Exam 4: Completing the Accounting Cycle and Classifying Accounts

Exam 1: Accounting in Business242 Questions

Exam 2: Analyzing and Recording Transactions137 Questions

Exam 3: Adjusting Accounts for Financial Statements205 Questions

Exam 4: Completing the Accounting Cycle and Classifying Accounts140 Questions

Exam 5: Accounting for Merchandising Activities129 Questions

Exam 6: Inventory Costing and Valuation149 Questions

Exam 7: Internal Control and Cash142 Questions

Exam 8: Receivables147 Questions

Exam 9: Property, Plant and Equipment Intangibles203 Questions

Exam 10: Payroll Liabilities61 Questions

Exam 11: Accounting Information Systems102 Questions

Select questions type

Explain the current ratio. Describe how it is used to evaluate a company.

Free

(Essay)

4.8/5  (47)

(47)

Correct Answer:

The current ratio is current assets divided by current liabilities. It is used to evaluate a company's ability to pay its current debts with the amount of current assets available.

The third closing entry is to close Withdrawals to Income Summary.

Free

(True/False)

4.8/5  (24)

(24)

Correct Answer:

False

Below is an alphabetical listing of General Ledger accounts with identifying numbers for Scott's Suntanning Parlour. Indicate the accounts debited and credited in each of the following transactions by placing the proper account identifying number(s) in the columns to the right of each transaction.

1. Accounts Payable 10. Prepaid Insurance 2. Accounts Receivable 11 Rent Expense 3. Accum depreciation, Suntan Equip 12. Salaries Expense 4. Cash 13. Salaries Payable 5.Depreciation expense, Suntan Equip 14. Suntaining Equipment 6.Income Summary 15. Suntanning Revenue 7. Insurance Expense 16. Scott Smith, Capital 8.Office Supplies 17. Scott Smith, Withdrawals 9.Office Supplies Expense Debit Credit (a) Invested suntanning equipment and cash in a suntanning business. - - (b) Rented a store and paid rent for one month. - - (c) Paid the premium on a two-year insurance policy. - - (d) Purchased office supplies for cash and recorded an asset - - (e) Rendered services to clients for cash - - (f) Scott Smith withdrew cash from the business for personal use. - - (g) Rendered services to clients on account. - - (h) Paid salaries. - - (i) Made an adjusting entry to record expired insurance. - - (j) Made an adjusting entry to record accrued salaries. - - (k) Made an adjusting entry to record office supplies used. - - (l) Made an adjusting entry to record depreciation on suntanning equipment. - - (m) Closed the Income Summary account, which reflected a net loss. - - (n) Closed the owner's withdrawals account. - -

Free

(Essay)

4.7/5  (32)

(32)

Correct Answer:

The income summary has a zero balance after which step in the closing process

(Multiple Choice)

4.8/5  (47)

(47)

The closing process is a two-step process. First revenue, expense, and withdrawals are set to zero balance. Second, the process summarizes a period's assets and expenses.

(True/False)

4.8/5  (25)

(25)

Journal entries recorded at the end of each accounting period to prepare the revenue, expense, and withdrawals accounts for the upcoming year and to update the owner's capital account for the events of the year just finished are

(Multiple Choice)

4.9/5  (46)

(46)

Reversing entries are prepared to adjust accrued assets and liabilities that were created by adjusting entries at the end of the previous reporting period.

(True/False)

4.9/5  (36)

(36)

A trial balance prepared after the adjusting and closing entries have been posted, and which is the final step in the accounting cycle, is a(n)

(Multiple Choice)

4.9/5  (29)

(29)

Closing entries are normally entered in the General Journal and then recorded on the work sheet.

(True/False)

4.7/5  (26)

(26)

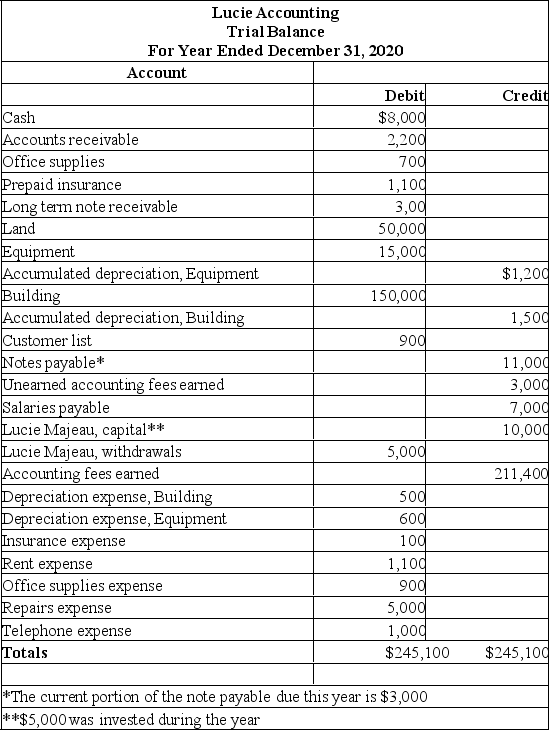

Below is the year-end adjusted trial balance for Lucie Accounting.

-Using the information from Lucie Accounting (Ref 4-137), calculate the current ratio.

-Using the information from Lucie Accounting (Ref 4-137), calculate the current ratio.

(Essay)

4.7/5  (26)

(26)

Property, plant and equipment and intangible assets are non-current assets used to produce or sell products and services.

(True/False)

4.8/5  (40)

(40)

Closing entries accomplish the goal of reflecting revenues and expenses in the owner's capital account.

(True/False)

4.8/5  (42)

(42)

(A) In a sole proprietorship, Income Summary is closed to what account? (B) In following the steps of the accounting cycle, what two steps must be done before preparation of an unadjusted trial balance?

(Essay)

4.8/5  (40)

(40)

A company had revenues of $75,000, withdrawals of $10,000 and expenses of $62,000 during an accounting period. Which of the following entries should not be journalized in the closing process?

(Multiple Choice)

4.7/5  (30)

(30)

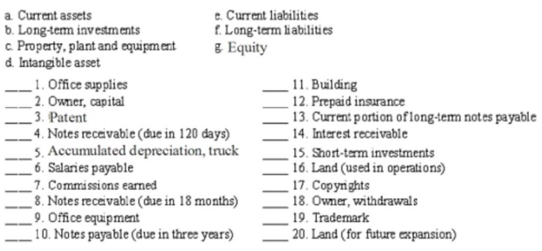

In the blank space beside each numbered item, enter the letter of its balance sheet classification. If the item should not appear on the balance sheet, enter "z" in the blank.

(Essay)

4.9/5  (27)

(27)

Given the following accounts and their adjusted balances before closing entries are posted, what amount will be posted to Bessie Cool, Capital in the process of closing the Income Summary account? Assume all accounts have normal balances. Bessie Cool, capital \ 7,000 Bessie Cool, withdrawals 9,600 Service Revenue 35,500 Rent expense 3,600 Salaries expense 7,200 Insurarace expense 920 Depreciation experse, equip. 500 Accumulated depreciation, equipment. 1,500

(Multiple Choice)

4.8/5  (29)

(29)

Showing 1 - 20 of 140

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)