Exam 10: Foreign Currency Transactions

Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice48 Questions

Exam 2: Consolidated Statements: Date of Acquisition44 Questions

Exam 3: Consolidated Statements: Subsequent to Acquisition37 Questions

Exam 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes43 Questions

Exam 5: Intercompany Transactions: Bonds and Leases54 Questions

Exam 6: Cash Flow, Eps, and Taxation48 Questions

Exam 7: Special Issues in Accounting for an Investment in a Subsidiary42 Questions

Exam 9: The International Accounting Environment17 Questions

Exam 10: Foreign Currency Transactions75 Questions

Exam 11: Translation of Foreign Financial Statements79 Questions

Exam 12: Interim Reporting and Disclosures About Segments of an Enterprise63 Questions

Exam 13: Partnerships: Characteristics, Formation, and Accounting for Activities36 Questions

Exam 14: Partnerships: Ownership Changes and Liquidations47 Questions

Exam 15: Government and Not for Profit Accounting44 Questions

Exam 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds60 Questions

Exam 17: Financial Reporting Issues37 Questions

Exam 18: Accounting for Private Not-For-Profit Organizations61 Questions

Exam 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations83 Questions

Exam 20: Estates and Trusts: Their Nature and the Accountants Role56 Questions

Exam 21: Debt Restructuring, Corporate Reorganizations, and Liquidations49 Questions

Exam 22: Derivatives and Related Accounting Issues60 Questions

Exam 23: Equity Method for Unconsolidated Investments25 Questions

Exam 24: Variable Interest Entities10 Questions

Select questions type

On 6/1/17, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/17.Also on 6/1/17, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/17.The exchange rates were as follows: ?

Spot Forward 6/1/17 1=\ 0.73 1=\ 0.74 6/30/17 1=\ 0.70 1=\ 0.75 8/1/17 1=\ 0.68 1=\ 0.68 The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.What is the value of the Forward Contract on 6/30/17?

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

C

The purpose of a hedge on an identifiable commitment where the U.S.company is selling goods is to:

Free

(Multiple Choice)

4.7/5  (34)

(34)

Correct Answer:

A

For a hedge on an exposed position, describe the process of valuing the forward contract as of the fiscal period end date.

Free

(Essay)

4.7/5  (39)

(39)

Correct Answer:

a. Calculate the fair value of the forward contract*:

Original Fwd. Value of Contract

* The number of days forward is based on the number of days remaining until the settlement date.

b. Calculate the present value of the change:

Change in forward value discounted at a rate of interest periods, for

number of months until settlement

c. Calculate the change in present value:

Current Present value of contract

Frior Present value of contract

Change in Present Value

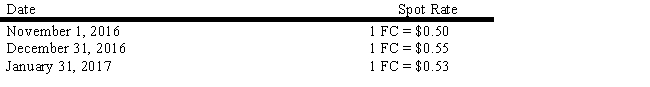

On November 1, 2016, DEMO Corp., a U.S.firm, sold merchandise to a foreign firm for 60,000 FC.DEMO will be paid on January 31, 2017, in FC.The spot rates on selected dates were as follows:

?

?

Required:

?

Assuming that DEMO has a December 31 year end, prepare the necessary journal entries to account for the series of transactions involving the sale.

Required:

?

Assuming that DEMO has a December 31 year end, prepare the necessary journal entries to account for the series of transactions involving the sale.

(Essay)

4.8/5  (31)

(31)

On November 1, 2016, a U.S.company sold merchandise to a foreign firm for 100,000 FC with payment to be made on January 31, 2017, in FC.To hedge against fluctuations in exchange rates, the firm also entered into a forward exchange contract on November 1, 2016 to sell 100,000 FC on January 31, 2017.The U.S.firm has a December 31 year end for accounting purposes.The following exchange rates may apply:

?

Discount rate = 10%

Date Spot Rate Fwd. Rate 11/1/16 \ 0.15 \ 0.17 12/31/16 \ 0.16 \ 0.175 1/31/17 \ 0.165 \ 0.165 ?

Required:

?

Make all the necessary journal entries for the U.S.firm relative to these events occurring between November 1, 2016, and January 31, 2017.

(Essay)

4.8/5  (34)

(34)

On 6/1/17, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 9/1/17.Also on 6/1/17, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 9/1/17.The exchange rates were as follows: ?

Spot Forward 6/1/17 1=\ 0.73 1=\ 0.74 6/30/17 1=\ 0.75 1=\ 0.76 9/1/17 1=\ 0.78 1=\ 0.78

The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.The transaction qualifies as for accounting as a cash flow hedge.What is the amount that will be recognized in earnings in the year ended 6/30/17?

(Multiple Choice)

4.7/5  (28)

(28)

Lion Corporation, a U.S.firm, entered into several foreign currency transactions during the year.Determine the effect of each transaction on net income for that current accounting year only.Lion has a June 30 year end.

?

Required:

?

a.On January 15, Lion sold $30,000 (Canadian) in merchandise to a Canadian firm, to be paid for on February 15 in Canadian dollars.Canadian dollars were worth $0.85 (U.S.) on January 15 and $0.82 (U.S.) on February 15.?

b.On June 1, Lion purchased and received a computer costing 100,000 euros from a German firm.Lion paid for the computer on August 1.On June 1, to reduce exchange risks, Lion purchased a contract to buy 100,000 marks in 60 days.Exchange rates are as follows:

?

?

Spot Forward 6/1 \ 0.53 \ 0.60 6/30 \ 0.54 \ 0.58 Discount rate = 6%

?

c.On June 1, Lion sold merchandise to a customer for 100,000 FC and purchased an option to sell 100,000 FC in 60 days to hedge the receivable.The option sold for a premium of $6,500 and a strike price of $1.20.The value of the option 6/30 was $12,500.The spot rate on June 1 was $1.19 and $1.25 on June 30.

(Essay)

4.8/5  (37)

(37)

In a hedge of a forecasted transaction, gains or losses on derivative instruments prior to the occurrence of the actual transaction should be reported as

(Multiple Choice)

4.9/5  (35)

(35)

Remle Corporation is a U.S.corporation that sold merchandise a foreign manufacturer on March 1, 2024 for 200,000 foreign currency units.The funds will be received on April 30, 2024.On March 1, 2024 Wolters also entered into a forward contract to sell 200,000 foreign currency units on April 30, 2024.Remle has a March 31 year end.

?

Exchange rates are as follows:

?

?

Date Spot Rate Forward Rate 3/1/24 \ 0.69 \ 0.65 3/31/24 \ 0.61 \ 0.63 4/30/24 \ 0.66 \ 0.66 Required:

?

Prepare the journal entries to record the transactions through April 30, 2024.March 31 is the fiscal period end.Ignore the split between spot gain/loss and time value and Cost of Goods Sold.

(Essay)

4.7/5  (32)

(32)

When an economic transaction is denominated in a currency other than the entity's domestic currency, the entity must establish a

(Multiple Choice)

4.9/5  (38)

(38)

On 6/1/17, an American firm purchased inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/17.Also on 6/1/17, the American firm acquired an option for $1,500 to purchase 100,000 Canadian dollars for delivery on 8/1/17.The strike price for the option was $0.685.The exchange rates were as follows: ?

Spot Option value 6/1/17 1=\ 0.68 \ 1,500 6/30/17 1=\ 0.70 \ 2,500 8/1/17 1=\ 0.73 \ 4,500 The entry to settle the option will include:

(Multiple Choice)

4.8/5  (30)

(30)

A United States based company that has not hedged an exposed asset position would experience an exchange gain if

(Multiple Choice)

4.9/5  (30)

(30)

Differentiate between the following monetary systems: floating system, controlled float system and tiered system.

(Essay)

4.9/5  (32)

(32)

Rex Corporation, a U.S.firm with a calendar accounting year, agreed to buy a specially made truck from a Japanese firm for delivery on February 28, 2017 with payment due on that date.On the same date the agreement was signed, November 1, 2016, a forward contract due on February 28, 2017, was also signed to purchase 1,000,000 yen, the contract price of the truck.Exchange rates were as follows:

?

Discount rate = 8%

Date Spot Rate Forward Rate 11/1/16 \ 0.0076 \ 0.0078 12/31/16 \ 0.0081 \ 0.0080 2/28/17 \ 0.0085 \ 0.0085 ?

Required:

?

Prepare the journal entries needed to properly reflect the purchase and forward contract through the end of the fiscal year.

(Essay)

4.9/5  (34)

(34)

A U.S.manufacturer has sold goods to a foreign firm for a sale price of 80,000 FC on 12/15/16.The invoice is due 1/15/17.The U.S.Firm fiscal year is 12/31/16.Given the following exchange rates, what gain or loss would the U.S.firm record on 12/31? ?

12/15 1=\ 0.60 US Dollars 12/31 1=\ 0.65 US Dollars 1/15 1=\ 0.63 US Dollars

(Multiple Choice)

4.9/5  (31)

(31)

Wolters Corporation is a U.S.corporation that purchased 50,000 chocolate bars from a foreign manufacturer on 6/1/24 for 80,000 foreign currency units, to be paid on 9/1/24.On 6/1/24 Wolters also entered into a forward contract to purchase 80,000 foreign currency units on 9/1/24.Wolters has a July 31 year end.

?

Exchange rates are as follows:

?

The option strike price was $0.645.

Date Spot Rate Option Price 6/1/24 \ 0.64 \ 800 7/31/24 \ 0.66 \ 1,500 9/1/24 \ 0.69 \ 3,600 ?

Required:

?

Make the necessary journal entries for Wolters for the period June 1 through September 1, 2024.

(Essay)

4.8/5  (38)

(38)

On 6/1/17, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/17.Also on 6/1/17, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/17.The exchange rates were as follows: ?

Spot Forward 6/1/17 1=\ 0.73 1=\ 0.74 6/30/17 1=\ 0.70 1=\ 0.75 8/1/17 1=\ 0.68 1=\ 0.68 The American firm's fiscal year end is 6/30/17.The changes in the value of the forward contract should be discounted at 8%.What is the recorded value of the Forward Contract on 6/1/17?

(Multiple Choice)

4.9/5  (35)

(35)

Foreign currency transactions not involving a hedge should be accounted for using

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 75

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)