Exam 11: Monetary Policy and the Fed

Exam 1: Economics: the Study of Choice145 Questions

Exam 3: Demand and Supply251 Questions

Exam 4: Applications of Supply and Demand113 Questions

Exam 5: Macroeconomics: the Big Picture145 Questions

Exam 6: Measuring Total Output and Income161 Questions

Exam 7: Aggregate Demand and Aggregate Supply166 Questions

Exam 8: Economic Growth136 Questions

Exam 9: The Nature and Creation of Money224 Questions

Exam 10: Financial Markets and the Economy175 Questions

Exam 11: Monetary Policy and the Fed178 Questions

Exam 12: Government and Fiscal Policy177 Questions

Exam 13: Consumption and the Aggregate Expenditures Model219 Questions

Exam 14: Investment and Economic Activity138 Questions

Exam 15: Net Exports and International Finance199 Questions

Exam 16: Inflation and Unemployment132 Questions

Exam 17: A Brief History of Macroeconomic Thought and Policy123 Questions

Exam 18: Inequality, Poverty, and Discrimination140 Questions

Select questions type

In an economy experiencing hyperinflation, we expect to observe

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following statements is true if interest rates were zero?

(Multiple Choice)

4.8/5  (43)

(43)

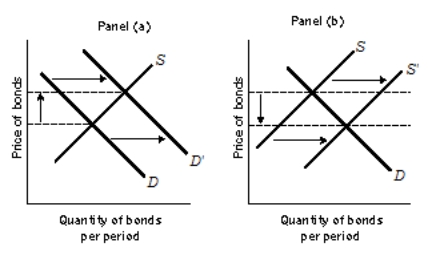

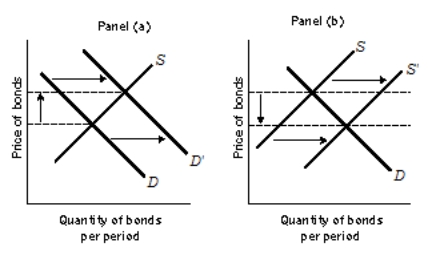

Use the following to answer questions .

Exhibit: The Bond Market  -(Exhibit: The Bond Market) Suppose the Fed takes action that shifts the demand curve from S to S′, as illustrated in Panel (b). As a result, the interest rate

-(Exhibit: The Bond Market) Suppose the Fed takes action that shifts the demand curve from S to S′, as illustrated in Panel (b). As a result, the interest rate

(Multiple Choice)

4.8/5  (43)

(43)

Use the following to answer questions .

Exhibit: The Bond Market  -(Exhibit: The Bond Market) If the Fed wants to achieve the results shown in Panel (b), it should

-(Exhibit: The Bond Market) If the Fed wants to achieve the results shown in Panel (b), it should

(Multiple Choice)

4.9/5  (45)

(45)

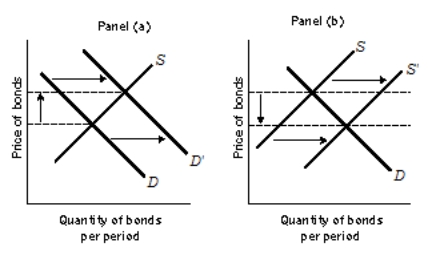

Use the following to answer questions .

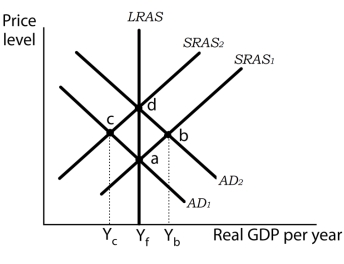

Exhibit: Monetary Policy and Rational Expectations  -(Exhibit: Monetary Policy and Rational Expectations) Suppose the economy is operating at point a and that individuals have rational expectations. They calculate that expansionary monetary policy

-(Exhibit: Monetary Policy and Rational Expectations) Suppose the economy is operating at point a and that individuals have rational expectations. They calculate that expansionary monetary policy

(Multiple Choice)

4.9/5  (44)

(44)

If you earn and spend $2,000 per month and maintain an average cash balance of $500 per month, your velocity of money is

(Multiple Choice)

4.7/5  (41)

(41)

According to the text, in many respects, the single most powerful economic policymaker in the United States is

(Multiple Choice)

4.9/5  (41)

(41)

If the velocity of money is constant, then nominal GDP can change only if there is a change in the money supply.

(True/False)

4.9/5  (38)

(38)

If you earn and spend $300 per week and maintain an average cash balance of $100 per week, your velocity of money is

(Multiple Choice)

4.8/5  (36)

(36)

Using the equation of exchange, if the nominal GDP is $8,000 billion and the money supply is $1,600 billion, then

(Multiple Choice)

4.8/5  (37)

(37)

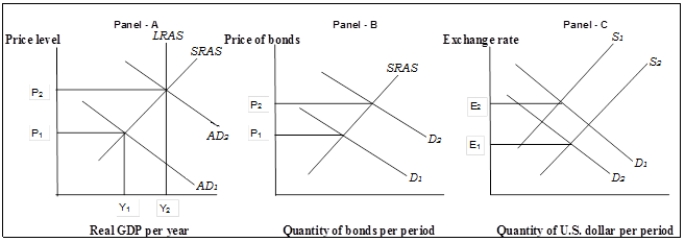

Use the following to answer questions .

Exhibit: Effects of Monetary Policy  -(Exhibit: Effects of Monetary Policy) The shift in the demand for bonds from D1 to D2, in Panel (b) will result in a

-(Exhibit: Effects of Monetary Policy) The shift in the demand for bonds from D1 to D2, in Panel (b) will result in a

(Multiple Choice)

4.8/5  (31)

(31)

During an economic slump, policies that lower interest rates may not actually boost investment because

(Multiple Choice)

4.9/5  (40)

(40)

Following the U.S. financial crisis in 2008, some observers assert that the policies of Fed Chairman Greenspan contributed to the crisis. Which of the following is a criticism of Greenspan's policies?

I. The very low interest rates used to fight the 2001 recession were maintained for too long, leading to the real estate bubble.

II. The Fed provided real estate developers with liquidity to encourage property development and offered tax breaks to first-time home buyers, which in turn fueled the real estate bubble.

III. The Fed did not promote appropriate regulations to deal with the new financial instruments that were created in the early 2000s.

(Multiple Choice)

4.8/5  (44)

(44)

Use the following to answer questions .

Exhibit: The Bond Market  -(Exhibit: The Bond Market) If the Fed wants to achieve the results shown in Panel (a), it should

-(Exhibit: The Bond Market) If the Fed wants to achieve the results shown in Panel (a), it should

(Multiple Choice)

4.7/5  (30)

(30)

A liquidity trap is said to exist when a change in monetary policy has no effect on

(Multiple Choice)

4.8/5  (38)

(38)

Changing the required reserve ratio is an often-used monetary tool to influence the federal funds rate.

(True/False)

4.8/5  (35)

(35)

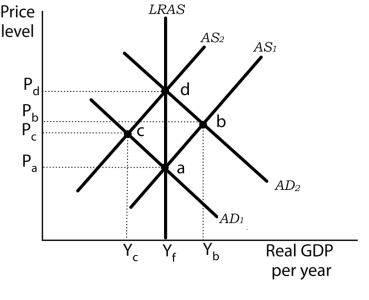

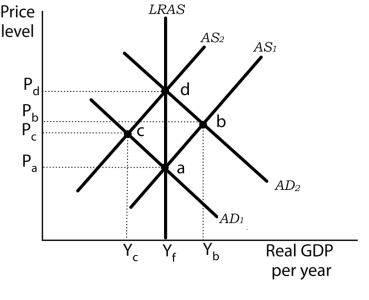

Use the following to answer questions .

Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply  -(Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply) If the economy is at point b, the Federal Reserve can close the output gap by selling bonds. In the bond market,

-(Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply) If the economy is at point b, the Federal Reserve can close the output gap by selling bonds. In the bond market,

(Multiple Choice)

4.9/5  (39)

(39)

Use the following to answer questions .

Exhibit: Monetary Policy and Rational Expectations  -(Exhibit: Monetary Policy and Rational Expectations) If rational expectations exist and the economy is initially operating at point d. If the Fed undertakes contractionary monetary policy the economy will

-(Exhibit: Monetary Policy and Rational Expectations) If rational expectations exist and the economy is initially operating at point d. If the Fed undertakes contractionary monetary policy the economy will

(Multiple Choice)

4.8/5  (40)

(40)

When the Fed buys bonds in the open market, we can expect the

(Multiple Choice)

4.9/5  (30)

(30)

Showing 121 - 140 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)