Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model

Exam 1: The Corporation38 Questions

Exam 2: Introduction to Financial Statement Analysis103 Questions

Exam 3: Financial Decision Making and the Law of One Price89 Questions

Exam 4: The Time Value of Money91 Questions

Exam 5: Interest Rates68 Questions

Exam 6: Valuing Bonds115 Questions

Exam 7: Investment Decision Rules86 Questions

Exam 8: Fundamentals of Capital Budgeting95 Questions

Exam 9: Valuing Stocks96 Questions

Exam 10: Capital Markets and the Pricing of Risk103 Questions

Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model134 Questions

Exam 12: Estimating the Cost of Capital104 Questions

Exam 13: Investor Behavior and Capital Market Efficiency77 Questions

Exam 14: Capital Structure in a Perfect Market99 Questions

Exam 15: Debt and Taxes97 Questions

Exam 16: Financial Distress,managerial Incentives,and Information111 Questions

Exam 17: Payout Policy96 Questions

Exam 18: Capital Budgeting and Valuation With Leverage99 Questions

Exam 19: Valuation and Financial Modeling: a Case Study49 Questions

Exam 20: Financial Options57 Questions

Exam 21: Option Valuation42 Questions

Exam 22: Real Options64 Questions

Exam 23: Raising Equity Capital51 Questions

Exam 24: Debt Financing54 Questions

Exam 25: Leasing46 Questions

Exam 26: Working Capital Management47 Questions

Exam 27: Short-Term Financial Planning47 Questions

Exam 28: Mergers and Acquisitions59 Questions

Exam 29: Corporate Governance46 Questions

Exam 30: Risk Management53 Questions

Exam 31: International Corporate Finance48 Questions

Select questions type

Use the information for the question(s)below.

Sisyphean industries is seeking to raise capital from a large group of investors to fund a new project.Suppose that the efficient portfolio has an expected return of 14% and a volatility of 20%.Sisyphean's new project is expected to have a volatility of 40% and a 70% correlation with the efficient portfolio.The risk-free rate is 4%.

-The required return for Sisyphean's new project is closest to:

(Multiple Choice)

4.9/5  (46)

(46)

Use the table for the question(s)below.

Consider the following expected returns,volatilities,and correlations:  -The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to:

-The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to:

(Multiple Choice)

4.9/5  (48)

(48)

Suppose you have $10,000 in cash to invest.You decide to sell short $5000 worth of Kinston stock and invest the proceeds from your short sale,plus your $10,000 into one-year U.S.treasury bills earning 5%.At the end of the year,you decide to liquidate your portfolio.Kinston Industries has the following realized returns:  The return on your portfolio is closest to:

The return on your portfolio is closest to:

(Multiple Choice)

4.7/5  (31)

(31)

Use the table for the question(s)below.

Consider the following returns:  -The Volatility on Stock Y's returns is closest to:

-The Volatility on Stock Y's returns is closest to:

(Multiple Choice)

4.9/5  (39)

(39)

Suppose over the next year Ball Corporation has a return of 12.5%,Lowes Companies has a return of 20%,and Abbott Labs has a return of -10%.The weight on Lowes Companies in your portfolio after one year is closest to:

(Multiple Choice)

4.8/5  (34)

(34)

Use the information for the question(s)below.

Suppose that the risk-free rate is 5% and the market portfolio has an expected return of 13% with a volatility of 18%.Monsters Inc.has a 24% volatility and a correlation with the market of .60,while California Gold Mining has a 32% volatility and a correlation with the market of -.7.Assume the CAPM assumptions hold.

-California Gold Mining's beta with the market is closest to:

(Multiple Choice)

4.9/5  (41)

(41)

Use the following information to answer the question(s)below.  The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The expected return for Wyatt Oil is closest to:

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The expected return for Wyatt Oil is closest to:

(Multiple Choice)

4.7/5  (31)

(31)

Use the information for the question(s)below.

Suppose you invest $20,000 by purchasing 200 shares of Abbott Labs (ABT)at $50 per share,200 shares of Lowes Companies,Inc.(LOW)at $30 per share,and 100 shares of Ball Corporation (BLL)at $40 per share.

-The weight on Lowes in your portfolio is:

(Multiple Choice)

4.8/5  (39)

(39)

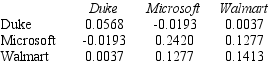

Use the table for the question(s)below.

Consider the following covariances between securities:  -The variance on a portfolio that is made up of equal investments in Duke Energy and Microsoft stock is closest to:

-The variance on a portfolio that is made up of equal investments in Duke Energy and Microsoft stock is closest to:

(Multiple Choice)

4.8/5  (31)

(31)

Use the information for the question(s)below.

Tom's portfolio consists solely of an investment in Merck stock.Merck has an expected return of 13% and a volatility of 25%.The market portfolio has an expected return of 12% and a volatility of 18%.The risk-free rate is 4%.Assume that the CAPM assumptions hold in the market.

-Assuming that Tom wants to maintain the current expected return on his portfolio,then the amount that Tom should invest in the market portfolio to minimize his volatility is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

Use the following information to answer the question(s)below.

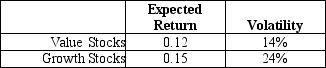

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio): growth stocks and value stocks.Assume that these two portfolios are equal in size (market value),the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

Use the information for the question(s)below.

Suppose you have $10,000 in cash and you decide to borrow another $10,000 at a 6% interest rate to invest in the stock market.You invest the entire $20,000 in an exchange traded fund (ETF)with a 12% expected return and a 20% volatility.

-The expected return on your investment is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

Use the information for the question(s)below.

You are presently invested in the Luther Fund,a broad-based mutual fund that invests in stocks and other securities.The Luther Fund has an expected return of 14% and a volatility of 20%.Risk-free Treasury bills are currently offering returns of 4%.You are considering adding a precious metals fund to your current portfolio.The metals fund has an expected return of 10%,a volatility of 30%,and a correlation of -.20 with the Luther Fund.

-The beta of the precious metals fund with the Luther Fund  is closest to:

is closest to:

(Multiple Choice)

4.7/5  (34)

(34)

Use the information for the question(s)below.

You are presently invested in the Luther Fund,a broad-based mutual fund that invests in stocks and other securities.The Luther Fund has an expected return of 14% and a volatility of 20%.Risk-free Treasury bills are currently offering returns of 4%.You are considering adding a precious metals fund to your current portfolio.The metals fund has an expected return of 10%,a volatility of 30%,and a correlation of -.20 with the Luther Fund.

-Will adding the precious metals fund improve your portfolio?

(Essay)

4.9/5  (42)

(42)

Consider a portfolio consisting of only Microsoft and Walmart stock.Calculate the expected return on such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%,and 100%

(Essay)

4.7/5  (35)

(35)

Which of the following is NOT an assumption used in deriving the Capital Asset Pricing Model (CAPM)?

(Multiple Choice)

4.7/5  (45)

(45)

Use the information for the question(s)below.

Suppose that the risk-free rate is 5% and the market portfolio has an expected return of 13% with a volatility of 18%.Monsters Inc.has a 24% volatility and a correlation with the market of .60,while California Gold Mining has a 32% volatility and a correlation with the market of -.7.Assume the CAPM assumptions hold.

-Suppose that California Gold Mining's expected return is 2%.Then California Gold Mining's alpha is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Use the table for the question(s)below.

Consider the following covariances between securities:  -The variance on a portfolio that is made up of a $6000 investment in Microsoft and a $4000 investment in Walmart stock is closest to:

-The variance on a portfolio that is made up of a $6000 investment in Microsoft and a $4000 investment in Walmart stock is closest to:

(Essay)

4.8/5  (31)

(31)

Showing 101 - 120 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)