Exam 26: Economic Policy in the Open Economy Under Flexible Exchange Rates

Exam 2: Early Trade Theories: Mercantilism and the Transition to the Classical World of David Ricardo25 Questions

Exam 3: The Classical World of David Ricardo and Comparative Advantage28 Questions

Exam 4: Extensions and Tests of the Classical Model of Trade32 Questions

Exam 5: Introduction to Neoclassical Trade Theory: Tools to Be Employed26 Questions

Exam 6: Gains From Trade in Neoclassical Theory28 Questions

Exam 7: Offer Curves and the Terms of Trade28 Questions

Exam 8: The Basis for Trade: Factor Endowments and the Heckscher-Ohlin Model31 Questions

Exam 9: Empirical Tests of the Factor Endowments Approach25 Questions

Exam 10: Post Heckscher-Ohlin Theories of Trade and Intra-Industry Trade30 Questions

Exam 11: Economic Growth and International Trade34 Questions

Exam 12: International Factor Movements30 Questions

Exam 13: The Instruments of Trade Policy27 Questions

Exam 14: The Impact of Trade Policies36 Questions

Exam 15: Arguments for Interventionist Trade Policies37 Questions

Exam 16: Political Economy and Us Trade Policy25 Questions

Exam 17: Economic Integration28 Questions

Exam 18: International Trade and the Developing Countries24 Questions

Exam 19: The Balance-Of-Payments Accounts29 Questions

Exam 20: The Foreign Exchange Market33 Questions

Exam 21: International Financial Markets and Instruments: an Introduction24 Questions

Exam 22: The Monetary and Portfolio Balance Approaches to External Balance24 Questions

Exam 23: Price Adjustments and Balance-Of-Payments Disequilibrium24 Questions

Exam 24: National Income and the Current Account26 Questions

Exam 25: Economic Policy in the Open Economy Under Fixed Exchange Rates28 Questions

Exam 26: Economic Policy in the Open Economy Under Flexible Exchange Rates27 Questions

Exam 27: Prices and Output in the Open Economy: Aggregate Supply and Demand28 Questions

Exam 28: Fixed or Flexible Exchange Rates25 Questions

Exam 29: The International Monetary System: Past, Present, and Future28 Questions

Select questions type

If, in the IS/LM/BP diagram in a situation where short-term capital is imperfectly mobile Internationally and a flexible exchange rate system exists, an incipient balance-of- Payments (official reserve transactions) surplus will cause the BP curve to shift__________ and the IS curve to shift __________.

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

A

The IS/LM/BP analysis suggests that, if the BP curve is flatter than the LM curve and the exchange rate is flexible, expansionary fiscal policy will lead to __________ of the Country's currency, which will make the fiscal policy __________ effective in influencing National income than if the country had a fixed exchange rate.

Free

(Multiple Choice)

4.7/5  (26)

(26)

Correct Answer:

D

If we consider a situation of expansionary monetary policy under flexible exchange rates, the monetary expansion will lead to __________ of the home currency and thus will be __________ effective in increasing national income than under fixed exchange rates.

Free

(Multiple Choice)

4.8/5  (28)

(28)

Correct Answer:

C

Suppose that country A with a flexible exchange rate undertakes expansionary monetary Policy. Especially if short-term funds are extremely mobile between countries, A's Currency will tend to __________ because of this policy, and this result suggests that A's Monetary policy will be __________ effective in influencing national income than if A Had a fixed exchange rate rather than a flexible exchange rate.

(Multiple Choice)

4.8/5  (35)

(35)

If a country's BP curve is upward-sloping (i.e., it is neither vertical nor horizontal), then An intersection of the country's IS and LM curves at a point above the BP curve will be Associated with __________ in the country's balance of payments. With flexible Exchange rates, the country's BP curve will consequently shift __________.

(Multiple Choice)

4.8/5  (40)

(40)

In the view of economists, which one of the following statements is true?

(Multiple Choice)

4.9/5  (37)

(37)

Under a flexible-rate system, when the BP curve is flatter than the LM curve, an Autonomous increase in foreign interest rates will have what impacts on the domestic Interest rate and domestic national income?

(Multiple Choice)

4.9/5  (30)

(30)

In a situation of flexible exchange rates, an exogenous increase in foreign interest rates will cause __________ of the domestic currency and, most likely, a __________ in the domestic interest rate.

(Multiple Choice)

4.7/5  (36)

(36)

The IS/LM/BP analysis suggests that, if the BP curve is steeper than the LM curve and The exchange rate is flexible, contractionary fiscal policy by country A will lead to __________ in country A's balance of payments and hence to __________ of A's

Currency relative to other currencies.

(Multiple Choice)

4.9/5  (38)

(38)

It appears that the world is becoming more financially interdependent. How might you incorporate this change, if necessary, in the IS/LM/BP model? What are the implications of this change for macro policy in general and fiscal policy in particular?

(Essay)

4.7/5  (27)

(27)

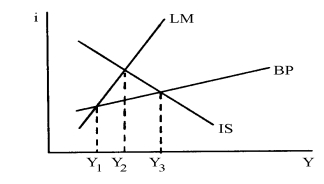

Given the following diagram, with flexible exchange rates:

Assume that the economy is in domestic equilibrium. In this situation, there will be __________ in the country's balance of payments (official reserve transactions balance), with the consequence that the country's currency will __________ in the foreign exchange markets.

Assume that the economy is in domestic equilibrium. In this situation, there will be __________ in the country's balance of payments (official reserve transactions balance), with the consequence that the country's currency will __________ in the foreign exchange markets.

(Multiple Choice)

4.7/5  (42)

(42)

Under flexible exchange rates, expansionary fiscal policy is less likely to lead to crowding out of investment and more likely to penalize the foreign sector than under fixed rates. Agree? Disagree? Explain.

(Essay)

4.9/5  (31)

(31)

If capital is imperfectly mobile (with BP flatter than LM), explain why governments find fiscal policy less effective under flexible rates compared to fixed rates. Is fiscal policy ever completely ineffective? If so, under what conditions? If not, why not?

(Essay)

4.8/5  (36)

(36)

Explain, in the IS/LM/BP framework with flexible exchange rates, the impact of an autonomous increase in foreign demand for a country's exports upon the country's national income, money supply, and exchange rate. If there is no impact on a variable, explain why.

(Essay)

4.8/5  (42)

(42)

The effectiveness of monetary policy in influencing national income will, under a system of fixed exchange rates, be __________ under a system of flexible exchange rates.

(Multiple Choice)

4.8/5  (29)

(29)

If, other things equal, a country with a flexible exchange rate decreases its money supply, this will lead to __________ in the value of the country's currency, which will tend to __________ the country's national income.

(Multiple Choice)

4.9/5  (34)

(34)

In a situation of flexible exchange rates, other things equal, a shift of the IS curve to the left will lead to __________ of the country's currency if the BP curve is steeper than the LM curve and __________ of the country's currency if the LM curve is steeper than The BP curve.

(Multiple Choice)

4.7/5  (44)

(44)

In the situation in Question #13 above, during exchange-rate adjustment process that takes place due to the incipient imbalance in the external sector,

(Multiple Choice)

4.8/5  (41)

(41)

In a situation of flexible exchange rates and where the BP curve is steeper than the LM curve,

(Multiple Choice)

4.8/5  (36)

(36)

Showing 1 - 20 of 27

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)