Deck 18: Evaluating Investment Performance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/78

Play

Full screen (f)

Deck 18: Evaluating Investment Performance

1

Suppose two portfolios have the same average return and the same standard deviation of returns, but Aggie Fund has a lower beta than Raider Fund. According to the Treynor measure, the performance of Aggie Fund

A) is better than the performance of Raider Fund.

B) is the same as the performance of Raider Fund.

C) is poorer than the performance of Raider Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

A) is better than the performance of Raider Fund.

B) is the same as the performance of Raider Fund.

C) is poorer than the performance of Raider Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

A

Explanation: The Treynor Index is a measure of average portfolio returns (in excess of the risk-free return) per unit of unit of systematic risk (as measured by beta).

Explanation: The Treynor Index is a measure of average portfolio returns (in excess of the risk-free return) per unit of unit of systematic risk (as measured by beta).

2

Suppose you purchase 100 shares of GM stock at the beginning of year 1 and purchase another 100 shares at the end of year 1. You sell all 200 shares at the end of year 2. Assume that the price of GM stock is $50 at the beginning of year 1, $55 at the end of year 1, and $65 at the end of year 2. Assume no dividends were paid on GM stock. Your dollar-weighted return on the stock will be ________ your time-weighted return on the stock.

A) higher than

B) the same as

C) less than

D) exactly proportional to

E) More information is necessary to answer this question.

A) higher than

B) the same as

C) less than

D) exactly proportional to

E) More information is necessary to answer this question.

A

Explanation: In the dollar-weighted return, the stock's performance in the second year, when 200 shares are held, has a greater influence on the overall dollar-weighted return. The time-weighted return ignores the number of shares held.

Explanation: In the dollar-weighted return, the stock's performance in the second year, when 200 shares are held, has a greater influence on the overall dollar-weighted return. The time-weighted return ignores the number of shares held.

3

The comparison universe is not

A) a concept found only in astronomy.

B) the set of all mutual funds in the world.

C) the set of all mutual funds in the U.S.

D) a set of mutual funds with similar risk characteristics to your mutual fund.

E) a concept found only in astronomy, the set of all mutual funds in the world, or the set of all mutual funds in the U.S.

A) a concept found only in astronomy.

B) the set of all mutual funds in the world.

C) the set of all mutual funds in the U.S.

D) a set of mutual funds with similar risk characteristics to your mutual fund.

E) a concept found only in astronomy, the set of all mutual funds in the world, or the set of all mutual funds in the U.S.

E

4

Suppose two portfolios have the same average return and the same standard deviation of returns, but portfolio A has a higher beta than portfolio B. According to the Sharpe measure, the performance of portfolio A

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

5

________ developed a popular method for risk-adjusted performance evaluation of mutual funds.

A) Eugene Fama

B) Michael Jensen

C) William Sharpe

D) Jack Treynor

E) Michael Jensen, William Sharpe, and Jack Treynor

A) Eugene Fama

B) Michael Jensen

C) William Sharpe

D) Jack Treynor

E) Michael Jensen, William Sharpe, and Jack Treynor

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

6

________ did not develop a popular method for risk-adjusted performance evaluation of mutual funds.

A) Eugene Fama

B) Michael Jensen

C) William Sharpe

D) Jack Treynor

E) Eugene Fama and Michael Jensen

A) Eugene Fama

B) Michael Jensen

C) William Sharpe

D) Jack Treynor

E) Eugene Fama and Michael Jensen

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

7

The comparison universe is

A) a concept found only in astronomy.

B) the set of all mutual funds in the world.

C) the set of all mutual funds in the U.S.

D) a set of mutual funds with similar risk characteristics to your mutual fund.

E) None of the options are correct.

A) a concept found only in astronomy.

B) the set of all mutual funds in the world.

C) the set of all mutual funds in the U.S.

D) a set of mutual funds with similar risk characteristics to your mutual fund.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose two portfolios have the same average return and the same standard deviation of returns, but Buckeye Fund has a higher beta than Husker Fund. According to the Treynor measure, the performance of Buckeye Fund

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose two portfolios have the same average return and the same standard deviation of returns, but Aggie Fund has a higher beta than Raider Fund. According to the Treynor measure, the performance of Aggie Fund

A) is better than the performance of Raider Fund.

B) is the same as the performance of Raider Fund.

C) is poorer than the performance of Raider Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

A) is better than the performance of Raider Fund.

B) is the same as the performance of Raider Fund.

C) is poorer than the performance of Raider Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

10

Most professionally managed equity funds generally

A) outperform the S&P 500 Index on both raw and risk-adjusted return measures.

B) underperform the S&P 500 Index on both raw and risk-adjusted return measures.

C) outperform the S&P 500 Index on raw return measures and underperform the S&P 500 Index on risk-adjusted return measures.

D) underperform the S&P 500 Index on raw return measures and outperform the S&P 500 Index on risk-adjusted return measures.

E) match the performance of the S&P 500 Index on both raw and risk-adjusted return measures.

A) outperform the S&P 500 Index on both raw and risk-adjusted return measures.

B) underperform the S&P 500 Index on both raw and risk-adjusted return measures.

C) outperform the S&P 500 Index on raw return measures and underperform the S&P 500 Index on risk-adjusted return measures.

D) underperform the S&P 500 Index on raw return measures and outperform the S&P 500 Index on risk-adjusted return measures.

E) match the performance of the S&P 500 Index on both raw and risk-adjusted return measures.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

11

Henriksson (1984) found that, on average, betas of funds ________ during market advances.

A) increased very significantly

B) increased slightly

C) decreased slightly

D) decreased very significantly

E) did not change

A) increased very significantly

B) increased slightly

C) decreased slightly

D) decreased very significantly

E) did not change

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

12

Suppose two portfolios have the same average return and the same standard deviation of returns, but Aggie Fund has a higher beta than Raider Fund. According to the Sharpe measure, the performance of Aggie Fund

A) is better than the performance of Raider Fund.

B) is the same as the performance of Raider Fund.

C) is poorer than the performance of Raider Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options

A) is better than the performance of Raider Fund.

B) is the same as the performance of Raider Fund.

C) is poorer than the performance of Raider Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

13

Suppose two portfolios have the same average return and the same standard deviation of returns, but Buckeye Fund has a lower beta than Husker Fund. According to the Sharpe measure, the performance of Buckeye Fund

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose two portfolios have the same average return and the same standard deviation of returns, but Buckeye Fund has a lower beta than Husker Fund. According to the Treynor measure, the performance of Buckeye Fund

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

15

Mutual funds show ________ evidence of serial correlation, and hedge funds show ________ evidence of serial correlation.

A) almost no; almost no

B) almost no; substantial

C) substantial; substantial

D) substantial; almost no

E) modest; modest

A) almost no; almost no

B) almost no; substantial

C) substantial; substantial

D) substantial; almost no

E) modest; modest

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose two portfolios have the same average return and the same standard deviation of returns, but portfolio A has a lower beta than portfolio B. According to the Treynor measure, the performance of portfolio A

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

17

Morningstar's RAR method

I) is one of the most widely-used performance measures.

II) indicates poor performance by placing up to 5 darts next to the fund's name.

III) computes fund returns adjusted for loads.

IV) computes fund returns adjusted for risk.

V) produces ranking results that are the same as those produced with the Sharpe measure.

A) I, II, and IV

B) I, III, and IV

C) I, IV, and V

D) I, II, IV, and V

E) I, II, III, IV, and V

I) is one of the most widely-used performance measures.

II) indicates poor performance by placing up to 5 darts next to the fund's name.

III) computes fund returns adjusted for loads.

IV) computes fund returns adjusted for risk.

V) produces ranking results that are the same as those produced with the Sharpe measure.

A) I, II, and IV

B) I, III, and IV

C) I, IV, and V

D) I, II, IV, and V

E) I, II, III, IV, and V

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose two portfolios have the same average return and the same standard deviation of returns, but Buckeye Fund has a higher beta than Husker Fund. According to the Sharpe measure, the performance of Buckeye Fund

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose two portfolios have the same average return and the same standard deviation of returns, but portfolio A has a higher beta than portfolio B. According to the Treynor measure, the performance of portfolio A

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

20

Hedge funds

I) are appropriate as a sole investment vehicle for an investor.

II) should only be added to an already well-diversified portfolio.

III) pose performance-evaluation issues due to nonlinear factor exposures.

IV) have down-market betas that are typically larger than up-market betas.

V) have symmetrical betas.

A) I only

B) II and V

C) I, III, and IV

D) II, III, and IV

E) I, III, and V

I) are appropriate as a sole investment vehicle for an investor.

II) should only be added to an already well-diversified portfolio.

III) pose performance-evaluation issues due to nonlinear factor exposures.

IV) have down-market betas that are typically larger than up-market betas.

V) have symmetrical betas.

A) I only

B) II and V

C) I, III, and IV

D) II, III, and IV

E) I, III, and V

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose a particular investment earns an arithmetic return of 10% in year 1, 20% in year 2, and 30% in year 3. The geometric average return for the period will be

A) greater than the arithmetic average return.

B) equal to the arithmetic average return.

C) less than the arithmetic average return.

D) equal to the market return.

E) It cannot be determined from the information given.

A) greater than the arithmetic average return.

B) equal to the arithmetic average return.

C) less than the arithmetic average return.

D) equal to the market return.

E) It cannot be determined from the information given.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

22

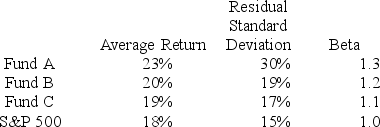

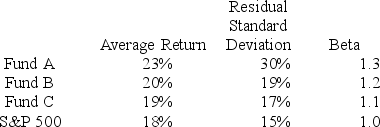

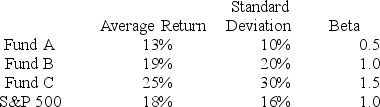

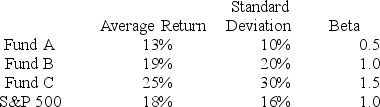

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 5%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The investment with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) the index.

E) Funds A and C (tied for highest).

The investment with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) the index.

E) Funds A and C (tied for highest).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose you purchase one share of the stock of Volatile Engineering Corporation at the beginning of year 1 for $36. At the end of year 1, you receive a $2 dividend and buy one more share for $30. At the end of year 2, you receive total dividends of $4 (i.e., $2 for each share) and sell the shares for $36.45 each. The dollar-weighted return on your investment is

A) −1.75%.

B) 4.08%.

C) 8.53%.

D) 8.00%.

E) 12.35%.

A) −1.75%.

B) 4.08%.

C) 8.53%.

D) 8.00%.

E) 12.35%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

24

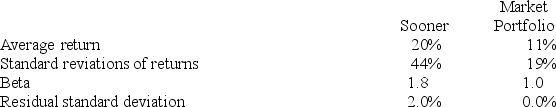

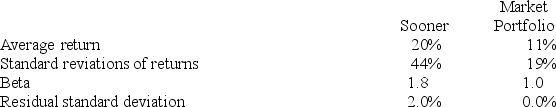

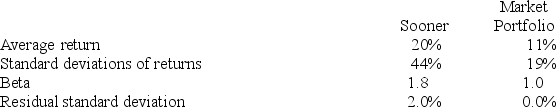

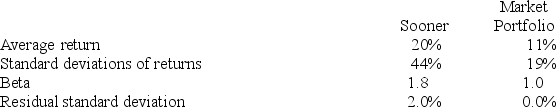

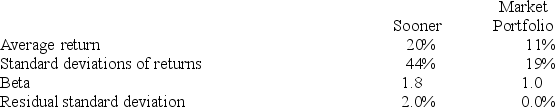

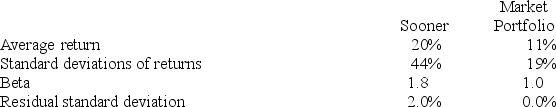

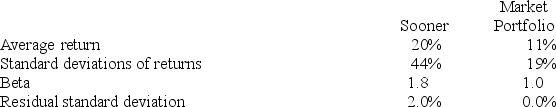

The following data are available relating to the performance of Sooner Stock Fund and the market portfolio:

The risk-free return during the sample period was 3%.

Calculate the Jensen measure of performance evaluation for Sooner Stock Fund.

A) 2.6%

B) 4.00%

C) 8.67%

D) 31.43%

E) 37.14%

The risk-free return during the sample period was 3%.

Calculate the Jensen measure of performance evaluation for Sooner Stock Fund.

A) 2.6%

B) 4.00%

C) 8.67%

D) 31.43%

E) 37.14%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

25

The following data are available relating to the performance of Sooner Stock Fund and the market portfolio:

The risk-free return during the sample period was 3%.

What is the Treynor measure of performance evaluation for Sooner Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.0944

E) 0.3714

The risk-free return during the sample period was 3%.

What is the Treynor measure of performance evaluation for Sooner Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.0944

E) 0.3714

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose you purchase one share of the stock of Cereal Correlation Company at the beginning of year 1 for $50. At the end of year 1, you receive a $1 dividend and buy one more share for $72. At the end of year 2, you receive total dividends of $2 (i.e., $1 for each share) and sell the shares for $67.20 each. The dollar-weighted return on your investment is

A) 10.00%.

B) 8.78%.

C) 19.71%.

D) 20.36%.

A) 10.00%.

B) 8.78%.

C) 19.71%.

D) 20.36%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose the risk-free return is 3%. The beta of a managed portfolio is 1.75, the alpha is 0%, and the average return is 16%. Based on Jensen's measure of portfolio performance, you would calculate the return on the market portfolio as

A) 12.3%.

B) 10.4%.

C) 15.1%.

D) 16.7%.

A) 12.3%.

B) 10.4%.

C) 15.1%.

D) 16.7%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

28

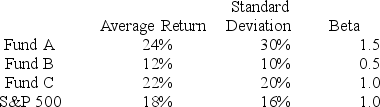

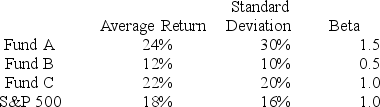

You want to evaluate three mutual funds using the Jensen measure for performance evaluation. The risk-free return during the sample period is 6%, and the average return on the market portfolio is 18%. The average returns, standard deviations, and betas for the three funds are given below.

The fund with the highest Jensen measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

The fund with the highest Jensen measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose you own two stocks, A and B. In year 1, stock A earns a 2% return and stock B earns a 9% return. In year 2, stock A earns an 18% return and stock B earns an 11% return. Which stock has the higher geometric average return?

A) Stock A

B) Stock B

C) The two stocks have the same geometric average return.

D) At least three periods are needed to calculate the geometric average return.

A) Stock A

B) Stock B

C) The two stocks have the same geometric average return.

D) At least three periods are needed to calculate the geometric average return.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

30

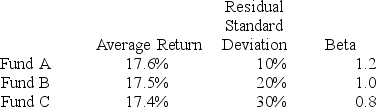

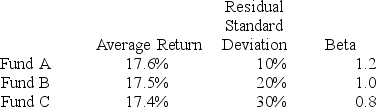

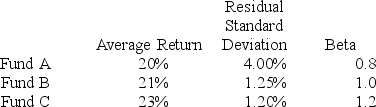

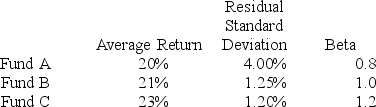

You want to evaluate three mutual funds using the information ratio measure for performance evaluation. The risk-free return during the sample period is 6%, and the average return on the market portfolio is 19%. The average returns, residual standard deviations, and betas for the three funds are given below.

The fund with the highest information ratio measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

The fund with the highest information ratio measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose you purchase one share of the stock of Cereal Correlation Company at the beginning of year 1 for $50. At the end of year 1, you receive a $1 dividend and buy one more share for $72. At the end of year 2, you receive total dividends of $2 (i.e., $1 for each share) and sell the shares for $67.20 each. The time-weighted return on your investment is

A) 10.0%.

B) 8.7%.

C) 19.7%.

D) 17.6%.

A) 10.0%.

B) 8.7%.

C) 19.7%.

D) 17.6%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

32

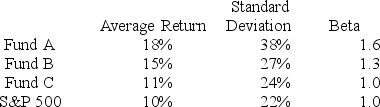

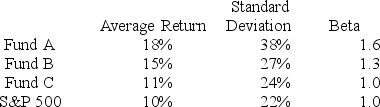

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 4%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

The fund with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose the risk-free return is 4%. The beta of a managed portfolio is 1.2, the alpha is 1%, and the average return is 14%. Based on Jensen's measure of portfolio performance, you would calculate the return on the market portfolio as

A) 11.5%.

B) 14%.

C) 15%.

D) 16%.

A) 11.5%.

B) 14%.

C) 15%.

D) 16%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

34

You want to evaluate three mutual funds using the Treynor measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index.

The fund with the highest Treynor measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

The fund with the highest Treynor measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

35

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

The fund with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest).

E) Funds A and C (tied for highest).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

36

Suppose you buy 100 shares of Abolishing Dividend Corporation at the beginning of year 1 for $80. Abolishing Dividend Corporation pays no dividends. The stock price at the end of year 1 is $100, $120 at the end of year 2, and $150 at the end of year 3. The stock price declines to $100 at the end of year 4, and you sell your 100 shares. For the four years, your geometric average return is

A) 0.0%.

B) 1.0%.

C) 5.7%.

D) 9.2%.

E) 34.5%.

A) 0.0%.

B) 1.0%.

C) 5.7%.

D) 9.2%.

E) 34.5%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

37

The following data are available relating to the performance of Sooner Stock Fund and the market portfolio:

The risk-free return during the sample period was 3%.

What is the Sharpe measure of performance evaluation for Sooner Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.386

E) 0.3714

The risk-free return during the sample period was 3%.

What is the Sharpe measure of performance evaluation for Sooner Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.386

E) 0.3714

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose you purchase one share of the stock of Volatile Engineering Corporation at the beginning of year 1 for $36. At the end of year 1, you receive a $2 dividend and buy one more share for $30. At the end of year 2, you receive total dividends of $4 (i.e., $2 for each share) and sell the shares for $36.45 each. The time-weighted return on your investment is

A) -1.75%.

B) 4.08%.

C) 6.74%.

D) 11.46%.

E) 12.35%.

A) -1.75%.

B) 4.08%.

C) 6.74%.

D) 11.46%.

E) 12.35%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

39

Suppose you own two stocks, A and B. In year 1, stock A earns a 2% return and stock B earns a 9% return. In year 2, stock A earns an 18% return and stock B earns an 11% return. ________ has the higher arithmetic average return.

A) Stock A

B) Stock B

C) The two stocks have the same arithmetic average return.

D) At least three periods are needed to calculate the arithmetic average return.

A) Stock A

B) Stock B

C) The two stocks have the same arithmetic average return.

D) At least three periods are needed to calculate the arithmetic average return.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

40

Suppose the risk-free return is 6%. The beta of a managed portfolio is 1.5, the alpha is 3%, and the average return is 18%. Based on Jensen's measure of portfolio performance, you would calculate the return on the market portfolio as

A) 12%.

B) 14%.

C) 15%.

D) 16%.

A) 12%.

B) 14%.

C) 15%.

D) 16%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

41

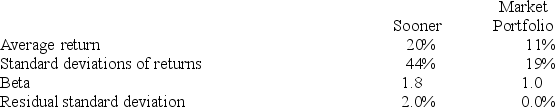

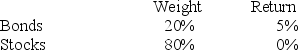

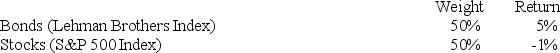

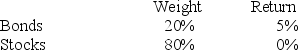

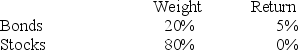

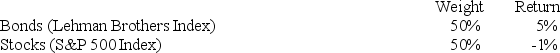

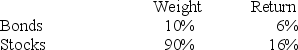

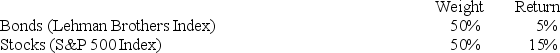

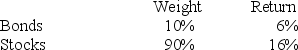

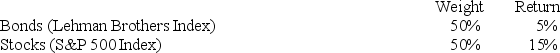

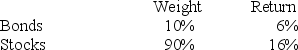

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:

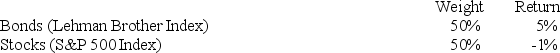

The return on a bogey portfolio was 2%, calculated from the following information.

The contribution of selection within markets to the Razorback Fund's total excess return was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.80%.

The return on a bogey portfolio was 2%, calculated from the following information.

The contribution of selection within markets to the Razorback Fund's total excess return was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.80%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

42

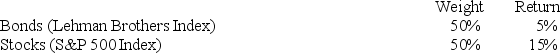

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:

The return on a bogey portfolio was 2%, calculated from the following information.

The total excess return on the Razorback Fund's managed portfolio was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.90%

The return on a bogey portfolio was 2%, calculated from the following information.

The total excess return on the Razorback Fund's managed portfolio was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.90%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

43

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:

The return on a bogey portfolio was 2%, calculated from the following information.

The contribution of asset allocation across markets to the Razorback Fund's total excess return was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.80%

The return on a bogey portfolio was 2%, calculated from the following information.

The contribution of asset allocation across markets to the Razorback Fund's total excess return was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.80%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

44

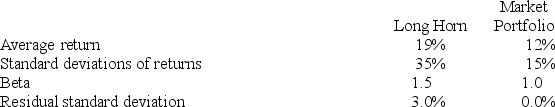

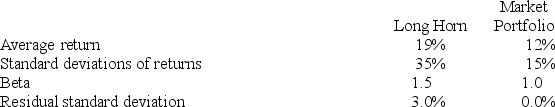

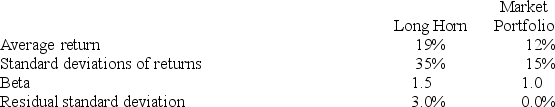

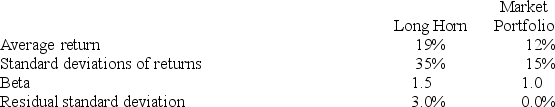

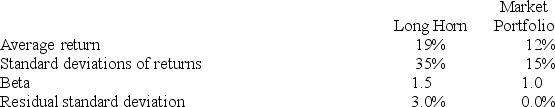

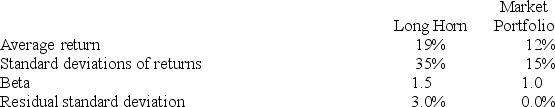

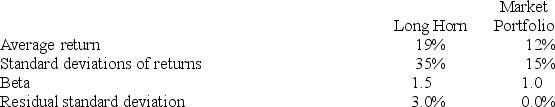

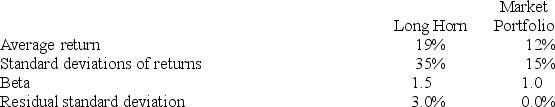

The following data are available relating to the performance of Long Horn Stock Fund and the market portfolio:

The risk-free return during the sample period was 6%.

What is the Treynor measure of performance evaluation for Long Horn Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.3143

E) 0.3714

The risk-free return during the sample period was 6%.

What is the Treynor measure of performance evaluation for Long Horn Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.3143

E) 0.3714

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

45

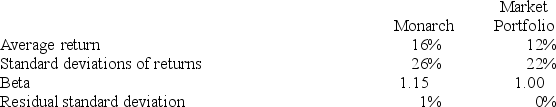

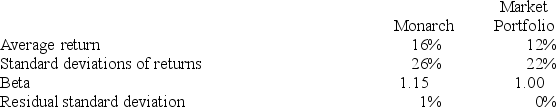

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:

The risk-free return during the sample period was 4%.

Calculate Sharpe's measure of performance for Monarch Stock Fund.

A) 0.01

B) 0.46

C) 0.44

D) 0.55

E) None of the options are correct.

The risk-free return during the sample period was 4%.

Calculate Sharpe's measure of performance for Monarch Stock Fund.

A) 0.01

B) 0.46

C) 0.44

D) 0.55

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

46

If an investor has a portfolio that has constant proportions in T-bills and the market portfolio, the portfolio's characteristic line will plot as a line with ________. If the investor can time bull markets, the characteristic line will plot as a line with ________.

A) a positive slope; a negative slope

B) a negative slope; a positive slope

C) a constant slope; a negative slope

D) a negative slope; a constant slope

E) a constant slope; a positive slope

A) a positive slope; a negative slope

B) a negative slope; a positive slope

C) a constant slope; a negative slope

D) a negative slope; a constant slope

E) a constant slope; a positive slope

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

47

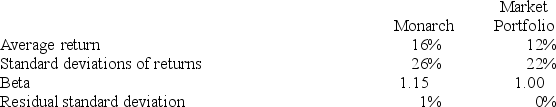

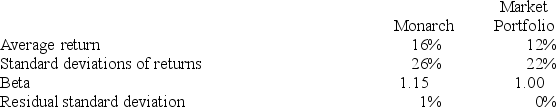

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:

The risk-free return during the sample period was 4%.

Calculate Jensen's measure of performance for Monarch Stock Fund.

A) 1.00%

B) 2.80%

C) 44.00%

D) 50.00%

The risk-free return during the sample period was 4%.

Calculate Jensen's measure of performance for Monarch Stock Fund.

A) 1.00%

B) 2.80%

C) 44.00%

D) 50.00%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

48

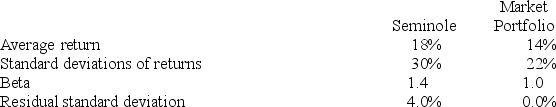

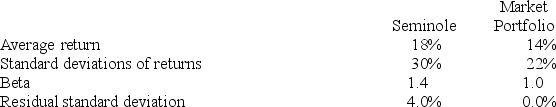

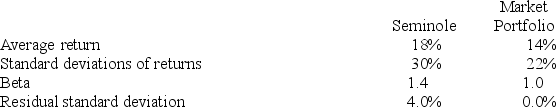

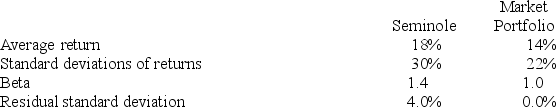

The following data are available relating to the performance of Seminole Fund and the market portfolio:

The risk-free return during the sample period was 6%.

Calculate the M2 measure for the Seminole Fund.

A) 4.0%

B) 20.0%

C) 2.86%

D) 0.8%

E) 40.0%

The risk-free return during the sample period was 6%.

Calculate the M2 measure for the Seminole Fund.

A) 4.0%

B) 20.0%

C) 2.86%

D) 0.8%

E) 40.0%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

49

The following data are available relating to the performance of Long Horn Stock Fund and the market portfolio:

The risk-free return during the sample period was 6%.

Calculate the Jensen measure of performance evaluation for Long Horn Stock Fund.

A) 1.33%

B) 4.00%

C) 8.67%

D) 31.43%

E) 37.14%

The risk-free return during the sample period was 6%.

Calculate the Jensen measure of performance evaluation for Long Horn Stock Fund.

A) 1.33%

B) 4.00%

C) 8.67%

D) 31.43%

E) 37.14%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

50

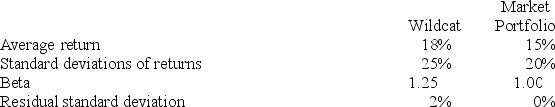

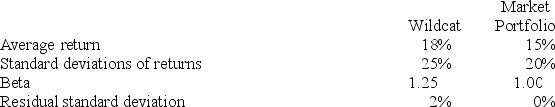

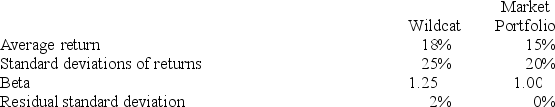

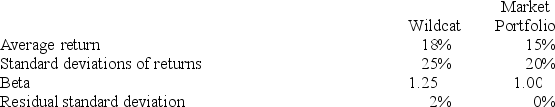

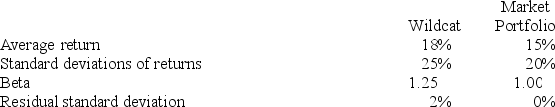

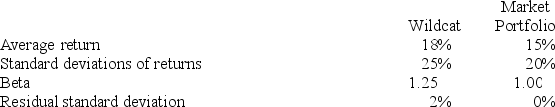

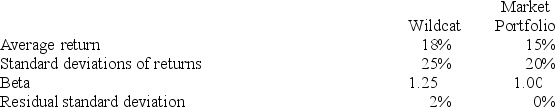

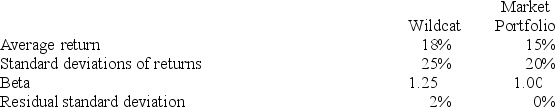

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

Calculate Treynor's measure of performance for Wildcat Fund.

A) 0.01

B) 0.088

C) 0.44

D) 0.50

E) 0.61

The risk-free return during the sample period was 7%.

Calculate Treynor's measure of performance for Wildcat Fund.

A) 0.01

B) 0.088

C) 0.44

D) 0.50

E) 0.61

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

51

The following data are available relating to the performance of Seminole Fund and the market portfolio:

The risk-free return during the sample period was 6%.

If you wanted to evaluate the Seminole Fund using the M2 measure, what percent of the adjusted portfolio would need to be invested in T-Bills?

A) -36% (borrow)

B) 50%

C) 8%

D) 36%

E) 27%

The risk-free return during the sample period was 6%.

If you wanted to evaluate the Seminole Fund using the M2 measure, what percent of the adjusted portfolio would need to be invested in T-Bills?

A) -36% (borrow)

B) 50%

C) 8%

D) 36%

E) 27%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

52

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

Calculate Jensen's measure of performance for Wildcat Fund.

A) 1.00%

B) 8.80%

C) 44.00%

D) 50.00%

E) 55.00%

The risk-free return during the sample period was 7%.

Calculate Jensen's measure of performance for Wildcat Fund.

A) 1.00%

B) 8.80%

C) 44.00%

D) 50.00%

E) 55.00%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

53

The following data are available relating to the performance of Long Horn Stock Fund and the market portfolio:

The risk-free return during the sample period was 6%.

What is the Sharpe measure of performance evaluation for Long Horn Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.3143

E) 0.3714

The risk-free return during the sample period was 6%.

What is the Sharpe measure of performance evaluation for Long Horn Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.3143

E) 0.3714

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

54

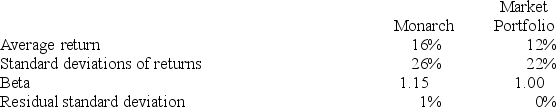

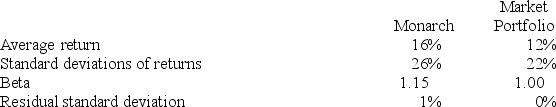

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:

The risk-free return during the sample period was 4%.

Calculate Treynor's measure of performance for Monarch Stock Fund.

A) 0.0143

B) 0.088

C) 0.44

D) 0.50

The risk-free return during the sample period was 4%.

Calculate Treynor's measure of performance for Monarch Stock Fund.

A) 0.0143

B) 0.088

C) 0.44

D) 0.50

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

55

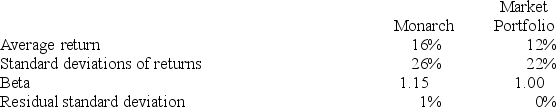

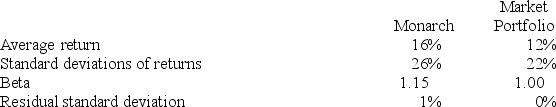

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:

The risk-free return during the sample period was 4%.

What is the information ratio measure of performance evaluation for Monarch Stock Fund?

A) 1.00%

B) 280.00%

C) 44.00%

D) 50.00%

E) None of the options are correct.

The risk-free return during the sample period was 4%.

What is the information ratio measure of performance evaluation for Monarch Stock Fund?

A) 1.00%

B) 280.00%

C) 44.00%

D) 50.00%

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

56

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

Calculate Sharpe's measure of performance for Wildcat Fund.

A) 0.01

B) 0.08

C) 0.44

D) 0.50

E) 0.72

The risk-free return during the sample period was 7%.

Calculate Sharpe's measure of performance for Wildcat Fund.

A) 0.01

B) 0.08

C) 0.44

D) 0.50

E) 0.72

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

57

The following data are available relating to the performance of Long Horn Stock Fund and the market portfolio:

The risk-free return during the sample period was 6%.

Calculate the information ratio for Long Horn Stock Fund.

A) 1.33

B) 4.00

C) 8.67

D) 31.43

E) 37.14

The risk-free return during the sample period was 6%.

Calculate the information ratio for Long Horn Stock Fund.

A) 1.33

B) 4.00

C) 8.67

D) 31.43

E) 37.14

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

58

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

What is the information ratio measure of performance evaluation for Wildcat Fund?

A) 1.00%

B) 8.80%

C) 44.00%

D) 50.00%

E) 67.00%

The risk-free return during the sample period was 7%.

What is the information ratio measure of performance evaluation for Wildcat Fund?

A) 1.00%

B) 8.80%

C) 44.00%

D) 50.00%

E) 67.00%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

59

Studies of style analysis have found that ________ of fund returns can be explained by asset allocation alone.

A) between 50% and 70%

B) less than 10%

C) between 40 and 50%

D) between 75% and 90%

E) over 90%

A) between 50% and 70%

B) less than 10%

C) between 40 and 50%

D) between 75% and 90%

E) over 90%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

60

The following data are available relating to the performance of Sooner Stock Fund and the market portfolio:

The risk-free return during the sample period was 3%.

Calculate the information ratio for Sooner Stock Fund.

A) 1.53

B) 1.30

C) 8.67

D) 31.43

E) 37.14

The risk-free return during the sample period was 3%.

Calculate the information ratio for Sooner Stock Fund.

A) 1.53

B) 1.30

C) 8.67

D) 31.43

E) 37.14

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

61

The Sharpe, Treynor, and Jensen portfolio performance measures are derived from the CAPM,

A) therefore, it does not matter which measure is used to evaluate a portfolio manager.

B) however, the Sharpe and Treynor measures use different risk measures. Therefore, the measures vary as to whether or not they are appropriate, depending on the investment scenario.

C) therefore, all measure the same attributes.

D) therefore, it does not matter which measure is used to evaluate a portfolio manager. However, the Sharpe and Treynor measures use different risk measures, so therefore, the measures vary as to whether or not they are appropriate, depending on the investment scenario.

E) None of the options are correct.

A) therefore, it does not matter which measure is used to evaluate a portfolio manager.

B) however, the Sharpe and Treynor measures use different risk measures. Therefore, the measures vary as to whether or not they are appropriate, depending on the investment scenario.

C) therefore, all measure the same attributes.

D) therefore, it does not matter which measure is used to evaluate a portfolio manager. However, the Sharpe and Treynor measures use different risk measures, so therefore, the measures vary as to whether or not they are appropriate, depending on the investment scenario.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

62

In measuring the comparative performance of different fund managers, the preferred method of calculating rate of return is

A) internal rate of return.

B) arithmetic average.

C) dollar weighted.

D) time weighted.

E) None of the options are correct.

A) internal rate of return.

B) arithmetic average.

C) dollar weighted.

D) time weighted.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

63

The dollar-weighted return on a portfolio is equivalent to

A) the time-weighted return.

B) the geometric average return.

C) the arithmetic average return.

D) the portfolio's internal rate of return.

E) None of the options are correct.

A) the time-weighted return.

B) the geometric average return.

C) the arithmetic average return.

D) the portfolio's internal rate of return.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

64

A portfolio manager's ranking within a comparison universe may not provide a good measure of performance because

A) portfolio returns may not be calculated in the same way.

B) portfolio durations can vary across managers.

C) if managers follow a particular style or subgroup, portfolios may not be comparable.

D) portfolio durations can vary across managers and if managers follow a particular style or subgroup, portfolios may not be comparable.

E) All of the options are correct.

A) portfolio returns may not be calculated in the same way.

B) portfolio durations can vary across managers.

C) if managers follow a particular style or subgroup, portfolios may not be comparable.

D) portfolio durations can vary across managers and if managers follow a particular style or subgroup, portfolios may not be comparable.

E) All of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

65

The Jensen portfolio evaluation measure

A) is a measure of return per unit of risk, as measured by standard deviation.

B) is an absolute measure of return over and above that predicted by the CAPM.

C) is a measure of return per unit of risk, as measured by beta.

D) is a measure of return per unit of risk, as measured by standard deviation, and is an absolute measure of return over and above that predicted by the CAPM.

E) is an absolute measure of return over and above that predicted by the CAPM, and is a measure of return per unit of risk, as measured by beta.

A) is a measure of return per unit of risk, as measured by standard deviation.

B) is an absolute measure of return over and above that predicted by the CAPM.

C) is a measure of return per unit of risk, as measured by beta.

D) is a measure of return per unit of risk, as measured by standard deviation, and is an absolute measure of return over and above that predicted by the CAPM.

E) is an absolute measure of return over and above that predicted by the CAPM, and is a measure of return per unit of risk, as measured by beta.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

66

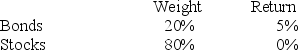

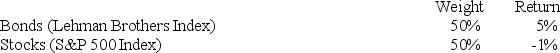

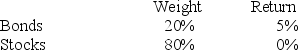

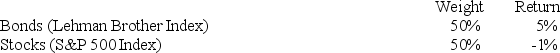

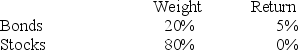

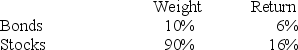

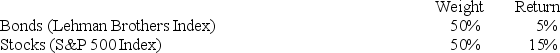

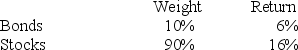

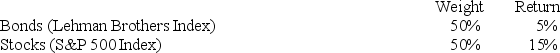

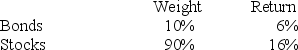

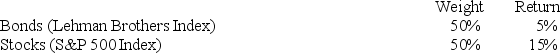

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:

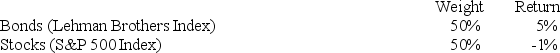

The return on a bogey portfolio was 10%, calculated as follows:

The contribution of asset allocation across markets to the total excess return was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

The return on a bogey portfolio was 10%, calculated as follows:

The contribution of asset allocation across markets to the total excess return was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

67

The Value Line Index is an equally-weighted geometric average of the returns of about 1,700 firms. The value of an index based on the geometric average returns of three stocks where the returns on the three stocks during a given period were 32%, 5%, and -10%, respectively, is

A) 4.3%.

B) 7.6%.

C) 9.0%.

D) 13.4%.

E) 5.0%.

A) 4.3%.

B) 7.6%.

C) 9.0%.

D) 13.4%.

E) 5.0%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

68

The ________ measures the reward to volatility trade-off by dividing the average portfolio excess return by the standard deviation of returns.

A) Sharpe measure

B) Treynor measure

C) Jensen measure

D) information ratio

E) None of the options are correct.

A) Sharpe measure

B) Treynor measure

C) Jensen measure

D) information ratio

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

69

A pension fund that begins with $500,000 earns 15% the first year and 10% the second year. At the beginning of the second year, the sponsor contributes another $300,000. The dollar-weighted and time-weighted rates of return, respectively, were

A) 11.7% and 12.5%.

B) 12.1% and 12.5%.

C) 12.5% and 11.7%.

D) 12.5% and 12.1%.

A) 11.7% and 12.5%.

B) 12.1% and 12.5%.

C) 12.5% and 11.7%.

D) 12.5% and 12.1%.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

70

Risk-adjusted mutual fund performance measures have decreased in popularity because

A) in nearly efficient markets, it is extremely difficult for portfolio managers to outperform the market.

B) the measures usually result in negative performance results for the portfolio managers.

C) the high rates of return earned by the mutual funds have made the measures useless.

D) in nearly efficient markets, it is extremely difficult for portfolio managers to outperform the market, and the measures usually result in negative performance results for the portfolio managers.

E) None of the options are correct.

A) in nearly efficient markets, it is extremely difficult for portfolio managers to outperform the market.

B) the measures usually result in negative performance results for the portfolio managers.

C) the high rates of return earned by the mutual funds have made the measures useless.

D) in nearly efficient markets, it is extremely difficult for portfolio managers to outperform the market, and the measures usually result in negative performance results for the portfolio managers.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

71

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:

The return on a bogey portfolio was 10%, calculated as follows:

The contribution of selection within markets to total excess return was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

The return on a bogey portfolio was 10%, calculated as follows:

The contribution of selection within markets to total excess return was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

72

The geometric average rate of return is based on

A) the market's volatility.

B) the concept of expected return.

C) the standard deviation of returns.

D) the CAPM.

E) the principle of compounding.

A) the market's volatility.

B) the concept of expected return.

C) the standard deviation of returns.

D) the CAPM.

E) the principle of compounding.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

73

To determine whether portfolio performance is statistically significant requires

A) a very long observation period due to the high variance of stock returns.

B) a short observation period due to the high variance of stock returns.

C) a very long observation period due to the low variance of stock returns.

D) a short observation period due to the low variance of stock returns.

E) a low variance of returns over any observation period.

A) a very long observation period due to the high variance of stock returns.

B) a short observation period due to the high variance of stock returns.

C) a very long observation period due to the low variance of stock returns.

D) a short observation period due to the low variance of stock returns.

E) a low variance of returns over any observation period.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

74

The M2 measure was developed by

A) Merton and Miller.

B) Miller and Miller.

C) Modigliani and Miller.

D) Modigliani and Modigliani.

E) the M&M Mars Company.

A) Merton and Miller.

B) Miller and Miller.

C) Modigliani and Miller.

D) Modigliani and Modigliani.

E) the M&M Mars Company.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

75

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:

The return on a bogey portfolio was 10%, calculated as follows:

The total excess return on the Aggie managed portfolio was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

The return on a bogey portfolio was 10%, calculated as follows:

The total excess return on the Aggie managed portfolio was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

76

The Modigliani M2 measure and the Treynor T2 measure

A) are identical.

B) are nearly identical and will rank portfolios the same way.

C) are nearly identical, but might rank portfolios differently.

D) are somewhat different; M2 can be used to rank portfolios, but T2 cannot.

E) are somewhat different; T2 can be used to rank portfolios, but M2 cannot.

A) are identical.

B) are nearly identical and will rank portfolios the same way.

C) are nearly identical, but might rank portfolios differently.

D) are somewhat different; M2 can be used to rank portfolios, but T2 cannot.

E) are somewhat different; T2 can be used to rank portfolios, but M2 cannot.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

77

Rodney holds a portfolio of risky assets that represents his entire risky investment. To evaluate the performance of Rodney's portfolio, in which order would you complete the steps listed?

I) Compare the Sharpe measure of Rodney's portfolio to the Sharpe measure of the best portfolio.

II) State your conclusions.

III) Assume that past security performance is representative of expected performance.

IV) Determine the benchmark portfolio that Rodney would have held if he had chosen a passive strategy.

A) I, III, IV, II

B) III, IV, I, II

C) IV, III, I, II

D) III, II, I, IV

E) III, I, IV, II

I) Compare the Sharpe measure of Rodney's portfolio to the Sharpe measure of the best portfolio.

II) State your conclusions.

III) Assume that past security performance is representative of expected performance.

IV) Determine the benchmark portfolio that Rodney would have held if he had chosen a passive strategy.

A) I, III, IV, II

B) III, IV, I, II

C) IV, III, I, II

D) III, II, I, IV

E) III, I, IV, II

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

78

The M-squared measure considers

A) only the return when evaluating mutual funds.

B) the risk-adjusted return when evaluating mutual funds.

C) only the total risk when evaluating mutual funds.

D) only the market risk when evaluating mutual funds.

E) None of the options are correct.

A) only the return when evaluating mutual funds.

B) the risk-adjusted return when evaluating mutual funds.

C) only the total risk when evaluating mutual funds.

D) only the market risk when evaluating mutual funds.

E) None of the options are correct.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck