Exam 10: Reporting and Analyzing Long-Term Liabilities

Exam 1: Introducing Financial Statements277 Questions

Exam 2: Financial Statements and the Accounting System237 Questions

Exam 3: Adjusting Accounts for Financial Statements381 Questions

Exam 4: Reporting and Analyzing Merchandising Operations269 Questions

Exam 5: Reporting and Analyzing Inventories236 Questions

Exam 6: Reporting and Analyzing Cash,fraud,and Internal Control210 Questions

Exam 7: Reporting and Analyzing Receivables218 Questions

Exam 8: Reporting and Analyzing Long-Term Assets257 Questions

Exam 9: Reporting and Analyzing Current Liabilities210 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities231 Questions

Exam 11: Reporting and Analyzing Equity245 Questions

Exam 12: Reporting and Analyzing Cash Flows248 Questions

Exam 13: Analyzing and Interpreting Financial Statements236 Questions

Exam 14: Applying Present and Future Values31 Questions

Exam 15: Investments199 Questions

Exam 16: International Operations28 Questions

Select questions type

Premium on Bonds Payable is an adjunct liability account,as it increases the carrying value of the bond.

(True/False)

4.8/5  (27)

(27)

Promissory notes that require the issuer to make a series of payments consisting of both interest and principal are:

(Multiple Choice)

4.8/5  (34)

(34)

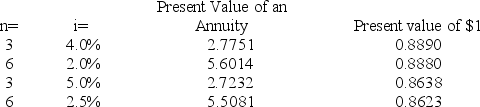

On January 1,a company issues bonds dated January 1 with a par value of $200,000.The bonds mature in 3 years.The contract rate is 4%,and interest is paid semiannually on June 30 and December 31.The market rate is 5%.Using the present value factors below,the issue (selling)price of the bonds is:

(Multiple Choice)

4.9/5  (45)

(45)

Sinking fund bonds reduce the bondholder's risk by requiring the issuer to create a fund of assets to repay the bonds at maturity.

(True/False)

4.9/5  (41)

(41)

A lease is a contractual agreement between a lessor and a lessee that grants the lessee the right to use the asset for a period of time in return for cash payment(s)to the lessor.

(True/False)

4.8/5  (36)

(36)

A company has assets of $350,000 and total liabilities of $200,000.Its debt-to-equity ratio is 0.6.

(True/False)

4.8/5  (38)

(38)

The market value (issue price)of a bond is equal to the present value of all future cash payments provided by the bond.

(True/False)

4.8/5  (33)

(33)

Debentures always have specific assets of the issuing company pledged as collateral.

(True/False)

4.8/5  (38)

(38)

A company issued 7%,5-year bonds with a par value of $100,000.The market rate when the bonds were issued was 7.5%.The company received $97,946.80 cash for the bonds.Using the effective interest method,the amount of interest expense for the second semiannual interest period is:

(Multiple Choice)

4.9/5  (33)

(33)

Compounded means that interest during a second period is based on the total amount borrowed plus the interest accrued in the first period.

(True/False)

4.7/5  (37)

(37)

An advantage of bond financing is that issuing bonds does not affect owner control.

(True/False)

4.9/5  (28)

(28)

The ________ concept is the idea that cash paid (or received)in the future has less value now than the same amount of cash paid (or received)today.

(Short Answer)

4.8/5  (29)

(29)

On July 1,Shady Creek Resort borrowed $250,000 cash by signing a 10-year,8% installment note requiring equal payments each June 30 of $37,258.What amount of interest expense will be included in the first annual payment?

(Multiple Choice)

4.8/5  (37)

(37)

A company has bonds outstanding with a par value of $100,000.The unamortized discount on these bonds is $4,500.The company retired these bonds by buying them on the open market at 97.What is the gain or loss on this retirement?

(Multiple Choice)

5.0/5  (33)

(33)

On January 1,a company issues bonds dated January 1 with a par value of $300,000.The bonds mature in 5 years.The contract rate is 9%,and interest is paid semiannually on June 30 and December 31.The market rate is 8% and the bonds are sold for $312,177.The journal entry to record the first interest payment using straight-line amortization is:

(Multiple Choice)

4.9/5  (33)

(33)

Adonis Corporation issued 10-year,8% bonds with a par value of $200,000.Interest is paid semiannually.The market rate on the issue date was 7.5%.Adonis received $206,948 in cash proceeds.Which of the following statements is true?

(Multiple Choice)

4.8/5  (46)

(46)

On January 1,the Rodrigues Corporation leased some equipment on a 3-year lease,paying $15,000 at the inception of the lease,and $15,000 per year each December 31.The lease is considered to be an operating lease.Prepare the general journal entry to record the first lease payment on December 31.

(Essay)

4.7/5  (36)

(36)

Showing 41 - 60 of 231

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)