Exam 14: Accounting Principles and Reporting Standards

Exam 1: Accounting: the Language of Business82 Questions

Exam 2: Analyzing Business Transactions93 Questions

Exam 3: Analyzing Business Transactions Using T Accounts107 Questions

Exam 4: The General Journal and the General Ledger85 Questions

Exam 5: Adjustments and the Worksheet76 Questions

Exam 6: Closing Entries and the Postclosing Trial Balance80 Questions

Exam 7: Accounting for Sales and Accounts Receivable76 Questions

Exam 8: Accounting for Purchases and Accounts Payable89 Questions

Exam 9: Cash Receipts, Cash Payments, and Banking Procedures88 Questions

Exam 10: Payroll Computations, Records, and Payment79 Questions

Exam 11: Payroll Taxes, Deposits, and Reports82 Questions

Exam 12: Accruals, Deferrals, and the Worksheet84 Questions

Exam 13: Financial Statements and Closing Procedures38 Questions

Exam 14: Accounting Principles and Reporting Standards67 Questions

Exam 15: Accounts Receivable and Uncollectible Accounts65 Questions

Exam 16: Notes Payable and Notes Receivable83 Questions

Exam 17: Merchandise Inventory91 Questions

Exam 18: Property, Plant, and Equipment118 Questions

Exam 19: Accounting for Partnerships106 Questions

Exam 20: Corporations: Formation and Capital Stock Transactions76 Questions

Exam 21: Corporate Earnings and Capital Transactions99 Questions

Exam 22: Long-Term Bonds105 Questions

Exam 23: Financial Statement Analyses107 Questions

Exam 24: The Statement of Cash Flows114 Questions

Exam 25: Departmentalized Profit and Cost Centers103 Questions

Exam 26: Accounting for Manufacturing Activities103 Questions

Exam 27: Job Order Cost Accounting102 Questions

Exam 28: Process Cost Accounting94 Questions

Exam 29: Controlling Manufacturing Costs: Standard Costs118 Questions

Exam 30: Cost-Revenue Analysis for Decision Making124 Questions

Select questions type

The Boston Red Sox receives cash from its season ticket holders in advance for the entire season.Under the revenue recognition principle,the Boston Red Sox should recognize the revenue from the season ticket holders

Free

(Multiple Choice)

4.7/5  (51)

(51)

Correct Answer:

C

Holly Day Company purchased a piece of land 10 years ago for $50,000.Holly Day Company is considering selling the land.The piece of land was recently appraised for $120,000,they received an offer from a prospective buyer for $105,000,and a similar piece of land 5 block away recently sold for $113,000.How much should Holly Day Company report on its balance sheet for the piece of land?

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

B

Assets are recorded at cost when they are purchased,but the asset accounts are adjusted each year to reflect changes in market value.

Free

(True/False)

4.7/5  (31)

(31)

Correct Answer:

False

The ____________________ assumption,which assumes that a firm will continue to operate indefinitely,permits carrying forward a portion of the cost of assets that will be used in future periods.

(Essay)

4.9/5  (36)

(36)

The accountant records an expense for wages earned by employees during the last four days of the year,even though the wages will not be paid in that year.The accountant is following the ____________________ principle.

(Essay)

4.8/5  (31)

(31)

The separate entity assumption permits businesses to record property and equipment as assets that will provide benefits in future periods.

(True/False)

4.8/5  (35)

(35)

Accounting information that is capable of making a difference in a decision by the user of the report is

(Multiple Choice)

4.9/5  (36)

(36)

The Garrison Company offers terms of net 30 days for its credit sales.It records the revenue from these sales as soon as the sales are made rather than waiting until cash is received from the customers.This is an example of the

(Multiple Choice)

4.8/5  (43)

(43)

Each year there was an increase in the market value of some stock owned by the Mudstream Company,but the accountant did not record the increase in asset value and equity until the stock was sold.In this situation,the accountant

(Multiple Choice)

4.8/5  (34)

(34)

Depreciating equipment over its useful life is an example of

(Multiple Choice)

4.8/5  (37)

(37)

Accountants use footnotes to financial statements to disclose information that may influence investor decisions.

(True/False)

4.8/5  (32)

(32)

An accountant generally assumes that a firm is a(n)____________________ and will continue to operate indefinitely.

(Essay)

4.8/5  (39)

(39)

When a new company was formed,one partner contributed some used equipment he owned.The equipment was appraised at $44,000 and $50,000 by two different dealers.The accountant entered the equipment at $44,000 in the financial records of the partnership.This is an example of

(Multiple Choice)

4.9/5  (33)

(33)

The Cervantes Company uses the same method of depreciation for its equipment in each fiscal period.This practice is an example of

(Multiple Choice)

4.8/5  (36)

(36)

The financial statements in the annual report of a corporation contain footnotes explaining the methods used to depreciate the firm's equipment.This practice is an example of

(Multiple Choice)

4.8/5  (29)

(29)

A deviation from generally accepted accounting principles is

(Multiple Choice)

4.9/5  (46)

(46)

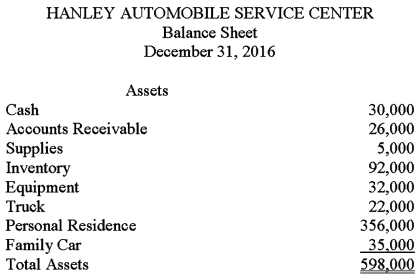

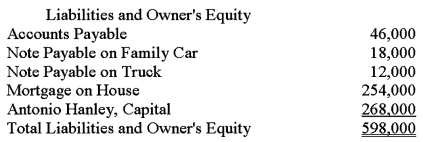

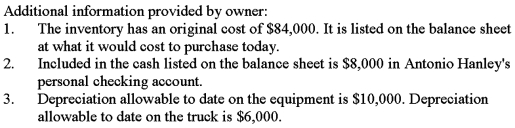

Antonio Hanley owns a small automobile service center.He recently approached the local bank for a loan to finance an expansion of his service center.Antonio prepared the balance sheet given below and submitted it with his loan application.The balance sheet does not conform to generally accepted accounting principles.Using the additional information provided by the owner,prepare a corrected balance sheet in accordance with generally accepted accounting principles.

(Essay)

4.8/5  (26)

(26)

An accountant charged the Repairs Expense account for a tool that cost $12.The tool had an estimated useful life of 5 years;however,the accountant did not choose to depreciate it.The modifying constraint that the accountant followed was

(Multiple Choice)

4.8/5  (32)

(32)

Showing 1 - 20 of 67

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)