Exam 22: Transfer Pricing

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

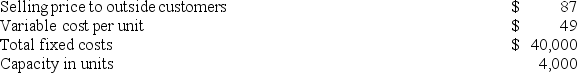

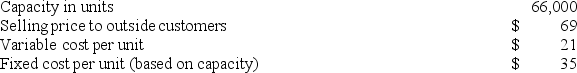

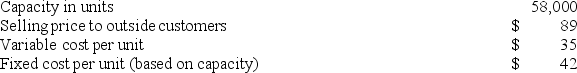

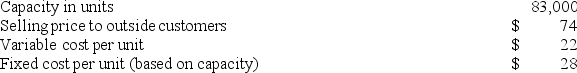

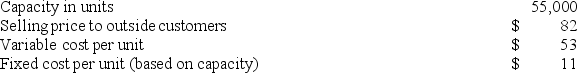

Division G makes a part that it sells to customers outside of the company. Data concerning this part appear below:  Division H of the same company would like to use the part manufactured by Division G in one of its products. Division H currently purchases a similar part made by an outside company for $83 per unit and would substitute the part made by Division G. Division H requires 500 units of the part each period. Division G has ample capacity to produce the units for Division H without any increase in fixed costs and without cutting into sales to outside customers. If Division G sells to Division H rather than to outside customers, the variable cost be unit would be $2 lower. What should be the lowest acceptable transfer price from the perspective of Division G?

Division H of the same company would like to use the part manufactured by Division G in one of its products. Division H currently purchases a similar part made by an outside company for $83 per unit and would substitute the part made by Division G. Division H requires 500 units of the part each period. Division G has ample capacity to produce the units for Division H without any increase in fixed costs and without cutting into sales to outside customers. If Division G sells to Division H rather than to outside customers, the variable cost be unit would be $2 lower. What should be the lowest acceptable transfer price from the perspective of Division G?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

A

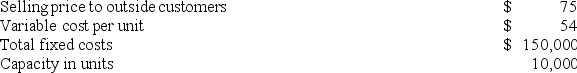

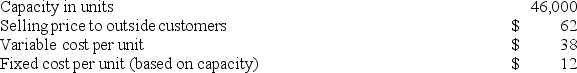

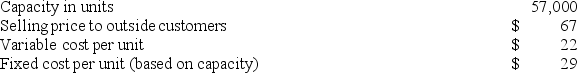

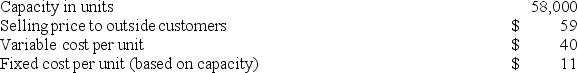

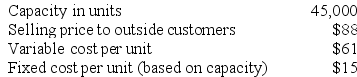

Division C makes a part that it sells to customers outside of the company. Data concerning this part appear below:  Division D of the same company would like to use the part manufactured by Division C in one of its products. Division D currently purchases a similar part made by an outside company for $79 per unit and would substitute the part made by Division C. Division D requires 1,000 units of the part each period. Division C has ample excess capacity to handle all of Division D's needs without any increase in fixed costs and without cutting into outside sales. What is the lowest acceptable transfer price from the standpoint of the selling division?

Division D of the same company would like to use the part manufactured by Division C in one of its products. Division D currently purchases a similar part made by an outside company for $79 per unit and would substitute the part made by Division C. Division D requires 1,000 units of the part each period. Division C has ample excess capacity to handle all of Division D's needs without any increase in fixed costs and without cutting into outside sales. What is the lowest acceptable transfer price from the standpoint of the selling division?

Free

(Multiple Choice)

4.8/5  (47)

(47)

Correct Answer:

C

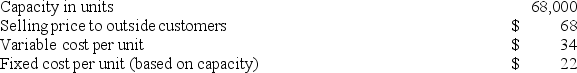

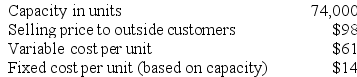

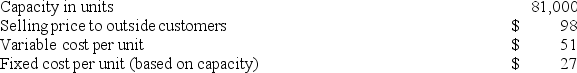

Mittan Products, Inc., has a Antennae Division that manufactures and sells a number of products, including a standard antennae that could be used by another division in the company, the Aircraft Products Division, in one of its products. Data concerning that antennae appear below:  The Aircraft Products Division is currently purchasing 4,000 of these antennaes per year from an overseas supplier at a cost of $66 per antennae.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. From the standpoint of the Valve Division, what is the lost contribution margin if the valves are transferred internally rather than sold to outside customers?

The Aircraft Products Division is currently purchasing 4,000 of these antennaes per year from an overseas supplier at a cost of $66 per antennae.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. From the standpoint of the Valve Division, what is the lost contribution margin if the valves are transferred internally rather than sold to outside customers?

Free

(Multiple Choice)

4.8/5  (48)

(48)

Correct Answer:

B

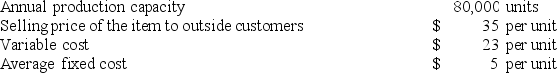

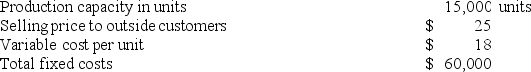

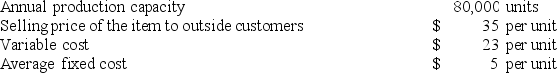

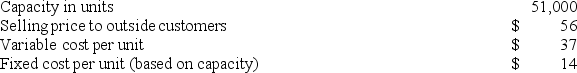

Division P of the Nyers Company makes a part that can either be sold to outside customers or transferred internally to Division Q for further processing. Annual data relating to this part are as follows:  Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.

If outside customers demand 80,000 units and if, by selling to Division Q, Division P could avoid $4 per unit in variable selling expense, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.

If outside customers demand 80,000 units and if, by selling to Division Q, Division P could avoid $4 per unit in variable selling expense, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

(Multiple Choice)

4.7/5  (39)

(39)

Royal Products, Inc., has a Connector Division that manufactures and sells a number of products, including a standard connector that could be used by another division in the company, the Transmission Division, in one of its products. Data concerning that connector appear below:  The Transmission Division is currently purchasing 6,000 of these connectors per year from an overseas supplier at a cost of $65 per connector.

Assume that the Connector Division has enough idle capacity to handle all of the Transmission Division's needs. What should be the minimum acceptable transfer price for the connectors from the standpoint of the Connector Division?

The Transmission Division is currently purchasing 6,000 of these connectors per year from an overseas supplier at a cost of $65 per connector.

Assume that the Connector Division has enough idle capacity to handle all of the Transmission Division's needs. What should be the minimum acceptable transfer price for the connectors from the standpoint of the Connector Division?

(Multiple Choice)

4.9/5  (37)

(37)

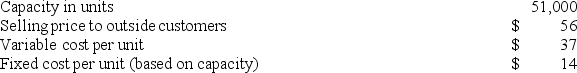

Lumpkins Products, Inc., has a Valve Division that manufactures and sells a number of products, including a standard valve that could be used by another division in the company, the Pump Division, in one of its products. Data concerning that valve appear below:  The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $59 per valve.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that none of the variable expenses can be avoided on transfers within the company. What should be the minimum acceptable transfer price for the valves from the standpoint of the Valve Division?

The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $59 per valve.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that none of the variable expenses can be avoided on transfers within the company. What should be the minimum acceptable transfer price for the valves from the standpoint of the Valve Division?

(Multiple Choice)

4.8/5  (39)

(39)

Division A makes a part with the following characteristics:  Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division B is now purchasing these parts from an outside supplier at a price of $24 each.

Suppose that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into sales to outside customers. If Division A refuses to accept the $24 price internally and Division B continues to buy from the outside supplier, the company as a whole will be:

Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division B is now purchasing these parts from an outside supplier at a price of $24 each.

Suppose that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into sales to outside customers. If Division A refuses to accept the $24 price internally and Division B continues to buy from the outside supplier, the company as a whole will be:

(Multiple Choice)

4.8/5  (31)

(31)

Steinhoff Products, Inc., has a Sensor Division that manufactures and sells a number of products, including a standard sensor that could be used by another division in the company, the Safety Products Division, in one of its products. Data concerning that sensor appear below:  The Safety Products Division is currently purchasing 4,000 of these sensors per year from an overseas supplier at a cost of $48 per sensor.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. From the standpoint of the Valve Division, what is the lost contribution margin if the valves are transferred internally rather than sold to outside customers?

The Safety Products Division is currently purchasing 4,000 of these sensors per year from an overseas supplier at a cost of $48 per sensor.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. From the standpoint of the Valve Division, what is the lost contribution margin if the valves are transferred internally rather than sold to outside customers?

(Multiple Choice)

4.8/5  (39)

(39)

Godina Products, Inc., has a Receiver Division that manufactures and sells a number of products, including a standard receiver that could be used by another division in the company, the Industrial Products Division, in one of its products. Data concerning that receiver appear below:  The Industrial Products Division is currently purchasing 10,000 of these receivers per year from an overseas supplier at a cost of $81 per receiver.

Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. Does there exist a transfer price that would make both the Receiver and Industrial Products Division financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier?

The Industrial Products Division is currently purchasing 10,000 of these receivers per year from an overseas supplier at a cost of $81 per receiver.

Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. Does there exist a transfer price that would make both the Receiver and Industrial Products Division financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier?

(Multiple Choice)

4.9/5  (41)

(41)

Toldness Products, Inc., has a Connector Division that manufactures and sells a number of products, including a standard connector that could be used by another division in the company, the Transmission Division, in one of its products. Data concerning that connector appear below:  The Transmission Division is currently purchasing 11,000 of these connectors per year from an overseas supplier at a cost of $58 per connector.

What is the maximum price that the Transmission Division should be willing to pay for connectors transferred from the Connector Division?

The Transmission Division is currently purchasing 11,000 of these connectors per year from an overseas supplier at a cost of $58 per connector.

What is the maximum price that the Transmission Division should be willing to pay for connectors transferred from the Connector Division?

(Multiple Choice)

4.9/5  (39)

(39)

Cominsky Products, Inc., has a Screen Division that manufactures and sells a number of products, including a standard screen. Data concerning that screen appear below:

The company has a Home Security Division that could use this screen in one of its products. The Home Security Division is currently purchasing 6,000 of these screens per year from an overseas supplier at a cost of $96 per screen.

Required:

Assume that the Screen Division is selling all of the screens it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?

The company has a Home Security Division that could use this screen in one of its products. The Home Security Division is currently purchasing 6,000 of these screens per year from an overseas supplier at a cost of $96 per screen.

Required:

Assume that the Screen Division is selling all of the screens it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?

(Essay)

4.8/5  (31)

(31)

Division P of the Nyers Company makes a part that can either be sold to outside customers or transferred internally to Division Q for further processing. Annual data relating to this part are as follows:  Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.

If outside customers demand 80,000 units, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.

If outside customers demand 80,000 units, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

(Multiple Choice)

4.8/5  (28)

(28)

Tommasino Products, Inc., has a Motor Division that manufactures and sells a number of products, including a standard motor that could be used by another division in the company, the Automotive Division, in one of its products. Data concerning that motor appear below:  The Automotive Division is currently purchasing 9,000 of these motors per year from an overseas supplier at a cost of $72 per motor.

Assume that the Motor Division is selling all of the motors it can produce to outside customers. Does there exist a transfer price that would make both the Motor and Automotive Division financially better off than if the Automotive Division were to continue buying its motors from the outside supplier?

The Automotive Division is currently purchasing 9,000 of these motors per year from an overseas supplier at a cost of $72 per motor.

Assume that the Motor Division is selling all of the motors it can produce to outside customers. Does there exist a transfer price that would make both the Motor and Automotive Division financially better off than if the Automotive Division were to continue buying its motors from the outside supplier?

(Multiple Choice)

4.9/5  (33)

(33)

The selling division in a transfer pricing situation should want the transfer price to cover at least the full cost per unit plus the lost contribution margin per unit on outside sales.

(True/False)

4.8/5  (32)

(32)

Yearout Products, Inc., has a Valve Division that manufactures and sells a number of products, including a standard valve that could be used by another division in the company, the Pump Division, in one of its products. Data concerning that valve appear below:  The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $1 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $1 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

(Multiple Choice)

4.8/5  (33)

(33)

Tron Products, Inc., has a Pump Division that manufactures and sells a number of products, including a standard pump that could be used by another division in the company, the Pool Products Division, in one of its products. Data concerning that pump appear below:  The Pool Products Division is currently purchasing 4,000 of these pumps per year from an overseas supplier at a cost of $94 per pump.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $3 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

The Pool Products Division is currently purchasing 4,000 of these pumps per year from an overseas supplier at a cost of $94 per pump.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $3 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

(Multiple Choice)

4.9/5  (37)

(37)

Ulrich Company has a Castings Division which does casting work of various types. The company's Machine Products Division has asked the Castings Division to provide it with 20,000 special castings each year on a continuing basis. The special casting would require $12 per unit in variable production costs.

In order to have time and space to produce the new casting, the Castings Division would have to cut back production of another casting - the RB4 which it presently is producing. The RB4 sells for $40 per unit, and requires $18 per unit in variable production costs. Boxing and shipping costs of the RB4 are $6 per unit. Boxing and shipping costs for the new special casting would be only $1 per unit, thereby saving the company $5 per unit in cost. The company is now producing and selling 100,000 units of the RB4 each year. Production and sales of this casting would drop by 25 percent if the new casting is produced. Some $240,000 in fixed production costs in the Castings Division are now being covered by the RB4 casting; 25 percent of these costs would have to be covered by the new casting if it is produced and sold to the Machine Products Division.

Required:

According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division? Show all computations.

(Essay)

4.7/5  (33)

(33)

Steinhoff Products, Inc., has a Sensor Division that manufactures and sells a number of products, including a standard sensor that could be used by another division in the company, the Safety Products Division, in one of its products. Data concerning that sensor appear below:  The Safety Products Division is currently purchasing 4,000 of these sensors per year from an overseas supplier at a cost of $48 per sensor.

What is the maximum price that the Safety Products Division should be willing to pay for sensors transferred from the Sensor Division?

The Safety Products Division is currently purchasing 4,000 of these sensors per year from an overseas supplier at a cost of $48 per sensor.

What is the maximum price that the Safety Products Division should be willing to pay for sensors transferred from the Sensor Division?

(Multiple Choice)

4.7/5  (44)

(44)

Wetherald Products, Inc., has a Pump Division that manufactures and sells a number of products, including a standard pump that could be used by another division in the company, the Pool Products Division, in one of its products. Data concerning that pump appear below:  The Pool Products Division is currently purchasing 4,000 of these pumps per year from an overseas supplier at a cost of $74 per pump.

Assume that the Pump Division is selling all of the pumps it can produce to outside customers. What should be the minimum acceptable transfer price for the pumps from the standpoint of the Pump Division?

The Pool Products Division is currently purchasing 4,000 of these pumps per year from an overseas supplier at a cost of $74 per pump.

Assume that the Pump Division is selling all of the pumps it can produce to outside customers. What should be the minimum acceptable transfer price for the pumps from the standpoint of the Pump Division?

(Multiple Choice)

4.9/5  (43)

(43)

Stibbins Products, Inc., has a Receiver Division that manufactures and sells a number of products, including a standard receiver. Data concerning that receiver appear below:

The company has a Industrial Products Division that could use this receiver in one of its products. The Industrial Products Division is currently purchasing 6,000 of these receivers per year from an overseas supplier at a cost of $79 per receiver.

Required:

a. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?

b. Assume again that the Receiver Division is selling all of the receivers it can produce to outside customers. Also assume that $13 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What is the acceptable range, if any, for the transfer price between the two divisions?

The company has a Industrial Products Division that could use this receiver in one of its products. The Industrial Products Division is currently purchasing 6,000 of these receivers per year from an overseas supplier at a cost of $79 per receiver.

Required:

a. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?

b. Assume again that the Receiver Division is selling all of the receivers it can produce to outside customers. Also assume that $13 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What is the acceptable range, if any, for the transfer price between the two divisions?

(Essay)

4.7/5  (39)

(39)

Showing 1 - 20 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)