Exam 18: Risk and Uncertainty

Exam 1: Supply,demand,and Equilibrium77 Questions

Exam 2: Prices,costs and Gains From Trade73 Questions

Exam 3: The Behavior of Consumers77 Questions

Exam 4: Consumers in the Marketplace77 Questions

Exam 5: The Behavior of Firms76 Questions

Exam 6: Production and Costs67 Questions

Exam 7: Competition76 Questions

Exam 8: Welfare Economics and the Gains From Trade77 Questions

Exam 9: Knowledge and Information74 Questions

Exam 10: Monopoly79 Questions

Exam 11: Market Power,collusion,and Oligopoly75 Questions

Exam 12: The Theory of Games77 Questions

Exam 13: External Costs and Benefits75 Questions

Exam 14: Common Property and Public Goods74 Questions

Exam 15: The Demand for Factors of Production73 Questions

Exam 16: The Market for Labor72 Questions

Exam 17: Allocating Goods Over Time76 Questions

Exam 18: Risk and Uncertainty76 Questions

Exam 19: What Is Economics73 Questions

Select questions type

Consider a portfolio with three stocks,each with the same value.The three stocks have expected returns of 15%,25%,and 50%.The expected return of this portfolio is

Free

(Multiple Choice)

4.7/5  (33)

(33)

Correct Answer:

B

A person is seen placing a wager on the Super Bowl.It can be concluded that

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

D

A die is rolled.The individual rolling the die will receive the number that lands in dollars (i.e.if it lands 1,they receive $1,if it lands two,they receive $2,etc).The expected value of the die roll is

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

C

When will an individual's indifference curves be identical with the iso-expected value lines?

(Multiple Choice)

4.8/5  (41)

(41)

By definition,a risk preferring person will gamble no matter what the odds.

(True/False)

4.7/5  (30)

(30)

What type(s)of individual will always choose a risk-free basket when offered a bet at fair odds?

(Multiple Choice)

5.0/5  (37)

(37)

Define the term adverse selection.Why is an insurance company unable to offer fair odds when it faces an adverse selection problem? How might the insurance company deal with an adverse selection problem?

(Essay)

4.9/5  (26)

(26)

A risk neutral person earning $30,000 per year would likely be willing to pay a year's worth of income for a 50-50 chance at winning $70,000.

(True/False)

4.8/5  (34)

(34)

Both ex ante and ex post preferences depend solely on the individual's tastes.

(True/False)

4.9/5  (32)

(32)

Consider a risk-averse individual whose initial situation is a risk-free basket of outcomes.How does this person react when he is offered a wager at favorable odds?

(Multiple Choice)

4.8/5  (30)

(30)

A fair coin is flipped.If it lands heads the person receives $1.00.If it lands tails,the person receives $11.00.If the person is not willing to pay $6.00 to take this gamble,they must be

(Multiple Choice)

4.9/5  (38)

(38)

A risk neutral individual has indifference curves that are identical to the iso-expected lines of a fair gamble.

(True/False)

4.7/5  (32)

(32)

When offered a bet at unfair odds,a risk-neutral individual will

(Multiple Choice)

4.9/5  (40)

(40)

There are two states of the world.The person receives $100 in state one which occurs with probability 0.6.If the person is rational and their expected return is $80,then in state two the person must receive

(Multiple Choice)

4.8/5  (28)

(28)

The standard deviation of a portfolio is exactly equal to the average standard deviations of the individual stocks.

(True/False)

4.8/5  (39)

(39)

Of two baskets with identical standard deviations,a risk-averse person will prefer the basket with the higher expected value.

(True/False)

4.9/5  (33)

(33)

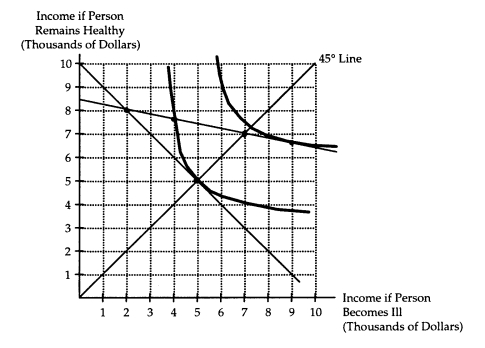

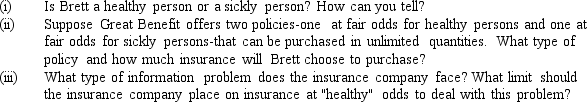

Great Benefit is a health insurance company with two types of customers: healthy persons and sickly persons.A healthy person has 1-to-5 odds of getting ill,and a sickly person has 1-to-1 odds of getting ill.However,the insurance company cannot distinguish between healthy and sickly persons.Brett is a risk-averse person who purchases health insurance from Great Benefit.Without insurance,Brett's income will be $8,000 if he remains healthy and $2,000 if he becomes ill.Brett's situation is diagrammed below.

(Essay)

4.8/5  (38)

(38)

An insurance company faces an adverse selection problem when people start taking additional risks after they acquire insurance.

(True/False)

4.9/5  (39)

(39)

Suppose an econometrician discovers that during the past decade,lower unemployment rates have always been accompanied by higher inflation rates.When asked how to reduce unemployment,the econometrician recommends the policy of increasing the money supply to trigger more inflation.Explain why this policy may fail to work in a world where people have rational expectations.

(Essay)

4.7/5  (31)

(31)

When faced with two portfolios that offer the same expected return,a risk-averse investor prefers the one with the higher standard deviation.

(True/False)

4.8/5  (37)

(37)

Showing 1 - 20 of 76

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)