Exam 11: Monetary Policy and the Fed

Exam 1: Economics: the Study of Choice145 Questions

Exam 3: Demand and Supply251 Questions

Exam 4: Applications of Supply and Demand113 Questions

Exam 5: Macroeconomics: the Big Picture145 Questions

Exam 6: Measuring Total Output and Income161 Questions

Exam 7: Aggregate Demand and Aggregate Supply166 Questions

Exam 8: Economic Growth136 Questions

Exam 9: The Nature and Creation of Money224 Questions

Exam 10: Financial Markets and the Economy175 Questions

Exam 11: Monetary Policy and the Fed178 Questions

Exam 12: Government and Fiscal Policy177 Questions

Exam 13: Consumption and the Aggregate Expenditures Model219 Questions

Exam 14: Investment and Economic Activity138 Questions

Exam 15: Net Exports and International Finance199 Questions

Exam 16: Inflation and Unemployment132 Questions

Exam 17: A Brief History of Macroeconomic Thought and Policy123 Questions

Exam 18: Inequality, Poverty, and Discrimination140 Questions

Select questions type

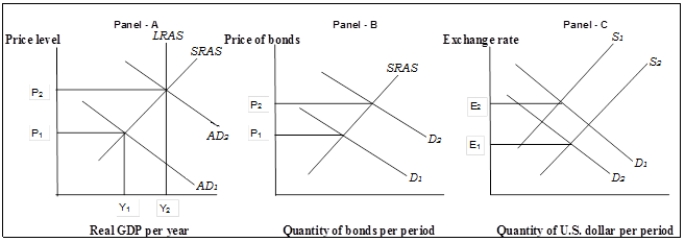

Use the following to answer questions .

Exhibit: Effects of Monetary Policy  -(Exhibit: Effects of Monetary Policy) If the Fed acts to close the output gap in Panel (a), it would

-(Exhibit: Effects of Monetary Policy) If the Fed acts to close the output gap in Panel (a), it would

Free

(Multiple Choice)

4.9/5  (30)

(30)

Correct Answer:

C

In the short-run velocity is not constant. Which of the following variables can be affected by a change in money supply?

I. real GDP

II. nominal GDP

III. the price level

Free

(Multiple Choice)

4.7/5  (26)

(26)

Correct Answer:

C

The impact lag is the time between putting a policy in place and when its effects are felt in the economy.

Free

(True/False)

4.8/5  (28)

(28)

Correct Answer:

True

When the Fed lowers the target rate of interest for federal funds, it

(Multiple Choice)

5.0/5  (32)

(32)

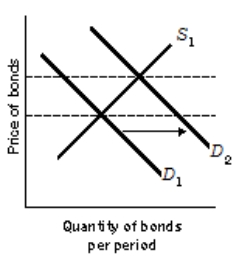

Use the following to answer questions .

Exhibit: Monetary Policy 1  -(Exhibit: Monetary Policy 1) By shifting the demand curve from D1 to D2, the Fed is exercising

-(Exhibit: Monetary Policy 1) By shifting the demand curve from D1 to D2, the Fed is exercising

(Multiple Choice)

4.8/5  (33)

(33)

If people wished to hold a quantity of money equal to 80% of nominal GDP, the velocity of money would be

(Multiple Choice)

4.8/5  (33)

(33)

Suppose at present people hold a quantity of money equal to 85% of nominal GDP. What happens to velocity if people wish to increase their money holdings to 80% of nominal GDP?

(Multiple Choice)

5.0/5  (33)

(33)

The equation of exchange determines the supply of money in the economy.

(True/False)

4.9/5  (38)

(38)

On October 12, 1987, the Dow Jones Industrial Average plunged 508 points, wiping out more than $500 billion in a few hours. How did the Fed respond to this drastic fall in the stock market index?

(Multiple Choice)

5.0/5  (47)

(47)

Possible targets for monetary policy include all of the following except

(Multiple Choice)

4.8/5  (28)

(28)

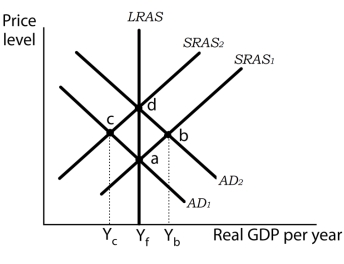

Use the following to answer questions .

Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply  -(Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply) If the economy is at point c,

-(Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply) If the economy is at point c,

(Multiple Choice)

4.9/5  (30)

(30)

Contractionary monetary policy, achieved by selling bonds in the open market, tends to discourage investment.

(True/False)

4.8/5  (29)

(29)

Mary Chestnut reported in her diary that, during the Civil War, she became much less willing to hold "'Confederates," currency issued by the Confederate State of America. Assuming that this change in preferences was widespread in the South, it suggests

(Multiple Choice)

4.9/5  (39)

(39)

The congressional act passed in 1978 that established specific numerical goals for the unemployment rate and the inflation rate to be achieved by 1983 was the

(Multiple Choice)

4.8/5  (34)

(34)

The recognition lag is the length of time it takes between recognizing a problem and adopting a policy to address that problem.

(True/False)

4.8/5  (34)

(34)

If the economy experiences an inflationary gap, a contractionary monetary policy will

(Multiple Choice)

4.8/5  (40)

(40)

If nominal GDP = $900 billion and the public holds $300 billion in M2, then the velocity of the M2 money supply is

(Multiple Choice)

4.8/5  (41)

(41)

Showing 1 - 20 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)