Exam 13: Mechanisms of International Adjustment

Exam 1: The International Economy and Globalization70 Questions

Exam 2: Foundations of Modern Trade Theory Comparative Advantage215 Questions

Exam 3: Sources of Comparative Advantage145 Questions

Exam 4: Tariffs157 Questions

Exam 5: Nontariff Trade Barriers181 Questions

Exam 6: Trade Regulations and Industrial Policies199 Questions

Exam 7: Trade Policies for the Developing Nations141 Questions

Exam 8: Regional Trading Arrangements164 Questions

Exam 9: International Factor Movements and Multinational Enterprises136 Questions

Exam 10: The Balance of Payments148 Questions

Exam 11: Foreign Exchange197 Questions

Exam 12: Exchange Rate Determination199 Questions

Exam 13: Mechanisms of International Adjustment116 Questions

Exam 14: Exchange Rate Adjustments and the Balance of Payments162 Questions

Exam 15: Exchange Rate Systems and Currency Crises71 Questions

Select questions type

The shift in focus toward imperfectly competitive markets in domestic and international trade questions the concept of

Free

(Multiple Choice)

4.9/5  (32)

(32)

Correct Answer:

B

Which approach predicts that if an economy operates at full employment and faces a trade deficit, currency devaluation (depreciation) will improve the trade balance only if domestic spending is cut, thus freeing resources to produce exports?

Free

(Multiple Choice)

5.0/5  (34)

(34)

Correct Answer:

A

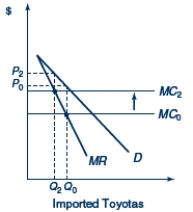

Figure 13.2. The U.S. Market for Imported Toyotas

-In Figure 13.2, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.Assume that Toyota behaves like a monopolist in the U.S.market.A shift in the marginal cost curve from MC0 to MC2 leads to

-In Figure 13.2, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.Assume that Toyota behaves like a monopolist in the U.S.market.A shift in the marginal cost curve from MC0 to MC2 leads to

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

C

Suppose the U.S.price elasticity of demand for imports equals 0.4 and the foreign demand elasticity for the U.S.exports equals 0.2.According to the Marshall-Lerner condition, a depreciation of the dollar's exchange value will improve the U.S.balance of trade.

(True/False)

4.8/5  (33)

(33)

How do demand elasticities influence a country's trade position when exchange rates change?

(Essay)

5.0/5  (34)

(34)

The extent to which changing currency values result in changing relative prices of imports and exports is known as the J-curve effect.

(True/False)

4.8/5  (34)

(34)

When manufacturing automobiles, suppose that General Motors uses labor and materials whose costs are denominated in dollars and pounds respectively.If the dollar's exchange value appreciates by 15 percent against the pound, the pound-denominated cost of a GM vehicle rises by 15 percent.

(True/False)

4.9/5  (44)

(44)

Partial currency pass-through implies that if the dollar's exchange value appreciates by 10 percent, imports would become, say, 6 percent more expensive to Americans while U.S.exports would become, say, 8 percent cheaper to foreigners.

(True/False)

4.7/5  (29)

(29)

Empirical evidence regarding the effects of currency devaluation on the balance of trade indicates that

(Multiple Choice)

4.8/5  (44)

(44)

According to the Marshall-Lerner condition, currency depreciation would have a positive effect on a country's trade balance if the elasticity of demand for its exports plus the elasticity of demand for its imports equals

(Multiple Choice)

4.8/5  (30)

(30)

The ______ refers to the extent to which changing currency values result in changes in import and export prices.

(Multiple Choice)

4.8/5  (38)

(38)

According to the absorption approach, the economic circumstances that best warrant a currency devaluation is where the domestic economy faces

(Multiple Choice)

4.8/5  (41)

(41)

Appreciation of the dollar's exchange value worsens the international competitiveness of Boeing Inc., whereas a dollar depreciation improves its international competitiveness.

(True/False)

4.8/5  (34)

(34)

If a currency's exchange rate is overvalued, a government would likely initiate actions to revalue the currency.

(True/False)

4.8/5  (35)

(35)

The analysis of the effects of a currency depreciation on a country's trade balance include all of the following except

(Multiple Choice)

4.9/5  (33)

(33)

If foreign manufacturers cut manufacturing costs and profit margins in response to a depreciation in the U.S.dollar, the effect of these actions is to

(Multiple Choice)

4.9/5  (38)

(38)

If a currency's exchange rate is undervalued, a government would likely initiate actions to devalue the currency.

(True/False)

4.9/5  (37)

(37)

The pass-through effect refers to the extent that import prices and export prices adjust to currency devaluation.

(True/False)

4.9/5  (37)

(37)

Showing 1 - 20 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)