Exam 16: Using Present Value to Make Multi-Period Managerial Decisions

Exam 1: Managerial Economics and Decision Making90 Questions

Exam 2: Demand and Supply207 Questions

Exam 3: Measuring and Using Demand124 Questions

Exam 4: Production and Costs138 Questions

Exam 5: Perfect Competition120 Questions

Exam 6: Monopoly and Monopolistic Competition149 Questions

Exam 7: Cartels and Oligopoly114 Questions

Exam 8: Game Theory and Oligopoly100 Questions

Exam 9: A Managers Guide to Antitrust Policy175 Questions

Exam 10: Advanced Pricing Decisions120 Questions

Exam 11: Decisions About Vertical Integration and Distribution113 Questions

Exam 12: Decisions About Production, Products, and Location175 Questions

Exam 13: Marketing Decisions: Advertising and Promotion175 Questions

Exam 14: Business Decisions Under Uncertainty200 Questions

Exam 15: Managerial Decisions About Information137 Questions

Exam 16: Using Present Value to Make Multi-Period Managerial Decisions106 Questions

Select questions type

All of the following will lead to a smaller discount factor except which one?

(Multiple Choice)

4.9/5  (39)

(39)

A make- or- buy decision examines whether a manager should incur - period costs in order to produce _______in the ________ period(s).

(Multiple Choice)

4.8/5  (42)

(42)

Depreciation allowance _________ the profit subject to taxation, which_______ the amount of tax the firm pays.

(Multiple Choice)

4.8/5  (38)

(38)

Super Haulers is a hauling company and delivers large and heavy materials to construction job sites. Super Haulers is considering purchasing a new dump truck that costs $200,000 and the managers of Super Haulers have estimated that the new dump truck will generate $50,000 a year in future operating profit for the next four years. At the end of four years, Super Haulers can sell the dump truck at a salvage price of $26,000. If the discount rate is 6 percent, what is the net present value of the dump truck?

(Multiple Choice)

4.9/5  (36)

(36)

When costs occur in the future, the_______the costs occurs, the _ _______it is discounted and the negative effect it has on the net present value.

(Multiple Choice)

4.7/5  (40)

(40)

When profits occur in the future, the the profit occurs, the it is discounted and the positive effect it has on the net present value.

(Multiple Choice)

4.8/5  (45)

(45)

All else equal, if a firm needs a small quantity of an input, it is likely to be cost saving for the firm to make the input.

(True/False)

4.9/5  (33)

(33)

Production of a small quantity of an input is often _______as firms typically _______able to enjoy economies of scale.

(Multiple Choice)

4.8/5  (28)

(28)

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of e the respective years.

-Refer to the table above. If the discount rate is 4 percent and the cost of the investment is $40,000, what is the net present value of the investment?

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of e the respective years.

-Refer to the table above. If the discount rate is 4 percent and the cost of the investment is $40,000, what is the net present value of the investment?

(Multiple Choice)

4.8/5  (34)

(34)

What is the present value of four payments of $5,000 at the end of each of the next four years if the interest rate is 2 percent?

(Multiple Choice)

4.8/5  (41)

(41)

Interest earned on funds compounds because in future years, interest is earned on _______.

(Multiple Choice)

4.9/5  (34)

(34)

Health Bars is considering a two- year advertising campaign. The campaign will cost $60,000 at the end of each of the two years. The managers of Health Bars have estimated that the campaign will generate $42,000 a year in additional profit for the next three years. If the discount rate is 4 percent, what is the net present value of the advertising campaign?

(Multiple Choice)

4.8/5  (33)

(33)

If the present value of an individual's savings account is $52,354, what is its future value in 3 years if the account earns an annual interest rate of 8 percent?

(Multiple Choice)

4.8/5  (43)

(43)

If the salvage value is positive the net present value of an investment_______ and this_______ the likelihood that managers will undertake the project.

(Multiple Choice)

5.0/5  (43)

(43)

Economists consider economic depreciation to be the_______ in market value from the use of the capital and measure this use in terms of _______cost.

(Multiple Choice)

4.8/5  (39)

(39)

The annuity factor_______ by the amount of the annual payment equals the _______value of payments for the specified number of years at the specified discount rate.

(Multiple Choice)

4.8/5  (38)

(38)

Financing an investment with debt _______the net present value of the investment because interest payments_______ tax deductible and the full amount of the principal is due in .

(Multiple Choice)

4.9/5  (36)

(36)

If the net present value is positive, the present value of the investment's stream of future operating profits is ________ than the present value of its cost and profit- maximizing managers_______ make the investment.

(Multiple Choice)

4.8/5  (34)

(34)

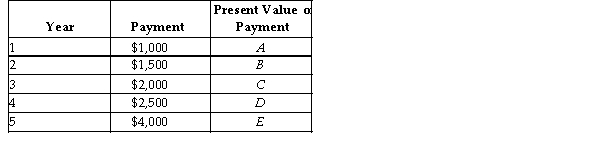

The above table shows a 5 year payment plan. Each payment is made at the end of the year, so after one year, a payment of $ made, after two years another payment of $1,500 is made and so on. The interest rate is 3 percent.

-Refer to the table above. What is the value of A plus B plus C (A + B +C)or the present value of the first three payments?

The above table shows a 5 year payment plan. Each payment is made at the end of the year, so after one year, a payment of $ made, after two years another payment of $1,500 is made and so on. The interest rate is 3 percent.

-Refer to the table above. What is the value of A plus B plus C (A + B +C)or the present value of the first three payments?

(Multiple Choice)

4.8/5  (28)

(28)

The greater the interest rate, the_______ _ the present value and the _________ the discount factor.

(Multiple Choice)

4.9/5  (46)

(46)

Showing 41 - 60 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)