Exam 5: Reporting and Analyzing Inventory

Exam 1: Introduction to Financial Statements183 Questions

Exam 2: A Further Look at Financial Statements201 Questions

Exam 3: The Accounting Information System226 Questions

Exam 4: Merchandising Operations and the Multiple-Step Income Statement221 Questions

Exam 5: Reporting and Analyzing Inventory201 Questions

Exam 6: Fraud, Internal Control, and Cash209 Questions

Exam 7: Reporting and Analyzing Receivables220 Questions

Exam 8: Reporting and Analyzing Long-Lived Assets227 Questions

Exam 9: Reporting and Analyzing Liabilities245 Questions

Exam 10: Reporting and Analyzing Stockholders Equity215 Questions

Exam 11: Statement of Cash Flows170 Questions

Exam 12: Financial Analysis: The Big Picture211 Questions

Exam 13: Managerial Accounting151 Questions

Exam 14: Job Order Costing150 Questions

Exam 15: Process Costing129 Questions

Exam 16: Activity-Based Costing147 Questions

Exam 17: Cost-Volume-Profit156 Questions

Exam 18: Cost-Volume-Profit Analysis: Additional Issues81 Questions

Exam 19: Incremental Analysis166 Questions

Exam 20: Budgetary Planning158 Questions

Exam 21: Budgetary Control and Responsibility Accounting154 Questions

Exam 22: Standard Costs and Balanced Scorecard161 Questions

Exam 23: Planning for Capital Investments156 Questions

Select questions type

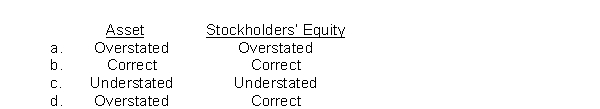

A company uses the periodic inventory method and the beginning inventory is overstated by $4,000 because the ending inventory in the previous period was overstated by $4,000; the ending inventory for this period is correct. The amounts reflected in the current end of the period balance sheet are

(Short Answer)

4.9/5  (36)

(36)

The accountant at Patton Company has determined that income before income taxes amounted to $11,000 using the FIFO costing assumption. If the income tax rate is 30% and the amount of income taxes paid would be $900 greater if the LIFO assumption were used, what would be the amount of income before taxes under the LIFO assumption?

(Multiple Choice)

4.8/5  (36)

(36)

The lower of cost or market basis of valuing inventories is an example of

(Multiple Choice)

4.8/5  (34)

(34)

To adjust a company's LIFO cost of goods sold to FIFO cost of goods sold

(Multiple Choice)

4.9/5  (40)

(40)

Raw materials inventories are the goods that a manufacturing company has completed and are ready to be sold to customers.

(True/False)

4.9/5  (36)

(36)

Pop-up Party Favors Inc. has the following inventory data: July 1 Beginning inventory 30 units at \ 19 \ 570 7 Purchases 105 units at \ 20 2,100 22 Purchases 15 units at \ 22 330 \ 3,000 A physical count of merchandise inventory on July 30 reveals that there are 48 units on hand. Using the FIFO inventory method, the amount allocated to ending inventory for July is

(Multiple Choice)

4.9/5  (32)

(32)

An inventory turnover that is too high may indicate that the company is losing sales opportunities because of inventory shortages.

(True/False)

4.9/5  (39)

(39)

Manufactured inventory that has begun the production process but is not yet completed is

(Multiple Choice)

4.8/5  (43)

(43)

When the average cost method is applied to a perpetual inventory system, a moving average cost per unit is computed with each purchase.

(True/False)

4.9/5  (31)

(31)

Which of the following companies would most likely have the highest inventory turnover?

(Multiple Choice)

4.8/5  (39)

(39)

At December 31, 2017 Mohling Company's inventory records indicated a balance of $632,000. Upon further investigation it was determined that this amount included the following:

-$112,000 in inventory purchases made by Mohling shipped from the seller 12/27/17 terms FOB destination, but not due to be received until January 2nd

-$74,000 in goods sold by Mohling with terms FOB destination on December 27th. The goods are not expected to reach their destination until January 6th.

-$6,000 of goods received on consignment from Dollywood Company

What is Mohling's correct ending inventory balance at December 31, 2017?

(Multiple Choice)

4.7/5  (37)

(37)

Use the following information for Boxter, Inc., Clifford Company, Danforth Industries, and Evans Services to answer the question "Using the LIFO adjustment, which company shows the greatest improvement in its current ratio from 2016 to 2017?" (amounts in \ millions) Boxter Clifford Danforth Evans Inventory Method for 2016 \& 2017 LIFO FIFO LIFO FIFO 2016 Ending inventory assuming LIFO \ 324 N/A \ 225 N/A 2016 Ending inventory assuming FIFO \ 427 \ 535 \ 310 \ 663 2017 Ending inventory assuming LIFO \ 436 N/A \ 167 N/A 2017 Ending inventory assuming FIFO \ 578 \ 612 \ 209 \ 542 2016 Current assets (reported on balance sheet) \ 1,677 \ 2,031 \ 1,308 \ 2,748 2016 Current liabilities \ 987 \ 1,209 \ 545 \ 1,200 2017 Current assets (reported on balance sheet) \ 2,225 \ 2,605 \ 1,100 \ 2,390 2017 Current liabilities \ 1,306 \ 1,410 \ 465 \ 1,000 2017 Cost of goods sold \ 4,678 \ 1,410 \ 465 \ 1,000

(Multiple Choice)

4.8/5  (46)

(46)

Barnett Company had the following records: 2017 2016 Ending inventory \ 32,650 \ 30,490 Cost of goods sold 306,300 313,600 What is Barnett's average days in inventory for 2017? (rounded)

(Multiple Choice)

4.8/5  (40)

(40)

In a period of rising prices, which of the following inventory methods generally results in the lowest net income figure?

(Multiple Choice)

4.8/5  (29)

(29)

When the terms of sale are FOB shipping point, legal title to the goods remains with the seller until the goods reach the buyer.

(True/False)

4.9/5  (40)

(40)

Which of the following statements is true regarding inventory cost flow assumptions?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 181 - 200 of 201

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)