Exam 27: Appendix C: Activity-Based Costing

Exam 1: Accounting in Business233 Questions

Exam 2: Analyzing and Recording Transactions200 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements161 Questions

Exam 4: Completing the Accounting Cycle106 Questions

Exam 5: Accounting for Merchandising Operations131 Questions

Exam 6: Inventories and Cost of Sales133 Questions

Exam 7: Accounting Information Systems112 Questions

Exam 8: Cash and Internal Controls131 Questions

Exam 9: Accounting for Receivables117 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles161 Questions

Exam 11: Current Liabilities and Payroll Accounting149 Questions

Exam 12: Accounting for Partnerships136 Questions

Exam 13: Accounting for Corporations205 Questions

Exam 14: Long-Term Liabilities187 Questions

Exam 15: Investments and International Operations188 Questions

Exam 16: Reporting the Statement of Cash Flows194 Questions

Exam 17: Analysis of Financial Statements194 Questions

Exam 18: Managerial Accounting Concepts and Principles205 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting179 Questions

Exam 21: Cost-Volume-Profit Analysis167 Questions

Exam 22: Master Budgets and Planning177 Questions

Exam 23: Flexible Budgets and Standard Costs177 Questions

Exam 24: Performance Measurement and Responsibility Accounting162 Questions

Exam 25: Capital Budgeting and Managerial Decisions158 Questions

Exam 26: Appendix B: Time Value of Money27 Questions

Exam 27: Appendix C: Activity-Based Costing50 Questions

Select questions type

In activity-based costing,costs are traced to individual activities and then allocated to cost objects.

Free

(True/False)

4.7/5  (38)

(38)

Correct Answer:

True

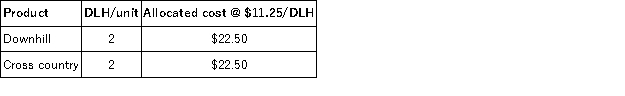

Traditional costing:

Total overhead costs/Total DLH = $4,500,000/(150,000 + 250,000)labor hours = $11.25 per DLH

Free

(Essay)

4.8/5  (41)

(41)

Correct Answer:

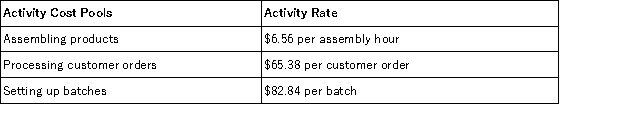

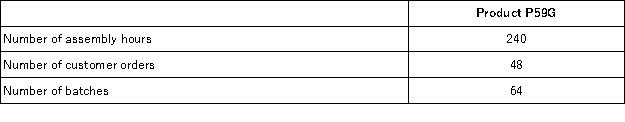

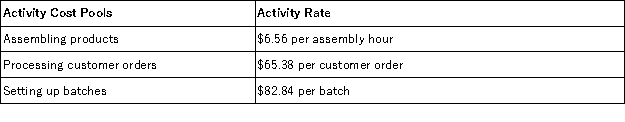

Mirkle Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

Data for one of the company's products follow:  The company produced 4,000 units of product during the period.Direct materials cost $7.30 per unit and direct labor cost $5.45 per unit.How much total cost would be assigned to the 4,000 units of Product P59G using the activity-based costing system?

The company produced 4,000 units of product during the period.Direct materials cost $7.30 per unit and direct labor cost $5.45 per unit.How much total cost would be assigned to the 4,000 units of Product P59G using the activity-based costing system?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

A

A _________________ is a factor that causes the cost of an activity to go up and down.

(Essay)

4.7/5  (28)

(28)

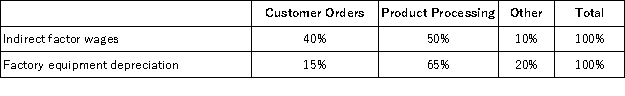

Naples Corporation has provided the following data from its activity-based costing accounting system:  Distribution of resource consumption across activity cost pools:

Distribution of resource consumption across activity cost pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?

(Multiple Choice)

4.7/5  (31)

(31)

With activity-based costing,complex products are assigned a larger portion of overhead.

(True/False)

4.9/5  (38)

(38)

Under traditional cost allocation methods,low-volume complex products are often ________________ and high-volume simpler products are likely to be ________________.

Answers must appear in this order.

(Essay)

4.9/5  (29)

(29)

An activity __________________ is a temporary account accumulating the costs a company incurs to support an identified set of activities.

(Essay)

4.7/5  (34)

(34)

Activity-based costing generally requires less effort to implement and maintain than a traditional cost system.

(True/False)

4.7/5  (27)

(27)

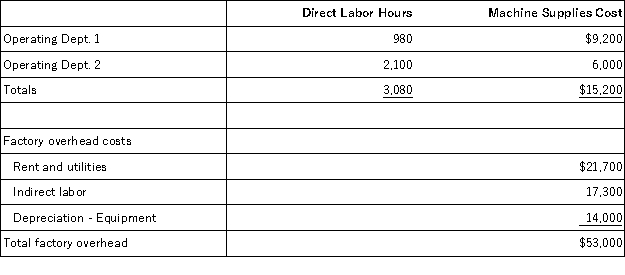

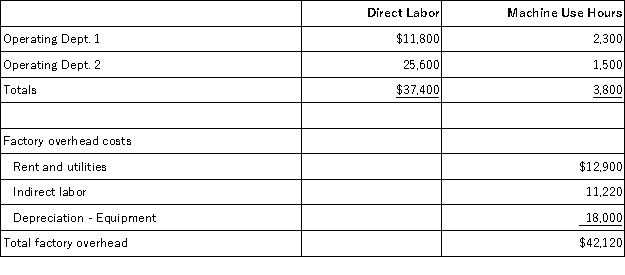

The following is taken from Clausen Company's internal records of its factory with two operating departments.The cost driver for indirect labor is direct labor hours,and the cost driver for the remaining items is number of hours of machine use.Compute the total amount of indirect labor allocated to Dept.1 using activity-based costing.

(Multiple Choice)

4.8/5  (35)

(35)

Unit costs can be significantly different when using activity-based costing compared to traditional cost allocation methods.

(True/False)

4.8/5  (25)

(25)

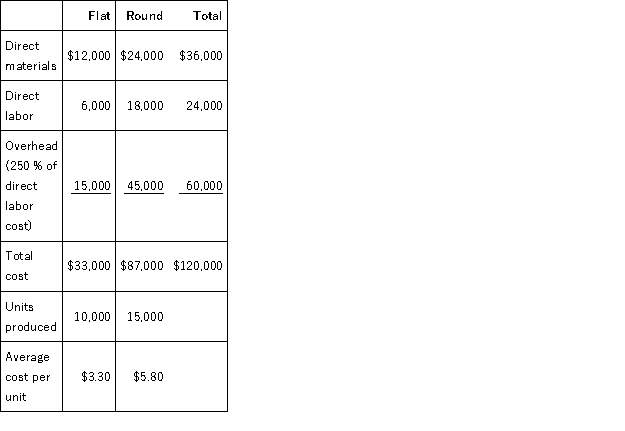

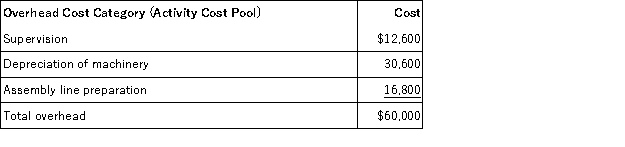

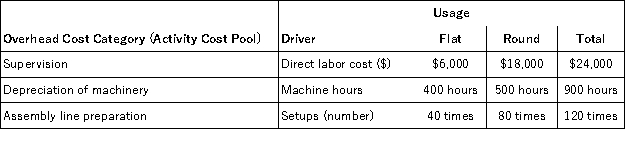

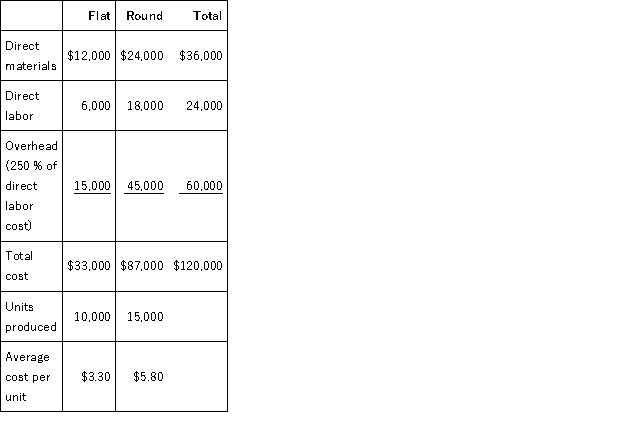

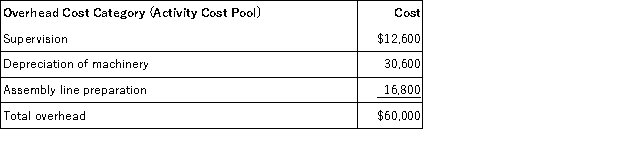

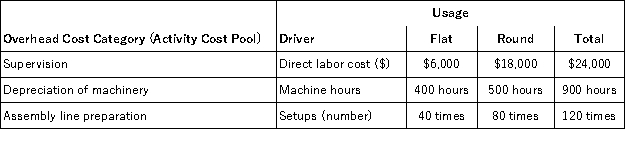

Rockaway Company produces two types of product,flat and round,on the same production line.For the current period,the company reports the following data.  Rockaway's controller wishes to apply activity-based costing (ABC)to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above.She has collected the following information.

Rockaway's controller wishes to apply activity-based costing (ABC)to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above.She has collected the following information.  She has also collected the following information about the cost drivers for each category (cost pool)and the amount of each driver used by the two product lines.

She has also collected the following information about the cost drivers for each category (cost pool)and the amount of each driver used by the two product lines.  Assign these three overhead cost pools to each of the two products using ABC.Show each overhead cost allocation by product and the total overhead allocated to each product.Determine average cost per unit for each of the two products using ABC.(Round your answer to 2 decimal places. )Which overhead cost allocation method would you recommend to the controller?

Assign these three overhead cost pools to each of the two products using ABC.Show each overhead cost allocation by product and the total overhead allocated to each product.Determine average cost per unit for each of the two products using ABC.(Round your answer to 2 decimal places. )Which overhead cost allocation method would you recommend to the controller?

(Essay)

4.8/5  (38)

(38)

Mirkle Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

Data for one of the company's products follow:  The company produced 4,000 units of product during the period.Direct materials cost $7.30 per unit and direct labor cost $5.45 per unit.What is the cost per unit of Product P59G using the activity-based costing system?

The company produced 4,000 units of product during the period.Direct materials cost $7.30 per unit and direct labor cost $5.45 per unit.What is the cost per unit of Product P59G using the activity-based costing system?

(Multiple Choice)

4.8/5  (35)

(35)

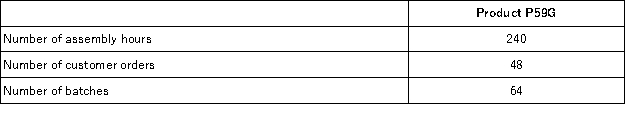

Quantum Corporation has provided the following data from its activity-based costing system:  The company makes 340 units of product J71B a year,requiring a total of 980 machine-hours,36 orders,and 22 inspection-hours per year.The product's direct materials cost is $27.50 per unit and its direct labor cost is $18.10 per unit.According to the activity-based costing system,the total overhead cost for producing the 340 units of the J71B product is:

The company makes 340 units of product J71B a year,requiring a total of 980 machine-hours,36 orders,and 22 inspection-hours per year.The product's direct materials cost is $27.50 per unit and its direct labor cost is $18.10 per unit.According to the activity-based costing system,the total overhead cost for producing the 340 units of the J71B product is:

(Multiple Choice)

4.7/5  (30)

(30)

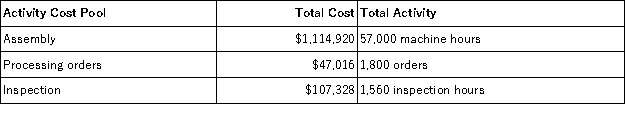

Winterland, Inc., produces two types of skis, downhill skis and cross country skis. Product and production information about the two items is shown below:

Required:

1. If Winterland uses the traditional two-stage method of allocating overhead costs based on direct labor hours, what is the amount of indirect costs per set of skis for each of the two types of skis?

2. If Winterland uses activity based costing, what is the total amount of indirect costs per set of skis for each of the two types of skis? Assume that depreciation is allocated based on machine hours, setup costs based on the number of setups, and miscellaneous costs based on the number of direct labor hours.

Required:

1. If Winterland uses the traditional two-stage method of allocating overhead costs based on direct labor hours, what is the amount of indirect costs per set of skis for each of the two types of skis?

2. If Winterland uses activity based costing, what is the total amount of indirect costs per set of skis for each of the two types of skis? Assume that depreciation is allocated based on machine hours, setup costs based on the number of setups, and miscellaneous costs based on the number of direct labor hours.

(Essay)

4.8/5  (32)

(32)

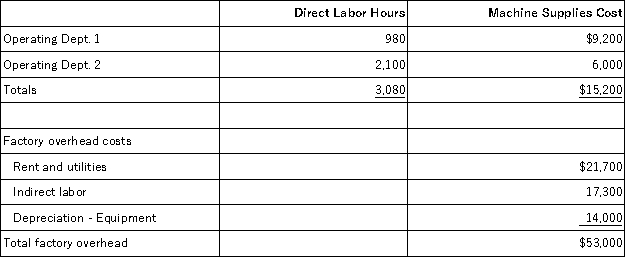

The following is taken from Jeffers Company's internal records of its factory with two operating departments.The cost driver for indirect labor is direct labor costs,and the cost driver for the remaining items is number of hours of machine use.Compute the total amount of overhead allocated to Dept.2 using activity-based costing.

(Multiple Choice)

4.9/5  (32)

(32)

The following is taken from Clausen Company's internal records of its factory with two operating departments.The cost driver for indirect labor is direct labor hours,and the cost driver for the remaining items is number of hours of machine use.Compute the total amount of rent and utilities allocated to Dept.2 using activity-based costing.

(Multiple Choice)

4.9/5  (29)

(29)

When using a plantwide overhead rate method to assign overhead costs,the cost object is always the unit of product.

(True/False)

4.9/5  (38)

(38)

Activity-based costing can be especially effective in situations where many different types of products are manufactured in the same department or departments.

(True/False)

4.8/5  (34)

(34)

Rockaway Company produces two types of product,flat and round,on the same production line.For the current period,the company reports the following data.  Rockaway's controller wishes to apply activity-based costing (ABC)to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above.She has collected the following information.

Rockaway's controller wishes to apply activity-based costing (ABC)to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above.She has collected the following information.  She has also collected the following information about the cost drivers for each category (cost pool)and the amount of each driver used by the two product lines.

She has also collected the following information about the cost drivers for each category (cost pool)and the amount of each driver used by the two product lines.  Assign these three overhead cost pools to flat using ABC and determine average cost per unit for the product.(Round your answer to 2 decimal places. )

Assign these three overhead cost pools to flat using ABC and determine average cost per unit for the product.(Round your answer to 2 decimal places. )

(Essay)

4.7/5  (42)

(42)

Showing 1 - 20 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)