Exam 9: An Introduction to Basic Macroeconomic Markets

Exam 1: The Economic Approach164 Questions

Exam 2: Some Tools of the Economist200 Questions

Exam 3: Demand, Supply, and the Market Process336 Questions

Exam 4: Supply and Demand: Applications and Extensions254 Questions

Exam 5: Difficult Cases for the Market, and the Role of Government130 Questions

Exam 6: The Economics of Political Action154 Questions

Exam 7: Taking the Nations Economic Pulse214 Questions

Exam 8: Economic Fluctuations, Unemployment, and Inflation174 Questions

Exam 9: An Introduction to Basic Macroeconomic Markets219 Questions

Exam 10: Dynamic Change, Economic Fluctuations, and the Ad-As Model189 Questions

Exam 11: Fiscal Policy: the Keynesian View and the Historical Development of Macroeconomics109 Questions

Exam 12: Fiscal Policy, Incentives, and Secondary Effects146 Questions

Exam 13: Money and the Banking System209 Questions

Exam 14: Modern Macroeconomics and Monetary Policy192 Questions

Exam 15: Stabilization Policy, Output, and Employment148 Questions

Exam 16: Creating an Environment for Growth and Prosperity120 Questions

Exam 17: Institutions, Policies, and Cross-Country Differences in Income and Growth111 Questions

Exam 18: Gaining From International Trade170 Questions

Exam 19: International Finance and the Foreign Exchange Market148 Questions

Select questions type

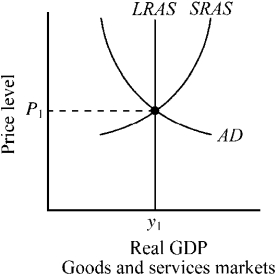

Use the figure below to answer the following question(s).

Figure 9-2  -The economy depicted in Figure 9-2 is experiencing

-The economy depicted in Figure 9-2 is experiencing

(Multiple Choice)

4.7/5  (34)

(34)

When equilibrium is present in the foreign exchange market, which of the following will tend to be in balance?

(Multiple Choice)

4.9/5  (36)

(36)

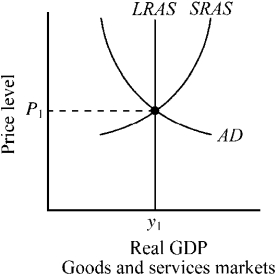

Use the figure below to answer the following question(s).

Figure 9-2  -The economy depicted in Figure 9-2 is

-The economy depicted in Figure 9-2 is

(Multiple Choice)

4.8/5  (35)

(35)

If the dollar price of the English pound goes from $1.50 to $1.20, the dollar has

(Multiple Choice)

4.9/5  (34)

(34)

You just bought a $1,000 bond that is scheduled to mature in ten years. If interest rates rise during the next six months, the market value (or price) of your bond will

(Multiple Choice)

4.9/5  (34)

(34)

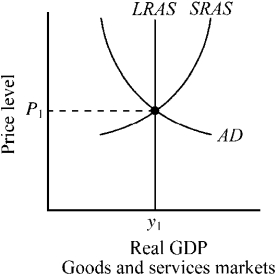

Use the figure below to answer the following question(s).

Figure 9-2  -Which of the following is true for the economy depicted in Figure 9-2?

-Which of the following is true for the economy depicted in Figure 9-2?

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following would generate a supply of euros in exchange for dollars?

(Multiple Choice)

4.9/5  (28)

(28)

If the price level in the current period is lower than what buyers and sellers anticipated,

(Multiple Choice)

4.9/5  (40)

(40)

If for some reason Americans wished to purchase more foreign assets, then other things the same

(Multiple Choice)

4.7/5  (32)

(32)

The actual rate of unemployment will be greater than the natural rate of unemployment when

(Multiple Choice)

4.7/5  (36)

(36)

If expected inflation is constant, then when the nominal interest rate increases, the real interest rate

(Multiple Choice)

4.8/5  (30)

(30)

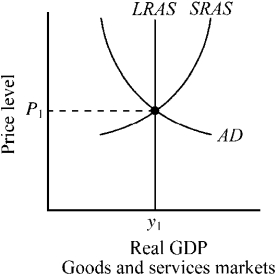

Use the figure below to answer the following question(s).

Figure 9-2  -Figure 9-2 indicates that the output of the economy, y1, is

-Figure 9-2 indicates that the output of the economy, y1, is

(Multiple Choice)

4.7/5  (33)

(33)

If expected inflation is constant, then when the nominal interest rate falls, the real interest rate

(Multiple Choice)

4.9/5  (34)

(34)

The potential output of an economy is the level of output produced when the

(Multiple Choice)

4.8/5  (28)

(28)

An unanticipated increase in the level of prices in the goods and services market, which results in a temporary reduction in real wage rates, will

(Multiple Choice)

4.8/5  (29)

(29)

You put money into an account. One year later you see that you have 6 percent more dollars and that your money will buy 2 percent more goods.

(Multiple Choice)

4.9/5  (36)

(36)

As the U.S. price level rises relative to price levels in other countries, what would happen in the U.S.?

(Multiple Choice)

4.9/5  (37)

(37)

In the AD/AS model, the aggregate demand for goods and services is composed of the purchases made by

(Multiple Choice)

4.9/5  (41)

(41)

In the short run, a price increase in the goods and services market will

(Multiple Choice)

4.8/5  (36)

(36)

Showing 121 - 140 of 219

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)