Deck 22: Time Series Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 22: Time Series Analysis

1

Consider the following to answer the question(s) below:

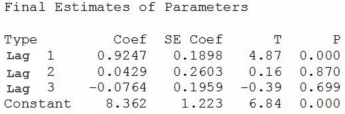

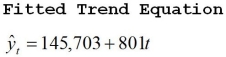

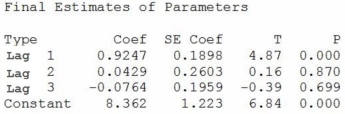

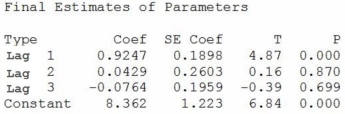

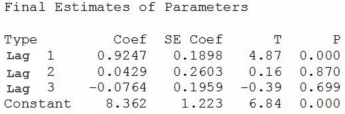

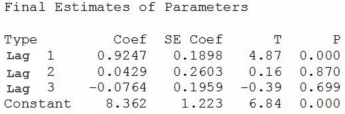

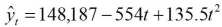

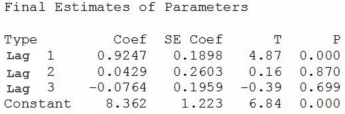

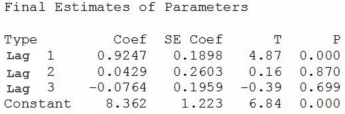

A third-order autoregressive model, AR (3) was fit to monthly closing stock prices, adjusted for dividends, of Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The results are as follows:

Which of the following is true about index numbers? Index numbers are

A) used to make a relative comparison of different time periods

B) used to measure the trend component

C) used to measure the seasonal component

D) used to measure the cyclical component

E) used to measure the irregular component

A third-order autoregressive model, AR (3) was fit to monthly closing stock prices, adjusted for dividends, of Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The results are as follows:

Which of the following is true about index numbers? Index numbers are

A) used to make a relative comparison of different time periods

B) used to measure the trend component

C) used to measure the seasonal component

D) used to measure the cyclical component

E) used to measure the irregular component

A

2

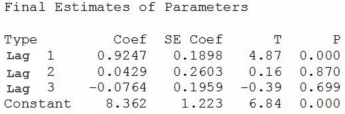

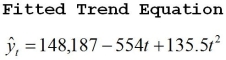

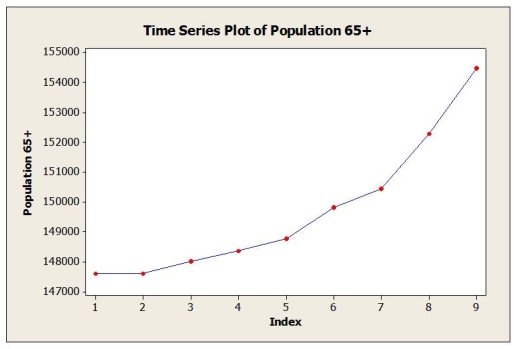

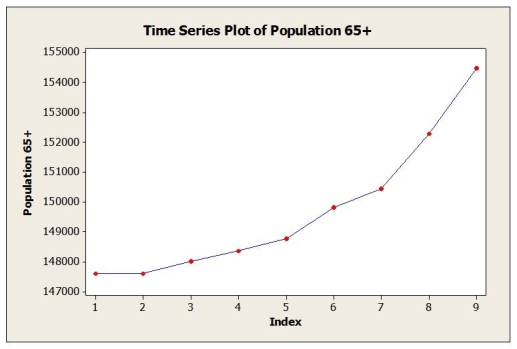

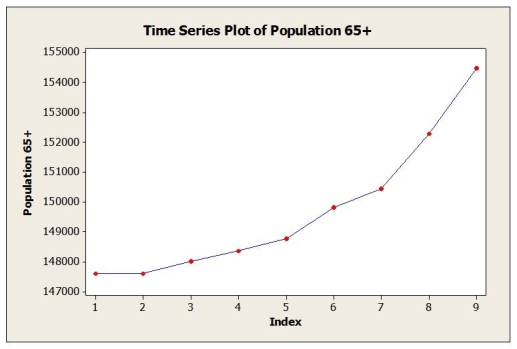

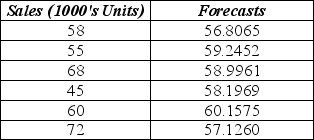

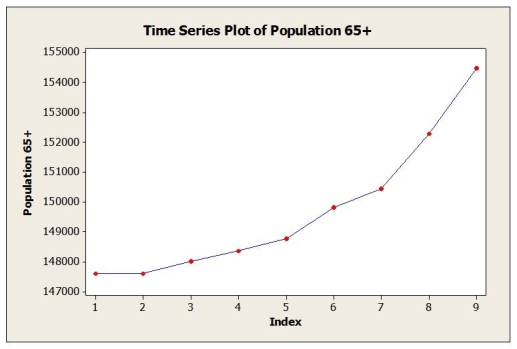

Annual estimates of the population in the age group 65+ in a mid-sized city from 1999 (t = 1) onward are shown in the time series graph below.  a. Identify the dominant time series component(s) in the data.

a. Identify the dominant time series component(s) in the data.

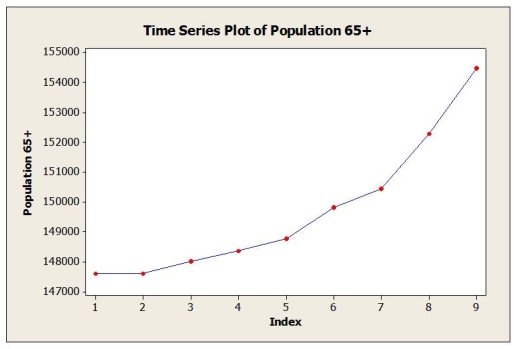

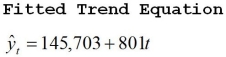

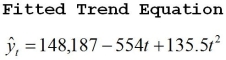

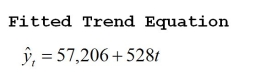

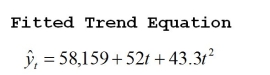

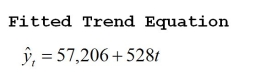

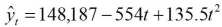

b. Below are the results from fitting a linear trend model to the data. Use this model to estimate the 65+ population in this city for 2008 (t = 10). c. Below are the results from fitting a quadratic trend model to the data. Use this model to estimate the 65+ population in this city for 2008 (t = 10).

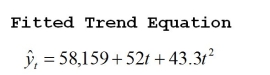

c. Below are the results from fitting a quadratic trend model to the data. Use this model to estimate the 65+ population in this city for 2008 (t = 10).  d. The actual population estimate for 2008 is 157,218. Which model does better? Why?

d. The actual population estimate for 2008 is 157,218. Which model does better? Why?

a. Identify the dominant time series component(s) in the data.

a. Identify the dominant time series component(s) in the data.b. Below are the results from fitting a linear trend model to the data. Use this model to estimate the 65+ population in this city for 2008 (t = 10).

c. Below are the results from fitting a quadratic trend model to the data. Use this model to estimate the 65+ population in this city for 2008 (t = 10).

c. Below are the results from fitting a quadratic trend model to the data. Use this model to estimate the 65+ population in this city for 2008 (t = 10).  d. The actual population estimate for 2008 is 157,218. Which model does better? Why?

d. The actual population estimate for 2008 is 157,218. Which model does better? Why?a. Trend

b. 153,713

c. 156,197

d. The quadratic trend model does better. As can be seen from the time series graph, the trend is not linear.

b. 153,713

c. 156,197

d. The quadratic trend model does better. As can be seen from the time series graph, the trend is not linear.

3

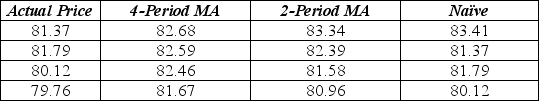

The table below shows the actual closing daily stock prices for Kyocera Corporation for September 2 through September 5, 2008, as well as 4-day moving average, 2-day moving average and naïve forecasts. Calculate the MAD and MSE for each of the three types of forecasts. Which is the best?

MAD (4-Period MA) = 1.59

MAD (2-Period MA) = 1.31

MAD (Naïve) = 1.12

MSE (4-Period MA) = 2.87

MSE (2-Period MA) = 1.95

MSE (Naïve) = 1.81

The Naïve method is best.

MAD (2-Period MA) = 1.31

MAD (Naïve) = 1.12

MSE (4-Period MA) = 2.87

MSE (2-Period MA) = 1.95

MSE (Naïve) = 1.81

The Naïve method is best.

4

Assume that the year 2000 is used as the index base period and that sales were $12 million in the year 2000. If sales were $18 million in the year 2006, the simple index number for the year 2006 is

A) 150.0

B) 15.0

C) 0.667

D) 6 million

E) 66.67

A) 150.0

B) 15.0

C) 0.667

D) 6 million

E) 66.67

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

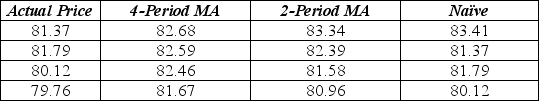

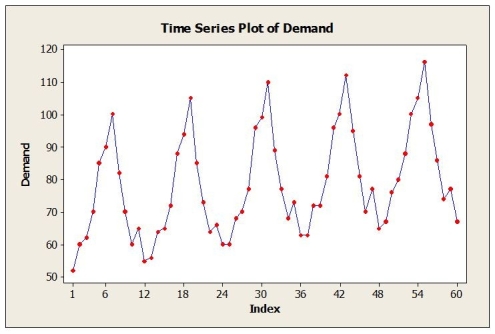

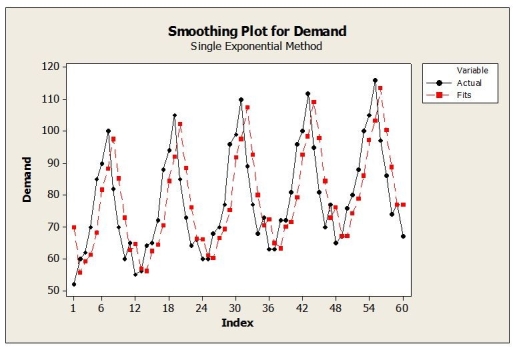

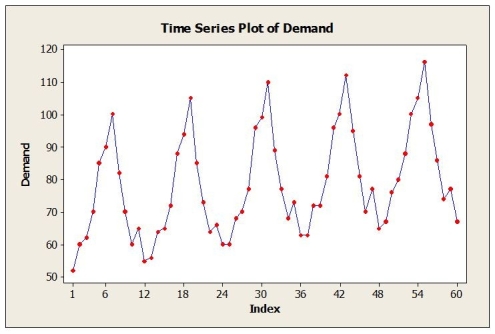

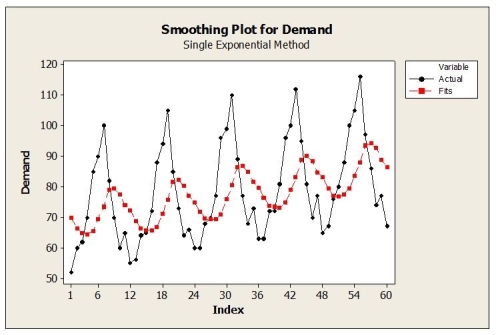

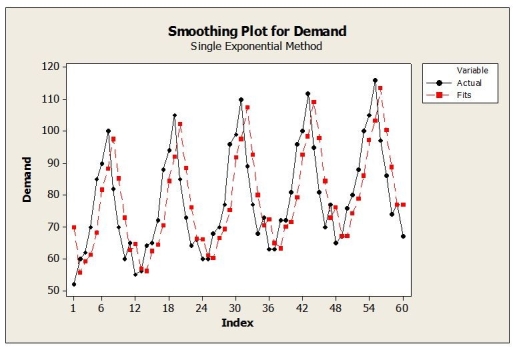

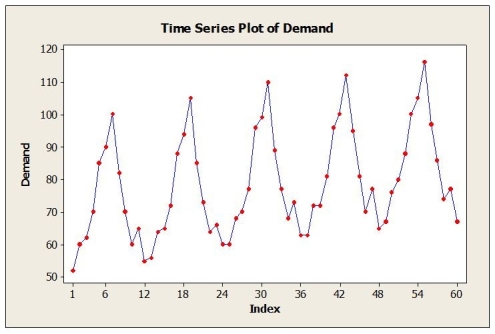

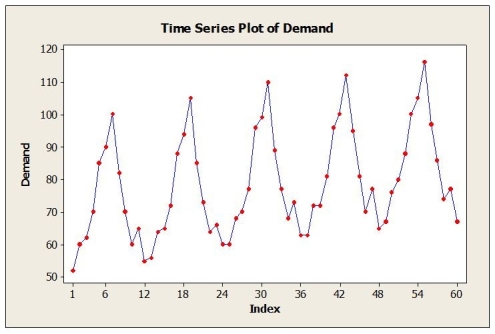

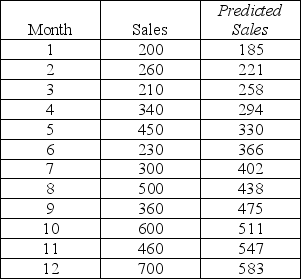

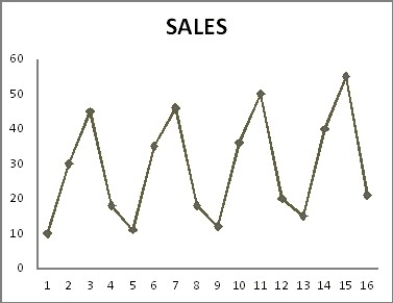

A large automobile parts supplier, keeps track of the demand for a particular part needed by its customers, automobile manufacturers. The time series plot below shows monthly demand for this part (in thousands) for a five year period.  a. Identify the dominant time series component (s) in the data.

a. Identify the dominant time series component (s) in the data.

b. Suppose that the single exponential smoothing (SES) model was applied to these data. Below are time series graphs showing SES results using two different smoothing constants (α = 0.2 and α = 0.8). In which application is a larger value of α used?

I. ii.

ii.  c. What forecasting method may be a better choice than SES for these data? Explain.

c. What forecasting method may be a better choice than SES for these data? Explain.

a. Identify the dominant time series component (s) in the data.

a. Identify the dominant time series component (s) in the data.b. Suppose that the single exponential smoothing (SES) model was applied to these data. Below are time series graphs showing SES results using two different smoothing constants (α = 0.2 and α = 0.8). In which application is a larger value of α used?

I.

ii.

ii.  c. What forecasting method may be a better choice than SES for these data? Explain.

c. What forecasting method may be a better choice than SES for these data? Explain.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

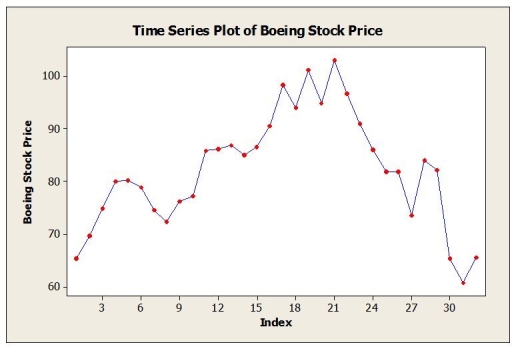

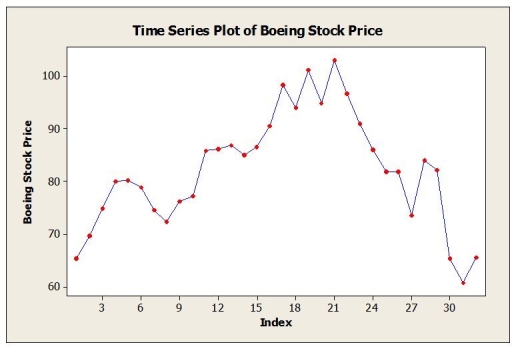

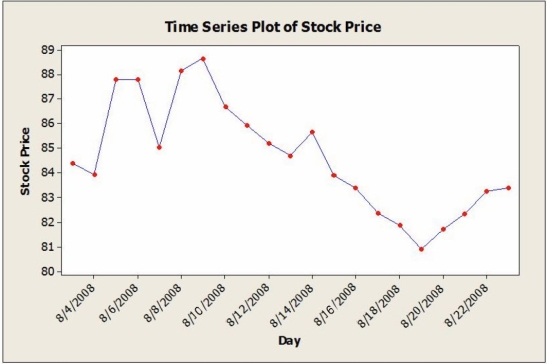

Monthly closing stock prices, adjusted for dividends, were obtained for Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The time series graph of these data is shown below.  a. Below are the results of fitting a third-order autoregressive model, AR (3). Write out the model. Are the second and third lagged values significant? Explain.

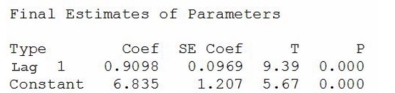

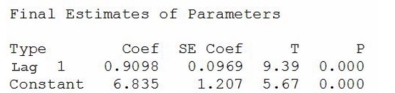

a. Below are the results of fitting a third-order autoregressive model, AR (3). Write out the model. Are the second and third lagged values significant? Explain.  b. Below are the results of fitting a first-order autoregressive model, AR (1). Write out the model. Is this model typical for stock price data? Explain.

b. Below are the results of fitting a first-order autoregressive model, AR (1). Write out the model. Is this model typical for stock price data? Explain.

a. Below are the results of fitting a third-order autoregressive model, AR (3). Write out the model. Are the second and third lagged values significant? Explain.

a. Below are the results of fitting a third-order autoregressive model, AR (3). Write out the model. Are the second and third lagged values significant? Explain.  b. Below are the results of fitting a first-order autoregressive model, AR (1). Write out the model. Is this model typical for stock price data? Explain.

b. Below are the results of fitting a first-order autoregressive model, AR (1). Write out the model. Is this model typical for stock price data? Explain.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

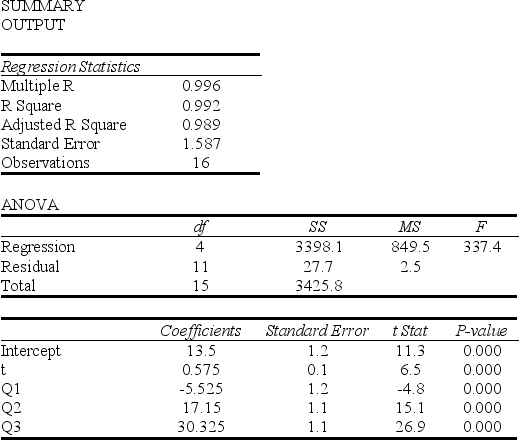

Consider the following to answer the question(s) below:

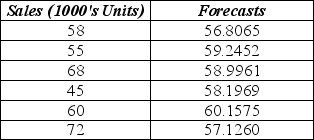

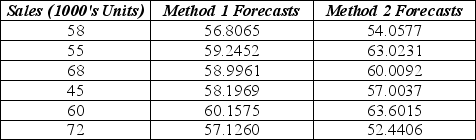

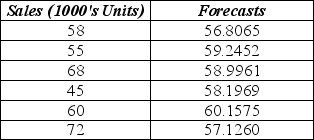

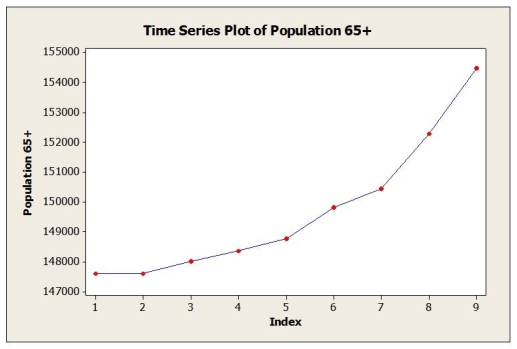

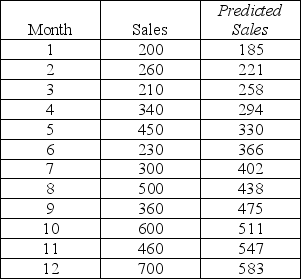

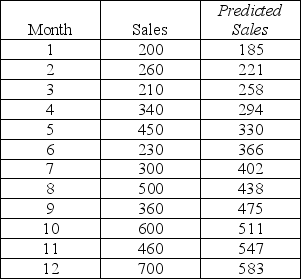

The following table shows actual sales values and forecasts.

The MSE for the forecasting method used is

A) 7.111

B) 9.187

C) 82.656

D) 113.899

E) Indeterminate

The following table shows actual sales values and forecasts.

The MSE for the forecasting method used is

A) 7.111

B) 9.187

C) 82.656

D) 113.899

E) Indeterminate

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

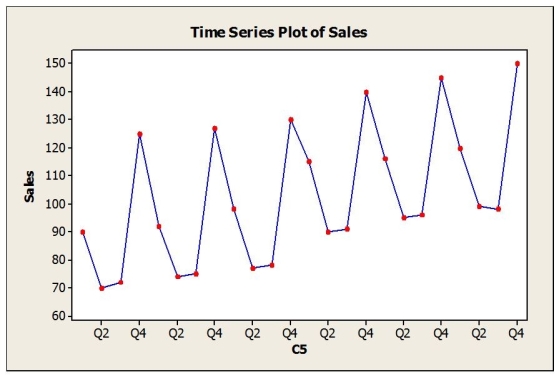

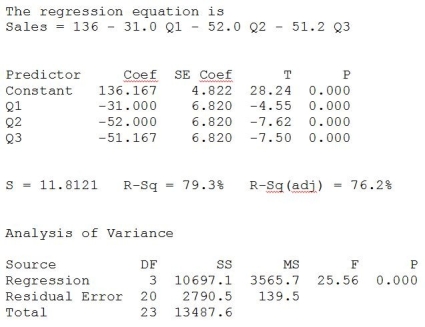

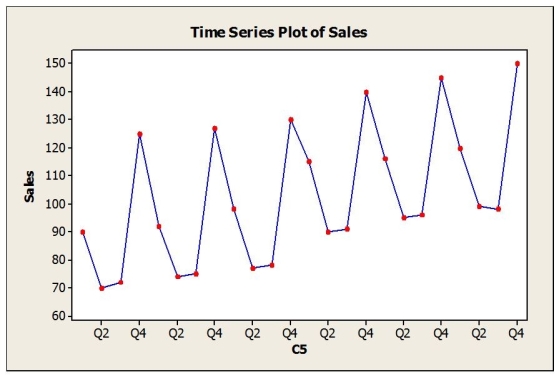

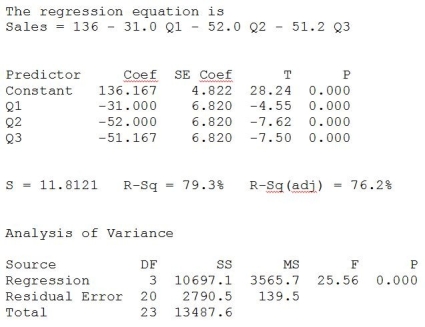

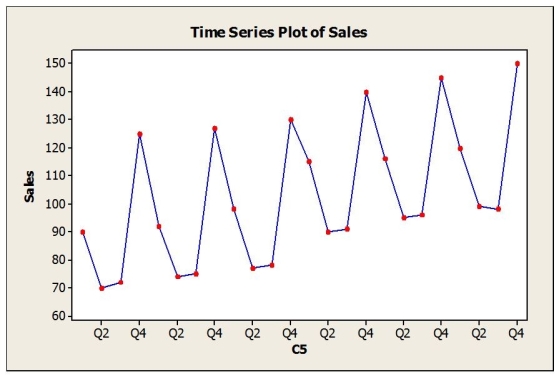

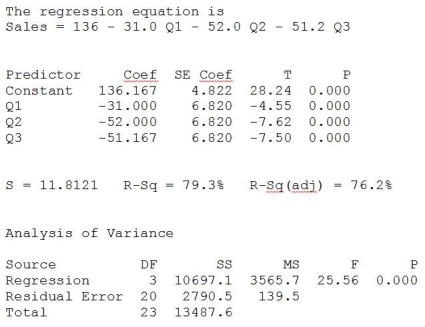

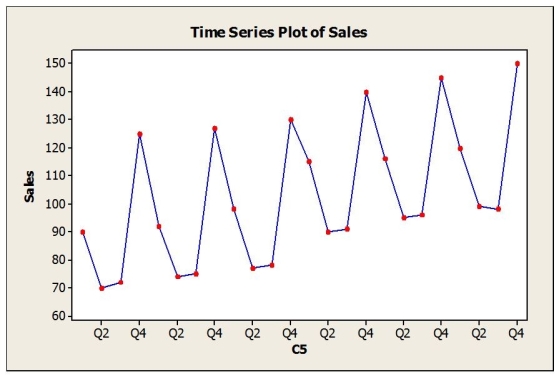

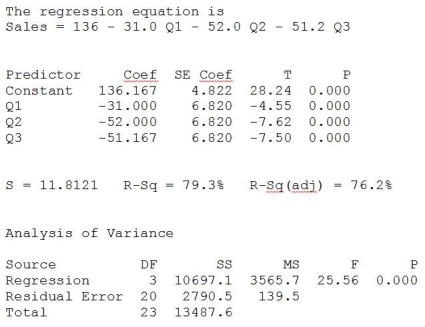

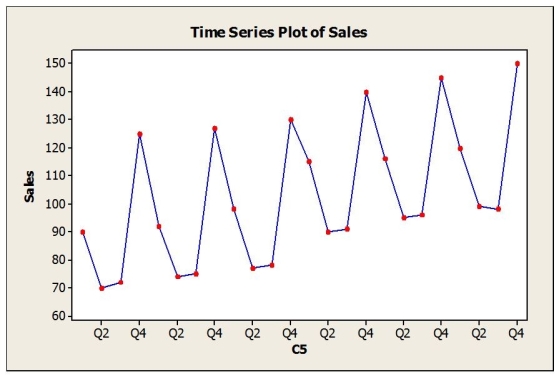

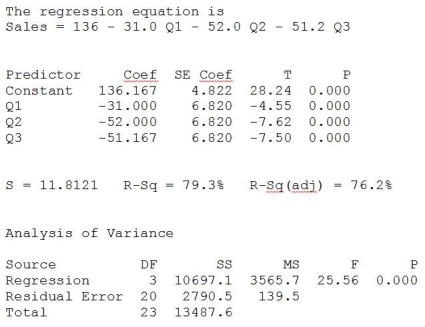

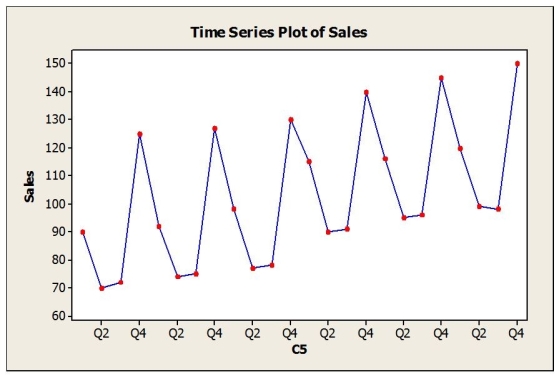

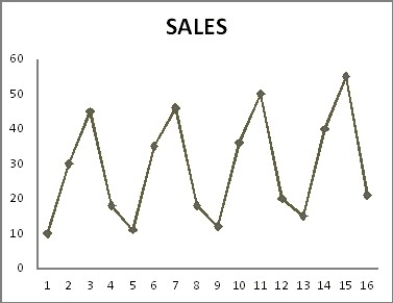

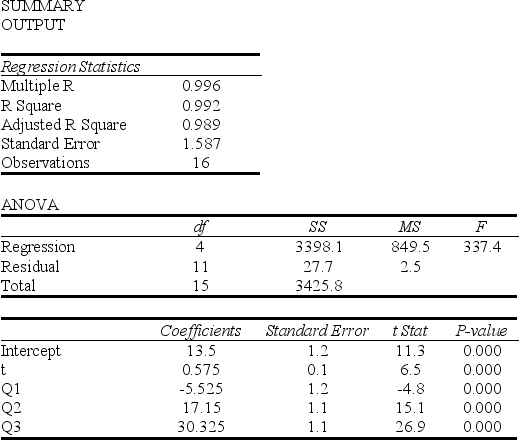

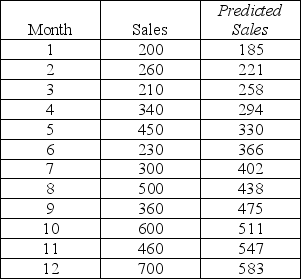

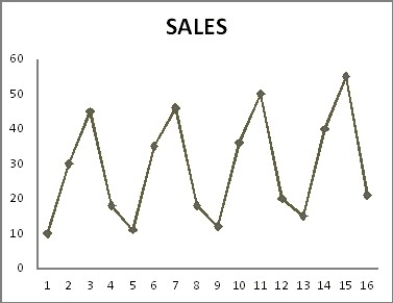

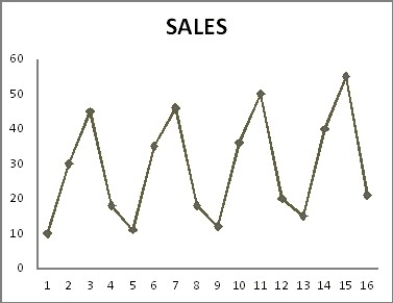

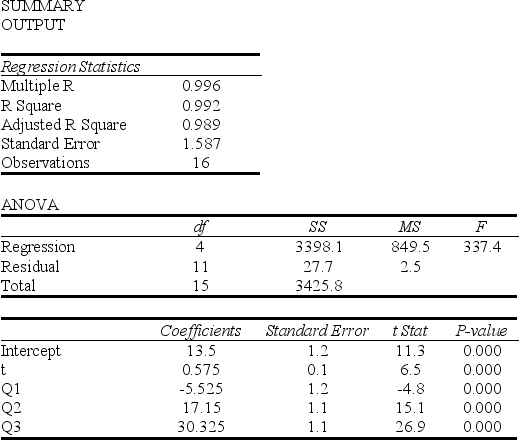

Quarterly sales data (in $10,000) for a small company specializing in green cleaning products are shown in the time series graph below.  A seasonal regression model was fit to these data and the results are shown below.

A seasonal regression model was fit to these data and the results are shown below.  a. Is the seasonal regression model significant overall? Explain.

a. Is the seasonal regression model significant overall? Explain.

b. Interpret the regression coefficients in this model.

c. Use this model to provide forecasts for each of the four quarters of the next year.

A seasonal regression model was fit to these data and the results are shown below.

A seasonal regression model was fit to these data and the results are shown below.  a. Is the seasonal regression model significant overall? Explain.

a. Is the seasonal regression model significant overall? Explain.b. Interpret the regression coefficients in this model.

c. Use this model to provide forecasts for each of the four quarters of the next year.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

The following table shows actual sales values and forecasts provided by two different methods.

a. Calculate the MAD for each method.

a. Calculate the MAD for each method.

b. Calculate the MSE for each method.

c. Which method forecasts better?

a. Calculate the MAD for each method.

a. Calculate the MAD for each method.b. Calculate the MSE for each method.

c. Which method forecasts better?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

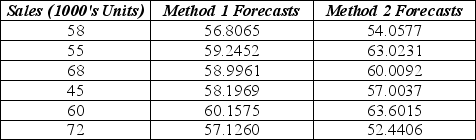

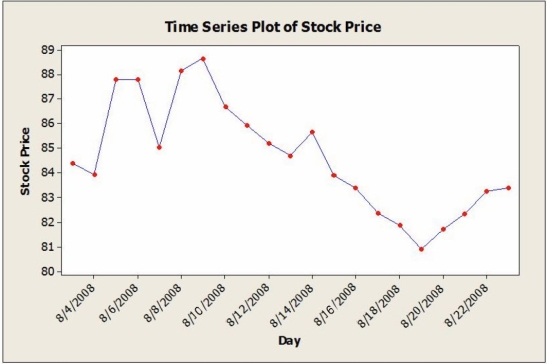

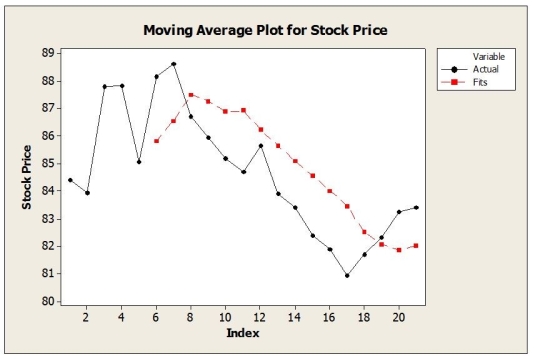

Daily closing stock prices for Kyocera Corporation were obtained from August 3, 2008 through August 23, 2008 and appear in the time series graph below.  a. Identify the dominant time series component(s) in the data.

a. Identify the dominant time series component(s) in the data.

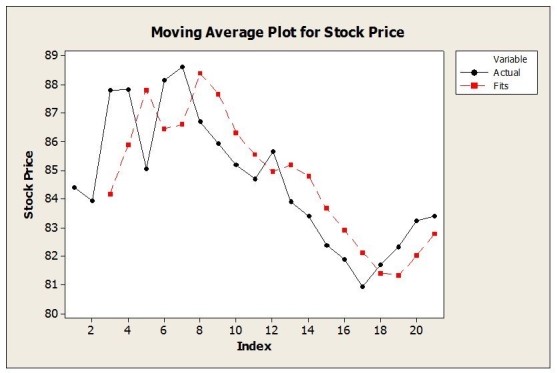

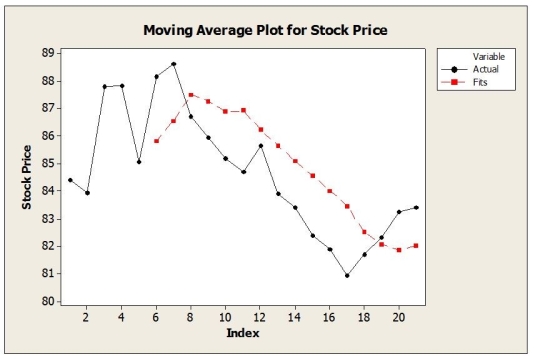

b. The method of moving averages was applied to these data. Below are time series graphs showing moving average results using two different values of L. In which application is a larger value of L used?

I. ii.

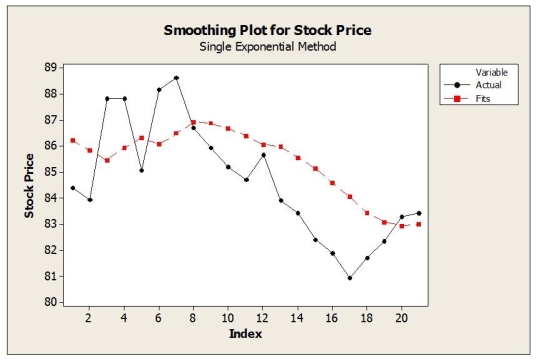

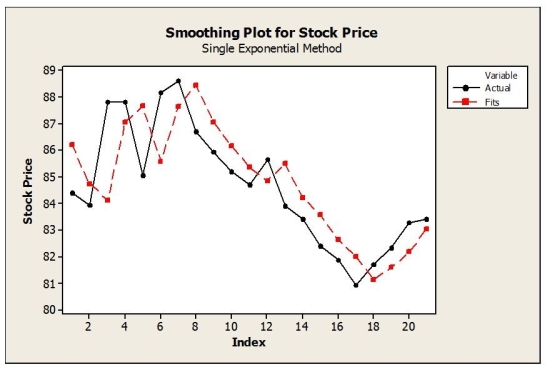

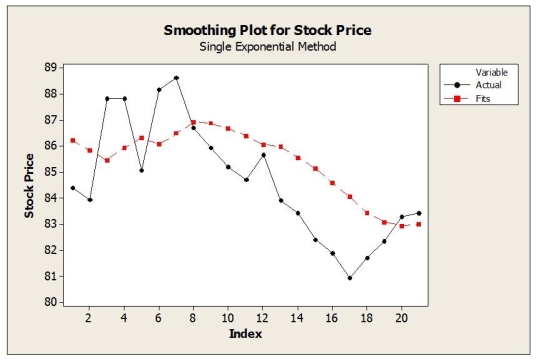

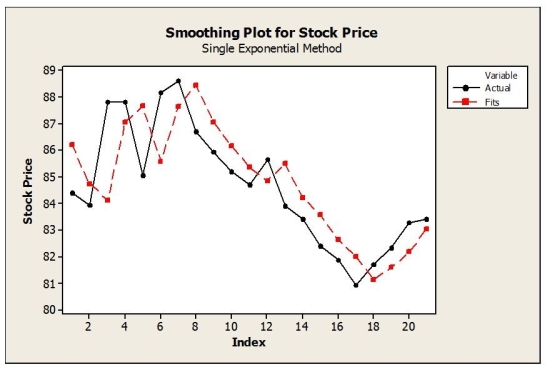

ii.  c. Suppose that the single exponential smoothing (SES) model was applied to these data. Below are time series graphs showing SES results using two different smoothing constants (α = 0.2 and α = 0.8). In which application is a larger value of α used?

c. Suppose that the single exponential smoothing (SES) model was applied to these data. Below are time series graphs showing SES results using two different smoothing constants (α = 0.2 and α = 0.8). In which application is a larger value of α used?

I. ii.

ii.

a. Identify the dominant time series component(s) in the data.

a. Identify the dominant time series component(s) in the data.b. The method of moving averages was applied to these data. Below are time series graphs showing moving average results using two different values of L. In which application is a larger value of L used?

I.

ii.

ii.  c. Suppose that the single exponential smoothing (SES) model was applied to these data. Below are time series graphs showing SES results using two different smoothing constants (α = 0.2 and α = 0.8). In which application is a larger value of α used?

c. Suppose that the single exponential smoothing (SES) model was applied to these data. Below are time series graphs showing SES results using two different smoothing constants (α = 0.2 and α = 0.8). In which application is a larger value of α used?I.

ii.

ii.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

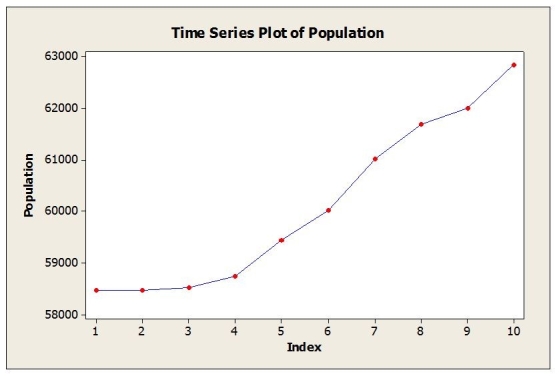

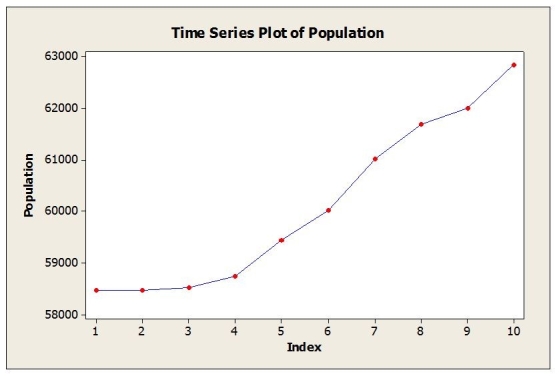

Annual estimates of the population in a certain city from 1999 (t = 1) onward are shown in the time series graph below.  a. Identify the dominant time series component(s) in the data.

a. Identify the dominant time series component(s) in the data.

b. Below are the results from fitting a linear trend model to the data. Use this model to estimate the population in this city for 2008 (t = 10). c. Below are the results from fitting a quadratic trend model to the data. Use this model to estimate the population in this city for 2008 (t = 10).

c. Below are the results from fitting a quadratic trend model to the data. Use this model to estimate the population in this city for 2008 (t = 10).  d. The actual population estimate for 2008 is 62,828. Which model does better? Why?

d. The actual population estimate for 2008 is 62,828. Which model does better? Why?

a. Identify the dominant time series component(s) in the data.

a. Identify the dominant time series component(s) in the data.b. Below are the results from fitting a linear trend model to the data. Use this model to estimate the population in this city for 2008 (t = 10).

c. Below are the results from fitting a quadratic trend model to the data. Use this model to estimate the population in this city for 2008 (t = 10).

c. Below are the results from fitting a quadratic trend model to the data. Use this model to estimate the population in this city for 2008 (t = 10).  d. The actual population estimate for 2008 is 62,828. Which model does better? Why?

d. The actual population estimate for 2008 is 62,828. Which model does better? Why?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

A large automobile parts supplier keeps track of the demand for a particular part needed by its customers, automobile manufacturers. The time series plot below shows monthly demand for this part (in thousands) for a five-year period. The dominant component in this time series is

A) cyclical

B) irregular

C) seasonal

D) systematic

E) No time series component is dominant.

A) cyclical

B) irregular

C) seasonal

D) systematic

E) No time series component is dominant.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

Consider the following to answer the question(s) below:

Annual estimates of the population in a certain city from 1999 (t = 1) onward are shown in the time series graph below.

The dominant component in this time series is

A) cyclical

B) randomness

C) seasonality

D) trend

E) No time series component is dominant.

Annual estimates of the population in a certain city from 1999 (t = 1) onward are shown in the time series graph below.

The dominant component in this time series is

A) cyclical

B) randomness

C) seasonality

D) trend

E) No time series component is dominant.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

Consider the following to answer the question(s) below:

A third-order autoregressive model, AR (3) was fit to monthly closing stock prices, adjusted for dividends, of Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The results are as follows:

Which of the following statements is true?

A) At α = 0.05, the first lagged variable is significant.

B) At α = 0.05, the second lagged variable is significant.

C) At α = 0.05, the third lagged variable is significant.

D) At α = 0.05, the second lagged variable is significant and at α = 0.05, the third lagged variable is significant.

E) All of the above

A third-order autoregressive model, AR (3) was fit to monthly closing stock prices, adjusted for dividends, of Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The results are as follows:

Which of the following statements is true?

A) At α = 0.05, the first lagged variable is significant.

B) At α = 0.05, the second lagged variable is significant.

C) At α = 0.05, the third lagged variable is significant.

D) At α = 0.05, the second lagged variable is significant and at α = 0.05, the third lagged variable is significant.

E) All of the above

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

Annual estimates of the population in the age group 65+ in a certain city from 1999 (t = 1) onward are used to estimate the following quadratic trend model:  Using this model, the estimate for 2008 is

Using this model, the estimate for 2008 is

A) 157,218

B) 156,197

C) 153,713

D) 161,312

E) Indeterminate

Using this model, the estimate for 2008 is

Using this model, the estimate for 2008 isA) 157,218

B) 156,197

C) 153,713

D) 161,312

E) Indeterminate

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

Consider the following to answer the question(s) below:

A third-order autoregressive model, AR (3) was fit to monthly closing stock prices, adjusted for dividends, of Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The results are as follows:

The estimated model is

A) Pricet = 1.223 + 0.1898 Pricet-1 + 0.2603 Pricet-2 + 0.1959 Price t-3

B) Pricet = 8.362 - 0.0764 Pricet-1 + 0.0429 Pricet-2 + 0.9247 Pricet-3

C) Pricet = 1.223 + 0.1959 Pricet-1 + 0.2603 Pricet-2 + 0.1898 Pricet-3

D) Pricet = 8.362 + 0.9247 Pricet-1 + 0.0429 Pricet-2 - 0.0764 Pricet-3

E) Indeterminate

A third-order autoregressive model, AR (3) was fit to monthly closing stock prices, adjusted for dividends, of Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The results are as follows:

The estimated model is

A) Pricet = 1.223 + 0.1898 Pricet-1 + 0.2603 Pricet-2 + 0.1959 Price t-3

B) Pricet = 8.362 - 0.0764 Pricet-1 + 0.0429 Pricet-2 + 0.9247 Pricet-3

C) Pricet = 1.223 + 0.1959 Pricet-1 + 0.2603 Pricet-2 + 0.1898 Pricet-3

D) Pricet = 8.362 + 0.9247 Pricet-1 + 0.0429 Pricet-2 - 0.0764 Pricet-3

E) Indeterminate

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

Consider the following to answer the question(s) below:

The following table shows actual sales values and forecasts.

The MAD for the forecasting method used is

A) 7.112

B) 9.187

C) 82.656

D) 113.899

E) Indeterminate

The following table shows actual sales values and forecasts.

The MAD for the forecasting method used is

A) 7.112

B) 9.187

C) 82.656

D) 113.899

E) Indeterminate

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

Consider the following to answer the question(s) below:

Annual estimates of the population in a certain city from 1999 (t = 1) onward are shown in the time series graph below.

The forecasting method that will most likely be best for this time series is

A) single exponential smoothing

B) quadratic trend

C) moving average

D) naïve

E) Absolutely no forecasting method will most likely be best.

Annual estimates of the population in a certain city from 1999 (t = 1) onward are shown in the time series graph below.

The forecasting method that will most likely be best for this time series is

A) single exponential smoothing

B) quadratic trend

C) moving average

D) naïve

E) Absolutely no forecasting method will most likely be best.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

Consider the following to answer the question(s) below:

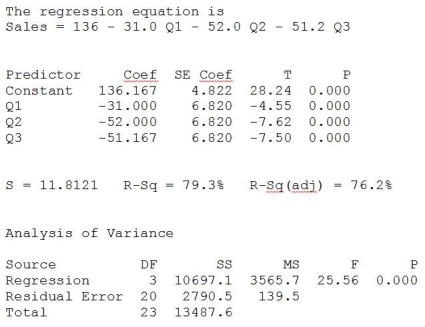

Quarterly sales data (in $10,000) for a small company specializing in green cleaning products are shown in the time series graph below. A seasonal regression model was fit to these data and the results are shown below.

A seasonal regression model was fit to these data and the results are shown below.

The regression coefficients in the seasonal regression model indicate that

A) Sales are, on average, lower in the first, second and third quarters compared with the fourth quarter.

B) Sales are, on average, lowest in the fourth quarter.

C) Sales are, on average, higher in the first, second and third quarters compared with the fourth quarter.

D) Sales are, on average, lowest in the first quarter.

E) Sales are, on average, lowest in the second quarter.

Quarterly sales data (in $10,000) for a small company specializing in green cleaning products are shown in the time series graph below.

A seasonal regression model was fit to these data and the results are shown below.

A seasonal regression model was fit to these data and the results are shown below.

The regression coefficients in the seasonal regression model indicate that

A) Sales are, on average, lower in the first, second and third quarters compared with the fourth quarter.

B) Sales are, on average, lowest in the fourth quarter.

C) Sales are, on average, higher in the first, second and third quarters compared with the fourth quarter.

D) Sales are, on average, lowest in the first quarter.

E) Sales are, on average, lowest in the second quarter.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

Consider the following to answer the question(s) below:

Quarterly sales data (in $10,000) for a small company specializing in green cleaning products are shown in the time series graph below. A seasonal regression model was fit to these data and the results are shown below.

A seasonal regression model was fit to these data and the results are shown below.

Which of the following is (are) true?

A) The seasonal regression model is significant in explaining sales as indicated by the F-statistic and associated P-value.

B) The seasonal regression model explains 79.3% of the variation in sales.

C) The t-statistics and associated P-values indicate that all dummy variables representing quarters are significant.

D) The seasonal regression model is significant in explaining sales as indicated by the F-statistic and associated P-value and the seasonal regression model explains 79.3% of the variation in sales.

E) All of the statements given here are true.

Quarterly sales data (in $10,000) for a small company specializing in green cleaning products are shown in the time series graph below.

A seasonal regression model was fit to these data and the results are shown below.

A seasonal regression model was fit to these data and the results are shown below.

Which of the following is (are) true?

A) The seasonal regression model is significant in explaining sales as indicated by the F-statistic and associated P-value.

B) The seasonal regression model explains 79.3% of the variation in sales.

C) The t-statistics and associated P-values indicate that all dummy variables representing quarters are significant.

D) The seasonal regression model is significant in explaining sales as indicated by the F-statistic and associated P-value and the seasonal regression model explains 79.3% of the variation in sales.

E) All of the statements given here are true.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

Consider the following to answer the question(s) below:

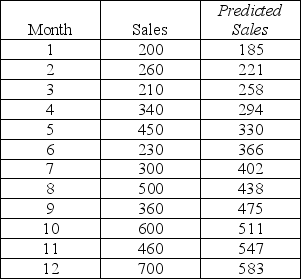

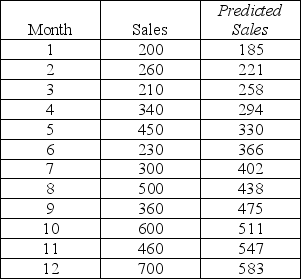

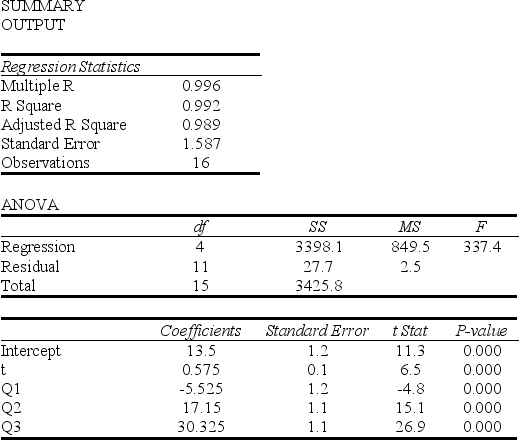

A company has developed a linear trend model to forecast monthly sales. The following data show the actual sales and the "fitted" sales for months 1-12.

Based on these data, what is the mean absolute percentage error (MAPE) for the linear trend model?

A) 22.79

B) 81.33

C) 2.73

D) 796

E) 0.22

A company has developed a linear trend model to forecast monthly sales. The following data show the actual sales and the "fitted" sales for months 1-12.

Based on these data, what is the mean absolute percentage error (MAPE) for the linear trend model?

A) 22.79

B) 81.33

C) 2.73

D) 796

E) 0.22

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

A company has recorded annual sales for the past 14 years and found the following linear trend model:  = 5.23 + 144.60 t. This means that

= 5.23 + 144.60 t. This means that

A) On average, sales are increasing by 144.6 per year.

B) On average, sales are increasing by 5.23 per year.

C) There is a seasonal component in the data.

D) Sales in year one were 5.23.

E) There is a cyclical component in the data.

= 5.23 + 144.60 t. This means that

= 5.23 + 144.60 t. This means thatA) On average, sales are increasing by 144.6 per year.

B) On average, sales are increasing by 5.23 per year.

C) There is a seasonal component in the data.

D) Sales in year one were 5.23.

E) There is a cyclical component in the data.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

Consider the following to answer the question(s) below:

The quarterly sales of all types of bicycles sold at a small sporting goods store in Charlottetown for the 16 quarters from January 2005 to December 2008 are depicted in the time series graph below.

Which of the following statements best describes this data and model?

A) The seasonal component is the most dominant.

B) All of the coefficients are significant for α = 0.05.

C) The model is additive.

D) The regression models both trend and seasonal components.

E) All of the above statements are correct.

The quarterly sales of all types of bicycles sold at a small sporting goods store in Charlottetown for the 16 quarters from January 2005 to December 2008 are depicted in the time series graph below.

Which of the following statements best describes this data and model?

A) The seasonal component is the most dominant.

B) All of the coefficients are significant for α = 0.05.

C) The model is additive.

D) The regression models both trend and seasonal components.

E) All of the above statements are correct.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

Consider the following to answer the question(s) below:

A company has developed a linear trend model to forecast monthly sales. The following data show the actual sales and the "fitted" sales for months 1-12.

Based on these data, what is the mean absolute deviation (MAD) for the linear trend model?

A) 81.33

B) 7976.167

C) 976

D) 95714

E) 115

A company has developed a linear trend model to forecast monthly sales. The following data show the actual sales and the "fitted" sales for months 1-12.

Based on these data, what is the mean absolute deviation (MAD) for the linear trend model?

A) 81.33

B) 7976.167

C) 976

D) 95714

E) 115

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

Consider the following to answer the question(s) below:

A company has developed a linear trend model to forecast monthly sales. The following data show the actual sales and the "fitted" sales for months 1-12.

Based on these data, what is the mean square error (MSE) for the linear trend model?

A) 7976.167

B) 95714

C) 81.33

D) 976

E) none of the above

A company has developed a linear trend model to forecast monthly sales. The following data show the actual sales and the "fitted" sales for months 1-12.

Based on these data, what is the mean square error (MSE) for the linear trend model?

A) 7976.167

B) 95714

C) 81.33

D) 976

E) none of the above

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

If you suspect that your trend forecasting model may have autocorrelated forecast errors, it is appropriate to compute

A) the Durbin-Watson test statistic

B) the MAD

C) the MSE

D) the MAPE

E) the correlation coefficient

A) the Durbin-Watson test statistic

B) the MAD

C) the MSE

D) the MAPE

E) the correlation coefficient

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

Consider the following to answer the question(s) below:

The quarterly sales of all types of bicycles sold at a small sporting goods store in Charlottetown for the 16 quarters from January 2005 to December 2008 are depicted in the time series graph below.

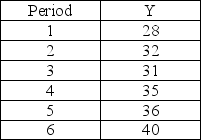

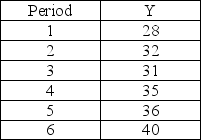

A time series is shown below. Perform single exponential smoothing for this data set using α = 0.2. What is the value of the forecast for period 6?

A) 31.5

B) 33.2

C) 36

D) 40

E) 30.4

The quarterly sales of all types of bicycles sold at a small sporting goods store in Charlottetown for the 16 quarters from January 2005 to December 2008 are depicted in the time series graph below.

A time series is shown below. Perform single exponential smoothing for this data set using α = 0.2. What is the value of the forecast for period 6?

A) 31.5

B) 33.2

C) 36

D) 40

E) 30.4

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statistical measures is(are) used to help decision makers assess the potential for their model to provide usable forecasts?

A) mean square error

B) mean absolute deviation

C) mean absolute percentage error

D) forecast errors

E) all of the above

A) mean square error

B) mean absolute deviation

C) mean absolute percentage error

D) forecast errors

E) all of the above

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck