Exam 16: Specimen Financial Statements: the Coca-Cola Company

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

Instructions

Compute Banner's payroll tax expense for the year. Make a summary journal entry to record the payroll tax expense.

(Essay)

4.7/5  (43)

(43)

The journal entry to record the payroll for a period will include a credit to Salaries and Wages Payable for the gross

(Multiple Choice)

4.7/5  (42)

(42)

Which of the following employees would likely receive a salary instead of wages?

(Multiple Choice)

4.9/5  (29)

(29)

An employee earnings record is a cumulative record of each employee's gross earnings, deductions, and net pay during the year.

(True/False)

4.8/5  (31)

(31)

Match the codes assigned to the following payroll functions to the procedures listed below:

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (39)

(39)

Internal control over payroll is not necessary because employees will complain if they do not receive the correct amount on their payroll checks.

(True/False)

4.9/5  (42)

(42)

A payroll tax expense which is borne entirely by the employer is the federal _______________ tax.

(Short Answer)

4.9/5  (38)

(38)

Assuming a FICA tax rate of 7.65% on the first $117,000 in wages and 1.45% in excess of $117,000 and a federal income tax rate of 20% on all wages, what would be an employee's net pay for the year if he earned $180,000? Round all calculations to the nearest dollar.

(Multiple Choice)

4.9/5  (45)

(45)

FICA taxes and federal income taxes are levied on employees' earnings without limit.

(True/False)

4.7/5  (36)

(36)

By January 31 following the end of a calendar year, an employer is required to provide each employee with a(n)

(Multiple Choice)

4.7/5  (32)

(32)

Jerri Rice has worked 44 hours this week. She worked at least 8 hours each day. Her regular hourly wage is $12 per hour with one and one-half times her regular rate for any hours which exceed 40 hours per week. What are Jerri's gross wages for the week?

(Multiple Choice)

4.8/5  (41)

(41)

A good internal control feature is to have several employees choose one person to punch all of their time cards.

(True/False)

4.8/5  (37)

(37)

The form showing gross earnings, FICA taxes withheld, and income taxes withheld for the year is

(Multiple Choice)

4.8/5  (38)

(38)

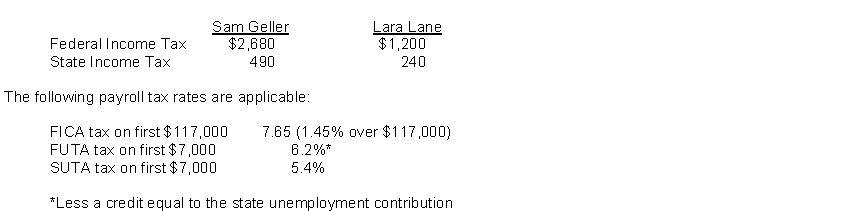

Sam Geller had earned (accumulated) salary of $110,000 through November 30. His December salary amounted to $9,800. Lara Lane began employment on December 1 and will be paid her first month's salary of $7,000 on December 31. Income tax withholding for December for each employee is as follows:  Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll. Round all calculations to the nearest dollar.

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll. Round all calculations to the nearest dollar.

(Essay)

4.8/5  (41)

(41)

Match the items below by entering the appropriate code letter in the space provided.

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (28)

(28)

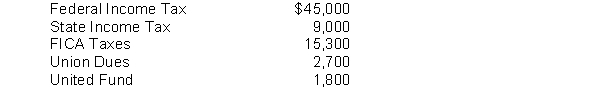

Warren Company's payroll for the week ending January 15 amounted to $200,000 for salaries and wages. None of the employees has reached the earnings limits specified for federal or state employer payroll taxes. The following deductions were withheld from employees' salaries and wages:  Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and also the employer's payroll tax expense on the payroll.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and also the employer's payroll tax expense on the payroll.

(Essay)

4.9/5  (34)

(34)

Showing 21 - 39 of 39

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)