Exam 11: Internal Service Funds

Exam 1: Governmental and Nonprofit Accountingenvironment and Characteristics27 Questions

Exam 2: State and Local Government Accounting and Financial Reporting Modelthe Foundation56 Questions

Exam 3: The General Fund and Special Revenue Funds58 Questions

Exam 4: Budgeting, Budgetary Accounting, and Budgetary Reporting35 Questions

Exam 5: Revenue Accountinggovernmental Funds42 Questions

Exam 6: Expenditure Accountinggovernmental Funds37 Questions

Exam 7: Capital Projects Funds52 Questions

Exam 8: Debt Service Funds43 Questions

Exam 9: General Capital Assets; General Long-Term Liabilities; Permanent Fundsintroduction to Interfund-Gca-Gltl Accounting50 Questions

Exam 10: Enterprise Funds45 Questions

Exam 11: Internal Service Funds33 Questions

Exam 12: Trust and Agency Fiduciary Funds Summary of Interfund-Gca-Gltl Accounting38 Questions

Exam 13: Financial Reportingthe Basic Financial Statements and Required Supplementary Information53 Questions

Exam 14: Financial Reporting Deriving Governmentwide Financial Statements and Required Reconciliations48 Questions

Exam 15: Financial Reportingthe Comprehensive Annual Financial Report and the Financial Reporting Entity43 Questions

Exam 16: Non-Slg Not-For-Profit Organizationssfas 116 and 117 Approach41 Questions

Exam 17: Accounting for Colleges and Universities43 Questions

Exam 18: Accounting for Health Care Organizations35 Questions

Exam 19: Federal Government Accounting34 Questions

Exam 20: Auditing Governments and Not-For-Profit Organizations36 Questions

Select questions type

If a government has more than one Internal Service Fund, they are reported in the basic financial statements

(Multiple Choice)

4.9/5  (32)

(32)

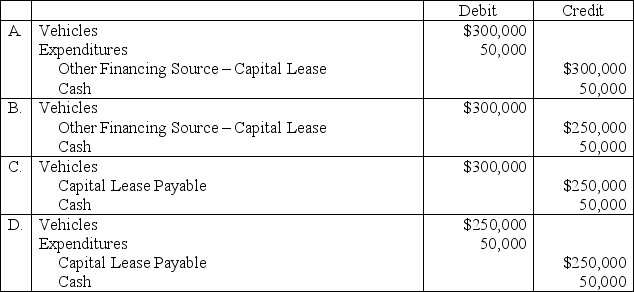

A Motor Pool Internal Service Fund purchased ten new vehicles for their fleet inventory. The fund entered into a capital lease. The capitalizable cost totaled $300,000 and there was a $50,000 down payment. The entry to record the transaction in the Internal Service Fund would be

(Short Answer)

4.9/5  (40)

(40)

An Internal Service Fund had investments with an original cost of $100,000. As of the end of the fiscal year, the fair market value on these investments was $85,000. The Internal Service Fund would

(Multiple Choice)

4.7/5  (39)

(39)

The General Fund paid $4,000 to the Internal Service Fund for services rendered. Which of the following statements accurately reflects the reporting effects of the transaction?

(Multiple Choice)

4.7/5  (41)

(41)

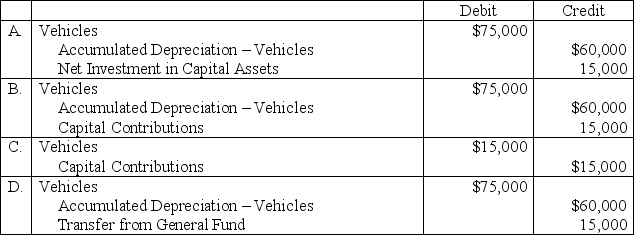

Nathan Township's General Fund transfers three vehicles to the Internal Service Fund. The vehicles, which have a useful life of five years, are transferred at the end of their fourth year. The original cost for all three vehicles totaled $75,000. The entry in the Internal Service Fund would be

(Short Answer)

4.8/5  (29)

(29)

Internal Service Funds report a statement of net position and a General Fund reports a balance sheet. Which of the following would potentially appear on both the statement of net position and the balance sheet?

(Multiple Choice)

4.8/5  (41)

(41)

A self-insurance activity that is accounted for in an Internal Service Fund pays $365,000 in claims during the year. Because the Internal Service Fund is a proprietary fund, the claims will be reported on the statement of revenues, expenses, and change in net position as

(Multiple Choice)

4.7/5  (30)

(30)

Which of the following statements accurately describes why the statement of revenues, expenses and changes in net position for an Internal Service Fund differs slightly from one for an Enterprise Fund?

(Multiple Choice)

4.7/5  (37)

(37)

Assume that an Internal Service Fund purchases land on which to construct a new warehousing facility. The fund paid cash for 30% of the purchase price and financed the reminder with a loan from a local lending institution. The Internal Service Fund will

(Multiple Choice)

4.8/5  (44)

(44)

The General Fund transfers cash to provide working capital for a new Internal Service Fund. The Internal Service Fund would report this transaction in the statement of cash flows as

(Multiple Choice)

5.0/5  (29)

(29)

An Internal Service Fund billed other departments $1,200,000 for services provided during the year. Expenses of $700,000 for salaries, $250,000 for supplies and materials used, $100,000 for depreciation, and $100,000 for interest expenses were incurred. The fund received a $42,000 transfer from the General Fund during the year. The Internal Service Fund should report operating income for the year of

(Multiple Choice)

4.8/5  (46)

(46)

Showing 21 - 33 of 33

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)