Exam 11: Reporting and Interpreting Owners Equity

Exam 1: Financial Statements and Business Decisions122 Questions

Exam 2: Investing and Financing Decisions and the Accounting System132 Questions

Exam 3: Operating Decisions and the Accounting System114 Questions

Exam 4: Adjustments, Financial Statements, and the Quality of Earnings136 Questions

Exam 5: Communicating and Interpreting Accounting Information111 Questions

Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash128 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory124 Questions

Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Intangibles; and Natural Resources126 Questions

Exam 9: Reporting and Interpreting Liabilities113 Questions

Exam 10: Reporting and Interpreting Bonds120 Questions

Exam 11: Reporting and Interpreting Owners Equity118 Questions

Exam 12: Statement of Cash Flows116 Questions

Exam 13: Analyzing Financial Statements110 Questions

Exam 14: Reporting and Interpreting Investments in Other Corporations112 Questions

Select questions type

Shares which a corporation has the ability to issue, as documented in its charter in the state where incorporated, are outstanding shares of stock.

(True/False)

4.8/5  (38)

(38)

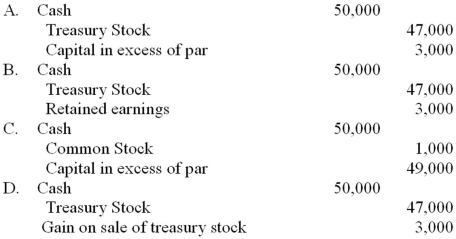

Which of the following entries would be recorded when a company reissues 1,000 shares of treasury stock for $50 per share when they were repurchased at a cost of $47 per share and have a $1 par value?

(Multiple Choice)

4.8/5  (42)

(42)

Preferred stockholders do not have voting rights but do have a preference with respect to dividend payments.

(True/False)

4.8/5  (27)

(27)

The declaration and payment of a cash dividend on common stock results in a reduction of the issuing corporation's total stockholders' equity.

(True/False)

4.9/5  (40)

(40)

Prepare journal entries, with account titles only and without dollar amounts, for each of the following DJ Partnership transactions:

1. D and J each contribute cash into the partnership in exchange for capital.

2. D makes a cash withdrawal from the partnership.

3. Partnership net income is allocated to the partners' capital accounts.

4. D's drawing account is closed.

(Essay)

4.7/5  (39)

(39)

The declaration of a stock dividend by a corporation's board of directors creates a liability on the declaration date.

(True/False)

4.8/5  (35)

(35)

Which of the following represents the number of shares currently owned by investors?

(Multiple Choice)

4.8/5  (39)

(39)

When a company acquires treasury stock, assets and stockholders' equity both decrease.

(True/False)

5.0/5  (40)

(40)

Which of the following is true about a sole proprietorship?

(Multiple Choice)

4.8/5  (35)

(35)

Assume the following capital structure: Preferred stock, 6%, $50 par value, 1,000 shares issued and outstanding with dividends in arrears for three prior years (2011-2013).

Common stock, $100 par value, 2,000 shares issued and outstanding.

Total dividends declared and paid in 2014 were $50,000. How much of the 2014 dividend will be paid to the common stockholders assuming the preferred stock is cumulative?

(Multiple Choice)

4.8/5  (29)

(29)

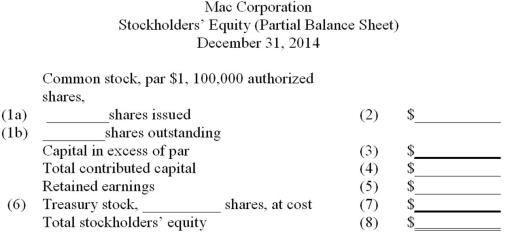

On January 1, 2014, the accounts of Mac Corporation showed the following: Common stock, par \ 1 , authorized 100,000 shares ? Capital in excess of par (at \ 2 per share) 60,000 Retained earnings 140,000 During 2014, the following transactions occurred which affected stockholders' equity (in the order given): A. Issued a stock dividend when the market price was at per share.

B. Purchased treasury stock, 1,000 shares, at a total cost of .

C. Declared and paid cash dividends, .

D. Net income for . Required:

The stockholders' equity section of the balance sheet for the company must be prepared for the December 31, 2014 balance sheet. The format is given below with certain amounts missing. Supply the missing amounts by entering them in the blanks.

(Essay)

4.9/5  (36)

(36)

When a company pays its previously declared cash dividend, an investing cash outflow is reported.

(True/False)

4.7/5  (34)

(34)

There would be 100,000 shares of common stock outstanding when the number of shares authorized was 150,000, issued shares totaled 120,000, and 20,000 shares were being held in the treasury.

(True/False)

4.8/5  (35)

(35)

Cornhusker Corporation plans to raise $10 million cash on January 1, 2014, by issuing either bonds payable (8% interest rate) or cumulative preferred stock (8% dividend rate). How would the annual interest amount on the bonds or annual preferred dividend amount (if paid) affect the net income for the year ended December 31, 2014?

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following journal entries is correct when no-par common stock is initially issued for cash? A. Cash

Common stock

B. Cash

Common stock

Capital in excess of par

C. Cash

Common stock

Retained earnings

D. Cash

Common stock

Gain on sale of stock

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following statements about earnings per share is correct?

(Multiple Choice)

4.8/5  (43)

(43)

A company's assets and liabilities both decrease when a previously declared cash dividend is paid.

(True/False)

5.0/5  (36)

(36)

Showing 81 - 100 of 118

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)