Exam 2: The Recording Process

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

Business documents can provide evidence that a transaction has occurred.

(True/False)

4.9/5  (31)

(31)

When three or more accounts are required in one journal entry, the entry is referred to as a

(Multiple Choice)

4.7/5  (44)

(44)

Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions.

1. The company issues stock in exchange for $40,000 cash

2. Purchased $400 of supplies on credit.

3. Purchased equipment for $8,000, paying $2,000 in cash and signed a 30-day, $6,000, note payable.

4. Real estate commissions billed to clients amount to $4,000.

5. Paid $700 in cash for the current month's rent.

6. Paid $200 cash on account for supplies purchased in transaction 2.

7. Received a bill for $600 for advertising for the current month.

8. Paid $2,200 cash for office salaries and wages.

9. The company paid dividends of $1,500.

10. Received a check for $3,000 from a client in payment on account for commissions billed in transaction 4.

(Essay)

4.8/5  (33)

(33)

For each of the following transactions of Neon Garden, identify the account to be debited and the account to be credited.

1. Purchased 18-month insurance policy for cash.

2. Paid weekly payroll.

3. Purchased supplies on account.

4. Received utility bill to be paid at later date.

(Essay)

4.8/5  (37)

(37)

The ledger is merely a bookkeeping device and therefore does not provide much useful data for management.

(True/False)

4.8/5  (38)

(38)

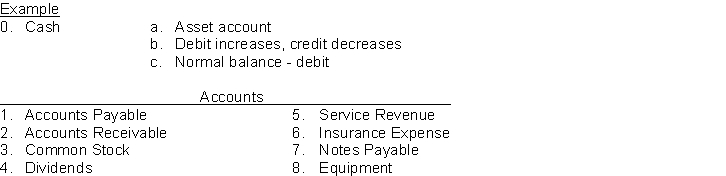

For each of the following accounts indicate (a) the type of account (Asset, Liability, Stockholders' Equity, Revenue, Expense), (b) the debit and credit effects, and (c) the normal account balance.

(Essay)

4.8/5  (35)

(35)

All business transactions must be entered first in the general ledger.

(True/False)

4.9/5  (31)

(31)

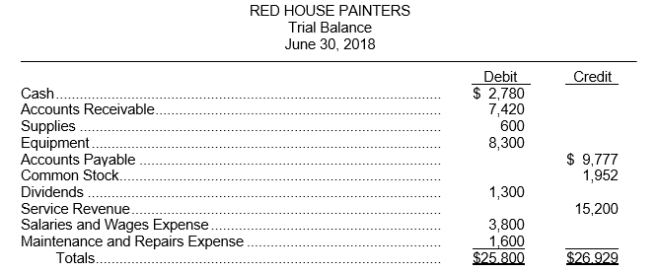

The trial balance of Red House Painters shown below does not balance.  An examination of the ledger and journal reveals the following errors:

1. Each of the above listed accounts has a normal balance per the general ledger.

2. Cash of $270 received from a customer on account was debited to Cash $720 and credited to Accounts Receivable $720.

3. A dividend of $400 was posted as a credit to Dividends $400 and credit to Cash $400.

4. A debit of $300 was not posted to Salaries and Wages Expense.

5. The purchase of equipment on account for $700 was recorded as a debit to Maintenance and Repairs Expense and a credit to Accounts Payable for $700.

6. Services were performed on account for a customer, $510, for which Accounts Receivable was debited $510 and Service Revenue was credited $51.

7. A payment on account for $235 was credited to Cash for $235 and credited to Accounts Payable for $253.

Instructions

Prepare a correct trial balance.

An examination of the ledger and journal reveals the following errors:

1. Each of the above listed accounts has a normal balance per the general ledger.

2. Cash of $270 received from a customer on account was debited to Cash $720 and credited to Accounts Receivable $720.

3. A dividend of $400 was posted as a credit to Dividends $400 and credit to Cash $400.

4. A debit of $300 was not posted to Salaries and Wages Expense.

5. The purchase of equipment on account for $700 was recorded as a debit to Maintenance and Repairs Expense and a credit to Accounts Payable for $700.

6. Services were performed on account for a customer, $510, for which Accounts Receivable was debited $510 and Service Revenue was credited $51.

7. A payment on account for $235 was credited to Cash for $235 and credited to Accounts Payable for $253.

Instructions

Prepare a correct trial balance.

(Essay)

4.8/5  (35)

(35)

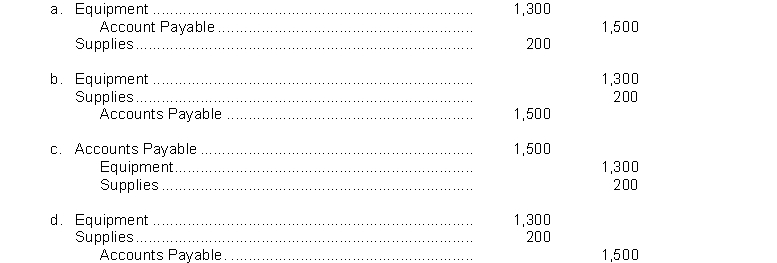

On August 13, 2018, Swell Maps Enterprises purchased equipment for $1,300 and supplies of $200 on account. Which of the following journal entries is recorded correctly and in the standard format?

(Short Answer)

4.9/5  (33)

(33)

The double-entry system is a logical method for recording transactions and results in equal debits and credits for each transaction.

(True/False)

4.9/5  (32)

(32)

Transactions are entered in the ledger first and then they are analyzed in terms of their effect on the accounts.

(True/False)

4.9/5  (39)

(39)

A credit balance in a liability account indicates that an error in recording has occurred.

(True/False)

5.0/5  (32)

(32)

Which account below is not a subdivision of retained earnings?

(Multiple Choice)

4.8/5  (31)

(31)

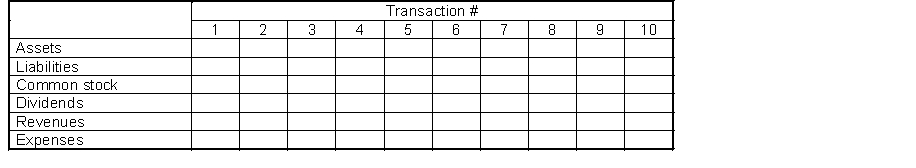

For each transaction given, enter in the tabulation given below a "D" for debit and a "C" for credit to reflect the increases and decreases of the assets, liabilities, and stockholders' equity accounts. In some cases there may be a "D" and a "C" in the same box.

Transactions:

1. Invests cash in exchange for stock.

2. Pays insurance in advance for six months.

3. Pays secretary's salary.

4. Purchases supplies on account.

5. Pays electricity bill.

6. Borrows money from local bank.

7. Makes payment on account.

8. Receives cash due from customers.

9. Provides services on account.

10. The company pays a dividends.

(Essay)

4.9/5  (34)

(34)

Showing 101 - 120 of 206

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)