Exam 9: The Time Value of Money

Exam 1: The Goals and Functions of Financial Management106 Questions

Exam 2: Review of Accounting150 Questions

Exam 3: Financial Analysis124 Questions

Exam 4: Financial Forecasting95 Questions

Exam 5: Operating and Financial Leverage106 Questions

Exam 6: Working Capital and the Financing Decision124 Questions

Exam 7: Current Asset Management148 Questions

Exam 8: Sources of Short-Term Financing117 Questions

Exam 9: The Time Value of Money100 Questions

Exam 10: Valuation and Rates of Return115 Questions

Exam 11: Cost of Capital144 Questions

Exam 12: The Capital Budgeting Decision131 Questions

Exam 13: Risk and Capital Budgeting97 Questions

Exam 14: Capital Markets128 Questions

Exam 15: Investment Underwriting112 Questions

Exam 16: Long-Term Debt and Lease Financing192 Questions

Exam 17: Common and Preferred Stock Financing111 Questions

Exam 18: Dividend Policy and Retained Earnings110 Questions

Exam 19: Derivative Securities146 Questions

Exam 20: External Growth Through Mergers107 Questions

Exam 21: International Financial Management126 Questions

Select questions type

The future value is the same concept as the way money grows in a bank account.

(True/False)

4.8/5  (34)

(34)

Dr. Russell wants to buy an expensive car which will cost $74,000 four years from today. He would like to set aside an equal amount at the end of each month in order to accumulate the amount needed. He can earn a 7% annual return. How much should he set aside?

(Multiple Choice)

4.9/5  (38)

(38)

The interest factor for the future value of an annuity is simply the sum of the interest factors for the future value using the same number of periods.

(True/False)

4.8/5  (35)

(35)

In paying off a mortgage loan, the amount of the periodic payment that goes toward the reduction of principal increases over the life of the mortgage.

(True/False)

4.8/5  (35)

(35)

You have decided to purchase a new home valued at $300,000. You have a 20% down payment the bank has offered to finance a mortgage at a rate of 3.25% over 30 years. What would be your biweekly payments?

(Multiple Choice)

4.9/5  (41)

(41)

As the time period until receipt increases, the present value of an amount at a fixed interest rate:

(Multiple Choice)

4.8/5  (38)

(38)

When the inflation rate is zero, the present value of $1 is identical to the future value of $1.

(True/False)

4.7/5  (30)

(30)

What is the difference between a nominal interest rate and an effective interest rate?

(Essay)

4.8/5  (33)

(33)

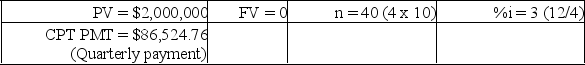

Mr. Sullivan is borrowing $2 million to expand his business. The loan will be for 10 years at 12% on the declining balance, and will be repaid in equal quarterly installments. What will the quarterly payments be? At the end of the first year, how much interest will Mr. Sullivan have paid? By how much will he have reduced the principal?

(Essay)

4.9/5  (43)

(43)

A home buyer signed a 20-year, 8% mortgage for $72,500. How much should the annual loan payments be? (Assume annual compounding.)

(Multiple Choice)

4.8/5  (29)

(29)

The time value of money is not a useful concept in determining the value of a bond or in capital investment decisions.

(True/False)

4.9/5  (37)

(37)

How long does it take $1,000 to double in value if you have a

A) 3% return

B) 6% return

C) 10% return

Assume compounding monthly.

(Essay)

5.0/5  (38)

(38)

As the time period until receipt decreases, the present value of an amount at a fixed interest rate:

(Multiple Choice)

4.8/5  (40)

(40)

The time value of money concept is fundamental to the analysis of cash inflow and outflow decisions covering periods of over one year.

(True/False)

4.9/5  (49)

(49)

The interest factor for the present value of a single sum is equal to (1 + i)/i.

(True/False)

4.9/5  (40)

(40)

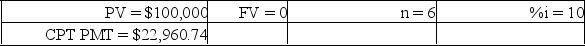

Sara Shouppe has invested $100,000 in an account at her local bank. The bank will pay her a constant amount each year for 6 years, starting one year from today, and the account's balance will be 0 at the end of the sixth year. If the bank has promised Ms. Shouppe a 10% return, how much will they have to pay her each year?

(Essay)

4.9/5  (34)

(34)

You will deposit $10,000 today. It will grow for 10 years at 10% interest compounded monthly. You will then withdraw the funds quarterly over the next 4 years. The annual interest rate over those 4 years is 8%. Your annual withdrawal will be:

(Multiple Choice)

4.9/5  (41)

(41)

You will deposit $2,000 today. It will grow for 6 years at 10% interest compounded semiannually. You will then withdraw the funds annually over the next 4 years. The annual interest rate is 8%. Your annual withdrawal will be:

(Multiple Choice)

4.8/5  (31)

(31)

Mr. Blochirt is creating a university investment fund for his daughter. He will put in $850 per year at the end of each year for the next 15 years and expects to earn an 8% annual rate of return. How much money will his daughter have when she starts university?

(Multiple Choice)

4.9/5  (34)

(34)

The amount of annual payments necessary to repay a mortgage loan can be found by reference to the present value of an annuity table.

(True/False)

4.8/5  (37)

(37)

Showing 61 - 80 of 100

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)