Exam 2: A Review of the Accounting Cycle

Exam 1: Financial Reporting86 Questions

Exam 2: A Review of the Accounting Cycle94 Questions

Exam 3: The Balance Sheet and Notes to the Financial Statements72 Questions

Exam 4: The Income Statement82 Questions

Exam 5: Statement of Cash Flows and Articulation79 Questions

Exam 6: Earnings Management46 Questions

Exam 7: The Revenuereceivablescash Cycle81 Questions

Exam 8: Revenue Recognition74 Questions

Exam 9: Inventory and Cost of Goods Sold121 Questions

Exam 10: Investments in Noncurrent Operating Assets-Acquisition88 Questions

Exam 11: Investments in Noncurrent Operating Assets-Utilization and Retirement84 Questions

Exam 12: Debt Financing103 Questions

Exam 13: Equity Financing88 Questions

Exam 14: Investments in Debt and Equity Securities81 Questions

Exam 15: Leases80 Questions

Exam 16: Income Taxes77 Questions

Exam 17: Employee Compensation-Payroll, Pensions, Other Comp Issues78 Questions

Exam 19: Derivatives, Contingencies, Business Segments, and Interim Reports79 Questions

Exam 20: Accounting Changes and Error Corrections74 Questions

Exam 21: Statement of Cash Flows Revisited61 Questions

Exam 22: Accounting in a Global Market60 Questions

Exam 23: Analysis of Financial Statements57 Questions

Select questions type

Thompson Company sublet a portion of its office space for ten years at an annual rental of $36,000, beginning on May 1. The tenant is required to pay one year's rent in advance, which Thompson recorded as a credit to Rental Income. Thompson reports on a calendar-year basis. The adjustment on December 31 of the first year should be

(Multiple Choice)

4.8/5  (34)

(34)

At the beginning of the fiscal year, office supplies inventory amounted to $600. During the year, office supplies amounting to $8,800 were purchased. This amount was debited to office supplies expense. An inventory of office supplies at the end of the fiscal year showed $400 of supplies remaining. The beginning of the year balance is still reflected in the office supplies inventory account. What is the required amount of the adjustment to the office supplies expense account?

(Multiple Choice)

5.0/5  (35)

(35)

On June 30, a company paid $3,600 for insurance premiums for the current year and debited the amount to Prepaid Insurance. At December 31, the bookkeeper forgot to record the amount expired. The omission has the following effect on the financial statements prepared December 31:

(Multiple Choice)

5.0/5  (38)

(38)

Failure to record depreciation expense at the end of an accounting period results in

(Multiple Choice)

4.8/5  (47)

(47)

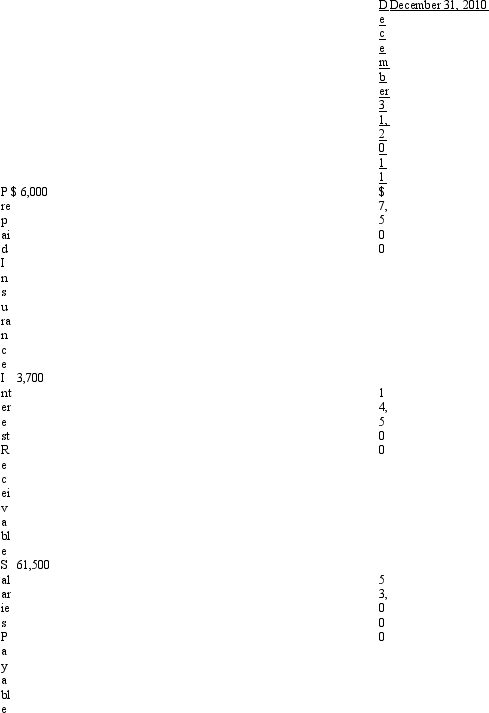

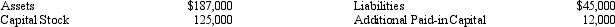

The following balances have been excerpted from Edwards' balance sheets:

Edwards Company paid or collected during 2011 the following items:

Edwards Company paid or collected during 2011 the following items:

The insurance expense on the income statement for 2011 was

The insurance expense on the income statement for 2011 was

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following criteria must be met before an event should be recorded for accounting purposes?

(Multiple Choice)

4.8/5  (32)

(32)

On March 1, 2010, Forest Co. borrowed cash and signed a 36-month, interest-bearing note on which both the principal and interest are payable on February 28, 2013. At December 31, 2013, the liability for accrued interest should be

(Multiple Choice)

4.7/5  (35)

(35)

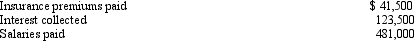

Caddis Co. had these unadjusted account balances on December 31, 2011:

Assuming that the ending inventory is $88,400, prepare the entry to adjust the inventory accounts.

Assuming that the ending inventory is $88,400, prepare the entry to adjust the inventory accounts.

(Essay)

4.8/5  (32)

(32)

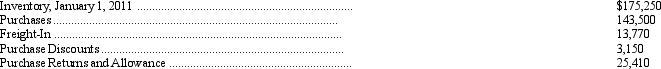

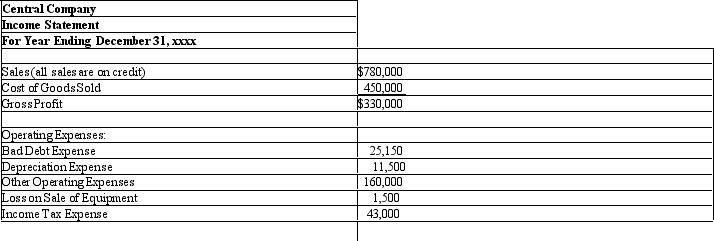

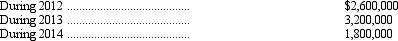

The following information is available for the Central Company:

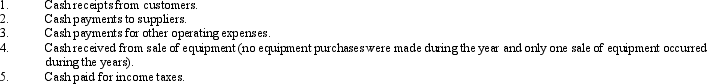

Determine the amount of cash flow associated with each of the following items:

Determine the amount of cash flow associated with each of the following items:

(Essay)

4.8/5  (35)

(35)

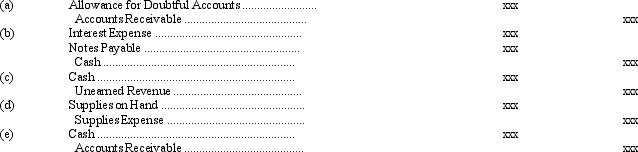

For each of the journal entries below, write a description of the underlying event. Assume that for prepaid expenses original debits are made to an expense account.

(Essay)

4.8/5  (37)

(37)

Teller Inc. reported an allowance for doubtful accounts of $30,000 (credit) at December 31, 2011, before performing an aging of accounts receivable. As a result of the aging, Teller Inc. determined that an estimated $52,000 of the December 31, 2011, accounts receivable would prove uncollectible. The adjusting entry required at December 31, 2011, would be

(Multiple Choice)

4.8/5  (38)

(38)

Ryan Company purchased a machine on July 1, 2011. The machine cost $250,000 and has a salvage value of $10,000 and a useful life of eight years. The adjusting entry for the year ending December 31, 2012, would include a debit to Depreciation Expense of

(Multiple Choice)

4.9/5  (27)

(27)

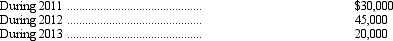

Chips-n-Bits Company sells service contracts for personal computers. The service contracts are for a one-year, two-year, or three-year period. All sales are for cash and all receipts are credited to Unearned Service Contract Revenues. This account had a balance of $144,000 at December 31, 2010, before year-end adjustment. Service contract costs are charged as incurred to the Service Contract Expense account, which had a balance of $36,000 at December 31, 2010. Service contracts still outstanding at December 31, 2010, expire as follows:

What amount should be reported as unearned service contract revenues in Chips-n-Bits December 31, 2010, balance sheet?

What amount should be reported as unearned service contract revenues in Chips-n-Bits December 31, 2010, balance sheet?

(Multiple Choice)

4.9/5  (38)

(38)

Kite Company paid $24,900 in insurance premiums during 2011. Kite showed $3,600 in prepaid insurance on its December 31, 2011, balance sheet and $4,500 on December 31, 2010. The insurance expense on the income statement for 2011 was

(Multiple Choice)

4.9/5  (41)

(41)

The following is a summary of the increases in the account categories of the balance sheet of Riley Company for the most recent fiscal year:

The only change to retained earnings during the fiscal year was for $20,000 of dividends. What was the company's net income for the fiscal year?

The only change to retained earnings during the fiscal year was for $20,000 of dividends. What was the company's net income for the fiscal year?

(Multiple Choice)

4.8/5  (34)

(34)

On August 1 of the current year, Kyle Company borrowed $278,000 from the local bank. The loan was for 12 months at 9 percent interest payable at the maturity date. The adjusting entry at the end of the fiscal year relating to this obligation would include a

(Multiple Choice)

4.8/5  (40)

(40)

Winston Company sells magazine subscriptions for one- to three-year subscription periods. Cash receipts from subscribers are credited to Magazine Subscriptions Collected in Advance, and this account had a balance of $9,600,000 at December 31, 2011, before year-end adjustment. Outstanding subscriptions at December 31, 2011, expire as follows:

In its December 31, 2011, balance sheet, what amount should Winston report as the balance for magazine subscriptions collected in advance?

In its December 31, 2011, balance sheet, what amount should Winston report as the balance for magazine subscriptions collected in advance?

(Multiple Choice)

4.9/5  (40)

(40)

Showing 41 - 60 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)