Exam 10: The Monetary System

Exam 1: Ten Principles of Economics218 Questions

Exam 2: Thinking Like an Economist231 Questions

Exam 3: Interdependence and the Gains From Trade206 Questions

Exam 4: The Market Forces of Supply and Demand307 Questions

Exam 5: Measuring a Nations Income169 Questions

Exam 6: Measuring the Cost of Living181 Questions

Exam 7: Production and Growth190 Questions

Exam 8: Saving, Investment, and the Financial System214 Questions

Exam 9: Unemployment and Its Natural Rate197 Questions

Exam 10: The Monetary System204 Questions

Exam 11: Money Growth and Inflation195 Questions

Exam 12: Open-Economy Macroeconomics: Basic Concepts219 Questions

Exam 13: A Macroeconomic Theory of the Small Open Economy195 Questions

Exam 14: Aggregate Demand and Aggregate Supply257 Questions

Exam 15: The Influence of Monetary Policy on Aggregate Demand130 Questions

Exam 16: The Influence of Fiscal Policy on Aggregate Demand126 Questions

Exam 17: The Short-Run Tradeoff Between Inflation and Unemployment207 Questions

Exam 18: Five Debates Over Macroeconomic Policy126 Questions

Select questions type

What is meant by the term "lender of last resort"? In what circumstances might the Bank of Canada be a lender of last resort?

(Essay)

4.9/5  (39)

(39)

Which of the three functions of money are met by each of the following assets in the Canadian economy?

a. paper dollar

b. precious metals

c. collectibles such as baseball cards, stamps, and antiques

(Essay)

4.8/5  (34)

(34)

Suppose a bank has $200,000 in deposits and $150,000 in loans. What is its reserve ratio?

(Multiple Choice)

4.7/5  (35)

(35)

Which statement best describes the process of open-market sales conducted by the Bank of Canada?

(Multiple Choice)

4.9/5  (37)

(37)

A bank has $100 reserves, $10,000 loans, $500 securities, $9000 deposits, and $1400 debt.

a) Calculate the bank's capital.

b) Calculate the bank's leverage ratio.

c) Suppose the bank's securities are mainly mortgage-based bonds and a wave of mortgage defaults combined with a fall in the stock market reduces the bank's assets by 10 percent. What is the percentage and dollar-value change of the bank's capital? Is the bank solvent?

(Essay)

4.8/5  (38)

(38)

As the reserve ratio increases, what happens to the money multiplier and money supply?

(Multiple Choice)

4.7/5  (26)

(26)

Suppose the banking system has $10 million in reserves and the reserve ratio is 25 percent. Then bankers decide to decrease the reserve ratio to 20 percent. How does this decision eventually change the money supply?

(Multiple Choice)

4.9/5  (34)

(34)

To increase the money supply, what could the Bank of Canada do?

(Multiple Choice)

4.9/5  (36)

(36)

Suppose a bank has $10,000 in deposits and $7000 in loans. What is its reserve ratio?

(Multiple Choice)

4.7/5  (40)

(40)

Assume that banks do not hold excess reserves. The banking system has $50 million in reserves and has a reserve requirement of 10 percent. The public holds $20 million in currency. Then the public decides to withdraw $5 million in currency from the banking system. If the Bank of Canada wants to keep the money supply stable by changing the reserve requirement, then what will the new reserve requirement be?

(Multiple Choice)

4.7/5  (43)

(43)

If the reserve ratio is 12.5 percent, how much new money can $1000 of excess reserves create?

(Multiple Choice)

4.8/5  (43)

(43)

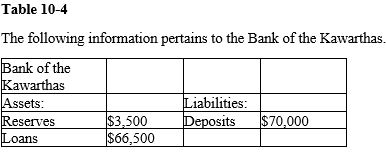

-Refer to Table 10-4. If all banks hold only the required 4 percent of deposits as reserves, then what is the money multiplier?

-Refer to Table 10-4. If all banks hold only the required 4 percent of deposits as reserves, then what is the money multiplier?

(Multiple Choice)

4.8/5  (31)

(31)

The bank of Hinton has $100 reserves, $10,000 long-term loans, $500 securities, $8800 deposits, and $1400 debt. Due to a macroeconomic slowdown, many people lose their jobs and need to live off their savings for a while. Discuss the possible effects of this situation on the bank of Hinton's assets, liabilities, and capital. Is the bank insolvent? Use numerical examples to illustrate your points.

(Essay)

4.7/5  (37)

(37)

Which of the following is a sterilization operation that supports the Canadian dollar?

(Multiple Choice)

4.9/5  (28)

(28)

Which statement best illustrates the medium of exchange function of money?

(Multiple Choice)

4.8/5  (29)

(29)

Shelly deposits half of her inheritance in a savings account at the bank. In doing so, Shelly is using money as a medium of exchange.

(True/False)

4.8/5  (38)

(38)

Showing 61 - 80 of 204

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)