Exam 10: Partnerships: Formation, Operation, and Basis

Exam 1: Understanding and Working With the Federal Tax Law71 Questions

Exam 2: Corporations: Introduction and Operating Rules94 Questions

Exam 3: Corporations: Special Situations99 Questions

Exam 4: Corporations: Organization and Capital Structure84 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions114 Questions

Exam 6: Corporations: Redemptions and Liquidations88 Questions

Exam 7: Corporations: Reorganizations86 Questions

Exam 8: Consolidated Tax Returns138 Questions

Exam 9: Taxation of International Transactions163 Questions

Exam 10: Partnerships: Formation, Operation, and Basis122 Questions

Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations128 Questions

Exam 12: S Corporations135 Questions

Exam 13: Comparative Forms of Doing Business108 Questions

Exam 14: Taxes on the Financial Statements55 Questions

Exam 15: Exempt Entities100 Questions

Exam 16: Multistate Corporate Taxation123 Questions

Exam 17: Tax Practice and Ethics129 Questions

Exam 18: The Federal Gift and Estate Taxes188 Questions

Exam 19: Family Tax Planning145 Questions

Exam 20: Income Taxation of Trusts and Estates136 Questions

Select questions type

During the current tax year, Jordan and Whitney each contributed $50,000 to form the J&W LLC. Each member has a 50% interest in LLC capital, profits, and losses (including deemed losses in the "constructive liquidation scenario"), except that depreciation expense is allocated 40% to Jordan and 60% to Whitney. During the first year, the LLC reported income (before depreciation expense) of $20,000 and had depreciation expense of $10,000. The LLC incurred recourse debt (that was personally guaranteed by both of the LLC members) of $60,000. Partnership assets are $170,000 at the end of the year. Under the constructive liquidation scenario, how is the recourse debt allocated to Jordan and Whitney?

(Multiple Choice)

4.7/5  (37)

(37)

Match each of the following statements with the terms below that provide the best definition

-Limited liability partnership

(Multiple Choice)

4.8/5  (35)

(35)

Match each of the following statements with the terms below that provide the best definition

-Outside basis

(Multiple Choice)

4.9/5  (37)

(37)

TEC Partners was formed during the current tax year. It incurred $10,000 of organizational expenses, $80,000 of startup expenses, and $5,000 of transfer taxes to retitle property contributed by a partner. The property had been held as MACRS property for ten years by the contributing partner, and had an adjusted basis to the partner of $300,000 and fair market value of $400,000. Which of the following statements is correct regarding these items?

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following is a correct definition of a concept related to partnership taxation?

(Multiple Choice)

4.8/5  (45)

(45)

The primary purpose of the partnership agreement is to document the various tax elections made by the partners regarding depreciation methods, treatment of research and experimental costs, calculation of the § 199 deduction, and the § 754 election.

(True/False)

4.8/5  (38)

(38)

Tara and Robert formed the TR Partnership four years ago. Because they decided the company needed some expertise in multimedia presentations, they offered Katie a 1/3 interest in partnership capital if she would come to work for the partnership. On July 1 of the current year, the unrestricted partnership interest (fair market value of $25,000) was transferred to Katie. How should Katie treat the receipt of the partnership interest in the current year?

(Multiple Choice)

4.9/5  (39)

(39)

Match each of the following statements with the terms below that provide the best definition

-Organizational costs

(Multiple Choice)

4.8/5  (41)

(41)

Katherine invested $80,000 this year to purchase a 30% interest in the KLM Partnership. The partnership reported $200,000 of net income from operations, a $2,000 short-term capital loss, and a $10,000 charitable contribution. In addition, the partnership distributed $20,000 to Katherine and $10,000 each to partners Lauren and Missy. Assuming the partnership has no beginning or ending liabilities, what is Katherine's basis in her partnership interest at the end of the year?

(Essay)

5.0/5  (31)

(31)

Ryan is a 25% partner in the ROCC Partnership. At the beginning of the tax year, Ryan's basis in the partnership interest was $90,000, including his share of partnership liabilities. During the current year, ROCC reported net ordinary income of $100,000. In addition, ROCC distributed $10,000 to each of the partners ($40,000 total). At the end of the year, Ryan's share of partnership liabilities increased by $10,000. Ryan's basis in the partnership interest at the end of the year is:

(Multiple Choice)

4.8/5  (28)

(28)

PaulCo, DavidCo, and Sean form a partnership with cash contributions of $80,000, $50,000 and $30,000, respectively, and agree to share profits and losses in the ratio of their original cash contributions. PaulCo uses a January 31 fiscal year-end, while DavidCo and Sean use a November 30 and December 31 year-end, respectively. The partnership must use the least aggregate deferral method to determine its year end.

(True/False)

4.9/5  (42)

(42)

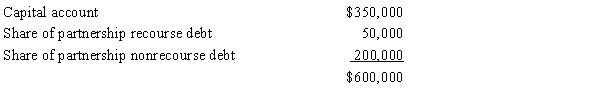

The MOP Partnership is involved in construction activities. Patricia has an adjusted basis for her partnership interest on January 1 of the current year of $600,000, consisting of the following:

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia. Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits, capital, and losses, and is an active ("material") participant in the partnership, how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss? How would your answer change if MOP were an LLC and Patricia had not personally guaranteed any of the debt?

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia. Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits, capital, and losses, and is an active ("material") participant in the partnership, how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss? How would your answer change if MOP were an LLC and Patricia had not personally guaranteed any of the debt?

(Essay)

4.9/5  (37)

(37)

Tim, Al, and Pat contributed assets to form the equal TAP Partnership. Tim contributed cash of $40,000 and land with a basis of $80,000 (fair market value of $60,000). Al contributed cash of $60,000 and land with a basis of $50,000 (fair market value of $40,000). Pat contributed cash of $60,000 and a fully depreciated property ($0 basis) valued at $40,000. Which of the following tax treatments is not correct?

(Multiple Choice)

4.8/5  (32)

(32)

Match each of the following statements with the terms below that provide the best definition

-Precontribution gain

(Multiple Choice)

4.9/5  (36)

(36)

Maria owns a 60% interest in the KLM Partnership. Four years ago her father gave her a parcel of land. The gift basis of the land to Maria is $60,000. In the current year, Maria had still not figured out how to use the land for her own personal or business use; consequently, she sold the land to the partnership for $50,000. The partnership immediately started using the land as a parking lot for its employees. Maria may recognize her $10,000 loss on the sale.

(True/False)

4.9/5  (47)

(47)

Which of the following is an election or calculation made by the partner rather than the partnership?

(Multiple Choice)

4.8/5  (36)

(36)

At the beginning of the year, Heather's "tax basis" capital account balance in the HEP Partnership was $85,000. During the tax year, Heather contributed property with a basis of $6,000 and a fair market value of $10,000. Her share of the partnership's ordinary income and separately stated income and deduction items was $40,000. At the end of the year, the partnership distributed $15,000 of cash to Heather. Also, the partnership allocated $12,000 of recourse debt and $10,000 of nonrecourse debt to Heather. What is Heather's ending capital account balance determined using the "tax basis" method?

(Multiple Choice)

4.7/5  (37)

(37)

Kristie is a 30% partner in the KKM Partnership. During the current year, KKM reported gross receipts of $280,000 and a charitable contribution of $30,000. The partnership paid office expenses of $80,000. In addition, KKM distributed $20,000 each to partners Kaylyn and Megan, and the partnership paid partner Kaylyn $20,000 for administrative services. Kristie reports the following income from KKM during the current tax year:

(Multiple Choice)

4.9/5  (46)

(46)

Match each of the following statements with the terms below that provide the best definition

-§ 179 deduction

(Multiple Choice)

4.9/5  (45)

(45)

Fern, Inc., Ivy, Inc., and Jeremy formed a general partnership. Fern owns a 50% interest and Ivy and Jeremy each own 25% interests. Fern, Inc. files its tax return on an October 31 year-end; Ivy, Inc., files with a May 31 year-end, and Jeremy is a calendar year taxpayer. Which of the following statements is true regarding the taxable year the partnership can choose?

(Multiple Choice)

4.7/5  (33)

(33)

Showing 61 - 80 of 122

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)