Exam 12: Accounting for Partnerships

Exam 1: Accounting in Business233 Questions

Exam 2: Analyzing and Recording Transactions200 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements161 Questions

Exam 4: Completing the Accounting Cycle106 Questions

Exam 5: Accounting for Merchandising Operations131 Questions

Exam 6: Inventories and Cost of Sales133 Questions

Exam 7: Accounting Information Systems112 Questions

Exam 8: Cash and Internal Controls131 Questions

Exam 9: Accounting for Receivables117 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles161 Questions

Exam 11: Current Liabilities and Payroll Accounting149 Questions

Exam 12: Accounting for Partnerships136 Questions

Exam 13: Accounting for Corporations205 Questions

Exam 14: Long-Term Liabilities187 Questions

Exam 15: Investments and International Operations188 Questions

Exam 16: Reporting the Statement of Cash Flows194 Questions

Exam 17: Analysis of Financial Statements194 Questions

Exam 18: Managerial Accounting Concepts and Principles205 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting179 Questions

Exam 21: Cost-Volume-Profit Analysis167 Questions

Exam 22: Master Budgets and Planning177 Questions

Exam 23: Flexible Budgets and Standard Costs177 Questions

Exam 24: Performance Measurement and Responsibility Accounting162 Questions

Exam 25: Capital Budgeting and Managerial Decisions158 Questions

Exam 26: Appendix B: Time Value of Money27 Questions

Exam 27: Appendix C: Activity-Based Costing50 Questions

Select questions type

A partnership is an incorporated association of two or more people to pursue a business for profit as co-owners.

Free

(True/False)

4.8/5  (39)

(39)

Correct Answer:

False

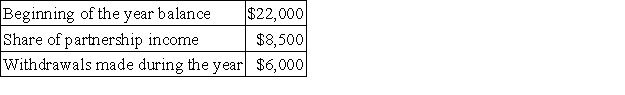

The following information is available regarding Grace Smit's capital account in Enterprise Consulting Group,a general partnership,for a recent year:  What is Smit's partner return on equity during the year in question?

What is Smit's partner return on equity during the year in question?

Free

(Multiple Choice)

4.7/5  (40)

(40)

Correct Answer:

A

At least one partner having a debit balance in his/her capital account at the point of the final distribution of cash is known as a _________________________.

Free

(Essay)

4.9/5  (32)

(32)

Correct Answer:

capital deficiency

Wallace and Simpson formed a partnership with Wallace contributing $60,000 and Simpson contributing $40,000.Their partnership agreement calls for the income (loss)division to be based on the ratio of capital investments.Wallace sold one-half of his partnership interest to Prince for $55,000 when his capital balance was $78,000.The partnership would record the admission of Prince into the partnership as:

(Multiple Choice)

4.8/5  (35)

(35)

During the closing process,partner's capital accounts are _______________ for their share of net income and _________________ for their share of net loss.

answers must appear in this order

(Essay)

4.8/5  (38)

(38)

Wheadon,Davis,and Singer formed a partnership with Wheadon contributing $60,000,Davis contributing $50,000 and Singer contributing $40,000.Their partnership agreement called for the income (loss)division to be based on the ratio of capital investments.If the partnership had income of $75,000 for its first year of operation,what amount of income (rounded to the nearest thousand)would be credited to Singer's capital account?

(Multiple Choice)

4.8/5  (28)

(28)

In the absence of a partnership agreement,the law says that income (and loss)should be allocated based on:

(Multiple Choice)

4.8/5  (25)

(25)

A partnership in which all partners have mutual agency and unlimited liability is called:

(Multiple Choice)

4.8/5  (35)

(35)

Cox,North,and Lee form a partnership.Cox contributes $180,000,North contributes $150,000,and Lee contributes $270,000.Their partnership agreement calls for the income or loss division to be based on the ratio of capital invested.If the partnership reports income of $150,000 for its first year,what amount of income is credited to Cox's capital account?

(Multiple Choice)

4.9/5  (29)

(29)

Brown invested $200,000 and Freeman invested $150,000 in a partnership.They agreed to an interest allowance on the partners' beginning-year capital investments at 10%,with the balance to be shared equally.Under this agreement,the shares of the partners when the partnership earns $205,000 in income are:

(Multiple Choice)

4.8/5  (39)

(39)

Wright,Bell,and Edison are partners and share income in a 2:5:3 ratio.The partnership's capital balances are as follows: Wright,$33,000,Bell $27,000 and Edison $40,000.Edison decides to withdraw from the partnership,and the partners agree not to revalue the assets upon Edison's retirement.The journal entry to record Edison's June 1 withdrawal from the partnership if Edison is paid $40,000 for his equity is:

(Multiple Choice)

4.9/5  (42)

(42)

A ________________ is an unincorporated association of two or more people to pursue a business for profit as co-owners.

(Essay)

4.9/5  (39)

(39)

Leto and Duncan allow Gunner to purchase a 25% interest in their partnership for $30,000 cash.Gunner has exceptional talents that will enhance the partnership.Leto's and Duncan's capital account balances are $55,000 each.The partners have agreed to share income or loss equally.Prepare the general journal entry to record the admission of Lepley to the partnership.

(Essay)

4.9/5  (32)

(32)

Zheng invested $100,000 and Murray invested $200,000 in a partnership.They agreed to share incomes and losses by allowing a $60,000 per year salary allowance to Zheng and a $40,000 per year salary allowance to Murray,plus an interest allowance on the partners' beginning-year capital investments at 10%,with the balance to be shared equally.Under this agreement,the shares of the partners when the partnership earns $105,000 in income are:

(Multiple Choice)

4.8/5  (34)

(34)

Fontaine and Monroe are forming a partnership.Fontaine invests a building that has a market value of $250,000;the partnership assumes responsibility for a $75,000 note secured by a mortgage on the property.Monroe invests $100,000 in cash and equipment that has a market value of $55,000.For the partnership,the amounts recorded for Fontaine's Capital account and for Monroe's Capital account are:

(Multiple Choice)

4.8/5  (39)

(39)

Kramer and Jones allow Sanders to purchase a 25% interest in their partnership for $50,000 cash.Kramer and Jones both have capital balances of $55,000 each,and have agreed to share income and loss equally.Prepare the journal entry to record the admission of Sanders to the partnership.

(Essay)

4.8/5  (38)

(38)

Montez and Flair formed a partnership.Montez contributed $15,000 cash and accounts receivable worth $11,000.Flair contributed cash of $5,000;inventory valued at $16,000;and supplies valued at $2,000.Prepare the journal entries to record each partner's investment in the new partnership.

(Essay)

4.8/5  (34)

(34)

Glade,Marker,and Walters are partners with beginning-year capital balances of $250,000,$150,000,and $100,000,respectively.Partnership net income for the year is $192,000.Make the necessary journal entry to close Income Summary to the capital accounts if partners agree to divide income based on their beginning-year capital balances.

(Essay)

4.8/5  (29)

(29)

Showing 1 - 20 of 136

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)