Exam 11: Reporting and Interpreting Owners Equity

Exam 1: Financial Statements and Business Decisions122 Questions

Exam 2: Investing and Financing Decisions and the Accounting System132 Questions

Exam 3: Operating Decisions and the Accounting System114 Questions

Exam 4: Adjustments, Financial Statements, and the Quality of Earnings136 Questions

Exam 5: Communicating and Interpreting Accounting Information111 Questions

Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash128 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory124 Questions

Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Intangibles; and Natural Resources126 Questions

Exam 9: Reporting and Interpreting Liabilities113 Questions

Exam 10: Reporting and Interpreting Bonds120 Questions

Exam 11: Reporting and Interpreting Owners Equity118 Questions

Exam 12: Statement of Cash Flows116 Questions

Exam 13: Analyzing Financial Statements110 Questions

Exam 14: Reporting and Interpreting Investments in Other Corporations112 Questions

Select questions type

The declaration by a corporation's board of directors of a cash dividend on common stock creates a liability on the declaration date.

Free

(True/False)

4.9/5  (42)

(42)

Correct Answer:

True

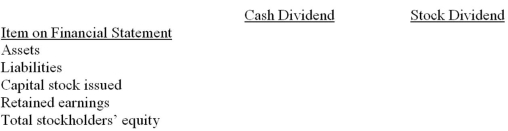

The board of directors of Atlantic Corp. does not know whether to declare and pay a cash dividend or to declare and distribute a stock dividend.

Required:

Complete the following chart to show the overall effect on each financial statement item for a cash dividend and a stock dividend. Enter the letter "I" if the effect of the dividend is to increase the financial statement item, a letter "D" if the effect of the dividend is to decrease the financial statement item, or a letter "N" if there is no overall effect. (Hint: Think of the journal entries that would be prepared for a cash dividend and a stock dividend. The overall effect is the net effect from declaration to final payment or distribution.)

Free

(Essay)

4.9/5  (31)

(31)

Correct Answer:

Katie Company had 40,000 shares of $2 par value common stock outstanding prior to a 40% common stock dividend declaration and distribution. The market value of the common stock on the declaration date was $10. Which of the following statements incorrectly describes the effect of the common stock dividend and declaration?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

C

A company reported total stockholders' equity of $340,000 on its balance sheet dated December 31, 2014. During the year ended December 31, 2015, the company reported net income of $40,000, declared and paid a cash dividend of $8,000, declared and distributed a 10% stock dividend with a $10,000 total market value, purchased treasury stock costing $12,000, and issued additional common stock for $60,000. What is total stockholders' equity as of December 31, 2015?

(Multiple Choice)

4.9/5  (39)

(39)

Stockholders' equity decreases when a company purchases treasury stock.

(True/False)

4.8/5  (39)

(39)

Which of the following statements is true about a partnership?

(Multiple Choice)

4.9/5  (42)

(42)

The charter of Delta Corporation specified a maximum of 25,000 shares of common stock. At the current date, 5,000 shares remain unissued, and 2,000 of the issued shares have been repurchased and are still held by Delta.

Required:

Calculate the number of shares that are:

A. Authorized

B. Issued

C. Held in the treasury

D. Outstanding

(Essay)

4.7/5  (31)

(31)

The issue of $1 par value common stock for $10 per share results in a $9 credit to the capital in excess of par account for each share issued.

(True/False)

4.9/5  (37)

(37)

Chicago Clock Corporation issued a 3-for-2 stock split of its common stock, which had a par value of $100 before the split. What dollar amount of retained earnings should be transferred to the common stock account?

(Multiple Choice)

4.8/5  (41)

(41)

Net income increases when treasury stock is sold for an amount in excess of its cost.

(True/False)

4.8/5  (42)

(42)

Kirova Company has provided the following information: • Number of issued common shares, 900,000

• Net income, $1,000,000

• Number of authorized common shares, 1,000,000

• Number of outstanding common shares, 800,000

• Number of treasury shares, 100,000

What is Kirova's earnings per share?

(Multiple Choice)

4.9/5  (35)

(35)

A company has 10 million common shares authorized and 2.5 million shares issued. The par value is $1 per share and the market price is $30 when the company declares a 4-for-1 stock split. Which of the following is correct?

(Multiple Choice)

4.9/5  (33)

(33)

Total assets remain the same when a company uses cash to purchase treasury stock.

(True/False)

4.8/5  (45)

(45)

Earnings per share increases when a company purchases treasury stock.

(True/False)

4.8/5  (35)

(35)

Atkins Company had 20,000 shares of $5 par value common stock outstanding prior to a 10% common stock dividend declaration and distribution. The market value of the common stock on the declaration date was $11. Which of the following statements correctly describes the effect of the common stock dividend and declaration?

(Multiple Choice)

4.8/5  (33)

(33)

Common stockholders have voting rights and can declare cash dividends.

(True/False)

4.7/5  (42)

(42)

Most investors who are retired people prefer to receive their return on investment in the form of stock price appreciation rather than in dividends.

(True/False)

4.9/5  (42)

(42)

The dividend yield ratio increases when a cash dividend is paid.

(True/False)

4.8/5  (33)

(33)

CGJ Company has provided the following: • 200,000 shares of $5 par value common stock are authorized

• 140,000 shares of common stock were issued for $11 per share

• 130,000 shares are outstanding

Which of the following statements is false?

(Multiple Choice)

4.9/5  (45)

(45)

Showing 1 - 20 of 118

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)