of a forecasted transaction, gains or losses on derivative instruments prior to the occurrence of the actual transaction should be reported as

A)a component of stockholders' equity.

B)a component of other comprehensive income.

C)an extraordinary item.

D)income from continuing operations.

A)a component of stockholders' equity.

B)a component of other comprehensive income.

C)an extraordinary item.

D)income from continuing operations.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

46

A U.S.Corp.purchased a computer from a French firm on July 1, 2020, when a Euro cost $0.25.The U.S.firm will be required to pay the French manufacturer 75,000 Euros on August 1, 2020, when the Euro costs $0.23.

Required:

Make the necessary journal entries for the U.S.firm on July 1 and August 1.

Required:

Make the necessary journal entries for the U.S.firm on July 1 and August 1.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

47

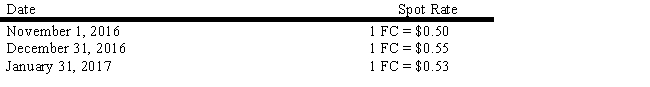

On November 1, 2016, a U.S.company purchased inventory from a foreign supplier for 100,000 FC, with payment to be made on January 31, 2017, in FC.To hedge against fluctuations in exchange rates, the firm entered into a forward exchange contract on November 1 to purchase 100,000 FC on January 31, 2017.The U.S.firm has a December 31 year end for accounting purposes.The following exchange rates may apply:

?

Discount rate = 12%

?

Required:

?

Make all the necessary journal entries for the U.S.firm relative to these events occurring between November 1, 2016, and January 31, 2017.

?

Discount rate = 12%

?

Required:

?

Make all the necessary journal entries for the U.S.firm relative to these events occurring between November 1, 2016, and January 31, 2017.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

48

The accounting treatment given a cash flow hedge of a forecasted transaction continues unless:

A)The hedging relationship is no longer highly effective based on management policies.

B)The derivative instrument is sold, terminated, or exercised.

C)The derivative instrument is no longer designated as a hedge on a forecasted transaction.

D)All of these statements are true.

A)The hedging relationship is no longer highly effective based on management policies.

B)The derivative instrument is sold, terminated, or exercised.

C)The derivative instrument is no longer designated as a hedge on a forecasted transaction.

D)All of these statements are true.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

49

Lion Corporation, a U.S.firm, entered into several foreign currency transactions during the year.Determine the effect of each transaction on net income for that current accounting year only.Lion has a June 30 year end.

?

Required:

?

a.On January 15, Lion sold $30,000 (Canadian) in merchandise to a Canadian firm, to be paid for on February 15 in Canadian dollars.Canadian dollars were worth $0.85 (U.S.) on January 15 and $0.82 (U.S.) on February 15.?

b.On June 1, Lion purchased and received a computer costing 100,000 euros from a German firm.Lion paid for the computer on August 1.On June 1, to reduce exchange risks, Lion purchased a contract to buy 100,000 marks in 60 days.Exchange rates are as follows:

?

?

Discount rate = 6%

?

c.On June 1, Lion sold merchandise to a customer for 100,000 FC and purchased an option to sell 100,000 FC in 60 days to hedge the receivable.The option sold for a premium of $6,500 and a strike price of $1.20.The value of the option 6/30 was $12,500.The spot rate on June 1 was $1.19 and $1.25 on June 30.

?

Required:

?

a.On January 15, Lion sold $30,000 (Canadian) in merchandise to a Canadian firm, to be paid for on February 15 in Canadian dollars.Canadian dollars were worth $0.85 (U.S.) on January 15 and $0.82 (U.S.) on February 15.?

b.On June 1, Lion purchased and received a computer costing 100,000 euros from a German firm.Lion paid for the computer on August 1.On June 1, to reduce exchange risks, Lion purchased a contract to buy 100,000 marks in 60 days.Exchange rates are as follows:

?

?

Discount rate = 6%

?

c.On June 1, Lion sold merchandise to a customer for 100,000 FC and purchased an option to sell 100,000 FC in 60 days to hedge the receivable.The option sold for a premium of $6,500 and a strike price of $1.20.The value of the option 6/30 was $12,500.The spot rate on June 1 was $1.19 and $1.25 on June 30.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

50

On November 1, 2016, DEMO Corp., a U.S.firm, sold merchandise to a foreign firm for 60,000 FC.DEMO will be paid on January 31, 2017, in FC.The spot rates on selected dates were as follows:

?

?

Required:

Required:

?

Assuming that DEMO has a December 31 year end, prepare the necessary journal entries to account for the series of transactions involving the sale.

?

?

Required:

Required:?

Assuming that DEMO has a December 31 year end, prepare the necessary journal entries to account for the series of transactions involving the sale.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

51

On 6/1/17, an American firm purchased an inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/17.Also on 6/1/17, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/17.The exchange rates were as follows: ?

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.The transaction qualifies as for accounting as a cash flow hedge.What is the total amount that will be recognized in other comprehensive income in the year ended 6/30/17?

A)$1,987 debit

B)$2,320 credit

C)$320 credit

D)$2,000 debit

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.The transaction qualifies as for accounting as a cash flow hedge.What is the total amount that will be recognized in other comprehensive income in the year ended 6/30/17?

A)$1,987 debit

B)$2,320 credit

C)$320 credit

D)$2,000 debit

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

52

Wolters Corporation is a U.S.corporation that purchased 50,000 chocolate bars from a foreign manufacturer on 6/1/24 for 80,000 foreign currency units, to be paid on 9/1/24.On 6/1/24 Wolters also entered into a forward contract to purchase 80,000 foreign currency units on 9/1/24.Wolters has a July 31 year end.

?

Exchange rates are as follows:

?

Discount rate = 12%

?

Required:

?

Make the necessary journal entries for Wolters for the period June 1 through September 1, 2024.

?

?

Exchange rates are as follows:

?

Discount rate = 12%

?

Required:

?

Make the necessary journal entries for Wolters for the period June 1 through September 1, 2024.

?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

53

On 4/1/18, a U.S.Company commits to sell a piece of equipment to a French customer.At that time, the U.S.company enters into a forward contract to sell foreign currency on 8/1/18 (120 days).Delivery will take place 7/1/18 with payment due on 8/1/18.The fiscal year end for the company is 6/30/18.The sales price of the equipment is 200,000 Euros.Various exchange rates are as follows: ?

Discount rate is 12%.What is the value of Forward Contract on 6/30?

A)4,000 debit

B)3,960 debit

C)4,000 credit

D)3,960 credit

Discount rate is 12%.What is the value of Forward Contract on 6/30?

A)4,000 debit

B)3,960 debit

C)4,000 credit

D)3,960 credit

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

54

On 4/1/18, a U.S.Company commits to sell a piece of equipment to a French customer.At that time, the U.S.company enters into a forward contract to sell foreign currency on 8/1/18 (120 days).Delivery and payment will take place 8/1/18.The fiscal year end for the company is 6/30/18.The sales price of the equipment is 200,000 Euros.Various exchange rates are as follows: ?

Discount rate is 12%.What is the amount in the Firm Commitment account on 6/30/18?

A)4,000 debit

B)9,901 debit

C)3,960 credit

D)6,000 credit

Discount rate is 12%.What is the amount in the Firm Commitment account on 6/30/18?

A)4,000 debit

B)9,901 debit

C)3,960 credit

D)6,000 credit

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is true concerning forward contracts classified as hedges of an identifiable foreign currency commitment?

A)Forward contracts used as hedges cannot exceed the foreign currency commitment.

B)Forward contracts cannot extend for a time period after the transaction date of the commitment.

C)The gain or loss traceable to the time period after the transaction date of the commitment are treated as a hedge of a receivable or payable.

D)None of these statements is true.

A)Forward contracts used as hedges cannot exceed the foreign currency commitment.

B)Forward contracts cannot extend for a time period after the transaction date of the commitment.

C)The gain or loss traceable to the time period after the transaction date of the commitment are treated as a hedge of a receivable or payable.

D)None of these statements is true.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not true concerning the accounting for hedges of forecasted transactions using an option?

A)An intrinsic value must be calculated throughout the hedge period

B)The accounting requires revaluing the market value of the option

C)The option fixes the value of the transaction to the date of the commitment.

D)All of these statements are true.

A)An intrinsic value must be calculated throughout the hedge period

B)The accounting requires revaluing the market value of the option

C)The option fixes the value of the transaction to the date of the commitment.

D)All of these statements are true.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

57

Remle Corporation is a U.S.corporation that sold merchandise a foreign manufacturer on March 1, 2024 for 200,000 foreign currency units.The funds will be received on April 30, 2024.On March 1, 2024 Wolters also entered into a forward contract to sell 200,000 foreign currency units on April 30, 2024.Remle has a March 31 year end.

?

Exchange rates are as follows:

?

?

Required:

?

Prepare the journal entries to record the transactions through April 30, 2024.March 31 is the fiscal period end.Ignore the split between spot gain/loss and time value and Cost of Goods Sold.

?

Exchange rates are as follows:

?

?

Required:

?

Prepare the journal entries to record the transactions through April 30, 2024.March 31 is the fiscal period end.Ignore the split between spot gain/loss and time value and Cost of Goods Sold.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

58

A hedge fund is similar to a mutual fund in that it invests funds on behalf of clients.Select the notable difference between hedge funds and mutual funds from the following choices?

A)Hedge funds have to register under U.S.federal securities law.

B)Hedge funds do not publicly offer their securities.

C)Mutual funds and not hedge funds have all sophisticated investors and thus are subject to more regulations.

D)Unlike mutual funds, rarely do hedge funds use derivatives for speculation.

A)Hedge funds have to register under U.S.federal securities law.

B)Hedge funds do not publicly offer their securities.

C)Mutual funds and not hedge funds have all sophisticated investors and thus are subject to more regulations.

D)Unlike mutual funds, rarely do hedge funds use derivatives for speculation.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

59

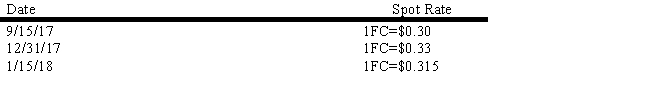

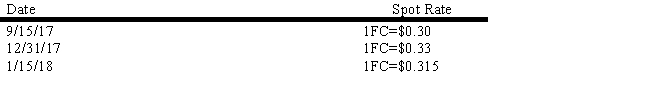

On September 15, 2017, Wall Company, a U.S.firm, purchased a piece of equipment from a foreign firm for 500,000 FC.Payment for the equipment was to be made in FC on January 15, 2018.The spot rates on selected dates were as follows:

Required:

a.Assuming that the US Corp.has a December 31 year end, prepare the necessary journal entries to account for the series of transactions involving the purchase.

b.Prepare all the necessary journal entries assuming that the US Corp.will be paying for the equipment in U.S.dollars.

Required:

a.Assuming that the US Corp.has a December 31 year end, prepare the necessary journal entries to account for the series of transactions involving the purchase.

b.Prepare all the necessary journal entries assuming that the US Corp.will be paying for the equipment in U.S.dollars.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

60

In the accounting for forward exchange contracts, gains and losses are measured using either spot or forward rates.Which of the following statements concerning measurement of gains and losses is true?

A)The gains or losses in a hedge on an exposed asset will be calculated using the spot rate for the asset and the forward rate for the forward contract.

B)The contract premium in a hedge of a forecasted transaction will be calculated using the forward rate throughout the contract.

C)The gains or losses in a hedge on an identifiable commitment will be calculated using the spot rate for the commitment and the forward rate for the forward contract.

D)All of these statements are true.

A)The gains or losses in a hedge on an exposed asset will be calculated using the spot rate for the asset and the forward rate for the forward contract.

B)The contract premium in a hedge of a forecasted transaction will be calculated using the forward rate throughout the contract.

C)The gains or losses in a hedge on an identifiable commitment will be calculated using the spot rate for the commitment and the forward rate for the forward contract.

D)All of these statements are true.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

61

On November 1, 20X8 Desket, Inc.a U.S.company agreed to sell goods to a foreign buyer for 200,000 FC.The goods were to be shipped on January 31, 2024 with payment to be received on that day.

?

The hedging contract, signed on November 1, 20X8, called for the sale of 200,000 FC on January 31, 2024.Assume the December 31 is fiscal year end.Exchange rates are as follows:

?

Discount rate = 12%

?

Required:

?

Prepare all necessary entries through December 31, 20X8 for the commitment hedge and sale.Ignore Cost of Goods Sold.

?

The hedging contract, signed on November 1, 20X8, called for the sale of 200,000 FC on January 31, 2024.Assume the December 31 is fiscal year end.Exchange rates are as follows:

?

Discount rate = 12%

?

Required:

?

Prepare all necessary entries through December 31, 20X8 for the commitment hedge and sale.Ignore Cost of Goods Sold.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

62

Blue & Green, Inc.sold merchandise for 100,000 FC to a foreign vendor on December 1, 2020.Payment in FC is due January 31, 2021.On December 1, 2020, Blue & Green purchased an option for $500 to sell 100,000 FC at $1.45 on January 30, 2021.Exchange rates to sell 1 FC are as follows:

?

Fiscal Year End is 12/31.

?

Required:

?

Prepare the journal entries for December 1 through January 31 related to the events described above.Ignore Cost of Goods Sold.

?

Fiscal Year End is 12/31.

?

Required:

?

Prepare the journal entries for December 1 through January 31 related to the events described above.Ignore Cost of Goods Sold.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

63

For a hedge on an exposed position, describe the process of valuing the forward contract as of the fiscal period end date.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

64

Blue & Green, Inc.sold merchandise for 100,000 FC to a foreign vendor on December 1, 2020.Payment in FC is due January 31, 2021.On December 1, 2020, Blue & Green signed an agreement with a foreign exchange broker to sell 100,000 FC on January 30, 2021.Exchange rates to sell 1 FC are as follows:

?

Fiscal Year End is 12/31; Discount rate = 12%

?

Required:

?

Prepare the journal entries for December 1 through January 31 related to the events described above.Ignore Cost of Goods Sold.

?

Fiscal Year End is 12/31; Discount rate = 12%

?

Required:

?

Prepare the journal entries for December 1 through January 31 related to the events described above.Ignore Cost of Goods Sold.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

65

Bulldog Enterprise, a U.S.firm, agreed on February 1, 2016, to buy gears from a Mexican firm for 75,000 pesos.Delivery is scheduled for May 1, 2016, with payment due at that time.On February 1, 2016, Bulldog also acquired a forward contract to buy 75,000 pesos on May 1, 2016.(The gears represent inventory to the U.S.firm.) Bulldog's year end is March 31.

?

Required:

?

Prepare the journal entries necessary for Bulldog Enterprise to record this activity.Assume that the following exchange rates existed:

?

Discount rate 15%

?

Required:

?

Prepare the journal entries necessary for Bulldog Enterprise to record this activity.Assume that the following exchange rates existed:

?

Discount rate 15%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

66

Rex Corporation, a U.S.firm with a calendar accounting year, agreed to buy a specially made truck from a Japanese firm for delivery on February 28, 2017 with payment due on that date.On the same date the agreement was signed, November 1, 2016, a forward contract due on February 28, 2017, was also signed to purchase 1,000,000 yen, the contract price of the truck.Exchange rates were as follows:

?

Discount rate = 8%

?

Required:

?

Prepare the journal entries needed to properly reflect the purchase and forward contract through the end of the fiscal year.

?

Discount rate = 8%

?

Required:

?

Prepare the journal entries needed to properly reflect the purchase and forward contract through the end of the fiscal year.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

67

Discuss the differences in using an option to hedge a foreign currency risk rather than a forward contract.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

68

Differentiate between the following monetary systems: floating system, controlled float system and tiered system.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

69

A 60-day contract has a value today in US dollars of $6,400 and $8,000 in Foreign Currency (FC) with interest rates of 5% and 8%, respectively.The spot rate today is 1 FC= .80.

Calculate the US Value in 2 months

Calculate the FC Value in 2 months

Calculate the Forward rate.

Calculate the US Value in 2 months

Calculate the FC Value in 2 months

Calculate the Forward rate.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

70

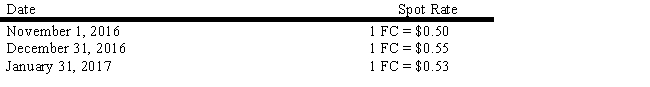

On November 1, 2016, a U.S.company sold merchandise to a foreign firm for 100,000 FC with payment to be made on January 31, 2017, in FC.To hedge against fluctuations in exchange rates, the firm also entered into a forward exchange contract on November 1, 2016 to sell 100,000 FC on January 31, 2017.The U.S.firm has a December 31 year end for accounting purposes.The following exchange rates may apply:

?

Discount rate = 10%

?

Required:

?

Make all the necessary journal entries for the U.S.firm relative to these events occurring between November 1, 2016, and January 31, 2017.

?

Discount rate = 10%

?

Required:

?

Make all the necessary journal entries for the U.S.firm relative to these events occurring between November 1, 2016, and January 31, 2017.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

71

On 7/1, a company forecasts the purchase of 10,000 units of inventory from a foreign vendor.The forecasted cost is estimated to be 150,000 FC.It is estimated inventory will be delivered 11/1.Also, on 7/1, the company purchased a call option to buy 150,000 FC at a strike price of $0.60 anytime during October.An option premium of $2,000 was paid.

?

?

Required:

?

Prepare the journal entries required through 10/1.

?

?

Required:

?

Prepare the journal entries required through 10/1.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

72

On November 1, 2016, a U.S.company purchased inventory from a foreign supplier for 100,000 FC, with payment to be made on January 31, 2017, in FC.To hedge against fluctuations in exchange rates, the firm entered into a forward exchange contract on November 1 to purchase 100,000 FC on January 31, 2017.The U.S.firm has a December 31 year end for accounting purposes.The following exchange rates may apply:

?

?

Discount rate = 12%.The transaction qualifies for treatment as a cash flow hedge.

?

Required:

?

Make all the necessary journal entries for the U.S.firm relative to these events occurring between November 1, 2016, and January 31, 2017.

?

?

?

Discount rate = 12%.The transaction qualifies for treatment as a cash flow hedge.

?

Required:

?

Make all the necessary journal entries for the U.S.firm relative to these events occurring between November 1, 2016, and January 31, 2017.

?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

73

Wolters Corporation is a U.S.corporation that purchased 50,000 chocolate bars from a foreign manufacturer on 6/1/24 for 80,000 foreign currency units, to be paid on 9/1/24.On 6/1/24 Wolters also entered into a forward contract to purchase 80,000 foreign currency units on 9/1/24.Wolters has a July 31 year end.

?

Exchange rates are as follows:

?

The option strike price was $0.645.

?

Required:

?

Make the necessary journal entries for Wolters for the period June 1 through September 1, 2024.

?

Exchange rates are as follows:

?

The option strike price was $0.645.

?

Required:

?

Make the necessary journal entries for Wolters for the period June 1 through September 1, 2024.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

74

Describe the risks and uncertainty a U.S.company faces when purchasing goods from a foreign corporation and settling the transaction in the foreign currency.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

75

On January 1, 2016, a domestic firm agrees to sell goods to a foreign customer, with delivery to be made and payment to be received on April 1, 2016.The goods are valued at 50,000 FC.On January 1, 2016, the domestic firm purchased a 90-day forward contract to sell 50,000 FC.Exchange rates on selected dates are as follows:

?

Discount rate = 10%

?

Required:

?

Prepare the journal entries needed to properly reflect the sales transaction and the forward exchange contract.The forward contract meets the conditions necessary to be classified as a hedge on an identifiable foreign currency commitment.Include the table to calculate the split between exchange gains or losses on the contract due to changes in spot rates and the changes in time value.

?

Discount rate = 10%

?

Required:

?

Prepare the journal entries needed to properly reflect the sales transaction and the forward exchange contract.The forward contract meets the conditions necessary to be classified as a hedge on an identifiable foreign currency commitment.Include the table to calculate the split between exchange gains or losses on the contract due to changes in spot rates and the changes in time value.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck