Exam 14: Special Tax Computation Methods, Tax Credits, and Payment of Tax

Exam 1: An Introduction to Taxation106 Questions

Exam 2: Determination of Tax144 Questions

Exam 3: Gross Income: Inclusions139 Questions

Exam 4: Gross Income: Exclusions112 Questions

Exam 5: Property Transactions: Capital Gains and Losses141 Questions

Exam 6: Deductions and Losses138 Questions

Exam 7: Itemized Deductions122 Questions

Exam 8: Losses and Bad Debts118 Questions

Exam 9: Employee Expenses and Deferred Compensation147 Questions

Exam 10: Depreciation, Cost Recovery, Amortization, and Depletion99 Questions

Exam 11: Accounting Periods and Methods114 Questions

Exam 12: Property Transactions: Nontaxable Exchanges119 Questions

Exam 13: Property Transactions: Section 1231 and Recapture109 Questions

Exam 14: Special Tax Computation Methods, Tax Credits, and Payment of Tax130 Questions

Select questions type

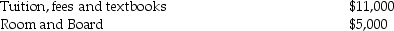

Tom and Anita are married, file a joint return with an AGI of $165,000, and have one dependent child, Tim, who is a first-time freshman in college. The following expenses are incurred and paid in 2015:  What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Free

(Essay)

4.9/5  (34)

(34)

Correct Answer:

Tim is eligible for the American Opportunity Tax credit. The maximum amount of the credit is (100% of the first $2,000 + 25% of the next $2,000 of tuition and fees) = $2,500.

$2,500 × $165,000 - $160,000 = $625 is phased-out leaving $1,875.

Current year foreign taxes paid exceed the ceiling based on U.S. tax attributable to foreign source income. These excess foreign tax credits

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

C

A credit for rehabilitation expenditures is available to a business for the purchase price of a building originally placed in service before 1936.

Free

(True/False)

4.9/5  (30)

(30)

Correct Answer:

False

A corporation has $100,000 of U.S. source taxable income and $300,000 of foreign source taxable income from countries X and Y for a total worldwide taxable income of $400,000. Countries X and Y levy a total of $60,000 in foreign taxes upon the foreign source taxable income. U.S. taxes before credits are $140,000. The foreign tax credit limitation is

(Multiple Choice)

4.9/5  (38)

(38)

Taxpayers with income below phase-out amounts are allowed a child credit of $1,000 for each qualifying child under age 18.

(True/False)

4.8/5  (34)

(34)

John has $55,000 net earnings from a sole proprietorship. John is also employed part-time by a major corporation and is paid $25,000. John's self-employment tax (rounded) for 2015 is

(Multiple Choice)

4.8/5  (39)

(39)

A taxpayer who paid AMT in prior years, but is not subject to the AMT in the current year, may be entitled to an AMT credit against his regular tax liability in the current year.

(True/False)

4.8/5  (44)

(44)

All of the following statements regarding self-employment income/tax are true except:

(Multiple Choice)

4.8/5  (35)

(35)

During the year, Jim incurs $50,000 of rehabilitation expenditures in connection with a certified historic structure used in his business. The adjusted basis of the structure was $40,000 at the time the rehabilitation began.

a. What is the amount, if any, of his rehabilitation credit for the year?

b. What is the depreciable basis of the rehabilitation expenditures?

(Essay)

4.8/5  (44)

(44)

Discuss actions a taxpayer can take if it is anticipated that his income taxes will be substantially underpaid in order to minimize penalties.

(Essay)

4.8/5  (37)

(37)

Which of the following expenditures will qualify as a research expenditure for purposes of the research credit?

(Multiple Choice)

4.9/5  (32)

(32)

The general business credit may not exceed the net income tax minus the greater of the tentative minimum tax or

(Multiple Choice)

4.8/5  (34)

(34)

Suzanne, a single taxpayer, has the following tax information for the current year. • Charitable contribution of real property with a FMV of $25,000 (adjusted basis $20,000) for which a $25,000 deduction was taken for regular tax.

• Research and experimental expenses of $40,000 deducted in full for regular tax.

Suzanne's total tax preferences and adjustments equals

(Multiple Choice)

4.8/5  (28)

(28)

Which of the following is not a qualifying property for the residential energy efficient property (REEP) credit?

(Multiple Choice)

4.9/5  (45)

(45)

Layla earned $20,000 of general business credits from her sole proprietorship. Her regular tax liability is $45,000, and her tentative minimum tax is $49,000. During the current year Layla will apply general business credits of

(Multiple Choice)

4.9/5  (37)

(37)

Octo Corp. purchases a building for use in its business at a cost of $100,000. The building was built in 1930 and needs substantial work so it can be used. Octo spends $150,000 on qualifying renovations. Octo will earn a rehabilitation credit of

(Multiple Choice)

4.7/5  (34)

(34)

The maximum amount of the American Opportunity Tax Credit for each qualified student is

(Multiple Choice)

4.7/5  (47)

(47)

Showing 1 - 20 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)