Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System

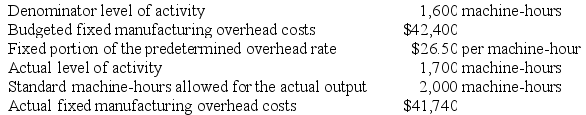

Potestio Incorporated makes a single product-a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:  The total of the overhead variances is:

The total of the overhead variances is:

A

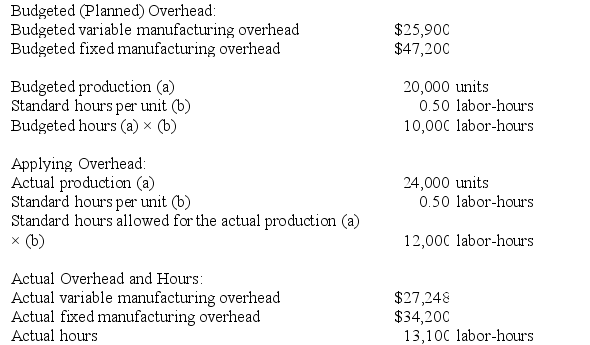

Warrenfeltz Incorporated makes a single product--a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

a. Compute the variable component of the company's predetermined overhead rate.

b. Compute the fixed component of the company's predetermined overhead rate.

c. Compute the company's predetermined overhead rate.

d. Determine the variable overhead rate variance for the year.

e. Determine the variable overhead efficiency variance for the year.

f. Determine the fixed overhead budget variance for the year.

g. Determine the fixed overhead volume variance for the year.

Required:

a. Compute the variable component of the company's predetermined overhead rate.

b. Compute the fixed component of the company's predetermined overhead rate.

c. Compute the company's predetermined overhead rate.

d. Determine the variable overhead rate variance for the year.

e. Determine the variable overhead efficiency variance for the year.

f. Determine the fixed overhead budget variance for the year.

g. Determine the fixed overhead volume variance for the year.

a. Variable component of the predetermined overhead rate = $35,125/12,500 labor-hours

= $2.81 per labor-hour

b. Fixed component of the predetermined overhead rate = $90,875/12,500 labor-hours

= $7.27 per labor-hour

c. Predetermined overhead rate = $126,000/12,500 labor-hours = $10.08 per labor-hour

d. Variable overhead rate variance = (AH × AR) − (AH × SR)

= ($26,536) − (10,700 labor-hours × $2.81 per labor-hour)

= ($26,536) − ($30,067)

= $3,531 F

e. Variable overhead efficiency variance = (AH − SH) × SR

= (10,700 labor-hours − 11,500 labor-hours) × $2.81 per labor-hour

= (-800 labor-hours) × $2.81 per labor-hour

= $2,248 F

f. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $71,875 − $90,875 = $19,000 F

g. Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $90,875 − ($7.27 per labor-hour × 11,500 labor-hours)

= $90,875 − ($83,605)

= $7,270 U

or

Volume variance = Fixed component of the predetermined overhead rate x (Denominator hours − Standard hours allowed for the actual output)

= $7.27 per labor-hour x (12,500 labor-hours − 11,500 labor-hours)

= $7.27 per labor-hour x (12,500 labor-hours − 11,500 labor-hours)

= $7.27 per labor-hour x (1,000 hours)

= $7,270 U

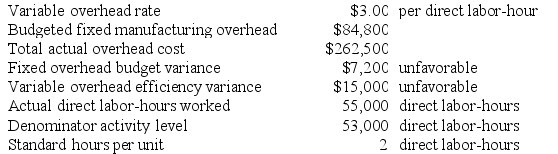

You have just been hired as the controller of the Eastern Division of Global Manufacturing. Performance records for last year are incomplete, with only the following data available:

Required:

Prepare a complete analysis of manufacturing overhead for the past year. Indicate actual, standard, and denominator activity levels; variable overhead rate and efficiency variances; and fixed manufacturing overhead budget and volume variances.

Required:

Prepare a complete analysis of manufacturing overhead for the past year. Indicate actual, standard, and denominator activity levels; variable overhead rate and efficiency variances; and fixed manufacturing overhead budget and volume variances.

Budgeted fixed overhead rate = Fixed overhead ÷ Denominator quantity

= $84,800 ÷ 53,000 direct labor-hours

= $1.60 per direct labor-hour

Actual fixed manufacturing overhead = Budgeted fixed manufacturing overhead + Budget variance

= $84,800 + $7,200

= $92,000

Actual variable overhead = Total actual overhead − Actual fixed manufacturing overhead

= $262,500 − $92,000

= $170,500

Actual variable overhead rate = Actual variable overhead ÷ Actual hours

= $170,500 ÷ 55,000 direct labor-hours

= $3.10 per direct labor-hour

Rate variance = AH (AR − SR)

= 55,000 hours ($3.10 per hour − $3.00 per hour)

= $5,500 U

SH × SR = AH × SR − overhead efficiency variance

= 55,000 hours × $3.00 per hour − $15,000

= $150,000

Standard hours allowed = (SH × SR) ÷ SR

= $150,000 ÷ $3.00 per direct labor-hour

= 50,000 direct labor-hours

Actual units produced = Standard hours allowed ÷ Standard hours per unit

= 50,000 hours ÷ 2 hours per unit

= 25,000 units

Volume variance = Budgeted fixed − (SH × SR)

= $84,800 − (50,000 hours × $1.60 per hour)

= $84,800 − $80,000

= $4,800 U

Summary:

At the beginning of last year, Tarind Corporation budgeted $75,000 of fixed manufacturing overhead and chose a denominator level of activity of 150,000 machine-hours. At the end of the year, Tari's fixed manufacturing overhead budget variance was $2,250 favorable. Its fixed manufacturing overhead volume variance was $3,750 favorable. Actual direct labor-hours for the year were 156,250. What was Tari's total standard machine-hours allowed for last year's output?

A manufacturing company has a standard costing system based on standard direct labor-hours (DLHs) as the measure of activity. Data from the company's flexible budget for manufacturing overhead are given below:  The following data pertain to operations for the most recent period:

The following data pertain to operations for the most recent period:

What was the variable overhead efficiency variance for the period to the nearest dollar?

What was the variable overhead efficiency variance for the period to the nearest dollar?

Alapai Corporation has a standard cost system in which it applies manufacturing overhead to products on the basis of standard machine-hours (MHs). The company has provided the following data for the most recent month:  What was the total of the variable overhead rate and fixed manufacturing overhead budget variances for the month?

What was the total of the variable overhead rate and fixed manufacturing overhead budget variances for the month?

There can be no volume variance for variable manufacturing overhead.

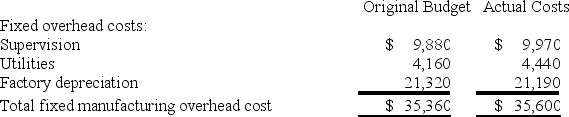

Modine Corporation has provided the following data for September.

Required:

a. Compute the budget variance for September. Show your work!

b. Compute the volume variance for September. Show your work!

Required:

a. Compute the budget variance for September. Show your work!

b. Compute the volume variance for September. Show your work!

Hoag Corporation applies manufacturing overhead to products on the basis of standard machine-hours. Budgeted and actual fixed manufacturing overhead costs for the most recent month appear below:  The company based its original budget on 2,600 machine-hours. The company actually worked 2,280 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 2,080 machine-hours. What was the overall fixed manufacturing overhead volume variance for the month?

The company based its original budget on 2,600 machine-hours. The company actually worked 2,280 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 2,080 machine-hours. What was the overall fixed manufacturing overhead volume variance for the month?

Arca Incorporated makes a single product-a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:  The variable overhead efficiency variance is:

The variable overhead efficiency variance is:

A manufacturing company has a standard costing system based on standard direct labor-hours (DLHs) as the measure of activity. Data from the company's flexible budget for manufacturing overhead are given below:  The following data pertain to operations for the most recent period:

The following data pertain to operations for the most recent period:

The variable overhead rate variance for the period was closest to:

The variable overhead rate variance for the period was closest to:

Arca Incorporated makes a single product-a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:  The fixed overhead volume variance is:

The fixed overhead volume variance is:

A company has a standard cost system in which fixed and variable manufacturing overhead costs are applied to products on the basis of direct labor-hours. A fixed manufacturing overhead volume variance will necessarily occur in a month in which actual direct labor-hours differ from standard hours allowed.

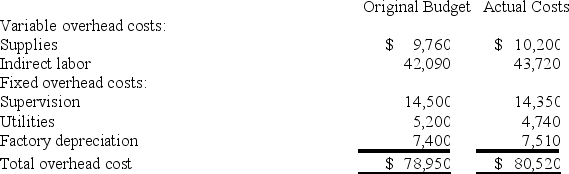

Mclellan Corporation applies manufacturing overhead to products on the basis of standard machine-hours. Budgeted and actual overhead costs for the month appear below:  The company based its original budget on 6,100 machine-hours. The company actually worked 6,480 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 6,370 machine-hours. What was the overall fixed manufacturing overhead budget variance for the month?

The company based its original budget on 6,100 machine-hours. The company actually worked 6,480 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 6,370 machine-hours. What was the overall fixed manufacturing overhead budget variance for the month?

A company has a standard cost system in which fixed and variable manufacturing overhead costs are applied to products on the basis of direct labor-hours. A fixed manufacturing overhead volume variance will necessarily occur in a month in which the fixed manufacturing overhead applied to units of product on the basis of standard hours allowed differs from the budgeted fixed manufacturing overhead.

Brister Incorporated has provided the following data concerning its overhead variances for the most recent period:  The total manufacturing overhead is underapplied or overapplied by how much?

The total manufacturing overhead is underapplied or overapplied by how much?

Pearlman Incorporated makes a single product--an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

a. Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

Required:

a. Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

Fabert Incorporated makes a single product--a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

a. Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

Required:

a. Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

A manufacturing company has a standard costing system based on standard direct labor-hours (DLHs) as the measure of activity. Data from the company's flexible budget for manufacturing overhead are given below:  The following data pertain to operations for the most recent period:

The following data pertain to operations for the most recent period:

The overhead applied to products during the period was closest to:

The overhead applied to products during the period was closest to:

Dapice Incorporated makes a single product-a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:  The fixed overhead volume variance is:

The fixed overhead volume variance is:

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)