Exam 11: Sole Proprietorships and Flow-Through Entities

Exam 1: Introduction to Taxation109 Questions

Exam 2: The Tax Practice Environment111 Questions

Exam 3: Determining Gross Income132 Questions

Exam 4: Employee Compensation101 Questions

Exam 5: Deductions for Individuals and Tax Determination120 Questions

Exam 6: Business Expenses116 Questions

Exam 7: Property Acquisitions and Cost Recovery Deductions114 Questions

Exam 8: Property Dispositions116 Questions

Exam 9: Tax-Deferred Exchanges112 Questions

Exam 10: Taxation of Corporations111 Questions

Exam 11: Sole Proprietorships and Flow-Through Entities133 Questions

Exam 12: Estates, Gifts, and Trusts116 Questions

Select questions type

What kind of an entity is a limited liability company for the purpose of taxing its income?

Free

(Essay)

4.9/5  (32)

(32)

Correct Answer:

A limited liability company may elect to be treated as a partnership or a corporation. If the limited liability company has only one member, however, it cannot be treated as a partnership. Unless it makes an election to be treated as a corporation, it will be treated as a sole proprietorship. If the single member of an LLC is a corporation, it will be treated as a branch of the corporation, unless it makes the election to also be treated as a separate corporation.

What is the effect on the AAA if an S corporation distributes a piece of property valued at $10,000 with a $5,000 basis to 50 percent shareholder and $10,000 cash to the other 50 percent shareholder in a nonliquidating distribution?

Free

(Multiple Choice)

5.0/5  (38)

(38)

Correct Answer:

C

Which of the following statements does not apply to a qualifying S corporation?

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

D

Calvin sells his 40 percent interest in a partnership with a $70,000 basis for $75,000. The partnership has two assets, inventory valued at $100,000 with a $50,000 basis and investments valued at $87,500 that have a basis of $125,000. How will Calvin report the sale of the partnership interest?

(Multiple Choice)

4.8/5  (43)

(43)

The LBJ Partnership has a March 31 year-end. It has three equal partners, L with a June 30 year-end, B with a January 31 year-end, and J with a December 31 year-end. What are the year-end dates for the tax returns of the partners that will include their shares of the partnership's income as of March 31, 2018?

(Essay)

4.9/5  (38)

(38)

Which of the following is not a characteristic of an S corporation?

(Multiple Choice)

4.8/5  (26)

(26)

Amber has a tax basis of $67,000 in her partnership interest in Lightfoot Partnership, which consists of her $27,000 net contribution to partnership capital and her $40,000 share of partnership debt. Amber receives a distribution of land (a capital asset) with a tax basis of $39,000 and a fair market value of $106,000 in complete liquidation of her partnership interest. The property is not encumbered by any of the partnership's liabilities. What is Amber's tax basis for the distributed property?

(Multiple Choice)

4.9/5  (37)

(37)

Michael was a partner in the M&M Partnership until November 1, when he received a liquidating distribution of investment property with a tax basis of $28,000 and a fair market value of $75,000. Prior to this distribution, his tax basis in his partnership interest was $40,000. What is his tax basis in the property received from the partnership?

(Multiple Choice)

4.7/5  (31)

(31)

A flow-through entity aggregates all its income and subtracts all expense items for reporting its net income.

(True/False)

4.9/5  (35)

(35)

A limited liability company that has only one member must be taxed as a sole proprietorship.

(True/False)

4.9/5  (40)

(40)

Other Objective Questions

Indicate by a PRP if the characteristic applies to a sole proprietorship, an SC if it applies to an S corporation, and a PAR if it applies to a partnership, and N if it does not apply to any of the three businesses. A characteristic can apply to more than one entity; write a brief explanation if a characteristic may only apply under certain conditions.

-Loss recognized on entity liquidation.

(Short Answer)

4.9/5  (32)

(32)

Which of the following is not a characteristic of sole proprietorships?

(Multiple Choice)

4.8/5  (30)

(30)

Logan's basis in his partnership interest is $20,000 when he receives a pro rata nonliquidating distribution from the partnership of $22,000 cash and inventory with a basis of $2,000 and fair market value of $3,000). What is Logan's basis for the inventory he received?

(Multiple Choice)

4.8/5  (32)

(32)

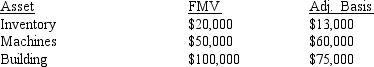

What is Alexander's net gain or loss on the liquidation of his 100 percent interest in an S corporation if the corporation distributes the following three assets to him in exchange for his stock:  Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

(Multiple Choice)

4.9/5  (33)

(33)

Showing 1 - 20 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)