Deck 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

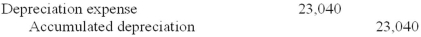

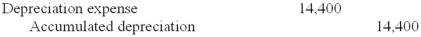

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/146

Play

Full screen (f)

Deck 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment

1

Property, plant, and equipment and finite-life intangible assets must be tested for impairment at least once a year.

False

2

Biological assets are valued at fair value less estimated costs to sell under International Financial Reporting Standards.

True

3

International Financial Reporting Standards require goodwill to be tested for impairment at least annually.

True

4

A change in the estimated recoverable units used to compute depletion requires retroactive adjustments to the financial statements.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

5

One of the advantages of group and composite methods is that gains and losses on the disposal of individual assets need not be computed.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

6

Total depreciation is the same over the life of an asset regardless of the method of depreciation used.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

7

MACRS (modified accelerated cost recovery system) depreciation is equivalent to sum-of-the-years' digits depreciation.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

8

According to International Financial Reporting Standards, property, plant, and equipment must be valued at cost less accumulated depreciation.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

9

Statutory depletion is the maximum amount of depletion that may be reported in financial statements prepared according to GAAP.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

10

The physical life of a depreciable asset sets the lower limit of its service life.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

11

According to International Financial Reporting Standards, an impairment loss for property, plant, and equipment is required only when an asset's book value exceeds the undiscounted sum of the asset's estimated future cash flows.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

12

According to International Financial Reporting Standards, the costs to successfully defend an intangible right normally are capitalized and amortized.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

13

According to International Financial Reporting Standards, the impairment loss for an indefinite-life intangible asset other than goodwill is the difference between book value and the recoverable amount.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

14

Any method of depreciation should be both systematic and rational.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

15

Changes in the estimates involved in depreciation, depletion, and amortization require retroactive restatement of financial statements.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

16

The three factors in cost allocation of a depreciable asset are service life, allocation base, and allocation method.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

17

Advocates of accelerated depreciation methods argue that their use tends to level out the total cost of ownership of an asset over its benefit period if one considers both depreciation and repair and maintenance costs.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

18

Once selected for existing assets, a company must consistently use the same method of depreciation for all subsequent fixed asset acquisitions.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

19

Activity-based methods of depreciation are appropriate for assets whose service life is a function of use rather than time.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

20

Component depreciation, required under International Financial Reporting Standards, is allowed but rarely used by U.S. companies.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

21

The factors that need to be determined to compute depreciation are an asset's:

A)Cost, residual value, and physical life.

B)Cost, replacement value, and service life.

C)Fair value, residual value, and economic life.

D)Cost, residual value, and service life.

A)Cost, residual value, and physical life.

B)Cost, replacement value, and service life.

C)Fair value, residual value, and economic life.

D)Cost, residual value, and service life.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

22

Gains on the cash sales of fixed assets:

A)Are the excess of the book value over the cash proceeds.

B)Are part of cash flows from operations.

C)Are reported on a net-of-tax basis if material.

D)Are the excess of the cash proceeds over the book value of the assets sold.

A)Are the excess of the book value over the cash proceeds.

B)Are part of cash flows from operations.

C)Are reported on a net-of-tax basis if material.

D)Are the excess of the cash proceeds over the book value of the assets sold.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

23

Prego would report depreciation in 2013 of:

A)$36,000.

B)$43,900.

C)$18,000.

D)$21,950.

A)$36,000.

B)$43,900.

C)$18,000.

D)$21,950.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

24

In the first year of an asset's life, which of the following methods has the smallest depreciation?

A)Straight-line.

B)Declining balance.

C)Sum-of-the-years' digits.

D)Composite or group.

A)Straight-line.

B)Declining balance.

C)Sum-of-the-years' digits.

D)Composite or group.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

25

Prego would report depreciation in 2014 of:

A)$135,230.

B)$126,000.

C)$108,000.

D)$105,000.

A)$135,230.

B)$126,000.

C)$108,000.

D)$105,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

26

Depreciation, depletion, and amortization:

A)All refer to the process of allocating the cost of long-term assets used in the business over future periods.

B)All generally use the same methods of cost allocation.

C)Are all handled the same in arriving at taxable income.

D)All of the above are correct.

A)All refer to the process of allocating the cost of long-term assets used in the business over future periods.

B)All generally use the same methods of cost allocation.

C)Are all handled the same in arriving at taxable income.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

27

Depreciation:

A)Is always considered a period cost.

B)Could be a product cost or a period cost depending on the use of the asset.

C)Is usually based on the declining-balance method.

D)Per books is usually higher than MACRS in the early years of an asset's life.

A)Is always considered a period cost.

B)Could be a product cost or a period cost depending on the use of the asset.

C)Is usually based on the declining-balance method.

D)Per books is usually higher than MACRS in the early years of an asset's life.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

28

The depreciable base for an asset is:

A)Its service life.

B)The excess of its cost over residual value.

C)The difference between its replacement value and cost.

D)The amount allowable under MACRS

A)Its service life.

B)The excess of its cost over residual value.

C)The difference between its replacement value and cost.

D)The amount allowable under MACRS

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

29

Assuming an asset is used evenly over a four-year service life, which method of depreciation will always result in the largest amount of depreciation in the first year?

A)Straight-line.

B)Units-of-production.

C)Double-declining balance.

D)Sum-of-the-year's digits.

A)Straight-line.

B)Units-of-production.

C)Double-declining balance.

D)Sum-of-the-year's digits.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

30

Using the straight-line method, the book value at December 31, 2013, would be:

A)$57,600.

B)$51,600.

C)$58,800.

D)$52,800.

A)$57,600.

B)$51,600.

C)$58,800.

D)$52,800.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

31

The overriding principle for all depreciation methods is that the method must be:

A)Conservative and economic.

B)Systematic and rational.

C)Consistent and conservative.

D)Significant and material.

A)Conservative and economic.

B)Systematic and rational.

C)Consistent and conservative.

D)Significant and material.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

32

Using the straight-line method, depreciation for 2013 would be:

A)$13,200.

B)$14,400.

C)$72,000.

D)None of the above is correct.

A)$13,200.

B)$14,400.

C)$72,000.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

33

Using the double-declining balance method, the book value at December 31, 2014, would be:

A)$14,400.

B)$24,960.

C)$27,360.

D)$25,920.

A)$14,400.

B)$24,960.

C)$27,360.

D)$25,920.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

34

Using the double-declining balance method, depreciation for 2014 would be:

A)$28,800.

B)$18,240.

C)$17,280.

D)None of the above is correct.

A)$28,800.

B)$18,240.

C)$17,280.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

35

By the replacement depreciation method, depreciation is recorded when assets are replaced.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

36

Using the sum-of-the-years'-digits method, depreciation for 2013 and book value at December 31, 2013, would be:

A)$22,000 and $44,000.

B)$22,000 and $50,000.

C)$24,000 and $48,000.

D)$24,000 and $42,000.

A)$22,000 and $44,000.

B)$22,000 and $50,000.

C)$24,000 and $48,000.

D)$24,000 and $42,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

37

Using the straight-line method, depreciation for 2014 and the equipment's book value at December 31, 2014, would be:

A)$14,400 and $43,200.

B)$28,800 and $37,200.

C)$13,200 and $39,600.

D)$13,200 and $45,600.

A)$14,400 and $43,200.

B)$28,800 and $37,200.

C)$13,200 and $39,600.

D)$13,200 and $45,600.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

38

Using the sum-of-the-years'-digits method, depreciation for 2014 and book value at December 31, 2014, would be:

A)$19,200 and $30,800.

B)$17,600 and $26,400.

C)$19,200 and $28,800.

D)$17,600 and $32,400.

A)$19,200 and $30,800.

B)$17,600 and $26,400.

C)$19,200 and $28,800.

D)$17,600 and $32,400.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

39

Using the double-declining balance method, depreciation for 2013 and the book value at December 31, 2013, would be:

A)$26,400 and $45,600.

B)$28,800 and $43,200.

C)$28,800 and $37,200.

D)$26,400 and $36,600.

A)$26,400 and $45,600.

B)$28,800 and $43,200.

C)$28,800 and $37,200.

D)$26,400 and $36,600.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

40

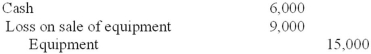

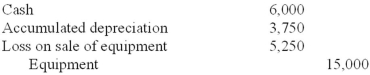

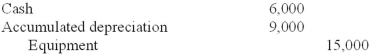

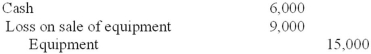

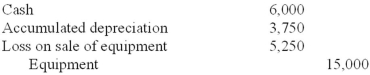

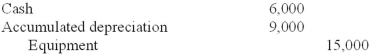

An asset acquired January 1, 2013, for $15,000 with an estimated 10-year life and no residual value is being depreciated in an equipment group asset account that has an average service life of eight years. The asset is sold on December 31, 2014, for $6,000. The entry to record the sale would be:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

41

Depreciation for 2013, using double-declining balance, would be:

A)$40,000.

B)$10,000.

C)$36,000.

D)$9,000.

A)$40,000.

B)$10,000.

C)$36,000.

D)$9,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

42

Using the sum-of-the-years'-digits method, depreciation for 2013 and book value at December 31, 2013, would be:

A)$18,000 and $27,000.

B)$16,000 and $29,000.

C)$16,000 and $24,000.

D)$18,000 and $22,000.

A)$18,000 and $27,000.

B)$16,000 and $29,000.

C)$16,000 and $24,000.

D)$18,000 and $22,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

43

The legal life of a patent is:

A)40 years.

B)20 years.

C)Life of the inventor plus 50 years.

D)Indefinite.

A)40 years.

B)20 years.

C)Life of the inventor plus 50 years.

D)Indefinite.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

44

Belotti would record depletion in 2014 of:

A)$54,667.

B)$65,600.

C)$52,480.

D)$55,760.

A)$54,667.

B)$65,600.

C)$52,480.

D)$55,760.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

45

Using the double-declining balance method, depreciation for 2014 and book value at December 31, 2014, would be:

A)$10,000 and $5,000.

B)$10,000 and $10,000.

C)$11,250 and $6,250.

D)$11,250 and $11,250.

A)$10,000 and $5,000.

B)$10,000 and $10,000.

C)$11,250 and $6,250.

D)$11,250 and $11,250.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

46

Asset C3PO has a depreciable base of $16.5 million and a service life of 10 years. What would the accumulated depreciation be at the end of year five under the sum-of-the-years' digits method?

A)$4.5 million.

B)$8.25 million.

C)$12 million.

D)None of the above is correct.

A)$4.5 million.

B)$8.25 million.

C)$12 million.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

47

Using the sum-of-the years'-digits method, depreciation for 2014 and book value at December 31, 2014, would be

A)$13,500 and $13,500.

B)$13,500 and $8,500.

C)$12,000 and $17,000.

D)$12,000 and $12,000.

A)$13,500 and $13,500.

B)$13,500 and $8,500.

C)$12,000 and $17,000.

D)$12,000 and $12,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

48

Short Corporation purchased Hathaway, Inc., for $52,000,000. The fair value of all Hathaway's identifiable tangible and intangible assets was $48,000,000. Short will amortize any goodwill over the maximum number of years allowed. What is the annual amortization of goodwill for this acquisition?

A)$100,000.

B)$400,000.

C)$200,000.

D)$0.

A)$100,000.

B)$400,000.

C)$200,000.

D)$0.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

49

In January 2013, Vega Corporation purchased a patent at a cost of $200,000. Legal and filing fees of $50,000 were paid to acquire the patent. The company estimated a 10-year useful life for the patent and uses the straight-line amortization method for all intangible assets. In 2016, Vega spent $40,000 in legal fees for an unsuccessful defense of the patent. The amount charged to income (expense and loss) in 2016 related to the patent should be:

A)$40,000.

B)$65,000.

C)$215,000.

D)$25,000.

A)$40,000.

B)$65,000.

C)$215,000.

D)$25,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

50

Granite Enterprises acquired a patent from Southern Research Corporation on January 1, 2013, for $4 million. The patent will be used for 5 years, even though its legal life is 20 years. Rocky Corporation has made a commitment to purchase the patent from Granite for $200,000 at the end of five years. Compute Granite's patent amortization for 2013, assuming the straight-line method is used.

A)$380,000.

B)$400,000.

C)$760,000.

D)$800,000.

A)$380,000.

B)$400,000.

C)$760,000.

D)$800,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

51

Gulf Consulting Co. reported the following on its December 31, 2013, balance sheet: Equipment (at cost)…..$700,000

In a disclosure note, Gulf indicates that it uses straight-line depreciation over five years and estimates salvage value as 10% of cost. Gulf's equipment averages 3.5 years at December 31, 2013. What is the book value of Gulf's equipment at December 31, 2013?

A)$490,000.

B)$441,000.

C)$259,000.

D)$210,000.

In a disclosure note, Gulf indicates that it uses straight-line depreciation over five years and estimates salvage value as 10% of cost. Gulf's equipment averages 3.5 years at December 31, 2013. What is the book value of Gulf's equipment at December 31, 2013?

A)$490,000.

B)$441,000.

C)$259,000.

D)$210,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

52

Depreciation for 2013, using the straight-line method is:

A)$13,500.

B)$15,000.

C)$4,500.

D)$5,000.

A)$13,500.

B)$15,000.

C)$4,500.

D)$5,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

53

Belotti would record depletion in 2013 of:

A)$41,000.

B)$32,800.

C)$30,750.

D)$24,600.

A)$41,000.

B)$32,800.

C)$30,750.

D)$24,600.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

54

Depreciation for 2014, using double-declining balance, would be:

A)$32,000.

B)$34,000.

C)$38,000.

D)$40,000.

A)$32,000.

B)$34,000.

C)$38,000.

D)$40,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

55

Using the straight-line method, depreciation for 2013 and book value at December 31, 2013, would be:

A)$10,000 and $30,000.

B)$11,250 and $28,750.

C)$10,000 and $35,000.

D)$11,250 and $33,750.

A)$10,000 and $30,000.

B)$11,250 and $28,750.

C)$10,000 and $35,000.

D)$11,250 and $33,750.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

56

Using the straight-line method, depreciation for 2014 and book value at December 31, 2014, would be:

A)$10,000 and $20,000.

B)$10,000 and $25,000.

C)$11,250 and $17,500.

D)$11,250 and $22,500.

A)$10,000 and $20,000.

B)$10,000 and $25,000.

C)$11,250 and $17,500.

D)$11,250 and $22,500.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

57

Depreciation (to the nearest dollar) for 2014, using sum-of-the-years' digits, would be:

A)$31,909.

B)$29,455.

C)$35,456.

D)$54,000.

A)$31,909.

B)$29,455.

C)$35,456.

D)$54,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

58

Using the double-declining balance method, depreciation for 2013 and book value at December 31, 2013, would be:

A)$22,500 and $22,500.

B)$22,500 and $17,500.

C)$20,000 and $25,000.

D)$20,000 and $20,000.

A)$22,500 and $22,500.

B)$22,500 and $17,500.

C)$20,000 and $25,000.

D)$20,000 and $20,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

59

Depreciation (to the nearest dollar) for 2013, using sum-of-the-years' digits, would be:

A)$9,091.

B)$24,545.

C)$27,273.

D)$8,182.

A)$9,091.

B)$24,545.

C)$27,273.

D)$8,182.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

60

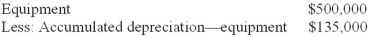

Jennings Advertising Inc. reported the following in its December 31, 2013, balance sheet:  In a disclosure note, Jennings indicates that it uses straight-line depreciation over 10 years and estimates salvage value at 10% of cost. What is the average age of the equipment owned by Jennings?

In a disclosure note, Jennings indicates that it uses straight-line depreciation over 10 years and estimates salvage value at 10% of cost. What is the average age of the equipment owned by Jennings?

A)2.7 years.

B)3 years.

C)7 years.

D)7.3 years.

In a disclosure note, Jennings indicates that it uses straight-line depreciation over 10 years and estimates salvage value at 10% of cost. What is the average age of the equipment owned by Jennings?

In a disclosure note, Jennings indicates that it uses straight-line depreciation over 10 years and estimates salvage value at 10% of cost. What is the average age of the equipment owned by Jennings?A)2.7 years.

B)3 years.

C)7 years.

D)7.3 years.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

61

Fryer Inc. owns equipment for which it paid $90 million. At the end of 2013, it had accumulated depreciation on the equipment of $27 million. Due to adverse economic conditions, Fryer's management determined that it should assess whether an impairment loss should be recognized for the equipment. The estimated undiscounted future cash flows to be provided by the equipment total $60 million, and the equipment's fair value at that point is $40 million. Under these circumstances, Fryer:

A)Would record no impairment loss on the equipment.

B)Would record a $3 million impairment loss on the equipment.

C)Would record a $23 million impairment loss on the equipment.

D)None of the above is correct.

A)Would record no impairment loss on the equipment.

B)Would record a $3 million impairment loss on the equipment.

C)Would record a $23 million impairment loss on the equipment.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

62

Accounting for impairment losses:

A)Involves a two-step process for recoverability and measurement.

B)Applies only to depreciable assets.

C)Applies only to assets with finite lives.

D)All of the above are correct.

A)Involves a two-step process for recoverability and measurement.

B)Applies only to depreciable assets.

C)Applies only to assets with finite lives.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

63

Fellingham Corporation purchased equipment on January 1, 2011, for $200,000. The company estimated the equipment would have a useful life of 10 years with a $20,000 residual value. Fellingham uses the straight-line depreciation method. Early in 2013, Fellingham reassessed the equipment's condition and determined that its total useful life would be only six years in total and that it would have no salvage value. How much would Fellingham report as depreciation on this equipment for 2013?

A)$24,000.

B)$27,333.

C)$36,000.

D)$41,000.

A)$24,000.

B)$27,333.

C)$36,000.

D)$41,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

64

On January 1, 2011, Al's Sporting Goods purchased store fixtures at a cost of $180,000. The anticipated service life was 10 years with no residual value. Al's has been using the double-declining balance method, but in 2013 adopted the straight-line method because the company believes it provides a better measure of income. Al's has a December 31 year-end. The journal entry to record depreciation for 2013 is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

65

Wilson Inc. owns equipment for which it paid $70 million. At the end of 2013, it had accumulated depreciation on the equipment of $12 million. Due to adverse economic conditions, Wilson's management determined that it should assess whether an impairment loss should be recognized for the equipment. The estimated undiscounted future cash flows to be provided by the equipment total $60 million, and the equipment's fair value at that point is $50 million. Under these circumstances, Wilson:

A)Would record no impairment loss on the equipment.

B)Would record an $8 million impairment loss on the equipment.

C)Would record a $20 million impairment loss on the equipment.

D)None of the above is correct.

A)Would record no impairment loss on the equipment.

B)Would record an $8 million impairment loss on the equipment.

C)Would record a $20 million impairment loss on the equipment.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

66

A change in the estimated useful life and residual value of machinery in the current year is handled as:

A)A retrospective change back to the date of acquisition as though the current estimated life and residual value had been used all along.

B)A prospective change from the current year through the remainder of its useful life, using the new estimates.

C)A cumulative adjustment to income in the current year for the difference in depreciation under the new versus old estimates.

D)None of the above is correct.

A)A retrospective change back to the date of acquisition as though the current estimated life and residual value had been used all along.

B)A prospective change from the current year through the remainder of its useful life, using the new estimates.

C)A cumulative adjustment to income in the current year for the difference in depreciation under the new versus old estimates.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

67

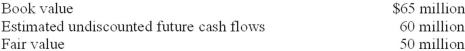

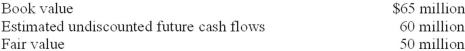

At the end of its 2013 fiscal year, a triggering event caused Janero Corporation to perform an impairment test for one of its manufacturing facilities. The following information is available:  The manufacturing facility is:

The manufacturing facility is:

A)Impaired because its book value exceeds undiscounted future cash flows.

B)Not impaired because its book value exceeds undiscounted future cash flows.

C)Not impaired because it continues to produce revenue.

D)Impaired because its book value exceeds fair value.

The manufacturing facility is:

The manufacturing facility is:A)Impaired because its book value exceeds undiscounted future cash flows.

B)Not impaired because its book value exceeds undiscounted future cash flows.

C)Not impaired because it continues to produce revenue.

D)Impaired because its book value exceeds fair value.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

68

Accounting for a change in the estimated service life of equipment:

A)Is handled prospectively.

B)Requires retroactive restatement of prior year's financial statements.

C)Requires a prior period adjustment.

D)Is handled currently as a change in accounting principle.

A)Is handled prospectively.

B)Requires retroactive restatement of prior year's financial statements.

C)Requires a prior period adjustment.

D)Is handled currently as a change in accounting principle.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following types of subsequent expenditures normally is capitalized?

A)Additions.

B)Improvements.

C)Rearrangements.

D)All of the above are normally capitalized.

A)Additions.

B)Improvements.

C)Rearrangements.

D)All of the above are normally capitalized.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

70

A major expenditure increased a truck's life beyond the original estimate of life. GAAP permits the expenditure to be debited to:

A)Repairs.

B)Accumulated depreciation.

C)Major repairs.

D)None of the above.

A)Repairs.

B)Accumulated depreciation.

C)Major repairs.

D)None of the above.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

71

Jung Inc. owns a patent for which it paid $66 million. At the end of 2013, it had accumulated amortization on the patent of $16 million. Due to adverse economic conditions, Jung's management determined that it should assess whether an impairment loss should be recognized for the patent. The estimated undiscounted future cash flows to be provided by the patent total $43 million, and the patent's fair value at that point is $35 million. Under these circumstances, Lester:

A)Would record no impairment loss on the patent.

B)Would record a $7 million impairment loss on the patent.

C)Would record a $15 million impairment loss on the patent.

D)Would record a $31 million impairment loss on the patent.

A)Would record no impairment loss on the patent.

B)Would record a $7 million impairment loss on the patent.

C)Would record a $15 million impairment loss on the patent.

D)Would record a $31 million impairment loss on the patent.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

72

Recognition of impairment for property, plant, and equipment is required if book value exceeds:

A)Fair value.

B)Present value of expected cash flows.

C)Undiscounted expected cash flows.

D)Accumulated depreciation.

A)Fair value.

B)Present value of expected cash flows.

C)Undiscounted expected cash flows.

D)Accumulated depreciation.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

73

Nanki Corporation purchased equipment on January 1, 2011, for $650,000. In 2011 and 2012, Nanki depreciated the asset on a straight-line basis with an estimated useful life of eight years and a $10,000 residual value. In 2013, due to changes in technology, Nanki revised the useful life to a total of six years with no residual value. What depreciation would Nanki record for the year 2013 on this equipment?

A)$108,333.

B)$106,667.

C)$122,500.

D)None of the above is correct.

A)$108,333.

B)$106,667.

C)$122,500.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

74

A change from the straight-line method to the sum-of-years'-digits method of depreciation is handled as:

A)A retrospective change back to the date of acquisition as though the current estimated life had been used all along.

B)A cumulative adjustment to income in the current year for the difference in depreciation under the new versus old useful life estimate.

C)A prospective change from the current year through the remainder of its useful life.

D)None of the above is correct.

A)A retrospective change back to the date of acquisition as though the current estimated life had been used all along.

B)A cumulative adjustment to income in the current year for the difference in depreciation under the new versus old useful life estimate.

C)A prospective change from the current year through the remainder of its useful life.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

75

Murgatroyd Co. purchased equipment on January 1, 2011, for $500,000, estimating a four-year useful life and no residual value. In 2011 and 2012, Murgatroyd depreciated the asset using the sum-of-years'-digits method. In 2013, Murgatroyd changed to straight-line depreciation for this equipment. What depreciation would Murgatroyd record for the year 2013 on this equipment?

A)$75,000.

B)$125,000.

C)$150,000.

D)None of the above is correct.

A)$75,000.

B)$125,000.

C)$150,000.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

76

The amount of impairment loss is the excess of book value over:

A)Carrying value.

B)Undiscounted future cash flows.

C)Fair value.

D)Future revenues.

A)Carrying value.

B)Undiscounted future cash flows.

C)Fair value.

D)Future revenues.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

77

An asset should be written down if there has been an impairment of value that is:

A)Relevant and objectively determined.

B)Material and market driven.

C)Unplanned and sudden.

D)Significant.

A)Relevant and objectively determined.

B)Material and market driven.

C)Unplanned and sudden.

D)Significant.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

78

Broadway Ltd. purchased equipment on January 1, 2011, for $800,000, estimating a five-year useful life and no residual value. In 2011 and 2012, Broadway depreciated the asset using the straight-line method. In 2013, Broadway changed to sum-of-years'-digits depreciation for this equipment. What depreciation would Broadway record for the year 2013 on this equipment?

A)$120,000.

B)$160,000.

C)$200,000.

D)$240,000.

A)$120,000.

B)$160,000.

C)$200,000.

D)$240,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

79

In testing for recoverability of property, plant, and equipment, an impairment loss is required if the:

A)Asset's book value exceeds the undiscounted sum of expected future cash flows.

B)Undiscounted sum of its expected future cash flows exceeds the asset's book value.

C)Present value of expected future cash flows exceeds its book value.

D)None of the above is correct.

A)Asset's book value exceeds the undiscounted sum of expected future cash flows.

B)Undiscounted sum of its expected future cash flows exceeds the asset's book value.

C)Present value of expected future cash flows exceeds its book value.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

80

In 2012, Antle Inc. had acquired Demski Co. and recorded goodwill of $245 million as a result. The net assets (including goodwill) from Antle's acquisition of Demski Co. had a 2013 year-end book value of $580 million. Antle assessed the fair value of Demski at this date to be $700 million, while the fair value of all of Demski's identifiable tangible and intangible assets (excluding goodwill) was $550 million. The amount of the impairment loss that Antle would record for goodwill at the end of 2013 is:

A)$150 million.

B)$95 million.

C)$0.

D)None of the above is correct.

A)$150 million.

B)$95 million.

C)$0.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck