Exam 6: Fundamentals of Product and Service Costing

Exam 1: Cost Accounting: Information for Decision Making145 Questions

Exam 2: Cost Concepts and Behavior153 Questions

Exam 3: Fundamentals of Cost-Volume-Profit Analysis161 Questions

Exam 4: Fundamentals of Cost Analysis for Decision Making150 Questions

Exam 5: Cost Estimation131 Questions

Exam 6: Fundamentals of Product and Service Costing150 Questions

Exam 7: Job Costing159 Questions

Exam 8: Process Costing153 Questions

Exam 9: Activity-Based Costing153 Questions

Exam 10: Fundamentals of Cost Management144 Questions

Exam 11: Service Department and Joint Cost Allocation152 Questions

Exam 12: Fundamentals of Management Control Systems160 Questions

Exam 13: Planning and Budgeting157 Questions

Exam 14: Business Unit Performance Measurement147 Questions

Exam 15: Transfer Pricing147 Questions

Exam 16: Fundamentals of Variance Analysis156 Questions

Exam 17: Additional Topics in Variance Analysis138 Questions

Exam 18: Performance Measurement to Support Business Strategy148 Questions

Select questions type

Barton Carts produces two models of push carts, the Standard and the Deluxe. Data on operations and costs for the month are:

Standard Deluxe Total Machine hours 16,000 8,000 24,000 Direct labor hours 12,000 8,000 20,000 Units produced 4,000 1,000 5,000 Direct material costs 80,000 \ 30,000 \ 110,000 Direct labor costs 262,000 138,000 400,000 Manufacturing overhead costs 557,400 Total costs \1 ,067,400

Required:

Compute the total cost for each model, assuming Barton Carts uses:

(a) Direct labor hours to allocate overhead costs.

(b) Direct labor costs to allocate overhead costs.

(c) Machine hours to allocate overhead costs.

Free

(Essay)

4.9/5  (40)

(40)

Correct Answer:

(a)Overhead rate: $557,400 / 20,000 hrs = $27.87/hr

Standard: $80,000 + $262,000 + ($27.87 × 12,000) = $676,440

Deluxe: $30,000 + $138,000 + ($27.87 × 8,000) = $390,960

(b)Overhead rate: $557,400 / $400,000 = 139.35%

Standard: $80,000 + $262,000 + (139.35% × $262,000) = $707,097

Deluxe: $30,000 + $138,000 + (139.35% × $138,000) = $360,303

(c)Overhead rate: $557,400 / 24,000 Machine hrs = $23.225/MHr

Standard: $80,000 + $262,000 + ($23.225 × 16,000) = $713,600

Deluxe: $30,000 + $138,000 + ($23.225 × 8,000) = $353,800

The management of Norbert Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity rather than on the estimated amount of activity for the year. The company's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 70,000 machine-hours. In addition, capacity is 82,000 machine-hours and the actual activity for the year is 72,900 machine-hours. All of the manufacturing overhead is fixed and is $4,132,800 per year. For simplicity, it is assumed that this is the estimated manufacturing overhead for the year as well as the manufacturing overhead at capacity and the actual amount of manufacturing overhead for the year. Job O65A, which required 300 machine-hours, is one of the jobs worked on during the year.

Required:

(a) Determine the predetermined overhead rate if the predetermined overhead rate is based on the amount of the allocation base at capacity.

(b) Determine how much overhead would be applied to Job O65A if the predetermined overhead rate is based on the amount of the allocation base at capacity.

Free

(Essay)

4.8/5  (34)

(34)

Correct Answer:

(a) Calculation of the predetermined overhead rate:

(b) Manufacturing overhead applied to Job O65A:

The Transfers In (TI) costs in the basic cost flow model of a manufacturing firm are direct materials, direct labor, and manufacturing overhead.

Free

(True/False)

4.8/5  (35)

(35)

Correct Answer:

True

Gentry Cabinetry produces two models of home shelving, the Basic and the Mega. Data on operations and costs for November are:

Basic Mega Total Machine hours 8,000 4,000 12,000 Direct labor hours 6,000 4,000 10,000 Units produced 1,000 250 1,250 Direct material costs \ 20,000 \ 7,500 \ 27,500 Direct labor costs 129,000 71,000 200,000 Manufacturing overhead costs 348,200 Total costs \5 75,700

Required:

Compute the predetermined overhead rate, assuming Gentry Cabinetry uses:

(a) Direct labor hours to allocate overhead costs.

(b) Direct labor costs to allocate overhead costs.

(c) Machine hours to allocate overhead costs.

(d) Compute the unit cost for each model using direct labor costs to allocate overhead.

(Essay)

5.0/5  (30)

(30)

Overestimating a period's allocation base will understate the predetermined overhead rate.

(True/False)

4.8/5  (38)

(38)

Thompson Metal Corporation (TMC) supplies various types of machine tools to manufacturing companies. TMC has always paid a lot of attention to the quality of its products. Recently, an outside supplier has approached TMC to supply an important and intricate component of one of its more advanced tools that TMC has been manufacturing in-house. Sam Weiss, a junior accountant at TMC, has collected the following information regarding this proposal.

The costs of manufacturing one unit of this component internally are as follows:

Direct materials: \ 29.60 Direct labor: 13.00 Variable overhead: 19.50(@150\% of direct labor cost) Fixed overhead: 26.00( 200\% of direct labor cost) Total cost: \ 88.10

The outside supplier has quoted a price of $90 per unit for supplying this component. The following is a conversation that took place among the manufacturing manager (Dana Rice), the buyer (Emily Scanlon), and Sam Weiss.

Weiss: I think that we should continue to manufacture internally because we can save $1.90 per unit on this component.

Rice: According to your report, we would save $1.90 per unit, but I do not agree with those numbers.

Weiss: What do you mean? I have followed the same costing guidelines this company has used for years. I have even cross-checked my numbers with historical data and know for sure that the overhead rates which I have used are correct.

Rice: I am sure you have done your job thoroughly, but I think that our costing system is archaic. This component is complex and difficult to manufacture. I believe that our overhead allocation method does not accurately capture the production difficulties and the additional resources that are devoted to the manufacture of this component. For example, a significant portion of our quality problems are due to this component. We spend close to a third of our quality inspection time on just this component alone, but that is not reflected. These quality problems cause delays in getting this component to the assembly department, and that causes a delay in getting the final product to the customers. Many of our customers are expecting just-in-time deliveries, and they get upset when we're late.

Scanlon: I know that the supplier that has approached us has a strong reputation for quality. Therefore, we can rest assured that we will have negligible quality problems.

Rice: Sam, your report does not consider this additional benefit from buying outside. I would appreciate it if you can rework your numbers to more accurately reflect the true costs associated with manufacturing this component internally.

Required:

(a) Assume the role of Sam Weiss. What are the different elements of costs that are likely to be associated with the manufacture of the component? Does the current costing system capture these costs?

(b) Recommend improvements in the costing system.

(c) How can Weiss quantify "qualitative" benefits such as quality and on-time delivery?

(Essay)

4.8/5  (32)

(32)

Case (A) Case (B) Case (C) Begirnirg Balance (BB) \ 36,520 \ 15,100 \ 5,600 Ending Balance (EB) ? 11,400 12,200 Transferred In (TI) 166,200 ? 68,400 Transferred Out (TO) 164,400 93,200 ?

-

For Case (A) above, what is the Ending Balance (EB)?

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following is the correct formula to compute the predetermined overhead rate?

(Multiple Choice)

4.8/5  (40)

(40)

Assume that the following events occurred at a division of Sawyer Enterprises for the current year.

(1) Purchased $900,000 in direct materials.

(2) Incurred direct labor costs of $520,000.

(3) Determined that manufacturing overhead was $820,000.

(4) Transferred 75% of the materials purchased to Work-in-Process Inventory.

(5) Completed work on 60% of the work in process. Costs assigned equally across all work-in-process.

(6) The inventory accounts have no beginning balances. All costs incurred were debited to the appropriate account and credited to Accounts Payable.

Required:

Compute the following amounts in the Work-in-Process Inventory account:

(a) Transfers-in (TI).

(b) Transfers-out (TO).

(c) Ending balance (EB).

(Essay)

5.0/5  (42)

(42)

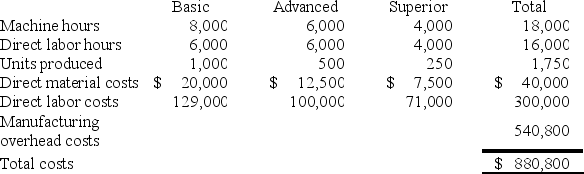

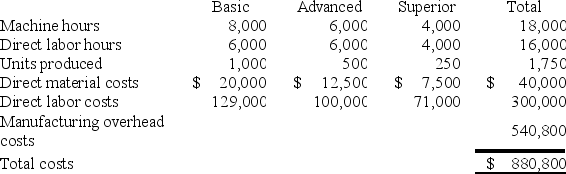

Misner Office Products produces three models of commercial shelving, the Basic, the Advanced and the Superior. Data on operations and costs for the month are:

Required:

Compute the unit cost for each model, assuming Misner Office Products uses:

(a) Direct labor hours to allocate overhead costs.

(b) Direct labor costs to allocate overhead costs.

(c) Machine hours to allocate overhead costs.

Required:

Compute the unit cost for each model, assuming Misner Office Products uses:

(a) Direct labor hours to allocate overhead costs.

(b) Direct labor costs to allocate overhead costs.

(c) Machine hours to allocate overhead costs.

(Essay)

4.8/5  (33)

(33)

Mason Industries restarted operations on September 1 after a 3-month shutdown. There were no beginning inventories. The following operations data are available for September and the one product the company refines:

Gallons Beginning inventory -0- Started in September 450,000 Ending work-in-process inventory (70\% complete) 15,000 Cost incurred in July were: Materials \ 560,000 Labor 164,300 Manufacturing overhead 242,350

All production at Mason is sold immediately.

Required:

(a) Compute cost of goods sold for September.

(b) What is the value of the work-in-process inventory on September 30?

(Essay)

5.0/5  (46)

(46)

MegaRock produces quick setting concrete mix. Production of 200,000 tons was started in April, 190,000 tons were completed. Material costs were $3,152,000 for the month while conversion costs were $591,000. There was no beginning work-in-process; the ending work-in-process was 70% complete.

- What is the cost of the product that remains in work-in-process?

(Multiple Choice)

4.7/5  (35)

(35)

Misner Office Products produces three models of commercial shelving, the Basic, the Advanced and the Superior. Data on operations and costs for the month are:

Required:

Compute the predetermined overhead rate, assuming Misner Office Products uses:

(a) Direct labor hours to allocate overhead costs.

(b) Direct labor costs to allocate overhead costs.

(c) Machine hours to allocate overhead costs.

(d) Compute the unit cost for each model using direct labor costs to allocate overhead.

Required:

Compute the predetermined overhead rate, assuming Misner Office Products uses:

(a) Direct labor hours to allocate overhead costs.

(b) Direct labor costs to allocate overhead costs.

(c) Machine hours to allocate overhead costs.

(d) Compute the unit cost for each model using direct labor costs to allocate overhead.

(Essay)

4.9/5  (35)

(35)

Assume that the following events occurred at a division of Advanced Enterprises for the current year.

(1) Purchased $450,000 in direct materials.

(2) Incurred direct labor costs of $260,000.

(3) Determined that manufacturing overhead was $410,000.

(4) Transferred 70% of the materials purchased to Work-in-Process Inventory.

(5) Completed work on 65% of the work in process. Costs assigned equally across all work-in-process.

(6) The inventory accounts have no beginning balances.

Required:

Compute the following amounts in the Work-in-Process Inventory account:

(a) Transfers-in (TI).

(b) Transfers-out (TO).

(c) Ending balance (EB).

(Essay)

5.0/5  (38)

(38)

Operation costing is a hybrid system used in manufacturing goods that have some common characteristics and some individual characteristics.

(True/False)

4.8/5  (41)

(41)

The following direct labor information pertains to the manufacture of product Scour:

Time required to make one unit 2direct labor hours Number of direct workers 50 Number of productive hours per week, per worker 40 Weekly wages per worker \ 500 Workers' benefits treated as direct labor costs 20\% of wages

What is the standard direct labor cost per unit of product Scour? (CPA adapted)

(Multiple Choice)

4.8/5  (39)

(39)

Flare Co. manufactures textiles. Among Flare's 2020 manufacturing costs were the following salaries and wages:

Loom operators \ 120,000 Factory foremen 45,000 Machine mechanics 30,000

-

What was the amount of Flare's 2020 indirect labor? (CPA adapted)

(Multiple Choice)

4.8/5  (24)

(24)

Case (A) Case (B) Case (C) Beginning Balance (BB) ? \ 23,000 \ 7,900 Ending Balance (EB) \ 67,000 19,200 8,300 Transferred In (TI) 149,600 97,700 Transferred Out (TO) 164,600 ? ?

-

For Case (B) above, what is the amount Transferred Out (TO)?

(Multiple Choice)

4.8/5  (30)

(30)

Rapid Enterprises applies manufacturing overhead to its cost objects on the basis of 75% of direct material cost. If Job 17X had $72,000 of manufacturing overhead applied to it during May, the direct materials assigned to Job 17X was:

(Multiple Choice)

4.9/5  (33)

(33)

Showing 1 - 20 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)