Exam 11: Internal Service Funds

Exam 1: Governmental and Nonprofit Accountingenvironment and Characteristics27 Questions

Exam 2: State and Local Government Accounting and Financial Reporting Modelthe Foundation56 Questions

Exam 3: The General Fund and Special Revenue Funds58 Questions

Exam 4: Budgeting, Budgetary Accounting, and Budgetary Reporting35 Questions

Exam 5: Revenue Accountinggovernmental Funds42 Questions

Exam 6: Expenditure Accountinggovernmental Funds37 Questions

Exam 7: Capital Projects Funds52 Questions

Exam 8: Debt Service Funds43 Questions

Exam 9: General Capital Assets; General Long-Term Liabilities; Permanent Fundsintroduction to Interfund-Gca-Gltl Accounting50 Questions

Exam 10: Enterprise Funds45 Questions

Exam 11: Internal Service Funds33 Questions

Exam 12: Trust and Agency Fiduciary Funds Summary of Interfund-Gca-Gltl Accounting38 Questions

Exam 13: Financial Reportingthe Basic Financial Statements and Required Supplementary Information53 Questions

Exam 14: Financial Reporting Deriving Governmentwide Financial Statements and Required Reconciliations48 Questions

Exam 15: Financial Reportingthe Comprehensive Annual Financial Report and the Financial Reporting Entity43 Questions

Exam 16: Non-Slg Not-For-Profit Organizationssfas 116 and 117 Approach41 Questions

Exam 17: Accounting for Colleges and Universities43 Questions

Exam 18: Accounting for Health Care Organizations35 Questions

Exam 19: Federal Government Accounting34 Questions

Exam 20: Auditing Governments and Not-For-Profit Organizations36 Questions

Select questions type

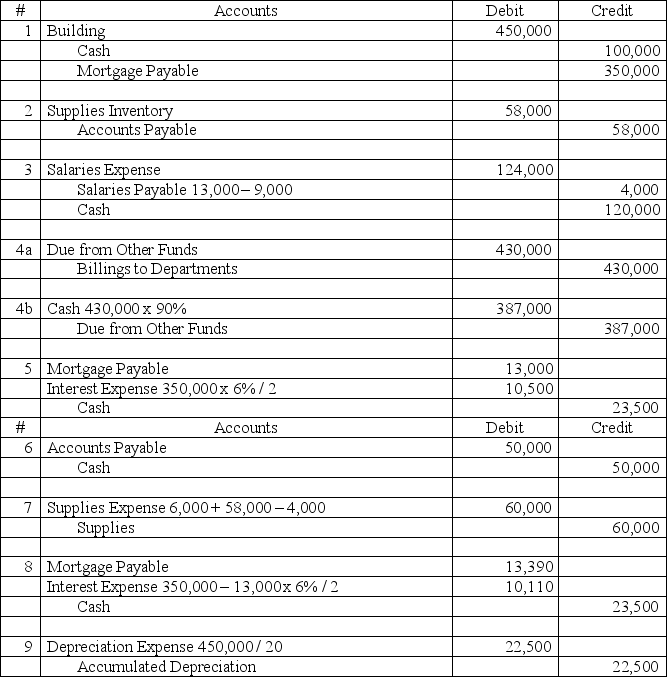

Listed below are selected transactions for the Maury County Internal Service Fund.

Transactions:

1. Purchased a building on January 2, 20X2, by paying $100,000 down and borrowing $350,000 on a 6%, 10-year mortgage. Assume semi-annual mortgage payments are due each June 30 and December 31, beginning this year. The building will be depreciated over 20 years with no salvage value using the straight-line method.

2. Purchased supplies on account, $58,000. The fund uses the perpetual inventory method when accounting for supplies.

3. Paid employee salaries, $120,000. Accrued salaries at year end were $13,000. Accrued salaries at the beginning of the year were $9,000.

4. Billed General Fund departments $400,000 for services provided to those departments. Billings to the Enterprise Fund totaled $30,000. 90% of these billings were collected by year end. The remaining 10% is not expected to be collected from the other funds until the second quarter of the next fiscal year.

5. The first semi-annual mortgage payment of $23,500 was made.

6. Paid $50,000 on account.

7. Supplies on hand at year end have a cost of $4,000. The beginning of the year inventory was $6,000.

8. The second semi-annual mortgage payment of $23,500 was made.

9. Record depreciation on the building for the year.

Requirements:

1. Prepare the journal entries required in the Internal Service Fund. If no entry is required, state "No entry required" and explain why.

2. Indicate the effects of each transaction on the accounting equation of the Internal Service Fund accounts. If an element of the equation is not affected or if the net effect is zero, put "NE" in the appropriate box. Do not leave any boxes blank.

Free

(Essay)

4.8/5  (29)

(29)

Correct Answer:

Requirement #1

Requirement #2

Requirement #2

Internal Service Funds may report each of the following equity classifications except

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

C

An Internal Service Fund would report which of the following items on its balance sheet

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

B

Cash paid to purchase capital assets is reported as a cash outflow in which section of an Internal Service Fund statement of cash flows?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following would most likely be accounted for in an Internal Service Fund?

(Multiple Choice)

4.9/5  (37)

(37)

Inventory in an Internal Service Fund would most likely be reflected in which of the following equity classifications?

(Multiple Choice)

4.9/5  (35)

(35)

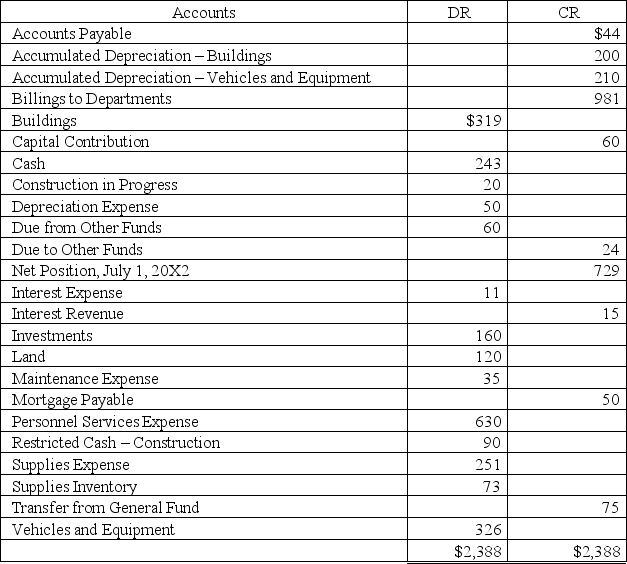

The accounts listed below are taken from an Internal Service Fund adjusted trial balance all amounts are in thousands:

Requirements: Prepare Statement of Fund Net Position and Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended June 30, 20X3, for the City of Bell Buckle.

Requirements: Prepare Statement of Fund Net Position and Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended June 30, 20X3, for the City of Bell Buckle.

(Essay)

4.8/5  (34)

(34)

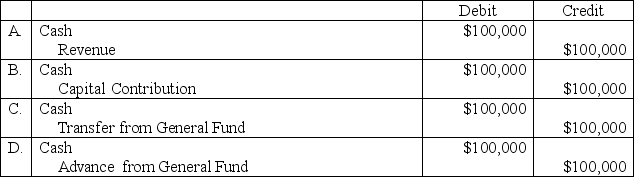

A government plans to create an Internal Service Fund to account for its new central warehouse. The General Fund loans the Internal Service Fund $100,000, which is going to pay back the loan interest-free in five years. The entry in the Internal Service Fund to record this transaction would be

(Short Answer)

4.7/5  (25)

(25)

Governments that centralize their risk financing activities should not account for this activity in which type of fund?

(Multiple Choice)

5.0/5  (44)

(44)

A self-insurance Internal Service Fund may not include which of the following in its charges to other funds?

(Multiple Choice)

4.8/5  (33)

(33)

The use of an Internal Service Fund is mandated by generally accepted accounting principles for which of the following activities?

(Multiple Choice)

4.8/5  (38)

(38)

The five sections for reporting items in an Internal Service Fund Statement of Cash Flows prepared using the direct method excluding the reconciliation of operating income to cash flows from operations are:

A. Operating Activities

B. Noncapital Financing Activities

C. Capital and Related Financing Activities

D. Investing Activities

E. Noncash Investing, Capital, and Financing Activities

Using these five sections, indicate in which section each of the following Internal Service Fund transactions should be reported. If a transaction should not be reported on the Statement of Cash Flows, indicate it using the letter "X".

1. Purchase of an Internal Service Fund capital asset for cash.

2. Providing services to other funds on a cash basis.

3. Issuing refunding bonds to refinance bonds issued 10 years ago to provide financing for capital asset acquisitions.

4. Sale of Internal Service Fund capital assets for cash.

5. Transfer from a Special Revenue Fund for the specific purpose of financing an Internal Service Fund capital asset purchase.

6. Payment of office workers' salaries.

7. Amortization of the Deferred Interest Expense Adjustment created when the capital asset debt was refunded.

8. Transfer to a Capital Projects Fund to provide financing for a general government capital asset construction project.

9. Purchases of investments with cash received from issuing bonds to finance construction of Internal Service Fund capital assets.

10. Transfer to the General Fund for the purpose of financing specific operating costs of a department accounted for in that fund.

11. Issuing bonds to provide operating cash for the Internal Service Fund.

12. Signing a capital lease for equipment to be used by activities accounted for in the Internal Service Fund.

13. Interest received during the year earned on investments.

14. Transfer the proceeds from the sale of an Internal Service Fund capital asset to the General Fund.

15. Depreciation on Internal Service Fund capital assets.

16. Proceeds of bonds issued to finance construction of Internal Service Fund capital assets.

17. Interest paid on bonds issued to finance construction of an Internal Service Fund capital asset.

18. Principal retirement payments on bonds issued to finance construction of Internal Service Fund capital assets

19. Unrealized gain on investments held at year end.

20. Receipt of a capital grant for an ongoing Internal Service Fund capital asset construction project.

A. Operating Activities

B. Noncapital Financing Activities

C. Capital and Related Financing Activities

D. Investing Activities

E. Noncash Investing, Capital, and Financing Activities

Using these five sections, indicate in which section each of the following Internal Service Fund transactions should be reported. If a transaction should not be reported on the Statement of Cash Flows, indicate it using the letter "X".

(Essay)

4.9/5  (40)

(40)

The Central Warehouse Internal Service Fund purchased $15,000 of inventory on account, which was unpaid as of the month end. Which of the following statements regarding the accounting for the transaction is false?

(Multiple Choice)

4.8/5  (35)

(35)

If a Self-Insurance Internal Service Fund pays claims of $5,000 during the month, the fund will report

(Multiple Choice)

4.9/5  (38)

(38)

Caraway County has a Self-Insurance Internal Service Fund. If the fund purchases $100,000 of investments during the month, the

(Multiple Choice)

4.8/5  (43)

(43)

Interest revenue earned by an Internal Service Fund will be reported on the statement of revenues, expenses, and changes in net position as

(Multiple Choice)

4.8/5  (37)

(37)

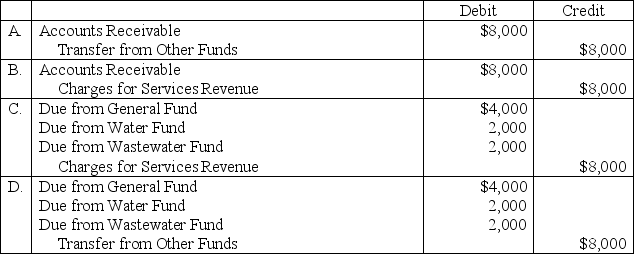

A municipality's Central Garage Internal Service Fund had total billings for $8,000 for the month. Of the 40 vehicles serviced, 20 were police vehicles, 10 were water department vehicles, and 10 were wastewater department vehicles. What would the journal entry be to account for this transaction?

(Short Answer)

4.9/5  (37)

(37)

The required statements for an Internal Service Fund include a Statement of

(Multiple Choice)

4.8/5  (40)

(40)

The General Fund transfers cash to provide working capital for a new Internal Service Fund. The Internal Service Fund would report this transaction in the operating statement as

(Multiple Choice)

4.9/5  (38)

(38)

The General Fund contributes $40,000 to an Internal Service Fund to subsidize the purchase of a capital asset. The contribution is not considered to be an interfund loan. The Internal Service Fund will report this contribution as a

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 33

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)