Exam 14: Exchange Rate Adjustments and the Balance of Payments

Exam 1: The International Economy and Globalization70 Questions

Exam 2: Foundations of Modern Trade Theory Comparative Advantage215 Questions

Exam 3: Sources of Comparative Advantage145 Questions

Exam 4: Tariffs157 Questions

Exam 5: Nontariff Trade Barriers181 Questions

Exam 6: Trade Regulations and Industrial Policies199 Questions

Exam 7: Trade Policies for the Developing Nations141 Questions

Exam 8: Regional Trading Arrangements164 Questions

Exam 9: International Factor Movements and Multinational Enterprises136 Questions

Exam 10: The Balance of Payments148 Questions

Exam 11: Foreign Exchange197 Questions

Exam 12: Exchange Rate Determination199 Questions

Exam 13: Mechanisms of International Adjustment116 Questions

Exam 14: Exchange Rate Adjustments and the Balance of Payments162 Questions

Exam 15: Exchange Rate Systems and Currency Crises71 Questions

Select questions type

Hong Kong provides an example of a country that has maintained a currency board.The purpose of its currency board is to

(Multiple Choice)

4.8/5  (35)

(35)

Other things equal, the central bank of the United Kingdom could prevent the pound from appreciating by

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following is an example of currency manipulation that would likely move Japan's trade balance to a trade surplus?

(Multiple Choice)

4.8/5  (42)

(42)

In recent years, the United States has accused China of manipulating the yuan so as to gain an unfair competitive advantage in global trade.The United States has argued that the central bank of China has sold yuan and bought dollars, thus depreciating the yuan against the dollar

(True/False)

5.0/5  (33)

(33)

The Bretton Woods system of 1944-1973 was a flexible exchange rate system in which member countries allowed their currencies to float within wide bands.

(True/False)

4.8/5  (37)

(37)

The exchange rate system established by the Bretton Woods Agreement of 1944-1973 was an adjustable pegged system.

(True/False)

4.9/5  (32)

(32)

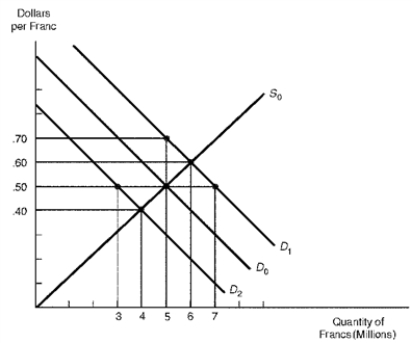

Figure 15.1 shows the market for the Swiss franc. In the figure, the initial demand for marks and supply of marks are depicted by D0 and S0 respectively.

Figure 15.1. The Market for the Swiss Franc

?  -Refer to Figure 15.1.Suppose that the United States increases its imports from Switzerland, resulting in a rise in the demand for francs from D0 to D1.Other things equal, under a floating exchange rate system, the new equilibrium exchange rate would be

-Refer to Figure 15.1.Suppose that the United States increases its imports from Switzerland, resulting in a rise in the demand for francs from D0 to D1.Other things equal, under a floating exchange rate system, the new equilibrium exchange rate would be

(Multiple Choice)

4.8/5  (31)

(31)

Other things equal, a surplus nation can reduce its payments imbalance by

(Multiple Choice)

4.8/5  (35)

(35)

A central bank that desires a (an) ______ of its currency would likely implement a ______ monetary policy.

(Multiple Choice)

4.9/5  (42)

(42)

For the United States, its current exchange rate system is generally considered to be a

(Multiple Choice)

4.9/5  (38)

(38)

Under a floating exchange rate system, other things equal, if there occurs a fall in the dollar price of the Swiss franc

(Multiple Choice)

4.8/5  (43)

(43)

Countries tend to be less served by a fixed exchange rate system when

(Multiple Choice)

4.8/5  (39)

(39)

Today, fixed exchange rates are used primarily by small, developing countries that tie their currencies to a key currency such as the U.S.dollar.

(True/False)

4.8/5  (36)

(36)

In 2016, the U.S.Treasury department found that China met ____________of the criteria of currency manipulation.

(Multiple Choice)

4.9/5  (27)

(27)

A "key currency" is one that is widely traded on world money markets, has demonstrated relatively stable values over time, and has widely been accepted as a means of international settlement.

(True/False)

4.8/5  (30)

(30)

An argument can be made for controls on the inflow of capital for developing countries because capital inflows can lead to a lending boom, speculation, and excessive risk taking.

(True/False)

4.9/5  (36)

(36)

Assume that interest rates in London increase relative to those in Switzerland.Other things equal, under a floating exchange rate system one would expect the pound (relative to the Swiss franc) to

(Multiple Choice)

4.9/5  (35)

(35)

Showing 41 - 60 of 162

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)