Exam 7: Property Acquisitions and Cost Recovery Deductions

Exam 1: Introduction to Taxation109 Questions

Exam 2: The Tax Practice Environment111 Questions

Exam 3: Determining Gross Income132 Questions

Exam 4: Employee Compensation101 Questions

Exam 5: Deductions for Individuals and Tax Determination120 Questions

Exam 6: Business Expenses116 Questions

Exam 7: Property Acquisitions and Cost Recovery Deductions114 Questions

Exam 8: Property Dispositions116 Questions

Exam 9: Tax-Deferred Exchanges112 Questions

Exam 10: Taxation of Corporations111 Questions

Exam 11: Sole Proprietorships and Flow-Through Entities133 Questions

Exam 12: Estates, Gifts, and Trusts116 Questions

Select questions type

Morgan Corporation, a calendar-year corporation, purchased a $2,800,000 factory building in February, $950,000 of new machinery in April, $80,000 of new office furniture in August, $900,000 of used machinery in October, and $150,000 of additional new office furniture in December 2018.

What is the corporation's first year maximum cost recovery deduction assuming the corporation expects at least $2,500,000 of income before depreciation deductions in 2018?

(Essay)

4.9/5  (43)

(43)

Wolfgang, a calendar-year taxpayer, purchased residential rental realty in April of year 1 for $150,000 ($50,000 of which was for the land).

(Multiple Choice)

4.8/5  (36)

(36)

Other Objective Questions

Indicated by a P for personalty, R for realty, or B for both personalty and realty which are subject to the following provisions:

-Half-year convention

(Short Answer)

4.8/5  (33)

(33)

When fully depreciating 5-year property, the final year of depreciation will be year:

(Multiple Choice)

4.9/5  (39)

(39)

When fully depreciating 7-year property, the final year of depreciation will be year:

(Multiple Choice)

5.0/5  (40)

(40)

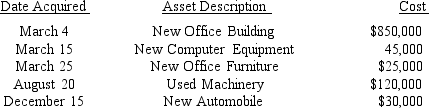

YumYum Corporation (a calendar-year corporation) moved into a new office building adjacent to its manufacturing plant in 2018. It purchased and placed in service the following assets during 2018:  All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2018, what would its maximum cost recovery deduction be for 2018?

All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2018, what would its maximum cost recovery deduction be for 2018?

(Multiple Choice)

4.9/5  (36)

(36)

What is a mixed-use asset? What adjustment must be made for depreciating a mixed-use asset?

(Essay)

4.8/5  (39)

(39)

Other Objective Questions

Indicated by a P for personalty, R for realty, or B for both personalty and realty which are subject to the following provisions:

-Jack did not depreciate one of his machines that cost $40,000 because he had net operating losses for the last two years. Which of the following statements is true?

(Multiple Choice)

4.8/5  (49)

(49)

Jeremy purchased an asset for $12,000 at the beginning of the year. No Section 179 expensing or bonus depreciation is claimed for this property. Assuming the asset is depreciated over three years on a straight-line basis, no averaging conventions apply, Jeremy's tax rate is 35 percent, and he uses a 6 percent discount rate, what is the after-tax cost of the asset?

(Essay)

4.8/5  (27)

(27)

Coralbay, a calendar-year corporation, purchased used office furniture for $240,000 and new machines for $1,880,000 in July 2018. What is Coralbay's maximum cost recovery deduction for 2018?

(Multiple Choice)

4.7/5  (35)

(35)

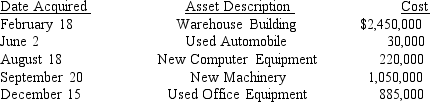

Sanjuro Corporation (a calendar-year corporation) purchased and placed in service the following assets during 2018 :  All assets are used 100% for business use. The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000. The corporation has $3,000,000 income from operations before calculating depreciation deductions. Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2018.

What would be Sanjuro Corporation's maximum cost recovery deduction for the warehouse for 2019?

All assets are used 100% for business use. The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000. The corporation has $3,000,000 income from operations before calculating depreciation deductions. Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2018.

What would be Sanjuro Corporation's maximum cost recovery deduction for the warehouse for 2019?

(Multiple Choice)

4.8/5  (47)

(47)

Harris Corporation (a calendar-year taxpayer), acquired a 5-year asset costing $10,000 on October 2nd. What are the first and last years of MACRS depreciation deductions using the mid-quarter convention?

(Multiple Choice)

4.8/5  (37)

(37)

The first and last years of MACRS depreciation deductions for a 7-year asset costing $20,000 using the half-year convention are:

(Multiple Choice)

4.8/5  (38)

(38)

Wendell purchased a computer system for $6,000 on June 1, 2016. He kept records of his computer usage and found out he used the computer 45 percent of the time for his business, 20 percent for tracking his extensive investment portfolio and making trades, and the remaining time was for personal use in both years.

a. Determine Wendell's depreciation deductions in 2016 and 2017.

b. In 2018, Wendell's usage remained the same but he decided to dispose of the computer on November 1. Determine his 2018 depreciation deduction and his gain or loss on the disposition if he received $2,500 for the system.

(Essay)

4.9/5  (34)

(34)

In a basket purchase of a group of assets, the purchaser and the seller can agree to the value of the separate assets.

(True/False)

4.9/5  (39)

(39)

Depletion is the term used for the cost allocation of wasting assets.

(True/False)

5.0/5  (39)

(39)

Showing 21 - 40 of 114

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)