Exam 9: The Time Value of Money

Exam 1: The Goals and Functions of Financial Management106 Questions

Exam 2: Review of Accounting150 Questions

Exam 3: Financial Analysis124 Questions

Exam 4: Financial Forecasting95 Questions

Exam 5: Operating and Financial Leverage106 Questions

Exam 6: Working Capital and the Financing Decision124 Questions

Exam 7: Current Asset Management148 Questions

Exam 8: Sources of Short-Term Financing117 Questions

Exam 9: The Time Value of Money100 Questions

Exam 10: Valuation and Rates of Return115 Questions

Exam 11: Cost of Capital144 Questions

Exam 12: The Capital Budgeting Decision131 Questions

Exam 13: Risk and Capital Budgeting97 Questions

Exam 14: Capital Markets128 Questions

Exam 15: Investment Underwriting112 Questions

Exam 16: Long-Term Debt and Lease Financing192 Questions

Exam 17: Common and Preferred Stock Financing111 Questions

Exam 18: Dividend Policy and Retained Earnings110 Questions

Exam 19: Derivative Securities146 Questions

Exam 20: External Growth Through Mergers107 Questions

Exam 21: International Financial Management126 Questions

Select questions type

If an individual's cost of capital were 10%, he or she would prefer to receive $107 at the end of one year rather than $100 right now.

Free

(True/False)

4.7/5  (41)

(41)

Correct Answer:

False

After 20 years, 100 shares of stock originally purchased for $1,000 was sold for $5,000. What was the annual yield on the investment? Choose the closest answer.

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

D

John Doeber borrowed $125,000 to buy a house. His loan cost was 11% and he promised to repay the loan over 15 years (amortization). How much are the monthly payments with semiannual compounding?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

D

The longer the length of time between a present value and its corresponding future value,:

(Multiple Choice)

4.8/5  (37)

(37)

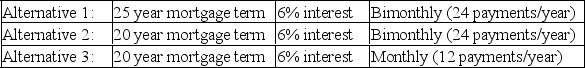

You are considering the purchase of a house. The house costs $300,000. You have no down payment. You have several financing alternatives.

For each alternative calculate

1. The payment cost

2. Total cost over the term of the mortgage

3. Total interest cost over the term of the mortgage

4. Compare the results and recommend which is the best decision and explain why.

For each alternative calculate

1. The payment cost

2. Total cost over the term of the mortgage

3. Total interest cost over the term of the mortgage

4. Compare the results and recommend which is the best decision and explain why.

(Essay)

4.7/5  (36)

(36)

Laura Diane is creating a university investment fund for her son Leland. She will put in $71.00 per month at the end of each month for the next 15 years and expects to earn an 8% annual rate of return, compounded monthly. How much money will Leland have when he starts university?

(Multiple Choice)

4.7/5  (32)

(32)

Morgan D expects to receive $200 per month for 10 years and $250 per month for the next 10 years. What is the present value of this 20-year cash flow? Use a 10% discount rate, assuming monthly compounding.

(Multiple Choice)

4.9/5  (38)

(38)

To determine the current worth of 4 annual payments of $1,000 at 4%, one would refer to a table for the present value of $1.

(True/False)

4.9/5  (38)

(38)

The shorter the length of time between a present value and its corresponding future value:

(Multiple Choice)

4.8/5  (37)

(37)

If you were to put $5,000 in the bank at 4% interest each year for the next 8 years, which table would you use to find the ending balance in your account?

(Multiple Choice)

4.9/5  (40)

(40)

A dollar today is worth more than a dollar to be received in the future because:

(Multiple Choice)

4.8/5  (37)

(37)

Using semiannual compounding rather than annual compounding will increase the future value of an annuity.

(True/False)

4.8/5  (42)

(42)

As the interest rate increases, the PVIF for the present value of $1 increases.

(True/False)

4.9/5  (43)

(43)

In determining the future value of an annuity, the final payment is not compounded at all.

(True/False)

4.8/5  (40)

(40)

What is the maximum price you would pay for an investment that guarantees a payment of $1,000 a month beginning immediately lasts for 15 years and yields 12%?

(Multiple Choice)

4.8/5  (36)

(36)

If a single amount were put on deposit at a given interest rate and allowed to grow, its future value could be determined by reference to the future value of $1 table.

(True/False)

4.8/5  (35)

(35)

Ambrin Corp. expects to receive $2,000 per year for 10 years and $3,500 per year for the next 10 years. What is the present value of this 20 year cash flow? Use an 11% discount rate.

(Multiple Choice)

4.8/5  (36)

(36)

The formula FV = PV (1 + n)i will determine the present value of $1.

(True/False)

4.8/5  (32)

(32)

In evaluating capital investment projects, current outlays must be judged against the current value of future benefits.

(True/False)

4.8/5  (35)

(35)

Mr. Fish wants to build a house in 10 years. He estimates that the total cost will be $170,000. If he can put aside $10,000 at the end of each year, what rate of return must he earn in order to have the amount needed?

(Multiple Choice)

4.8/5  (46)

(46)

Showing 1 - 20 of 100

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)