Exam 14: Time Value of Money

Exam 1: Introducing Financial Accounting259 Questions

Exam 2: Accounting for Transactions219 Questions

Exam 3: Preparing Financial Statements235 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Accounting for Inventories191 Questions

Exam 6: Accounting for Cash and Internal Controls203 Questions

Exam 7: Accounting for Receivables170 Questions

Exam 8: Accounting for Long-Term Assets202 Questions

Exam 9: Accounting for Current Liabilities195 Questions

Exam 10: Accounting for Long-Term Liabilities189 Questions

Exam 11: Accounting for Equity198 Questions

Exam 12: Accounting for Cash Flows175 Questions

Exam 13: Interpreting Financial Statements187 Questions

Exam 14: Time Value of Money57 Questions

Exam 15: Investments and International Operations178 Questions

Exam 16: Accounting for Partnerships122 Questions

Exam 17: Accounting With Special Journals164 Questions

Select questions type

At an annual interest rate of 8% compounded annually, $5,300 will accumulate to a total of $7,210.65 in five years.

Free

(True/False)

4.7/5  (39)

(39)

Correct Answer:

False

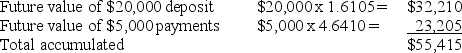

Madera Iron Sculpting is planning to save the money needed to replace one of its robotic welders in five years by making a one-time deposit of $20,000 today and four yearly contributions of $5,000 beginning at the end of year 1. The deposits will earn 10% interest. How much money will Sierra have accumulated at the end of five years to replace the welder?

Free

(Essay)

4.7/5  (42)

(42)

Correct Answer:

A company has $50,000 today to invest in a fund that will earn 7%. How much will the fund contain at the end of eight years?

Free

(Short Answer)

4.8/5  (37)

(37)

Correct Answer:

$50,000 x 1.7182 = $85,910

A company is considering investing in a project that is expected to return $350,000 four years from now. How much is the company willing to pay for this investment if the company requires a 12% return?

(Multiple Choice)

4.9/5  (33)

(33)

A company is creating a fund by depositing $65,763 today. The fund will grow to $90,000 after eight years. What annual interest rate is the company earning on the fund?

(Essay)

4.8/5  (38)

(38)

What interest rate is required to accumulate $6,802.50 in four years from an investment of $5,000?

(Multiple Choice)

4.9/5  (27)

(27)

The future value of an ordinary annuity is the accumulated value of each annuity payment with interest one period after the date of the final payment.

(True/False)

5.0/5  (50)

(50)

A company needs to have $200,000 in four years, and will create a fund to ensure that the $200,000 will be available. If they can earn a 7% return, how much must the company invest in the fund today to equal the $200,000 at the end of four years?

(Short Answer)

4.9/5  (41)

(41)

A company is setting up a sinking fund to pay off $8,654,000 in bonds that are due in seven years. The fund will earn 7% interest, and the company intends to put away a series of equal year-end amounts for seven years. What amount must the company deposit annually?

(Essay)

4.8/5  (38)

(38)

When you reach retirement age, you will have one fund of $100,000 from which you are going to make annual withdrawals of $14,702. The fund will earn 6% per year. For how many years will you be able to draw an even amount of $14,702?

(Short Answer)

4.8/5  (31)

(31)

The future value of $100 compounded semiannually for three years at 12% equals $140.49.

(True/False)

4.8/5  (35)

(35)

The present value of $5,000 per year for three years at 12% compounded annually is $12,009.

(True/False)

4.8/5  (30)

(30)

The number of periods in a future value calculation can only be expressed in years.

(True/False)

4.9/5  (31)

(31)

Troy has $105,000 now. He has a loan of $175,000 that he must pay at the end of five years. He can invest his $105,000 at 10% interest compounded semiannually. Will Troy have enough to pay his loan at the end of the five years?

(Essay)

4.9/5  (43)

(43)

The number of periods in a present value calculation can only be expressed in years.

(True/False)

4.9/5  (31)

(31)

The present value of 1 formula is often useful when a borrowed asset must be repaid in full at a later date and the borrower wants to know its worth at the future date.

(True/False)

4.9/5  (36)

(36)

An annuity is a series of equal payments occurring at equal intervals.

(True/False)

4.8/5  (30)

(30)

Showing 1 - 20 of 57

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)