Exam 14: Management Accounting in a Changing Environment

JIT and Stock-Out Costs

James Industries is considering a shift to JIT.The president feels that considerable costs can be saved by reducing inventory.The marketing manager is worried,however.She recognizes that the inventory holding costs such as storage and the opportunity cost of cash used to hold inventory are high and will be reduced if the company changes to JIT.But she is worried that the president has forgotten about stock-out costs.Stock-out costs occur when customers want to purchase an item,but the item is not immediately available so the customer goes elsewhere to make the purchase.

How should the company measure stock-out costs and what can be done to minimize stock-out costs?

Solution to JIT and Stock-Out Costs (15 minutes)

Stock-out costs are difficult to measure,because the accounting system does not recognize when a customer goes elsewhere because a product or service is not available.If an organization always has every product available for immediate delivery and never makes a customer wait for service,then stock-out costs should be zero.In theory,the stock-out costs should be the forgone profit lost by not making the sale.

Stock-out costs can be minimized by having excess inventory and staff available to provide services.This approach,however,is not consistent with JIT and creates considerable inventory holding costs.To use JIT and minimize stock-out costs at the same time,an organization must reduce throughput time and have a flexible workforce.With a reduced throughput time,the customers will only have to wait a short time for the product even if the product is not in inventory.A flexible workforce allows an organization to shift employees when needed to satisfy customer demand.

JIT and the Role of Accounting

The president of Kelly Windows is an avid believer in JIT.Kelly Windows manufactures bay windows.The president wants no inventory or work-in-process on the floor at the end of each day.Windows are only manufactured after being ordered and throughput time is quick enough to complete most orders during the day of the order.The president is also trying to eliminate all non-value added activities.She considers accounting to be non-value added and would like to reduce accounting activities sharply if not completely.

As the controller,how can you defend the accounting activities performed by your department?

Solution to JIT and the Role of Accounting (10 minutes)

Accounting does not directly add value to the product or service purchased by the customer.Indirectly,however,the accounting function can reduce the cost of operations through better planning and control decisions.These reduced costs can be passed on to customers in the form of lower prices for products and services.

Another way to view the question is to recognize that accounting creates value by identifying non-value-added activities that can be eliminated.

Productivity Measure With A Single Input and Output

An tax accountant is examining his productivity.In 1996 he did 300 tax returns in 1400 hours.In 1997 he did 250 tax returns in 1200 hours.

What was his percentage increase in productivity from 1996 to 1997?

Solution to Productivity Measure With a Single Input and Output

(5 minutes)

Assuming that tax returns per hour is the measure of productivity,the tax accountant has decreased productivity from 300/1,400 or .2143 tax returns per hour to 250/1,200 or .2083 tax returns per hour.The percentage change is (.2143 - .2083)/.2143 or -2.8 percent.

Productivity Measures With Multiple Inputs and Outputs

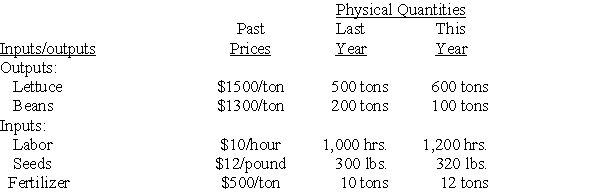

A farmer grows two crops:lettuce and beans.The farmer uses three inputs:labor,seed,and fertilizer.The past prices and the quantities of each are given in the following tables:  Required:

a.Calculate productivity measures for last year and this year using past prices.

b.Calculate the percentage change in productivity.

Required:

a.Calculate productivity measures for last year and this year using past prices.

b.Calculate the percentage change in productivity.

An Inspection Decision With Quality Costs

A company is considering additional final inspection costs of $1 per unit before delivery to customers.The additional inspection should reduce the defective rate from 3 percent to 1 percent.If a defective unit is found,it is scrapped at no additional cost.The manufacturing costs before the final inspection are $200 per unit.The management believes that the external failure costs are $40 per defective unit.

Should the management incur the additional inspection costs?

Accounting for JIT

Vail operates a JIT plant assembling ceiling fans.The Sunset Model ceiling fam has a standard material cost of $28.40,a standard direct labor cost of $14.80,and overhead (fixed and variable)of $16.10.On Monday,a batch of 100 Sunset fans is completed.All of the materials for the 100 fans were on hand prior to Monday and had been previously recorded in the raw and in-process inventory account.

Required:

In analyzing the financial statements of a firm using JIT and another firm in the same industry not using JIT,what differences would you expect to observe?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)