Exam 4: Complex Financial Instruments

Exam 1: Current Liabilities and Contingencies90 Questions

Exam 2: Non-Current Financial Liabilities85 Questions

Exam 3: Equities75 Questions

Exam 4: Complex Financial Instruments89 Questions

Exam 6: Accounting for Income Taxes85 Questions

Exam 7: Pensions and Other Employee Future Benefits96 Questions

Exam 8: Accounting for Leases95 Questions

Exam 9: Statement of Cash Flows68 Questions

Select questions type

Which statement is not correct for the "proportional method"?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following is correct about financial instruments?

(Multiple Choice)

4.9/5  (36)

(36)

A company issues convertible bonds with face value of $10,000,000 and receives proceeds of $10,500,000. Each $1,000 bond can be converted,at the option of the holder,into 800 common shares. The underwriter estimated the market value of the bonds alone,excluding the conversion rights,to be approximately $8,300,000.

Requirement:

Record the journal entry for the issuance of these bonds based on IFRS.

(Essay)

4.8/5  (40)

(40)

Roman Corporation issued call options on 5,000 shares of POMPEI Inc. on October 21,2012. These options give the holder the right to buy POMPEI shares at $35 per share until May 17,2013. For issuing these options,Roman received $15,000. On December 31,2012 (Roman's fiscal year-end),the options traded on the Montreal Exchange for $3.50 per option. On May 17,2013,POMPEI's share price increased to $40 and the option holders exercised their options. Roman had no holdings of POMPEI shares.

Requirement:

For Roman Corporation,record the journal entries related to these call options.

(Essay)

4.8/5  (40)

(40)

Which step is not required for hedge accounting under IFRS?

(Multiple Choice)

4.8/5  (39)

(39)

O'Neil Motor Parts issued 110,000 stock options to its employees. The company granted the stock options at-the-money,when the share price was $40. These options have no vesting conditions. By year-end,the share price had increased to $42. O'Neil's management estimates the value of these options at the grant date to be $1.60 each.

Requirement:

Record the issuance of the stock options.

(Essay)

4.7/5  (36)

(36)

How would the equity portion of the compound instrument be recorded?

(Multiple Choice)

4.8/5  (37)

(37)

Explain how bonds issued with warrants alleviate adverse selection problem.

(Essay)

4.9/5  (32)

(32)

Naples Corporation issued call options on 20,000 shares of VESPUS Inc. on October 21,2012. These options give the holder the right to buy VESPUS shares at $35 per share until May 17,2013. For issuing these options,Naples received $60,000. On December 31,2012 (Naples's fiscal year-end),the options traded on the Montreal Exchange for $3.50 per option. On May 17,2013,VESPUS's share price increased to $40 and the option holders exercised their options. Naples had no holdings of VESPUS shares.

Requirement:

For Naples Corporation,record the journal entries related to these call options.

(Essay)

4.8/5  (35)

(35)

How would exercise of warrants,that were part of the original compound instrument,be recorded?

(Multiple Choice)

4.8/5  (29)

(29)

Which statement is correct about the accounting for employee stock options?

(Multiple Choice)

4.8/5  (38)

(38)

How should warrants on the company's own common shares be accounted for?

(Multiple Choice)

4.8/5  (43)

(43)

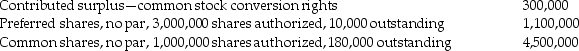

LMN Company reported the following amounts on its balance sheet at July 31,2013:

Liabilities

Equity

Equity

Additional information

1. The bonds pay interest each July 31. Each $1,000 bond is convertible into 5 common shares. The bonds were originally issued to yield 10%. On July 31,2014,all the bonds were converted after the final interest payment was made. LMN uses the book value method to record bond conversions as recommended under IFRS.

2. No other share or bond transactions occurred during the year.

Requirement:

a. Prepare the journal entry to record the bond interest payment on July 31,2014.

b. Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2014.

c. Prepare the journal entry to record the bond conversion.

Additional information

1. The bonds pay interest each July 31. Each $1,000 bond is convertible into 5 common shares. The bonds were originally issued to yield 10%. On July 31,2014,all the bonds were converted after the final interest payment was made. LMN uses the book value method to record bond conversions as recommended under IFRS.

2. No other share or bond transactions occurred during the year.

Requirement:

a. Prepare the journal entry to record the bond interest payment on July 31,2014.

b. Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2014.

c. Prepare the journal entry to record the bond conversion.

(Essay)

4.8/5  (47)

(47)

Sorrentino Corporation issued call options on 20,000 shares of BWC Inc. on October 21,2012. These options give the holder the right to buy BWC shares at $35 per share until May 17,2013. For issuing these options,Sorrentino received $20,000. On December 31,2012 (Sorrentino's fiscal year-end),the options traded on the Montreal Exchange for $2.00 per option. On May 17,2013,BWC's share price increased to $38 and the option holders exercised their options. Sorrentino had no holdings of BWC shares.

Requirement:

For Sorrentino Corporation,record the journal entries related to these call options.

(Essay)

4.8/5  (29)

(29)

Assume that MAK agrees to purchase US$500,000 for C$550,000 on January 15,2013. The exchange rate at year end is US$1 = C$0.95 and the January 15,2013 exchange rate is US$1 = C$0.97. What journal entry is required at year end?

(Multiple Choice)

4.8/5  (35)

(35)

A company issued 95,000 preferred shares and received proceeds of $6,000,000. These shares have a par value of $48 per share and pay cumulative dividends of 6%. Buyers of the preferred shares also received a detachable warrant with each share purchased. Each warrant gives the holder the right to buy one common share at $35 per share within 10 years.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $64 per share. Shortly after the issuance of the preferred shares,the detachable warrants traded at $8 each.

Requirement:

Record the journal entry for the issuance of these shares and warrants under IFRS.

(Essay)

4.9/5  (42)

(42)

McMillan Manufacturing issued 60,000 stock options to its employees. The company granted the stock options at-the-money,when the share price was $40. These options have no vesting conditions. By year-end,the share price had increased to $42. McMillan's management estimates the value of these options at the grant date to be $1.10 each.

Requirement:

Record the issuance of the stock options.

(Essay)

4.9/5  (30)

(30)

Showing 41 - 60 of 89

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)