Exam 2: The Recording Process

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

The usual sequence of steps in the transaction recording process is:

(Multiple Choice)

4.9/5  (37)

(37)

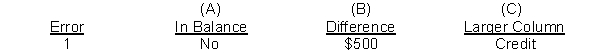

The bookkeeper for Panda Bear Yard Service made a number of errors in journalizing and posting as described below:

1. A debit posting to accounts receivable for $500 was omitted.

2. A payment of accounts payable for $600 was credited to cash and debited to accounts receivable.

3. A credit to accounts receivable for $950 was posted as $95.

4. A cash purchase of equipment for $893 was journalized as a debit to equipment and a credit to notes payable. The credit posting was made for $839 while the debit posting was made for $893.

5. A debit posting of $400 for purchase of supplies was credited to supplies.

6. A debit to maintenance and repairs expense for $451 was posted as $415.

7. A debit posting for salaries and wages expense for $900 was made twice.

8. A cash purchase of supplies for $700 was journalized and posted as a debit to supplies for $70 and a credit to cash for $70.

Instructions

For each error, indicate (a) whether the trial balance will balance; if the trial balance will not balance, indicate (b) the amount of the difference, and (c) the trial balance column that will have the larger total. Consider each error separately. Use the following form, in which error (1) is given as an example.

(Essay)

4.8/5  (36)

(36)

When three or more accounts are required in one journal entry, the entry is referred to as a ________________ entry.

(Short Answer)

4.8/5  (24)

(24)

Camper Van Company purchased equipment for $2,600 cash. As a result of this event,

(Multiple Choice)

4.7/5  (35)

(35)

At January 31, 2018, the balance in Aislers Inc.'s supplies account was $750. During February, Aislers purchased supplies of $900 and used supplies of $1,125. At the end of February, the balance in the supplies account should be

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is not true of the terms debit and credit?

(Multiple Choice)

4.8/5  (41)

(41)

Prepare journal entries for each of the following transactions.

1. Performed services for customers on account $8,000.

2. Purchased $20,000 of equipment on account.

3. Received $3,000 from customers in transaction 1.

4. The company paid dividends of $2,000.

(Essay)

4.7/5  (44)

(44)

Which one of the following represents the expanded basic accounting equation?

(Multiple Choice)

4.8/5  (42)

(42)

A credit is not the normal balance for which account listed below?

(Multiple Choice)

4.8/5  (35)

(35)

The accounts in the ledger of Ace Delivery Service contain ithe following balances on July 31, 2018. Accounts Receivable \ 10,000 Accounts Payable 7,900 Cash ? Common Stock 35,000 Equipment 45,000 Dividends 900 Gasoline Expense 800 Utilities Expense 600 Maintenance and Repair Expense 1,100 Retained Earnings 5,000 Service Revenue 13,000 Salaries and Wages Expense ? Salaries and Wages Payable 1,000 Supplies 3,000 Unearned Service Revenue 2,500 Notes Payable 22,000 Prepaid Insurance 2,000 Instructions

Prepare a trial balance with the accounts arranged as illustrated in the chapter and fill in the missing amounts for Cash and Salaries and Wages Expense. Assume net income for the period is $3,500.

(Essay)

5.0/5  (42)

(42)

Identify the accounts to be debited and credited for each of the following transactions.

1. Invested $8,000 cash in the business in exchange for stock.

2. Purchased supplies on account for $1,000.

3. Billed customers $2,000 for services performed.

4. Paid salaries of $1,200.

(Essay)

4.8/5  (31)

(31)

Under the double-entry system, revenues must always equal expenses.

(True/False)

4.9/5  (35)

(35)

An accountant has debited an asset account for $1,300 and credited a liability account for $500. Which of the following would be an incorrect way to complete the recording of the transaction?

(Multiple Choice)

4.7/5  (38)

(38)

Debit and credit can be interpreted to mean increase and decrease, respectively.

(True/False)

4.8/5  (34)

(34)

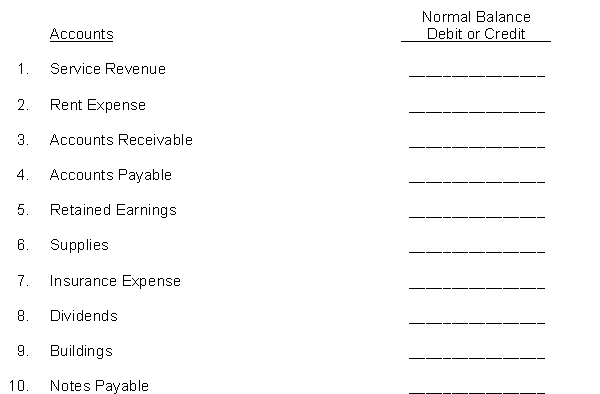

For the accounts listed below, indicate if the normal balance of the account is a debit or credit.

(Essay)

4.8/5  (35)

(35)

Showing 81 - 100 of 206

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)