Exam 10: Payroll Computations, Records, and Payment

Exam 1: Accounting: the Language of Business82 Questions

Exam 2: Analyzing Business Transactions93 Questions

Exam 3: Analyzing Business Transactions Using T Accounts107 Questions

Exam 4: The General Journal and the General Ledger85 Questions

Exam 5: Adjustments and the Worksheet76 Questions

Exam 6: Closing Entries and the Postclosing Trial Balance80 Questions

Exam 7: Accounting for Sales and Accounts Receivable76 Questions

Exam 8: Accounting for Purchases and Accounts Payable89 Questions

Exam 9: Cash Receipts, Cash Payments, and Banking Procedures88 Questions

Exam 10: Payroll Computations, Records, and Payment79 Questions

Exam 11: Payroll Taxes, Deposits, and Reports82 Questions

Exam 12: Accruals, Deferrals, and the Worksheet84 Questions

Exam 13: Financial Statements and Closing Procedures38 Questions

Exam 14: Accounting Principles and Reporting Standards67 Questions

Exam 15: Accounts Receivable and Uncollectible Accounts65 Questions

Exam 16: Notes Payable and Notes Receivable83 Questions

Exam 17: Merchandise Inventory91 Questions

Exam 18: Property, Plant, and Equipment118 Questions

Exam 19: Accounting for Partnerships106 Questions

Exam 20: Corporations: Formation and Capital Stock Transactions76 Questions

Exam 21: Corporate Earnings and Capital Transactions99 Questions

Exam 22: Long-Term Bonds105 Questions

Exam 23: Financial Statement Analyses107 Questions

Exam 24: The Statement of Cash Flows114 Questions

Exam 25: Departmentalized Profit and Cost Centers103 Questions

Exam 26: Accounting for Manufacturing Activities103 Questions

Exam 27: Job Order Cost Accounting102 Questions

Exam 28: Process Cost Accounting94 Questions

Exam 29: Controlling Manufacturing Costs: Standard Costs118 Questions

Exam 30: Cost-Revenue Analysis for Decision Making124 Questions

Select questions type

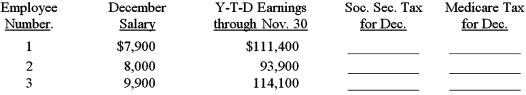

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Barbara's Bookstore,Inc.are listed below.Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December.Assume a 6.2 percent social security tax rate and a base of $113,700 for the calendar year.Assume a 1.45 percent Medicare tax rate.

Free

(Essay)

4.8/5  (34)

(34)

Correct Answer:

Employee No.1: Soc.Sec.Tax,$142.60;Medicare Tax,$114.55

Employee No.2: Soc.Sec.Tax,$496.00;Medicare Tax,$116.00

Employee No.3: Soc.Sec.Tax,zero;Medicare Tax,$143.55

Withholding for federal income taxes places employees on a pay-as-you-go basis.

Free

(True/False)

4.9/5  (45)

(45)

Correct Answer:

True

The column totals in a payroll register

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

A

Salespeople who are paid a percentage of net sales are paid on a(n)

(Multiple Choice)

4.9/5  (36)

(36)

The overtime rate is one and one-half times the regular hourly rate.

(True/False)

4.8/5  (34)

(34)

The employee's marital status is one factor that determines the amount of federal income tax withheld by the employer.

(True/False)

4.9/5  (28)

(28)

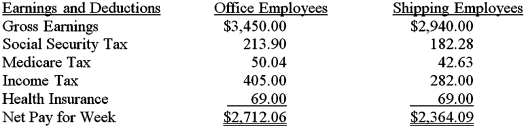

The Burns Company has two office employees and two shipping employees.A summary of their earnings and deductions for the week ended August 23,2016,is shown below.On page 10 of a general journal,record the August 23 payroll and the entry to summarize the effect of the checks written to pay the payroll.

(Essay)

4.8/5  (43)

(43)

An employee whose regular hourly rate is $20 and whose overtime rate is 1.5 times the regular rate worked 44 hours in one week.In the payroll register,the employer should record an overtime premium of

(Multiple Choice)

4.9/5  (38)

(38)

Identify the list of accounts below that would normally all have a credit balance.

(Multiple Choice)

4.8/5  (35)

(35)

During the week ended April 26,2016,Andy Tyler worked 40 hours.His regular hourly rate is $15.Assume that his earnings are subject to social security tax at a rate of 6.2 percent and Medicare tax at a rate of 1.45 percent.He also has deductions of $31 for federal income tax and $21 for health insurance.

A)What is his gross pay for the week?

B)What is the total of his deductions for the week?

C)What is his net pay for the week?

(Essay)

4.9/5  (44)

(44)

Publication 15,Circular E contains federal income tax withholding tables.

(True/False)

4.9/5  (48)

(48)

During the week ended February 8,2016,Stuart Wayne worked 40 hours.His regular hourly rate is $10.Assume that his earnings are subject to social security tax at a rate of 6.2 percent and Medicare tax at a rate of 1.45 percent.He also has deductions of $31 for federal income tax and $21 for health insurance.

A)What is his gross pay for the week?

B)What is the total of his deductions for the week?

C)What is his net pay for the week?

(Essay)

4.9/5  (32)

(32)

An employee whose regular hourly rate is $10 and whose overtime rate is 1.5 times the regular rate worked 44 hours in one week.In the payroll register,the employer should record an overtime premium of

(Multiple Choice)

4.9/5  (46)

(46)

Assuming a Medicare tax rate of 1.45% and monthly gross wages of $2,500,the amount recorded in Medicare Tax Payable for one quarter for the employee's payroll deduction is

(Multiple Choice)

4.7/5  (34)

(34)

Time sheets or time cards are used to keep a record of hours worked each day by each employee paid on an hourly basis.

(True/False)

4.7/5  (46)

(46)

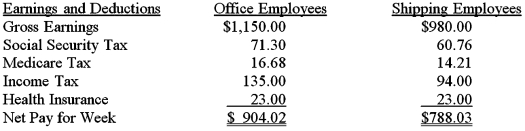

The Rollins Company has office employees and shipping employees.A summary of their earnings and deductions for the week ended June 14,2016,is shown below.On page 6 of a general journal,record the June 14 payroll and the entry to summarize the effect of the checks written to pay the payroll.

(Essay)

4.8/5  (42)

(42)

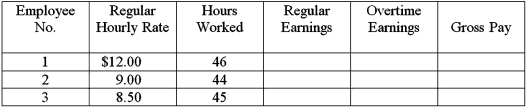

During one week,three employees of the Snowshoe Lodge worked the number of hours shown below.All these employees receive overtime pay at one and a half times their regular hourly rate for any hours worked beyond 40 in a week.Compute the regular earnings,overtime earnings,and gross pay for each employee.

(Essay)

4.8/5  (41)

(41)

Showing 1 - 20 of 79

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)