Essay

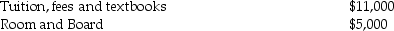

Tom and Anita are married, file a joint return with an AGI of $165,000, and have one dependent child, Tim, who is a first-time freshman in college. The following expenses are incurred and paid in 2015:  What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Current year foreign taxes paid exceed the

Q27: Which statement is correct?<br>A)Tax credits reduce tax

Q34: A credit for rehabilitation expenditures is available

Q34: All of the following statements regarding self-employment

Q52: A taxpayer who paid AMT in prior

Q64: All of the following are self-employment income

Q84: John has $55,000 net earnings from a

Q95: A corporation has $100,000 of U.S.source taxable

Q100: During the year,Jim incurs $50,000 of rehabilitation

Q108: Taxpayers with income below phase-out amounts are