Exam 16: Capital and Financial Markets

Exam 1: The Central Idea155 Questions

Exam 2: Observing and Explaining the Economy108 Questions

Exam 3: The Supply and Demand Model170 Questions

Exam 4: Subtleties of the Supply and Demand Model: Price Floors, Price Ceilings, and Elasticity179 Questions

Exam 5: The Demand Curve and the Behavior of Consumers136 Questions

Exam 6: The Supply Curve and the Behavior of Firms182 Questions

Exam 7: The Interaction of People in Markets158 Questions

Exam 8: Costs and the Changes at Firms Over Time172 Questions

Exam 9: The Rise and Fall of Industries139 Questions

Exam 10: Monopoly182 Questions

Exam 11: Product Differentiation, Monopolistic Competition, and Oligopoly169 Questions

Exam 12: Antitrust Policy and Regulation152 Questions

Exam 13: Labor Markets179 Questions

Exam 14: Taxes, Transfers, and Income Distribution180 Questions

Exam 15: Public Goods, Externalities, and Government Behavior201 Questions

Exam 16: Capital and Financial Markets174 Questions

Exam 17: Reading, Understanding, and Creating Graphs35 Questions

Exam 18: Consumer Theory With Indifference Curves39 Questions

Exam 19: Producer Theory With Isoquants19 Questions

Select questions type

What is the expected return on a stock with a guaranteed dividend of $3 if there is a 30-percent chance its price could rise by 50 percent, a 30-percent chance its price could fall by 50 percent, and a 40-percent chance its price could stay constant at the present price of $60 per share?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

C

The amount of principal that will be paid back when a bond matures is called the

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

E

The profit-maximizing principle that marginal revenue product equals the price of the input applies

Free

(Multiple Choice)

4.9/5  (35)

(35)

Correct Answer:

A

The equilibrium risk-return relationship for a risk-averse individual shows

(Multiple Choice)

4.9/5  (33)

(33)

If a new tax is placed on a good with a vertical supply curve, the price paid by demanders

(Multiple Choice)

4.8/5  (39)

(39)

Systematic risk is reduced to zero as the number of different stocks in a portfolio increases.

(True/False)

4.8/5  (33)

(33)

If the implicit rental price of an airliner is $200,000 per year, the interest rate is 5 percent, and depreciation is $60,000 per year, then the purchase price of the airliner is

(Multiple Choice)

4.9/5  (40)

(40)

What is the difference between a debt contract and an equity contract?

(Essay)

4.8/5  (24)

(24)

Suppose a stock has a lower expected rate of return than a bank account. Then

(Multiple Choice)

4.9/5  (33)

(33)

The equilibrium risk-return curve for a risk-loving individual is

(Multiple Choice)

5.0/5  (34)

(34)

One possible role for government is to intervene to prevent the failure of large financial institutions and thereby prevent instability in the financial markets. Indeed, during 2008 the federal government intervened in several ways by loaning or investing funds to help some of these financial institutions.

(True/False)

4.8/5  (29)

(29)

Suppose the U.S. government issues a one-year Treasury bill with a face value of $5,000 and a $100 coupon payment. If the market interest rate is 9 percent, what is the market price of the bond based on its present discounted value? If bond prices rise by 4 percent, what must have happened to the market interest rate? Explain.

(Essay)

4.9/5  (34)

(34)

In reality, it has been confirmed that riskier investments yield higher average rates of return.

(True/False)

4.9/5  (37)

(37)

Which of the following is not an example of physical capital?

(Multiple Choice)

5.0/5  (43)

(43)

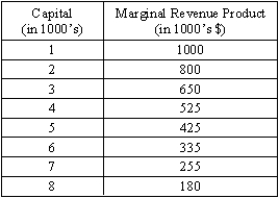

The table below contains information about a firm's marginal revenue product of capital.  Suppose the rental price of capital is $425,000. How many units should the firm hire to maximize profit?

Suppose the rental price of capital is $425,000. How many units should the firm hire to maximize profit?

(Multiple Choice)

4.9/5  (37)

(37)

Suppose you are considering purchasing stock from two firms, firm A and firm B. The expected return is the same for both stocks; however, the return on stock A is more variable than the return on stock B. Which stock would you buy? Why? What do you think other investors will do? What will be the effect of investors' behavior on the relative prices of these two stocks?

(Essay)

4.8/5  (27)

(27)

Showing 1 - 20 of 174

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)